Too much opportunity? 3M’s supply chain goes digital

What happens when digital technologies are introduced to a massive global supply chain? 3M provides one perspective.

Who is 3M and why does this company care about the digitalization of supply chains?

Formerly known as the Minnesota Mining and Manufacturing Company, 3M is $30 billion multinational conglomerate based in Maplewood, Minnesota. 3M manufactures over 55,000 products across multiple industries and operates in over 65 countries.[1] Their global supply chain, inclusive of 200 manufacturing plants, 100 warehouses, and 25 customer-facing divisions is not only critical but also considered a competitive advantage.[2]

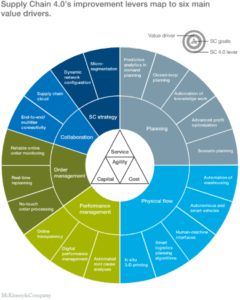

Yet changes in customer expectations coupled with new technologies mean the supply chain of today does not, and in many ways, cannot, look like the supply chain of tomorrow. Considered version 4.0, 3M’s supply chain must become faster, more precise, flexible, efficient and more accurate to remain competitive.[3]

“Digitalization” or the introduction of new operational technologies provide solutions for this supply chain 4.0. For example, 3D printing enables impossible shapes to be made with extraordinary precision; cloud computing presents real time network connectivity and significant cost advantages; machine learning provides predictive agility and proactive risk mitigation; robotics and drones permit speedy and efficient production and delivery.[4] With all of these options, the question then becomes where should 3M start?

3M goes digital:

3M’s leadership realized the need for supply chain transformation in 2011 as part of an overall business transformation.[5]

In a recent interview, Paul Keel, Sr. Vice President of Supply Chain Management at 3M noted that while there were many potential areas to optimize 3M’s supply chain, a common theme across of them was: “Friction occurs at the connection points.”[6]

Consequently, 3M decided to deploy a “common systems backbone” that provides end-to-end visibility to simplify and accelerate their decision making by investing in SAP’s Enterprise Resource Planning (ERP) software.[7]

This software allows 3M to simplify and integrate their supply chain processes, financial transactions and customer interactions on a unified digital platform.[8] 3M aims to complete the implementation globally by the end of 2020 across their ordering and transactional activities, distribution centers and manufacturing plants.[9]

The current ERP deployment enables 3M to further its efforts to transform its supply change in the long term. Such efforts include aligning and integrating common front-end interfaces with back-end processes critical to supply chain effectiveness and efficiency across supplier management, capacity planning, and/or network optimization.[10]

More connections, more complications?

The size and scope of 3M’s supply chain are as much assets as liabilities. The ever multiplying and evolving number of technologies in which to invest require 3M to focus on what makes its supply chain truly advantageous in the long run.

For example, 3M is using their ERP technology to digitally connect the physical supply chains between their suppliers and their factories. Mr. Keel explained, “Their systems talk directly to our systems. Our planning system speaks directly to theirs. They see our consumption, and we can look upstream at their capacity.” That said, often suppliers use different ERP systems requiring cloud middleware to operate as a translation layer.[11]

While optimizing their supply chain connectivity, these system integrations require large bets in spaces that have seen rapid proliferation.[12]/[13] 3M would be well served by utilizing their culture of innovation to continue to explore and evaluate the optimal digital solutions needed to keep their supply chain competitively advantageous. Consequently, one must ask:

Given the speed at which digital supply chain technology is advancing, can a company with such a wide product portfolio, and subsequently such an immense supply chain, keep apace?

How can a multinational conglomerate evaluate whether or not it has truly optimized across all connection points given the ever-expanding array of technological options?

(788 words excluding figures, headers and references)

[1] 3M, “About 3M,” http://www.3m.com/, accessed November 2017

[2] Ibid

[3] Alicke, K., D Rexhausen, and A. Seyfert, “Supply Chain 4.0 in consumer goods,” McKinsey & Company, April 2017, https://www.mckinsey.com/industries/consumer-packaged-goods/our-insights/supply-chain-4-0-in-consumer-goods, accessed November 2017

[4] Ibid

[5] 3M, “3M continues to transform our company,” https://www.3m.com/3M/en_US/company-us/enterprise-resource-planning, accessed November 2017

[6] Steve Banker, “Digitization and the 3M supply chain,” Forbes, May 3, 2017, https://www.forbes.com/sites/stevebanker/2017/05/03/digitization-and-the-3m-supply-chain/#37fd7f5541c1 accessed November, 2017

[7]“One on One: Paul Keel, senior vice president of supply chain, 3M,” Supply Chain Navigator: An Avnet Publication, January 2017, http://scnavigator.avnet.com/article/january-2017/paul-keel-senior-vice-president-of-supply-chain-3m/, accessed November 2017.

[8]3M, “3M continues to transform our company,” https://www.3m.com/3M/en_US/company-us/enterprise-resource-planning, accessed November 2017

[9]Julie Bushman, “Business Transformation: 2017 Outlook meeting,” PowerPoint presentation, December 13, 2016, 3M, Maplewood, MN, https://s2.q4cdn.com/974527301/files/doc_presentations/2016/Outlook/3M-2017-Outlook-Meeting_Bushman_Business_Transformation.pdf, accessed November 2017

[10] “One on One: Paul Keel, senior vice president of supply chain, 3M,” Supply Chain Navigator: An Avnet Publication, January 2017, http://scnavigator.avnet.com/article/january-2017/paul-keel-senior-vice-president-of-supply-chain-3m/, accessed November 2017

[11] Ibid

[12] Just one year after 3M invested in SAP’s ERP software, the ERP market grew 3.8% from $24.4B in 2012 to $25.4B in 2013. Louis Columbus, “Gartners ERP market share update shows the future of cloud ERP is now,” Forbes, May 12, 2014, https://www.forbes.com/sites/louiscolumbus/2014/05/12/gartners-erp-market-share-update-shows-the-future-of-cloud-erp-is-now/#3ecb43091fae, accessed November 2017

[13] It is now estimated to grow from $18.52B in 2016 to $29.84B by 2021, at an estimated CAGR of 10%. “Cloud Enterprise Resource Planning,” Market Watch, December 12, 2016, https://www.marketwatch.com/story/cloud-enterprise-resource-planning-erp-market-growing-at-a-cagr-of-10-during-2016-to-2021-2016-12-12-42033054, accessed November 2017

Featured image is from: http://sugikingdom.com/list-youtube-sub-networks/

As a company with tens of thousands of SKUs, it strikes me that 3M’s supply chain management is as much a product as is a Post-It. Like Domino’s does for its franchisees, it seems like removing the friction between 3M suppliers is a powerful way to achieve operational efficiency. Their scale is a benefit, in this regard; I imagine they have market power to push their supply chain management systems onto their suppliers with relative ease. You ask whether a company like 3M will know whether it is fully optimized. My reaction is that it is more important for 3M to consider how efficient it is vis a vis its competitors and whether it has achieved a return on its technology investment. 3M will theoretically always be able to further improve its supply chain, but if I were a company executive, I’d be more focused on creating a resilient and flexibile system to withstand the inevitable future disruptions.

I really appreciated the perspective in this article, particularly because it focused on digital optimization of a supply chain that did not simply jump straight to blockchain as a cure-all.

In the 3M case the most fascinating part of complex supply chain management is the inability to test or see all possible supply chain states. With so many different products, how can 3M tell if it chooses the right suppliers for each? And what if it made Post-Its side by side with paper, or does it make sense to manufacture those with tape? It is not economically or chronologically feasible to test all combinations or optimize all potential supplier combinations and sourcing. Thus the 3M challenge is similar to the New Zealand boat design tradeoff: 3M can intelligently “parachute” into a particular solution and then optimize, but who knows if a more efficient system exists?

The above commentator rightly points out that comparisons to competition are a critical benchmark and perhaps the most important one. A slightly loftier goal is to use machine learning to discover the true drivers of supply chain cost in such a complex system–machine learning and business analytics were invented for this purpose, although I have never heard of them being applied on this scale. I would not be surprised if a thoughtfully designed ML program could discover some substantial cost savings among 3M’s supply and distribution channels–the Post Office and UPS have used similar programs to great success on a network that is more complex but with fewer SKUs.