Trouble Brewing – Beer Imports from South of the Border

Can American alcoholic beverage giant Constellation Brands continue producing beers in Mexico amidst mounting momentum for protectionist trade policies in the new Trump era?

When Donald Trump won the election, Constellation Brands’ CEO Rob Sands admittedly prepared for war. No beers were cracked open that winter at the company’s Victor NY headquarters.

Serving Uncertain Cerveza

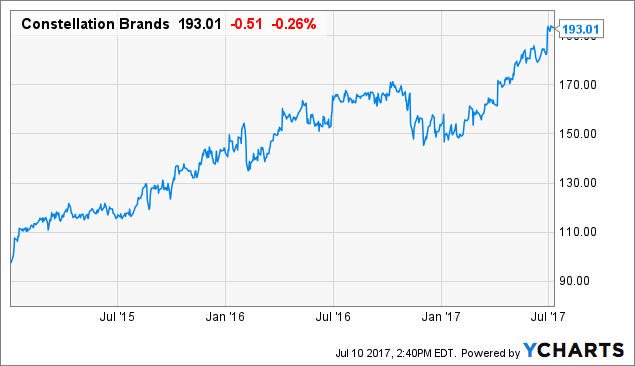

Between election day and Trump’s inauguration, Constellation’s shares plummeted by almost 15% [1], even as the rest of the market continued to soar with the “Trump Bump”. As the third largest American beer producer and the parent company of an iconic portfolio of Mexican brands (including Corona, Modelo, and Pacifico), investors were clearly troubled by global supply chain risk given the administration’s heightened rhetoric around protectionist trade policies targeted at Mexican imports. Despite Constellation’s Mexican beer sales growing nearly 16% from 2015 [2], representing an 8% market share in the U.S. [3], these new uncertainties demanded an immediate response from the management team.

Specifically, House Republicans looked to eliminate tax deductions on imports while exempting exports in its “border-adjusted” tax proposal. It sought to prevent American companies from deducting costs incurred abroad against corporate U.S. taxes. Additionally, Trump touted the idea of imposing a 20% “border tax” on Mexican imports to fund his wall-building initiative. Constellation’s ability to continue supplying its popular Mexican beers to American consumers at its current prices was severely jeopardized.

A Hops across the Border?

Constellation believes that the authenticity of its beers and their popularity with consumers is inextricable to its Mexican origins, steeped in decades of Mexican brewing tradition [1]. Sands outlined potential steps that the company would consider in order to keep prices in check while maintaining production in Mexico. Currently, 40% of the cost of producing the company’s Mexican beers comes from U.S.-sourced ingredients and freight services [2]. In the short term, Constellation could purchase a larger portion of its production materials from the U.S. to offset the proposal’s tax impact [1]. For example, the company could acquire natural gas from the U.S. instead of Mexico to produce glass for its bottles to realize higher tax deductions. Similarly, packaging materials could be sourced in the U.S. and transported to Mexico.

As expected, the management is also stepping up its lobbying efforts on Capitol Hill. Constellation acquired its Mexican brand assets, implying that no labor was actually outsourced from the U.S. This technicality may afford the company with an exemption of sorts from the proposed legislation meant to target American companies who actively shifted their domestic manufacturing operations abroad [3]. Additionally, the Republican plan to lower overall corporate taxes could work to offset the negative impacts of the border-adjustment tax [1].

However, the long-term effects of a protectionist trade policy are more difficult to combat for Constellation’s global supply chain. Rising tensions between the Trump administration and the Mexican government could devolve into a bilateral trade war, threatening to dissolve the long-standing NAFTA structure the food and beverage industry has grown accustomed to [5]. If trade and tax policies increasingly favor American companies producing domestically, Constellation would need to reexamine the long-term business and brand viability of relocating its current Mexican beer operations stateside. Otherwise, raising prices on its imported beers would likely impact demand and competitiveness.

Don’t Put All Your Beers in One Cooler

I argue that Constellation Brands should further diversify its product line to hedge against future trade volatility. Mexican beer imports alone accounted for 70% of its profits [6]. Other domestic brands, including Robert Mondavi wines and Svedka vodka represent significant growth opportunities. Constellation even has high hopes for cannabis-infused beverages, taking a 10% stake in a Canadian marijuana company [7]. The recent acquisitions of San Diego-based Ballast Point Brewing and Florida-based Funky Buddha Brewery signal efforts to play in the craft beer segment and shift more production capacity domestically [8,9]. Constellation should additionally build capability to produce a portion of its Mexican brands in the U.S. preventatively. For example, Constellation can additionally seek out small-scale U.S. production facilities in close proximity to significant Mexican-American populations and strive to integrate into these communities to preserve credibility and authenticity as a producer of Mexican beers.

No Trouble Brewing?

Meanwhile, as NAFTA renegotiation talks carry into 2018 [10], Constellation Brands seems intent to simply wait it out. To their credit, shares rebounded to an all-time high in April 2017 after the quarterly sales and profits beat expectations [11]. As the persistent threats of wall-building and tariff-slapping wanes, Constellation Brands has committed to invest $2.5 billion to expand its production facility in Nava, Mexico [2]. But is it too soon to relax with a cold beer and a wedge of lime?

Questions remain unanswered on how the company will manage shocks to its global supply chain in the long-term. Would another round of protectionist momentum in Washington bring the brewing to a drip? Would a push to increase minimum wages and unionization in Mexico [12], as part of the NAFTA renegotiation agenda, wipe out Constellation’s labor cost efficiencies? Would consumers react negatively to a bottle of made-in-USA Corona?

(799 words, excluding subtitles and captions)

References

[1] Maloney, Vipal. 2017. “Constellation Brands Gearing Up For GOP Border Tax”. WSJ. https://www.wsj.com/articles/constellation-brands-gearing-up-for-gop-border-tax-1483659894.

[2] Carey, Nick. 2017. “What It Takes To Get A Corona From Mexico To A U.S. Heartland Bar”. U.S.. https://www.reuters.com/article/us-usa-trump-mexico-corona/what-it-takes-to-get-a-corona-from-mexico-to-a-u-s-heartland-bar-idUSKBN15B2BO.

[3] Trotter, Greg. 2017. “Mexican Beer Prices Won’t Go Up With Tax Reform, Corona Parent Company Says”. Chicagotribune.Com. http://www.chicagotribune.com/business/ct-constellation-brands-border-tax-0106-biz-20170105-story.html.

[4] “Why President Trump Could Make It A Lot More Expensive To Drink Booze”. 2017. Washington Post. https://www.washingtonpost.com/news/wonk/wp/2017/01/26/why-president-trump-could-make-it-a-lot-more-expensive-to-drink-booze/?hpid=hp_regional-hp-cards_rhp-card-business%3Ahomepage%2Fcard&utm_term=.3aba862a48ad.

[5] Noland, Marcus, Gary Clyde Hufbauer, Sherman Robinson, and Tyler Moran. 2016. Assessing Trade Agendas In The US Presidential Campaign. Ebook. Peterson Institute for International Economics.

[6] Townsend, More. 2017. “Trump’S Mexico Tax Would Hammer Firms In $580 Billion Market”. Bloomberg.Com. https://www.bloomberg.com/news/articles/2017-01-27/trump-s-mexico-tax-would-hammer-companies-in-580-billion-market.

[7] George-Cosh, Jennifer. 2017. “Big Brewer Makes A Play For Marijuana Beverages”. WSJ. https://www.wsj.com/articles/big-brewer-makes-a-play-for-marijuana-beverages-1509300002.

[8] “Leading Craft Brewer Ballast Point Joins Constellation Brands | Constellation Brands”. 2017. Cbrands.Com. http://www.cbrands.com/news-media/leading-craft-brewer-ballast-point-joins-constellation-brands.

[9] “Craft Brewer Funky Buddha Joins Constellation Brands | Constellation Brands”. 2017. Cbrands.Com. http://www.cbrands.com/news-media/craft-brewer-funky-buddha-joins-constellation-brands-0.

[10] Pramuk, Jacob. 2017. “US Is Not Moving To Scrap NAFTA Despite ‘Challenges’ That Are Delaying Talks”. CNBC. https://www.cnbc.com/2017/10/17/nafta-renegotiation-talks-will-go-into-next-year.html.

[11] Monica, Paul. 2017. “Corona Owner Constellation Brands Hits All-Time High As Fears About A Trump Tax On Mexico Fade”. Cnnmoney. http://money.cnn.com/2017/04/06/investing/corona-constellation-brands-earnings-mexico/index.html.

[12] Althaus, Dudley. 2017. “Nafta Talks Target Stubbornly Low Mexican Wages”. WSJ. https://www.wsj.com/articles/nafta-talks-target-stubbornly-low-mexican-wages-1503999002.

First off, kudos to you, Toby, for great subheaders – very punny.

I agree with the concept that the authenticity of the Constellation brands are nearly inextricable to its Mexican origins, and would cite the US census projections that show that Latinos are one of the largest growing demographics in the US. As such Constellation should double down on its focus/emphasis of these brands. To get around potential isolationist trade policies, I’d recommend taking a page out of Fuyao Glass and Toyota; establish domestic production facilities ahead of time; in the event that these policies are not enacted, would still/should still drive efficiencies in the supply chain/distribution due to shorter transportation costs. Because of the clear bottles of a Corona, would also minimize the flavor distortion by shortening the time from the factory to the mouth of the consumer.

From a supply chain perspective, I agree with Jason above that there are efficiencies to be gained from preemptively establishing manufacturing sites in the United States, coupled with the growth of the Mexican population in the United States and the gaining popularity of Mexican beers in the United States. I’m more worried about the effect of increased labor costs in Mexico and how that will reverberate through the supply chain. This is similar to how Professor Shih has described the extreme increase in labor costs in certain regions of China. Unlike some of the major U.S. beer players whose margins have decreased because of the craft beer surge, Constellation’s huge sales growth over the past year has been largely unaffected, which signals strong loyalty in its consumer base. Constellation can diversify against isolationist policies and potential increases in Mexican labor costs by acquiring more U.S. based companies and establishing U.S.-based manufacturing. Additionally, with the recent surge in profit margins, they can push their popular Mexican brands further into U.S. markets and markets abroad [1] to drive growth elsewhere. By driving growth in new markets, they can posture themselves financially for potential increased labor costs and/or isolationist policies that affect their supply chain.

The Wall Street Journal, “Logistics Report”, https://www.wsj.com/articles/todays-top-supply-chain-and-logistics-news-from-wsj-1507286173 Accessed November 27. 2017.

Great write up! Thank you for sharing!

What strikes me, reading this case, is that the manufacturing process is primed for innovation and automation. Political risk exists both in the US and Mexico. In both scenarios, the risk is that labor cost increase – either through higher domestic wages or unionization. As such, an obvious strategy is to decrease the companies reliance on labor is innovation and automation. Both reshoring and using domestic labor or R&D require huge capital investments. The key question is location – where should these facilities be set up? Given the threat of higher tariffs, political instability in Mexico and indications of lower corporate tax rate in the US, reshoring with investment in R&D would be my recommended strategy.

Regarding the question as to whether US consumers would accept a US-made Corona: it is difficult to accept the premise that they would not. I agree that heritage plays an important role in the overall brand – but it would be interesting to see specific evidence that consumers 1) care significantly enough about where a beer is from to change their purchasing decision and 2) if most consumers would even realize that the Corona they are purchasing is now being made in the US. For me personally, I like Corona, do not care where it is manufactured, and would likely be unaware that it was being manufactured in the US in the future. Obviously that is anecdotal, but at minimum management needs to test its hypothesis that its heritage & manufacturing location is inseparable from the purchase decision. Should management choose to continue in Mexico and take the tariff risk, it is unlikely the US consumer will tolerate a cost increase, effectively pricing Corona out of the market (in the absence of other, offsetting cost cuts). Therefore, I believe management has a fiduciary responsibility to its shareholders to consider US manufacturing operations in order to continue to sell its product on a cost-effective basis to such a huge market in the event of a tariff.

Kudos on this paper, and especially the headings.

This case is wrought with uncertainty on both sides of the border. As Jason raised previously, proactively diversifying production by producing in the U.S. would insulate Constellation from some risk. It does, however, present the risk of bad PR if beer drinkers rebel against an American-made Mexican beer. Although, I wonder how many people know where Corona is made versus simply assuming its Mexican production and heritage.

Perhaps this is a rare instance in which marketing departments can assist in supply chain decisions. A market research study could quantify the importance of Mexican beers being produced in Mexico and the potential consumer reaction to learning it was made in the USA. After all, the worst-case scenario is investing in USA production facilities only to incur backlash and sales declines.

Several US industries are facing the similar problem of US isolationism policies, especially against Mexico. But I believe that Constellation is the one company that is unique in this problem because it has more than just cost and labor reasons to produce in Mexico – it has long traditions linked to Mexico. Given this context, moving production out probably will lose the charm the brand carries – with a marketing backlash, which is why I disagree with most of the comments above. Constellation’s best bet in the current political environment is to not irk the government and make smaller trade-offs and buy some time – one of them definitely is to not to go all out announcing its factory expansion.

I do like the idea of instead finding newer, profitable markets where Constellation could possibly enter with a higher price point factoring in the additional tax implications of producing in Mexico.

Thank you for your article, Toby Johnson! Relative to other articles I’ve read on the Isolationism topic, Constellation Brands response to the threat of NAFTA renegotiation talks reminds me how unsure political action is and how smart it is for Constellation to remain confident in pursuing its original strategy and to wait it out before new policies are actually implemented. In response to other articles, nevertheless, I agreed with your suggestion to take preventative measures and begin building factories in the US in the event the threat of isolationist policies are real.

Always great to get a cameo from Toby Johnson! I want to address your final question; yes consumers absolutely will have a problem with a Mexican beer made in the US. It seems as if the business is taking all the right steps to prepare themselves for NAFTA negotiations. However, and without trying to sound naive, is it possible that Trump’s bark is louder than his bite? From what I can infer, yes the administration has made extremely concentrated efforts at reducing, if not eliminating, manufacturing of US goods abroad and indeed make US goods more attractive than foreign ones but is it possible that consumers (especially in today’s craft-crazed world) willingness to pay for foreign goods is higher for alcohol?