To go or not Tesco? Brexit’s Potential Impact on the UK Food Industry.

Earlier this year, Tesco was the company online users most associated with Brexit. How can Tesco adapt to the uncertainty of Brexit and what changes should they make now to survive in a post-Brexit reality?

The rise of isolationist political movements around the world has created significant uncertainty for many companies with global supply chains. One isolationist scenario already playing on the global stage is Britain’s exit from the European Union. Understanding how Brexit will impact supply chains in Britain and Europe can help companies worldwide understand how isolationist policies may change the business landscape. Although the United Kingdom’s exit terms from the European Union have yet to be defined, the impact of Brexit is already being felt across many industries. Analysts forecast that the supply chain disruptions caused by Brexit could reduce the profitability of some industries by up to 30%.[1]

Brexit & Tesco

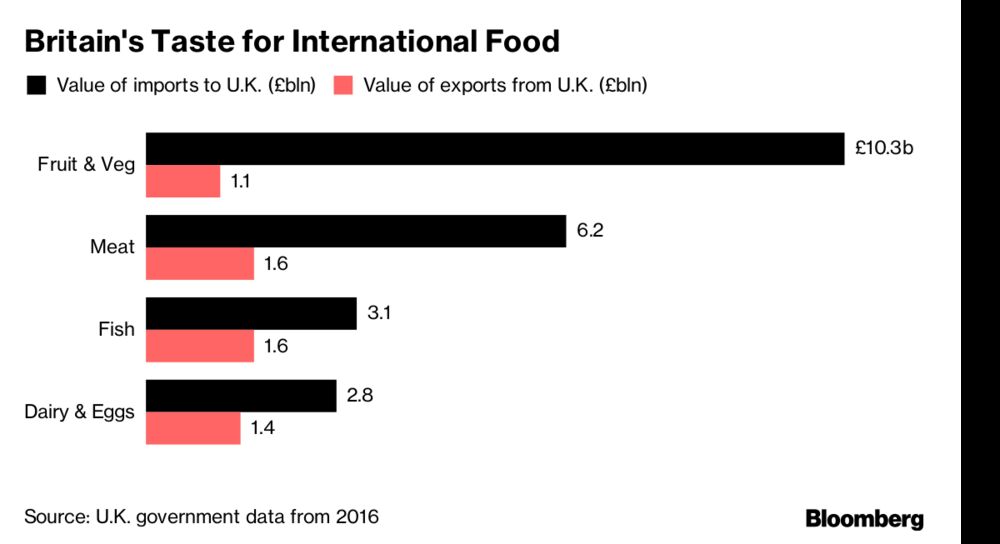

Tesco, the British grocery chain, is facing significant challenges as a result of the isolationist policies associated with Brexit. According to a marketing intelligence firm, consumers identify Tesco as the brand most associated with Brexit.[2] Tesco’s notoriety and association with Brexit comes after the grocery store refused to pay the higher prices for Heineken or Marmite products that manufacturers demanded and blamed on Brexit.[3]. The isolationist megatrend should concern Tesco’s management because almost half of the food consumed in Britain is imported.[4] The supply chain for the British food industry is particularly vulnerable to uncertainties caused by Brexit. Any increase in tariffs or customs wait times will add significant stress and real costs of importing groceries. UK food experts warn that the disruptions in the supply chain could disrupt food availability at a level “unprecedented for an advanced economy outside of wartime.”[5] While a range of Brexit scenarios have been identified, the ‘hard Brexit’ scenario doesn’t preserve any of the European Union member trade policies. In this scenario, food retailer profits would decline significantly as a result of higher tariffs, procurement bottlenecks and a decline in the relative value of the British pound. This scenario could cost food retailers 23% of profits, dropping £6 billion to £20 billion.[6]

Source: Sam Chambers, “Brexit Retail Mess: You Can’t Move Supermarkets to Frankfurt,” October 30, 2017, https://www.bloomberg.com/news/articles/2017-10-30/brexit-s-retail-mess-you-can-t-move-a-supermarket-to-frankfurt, accessed November 2017.

Source: Sam Chambers, “Brexit Retail Mess: You Can’t Move Supermarkets to Frankfurt,” October 30, 2017, https://www.bloomberg.com/news/articles/2017-10-30/brexit-s-retail-mess-you-can-t-move-a-supermarket-to-frankfurt, accessed November 2017.

What steps should Tesco take?

In the short term, Tesco needs to prepare for the worst Brexit scenario. One immediate action they need to take is to develop new domestic supplier relations to locally source products that are at-risk for the highest post-Brexit tariffs. Because of the long lead times in setting up these relationships, Tesco will need to establish these partnerships before a potentially hard Brexit deal is reached.[7] Tesco will also need to maintain higher inventory levels to offset the risk of inevitable delays caused at ports by more onerous customs regulations. The UK receives over 700,000 inbound shipments per day that would face additional border checks in a post-Brexit scenario. Any increase in clearing times for these shipments will create substantial bottlenecks at UK ports and create substantial problems for Tesco’s inventory management.[8] In the medium term, Tesco will need to adapt to whatever Brexit scenario ultimately becomes reality. They will need to adapt quickly and effectively to survive in a post-Brexit UK.

In addition to taking steps to protect its supply chain from the risks of Brexit, Tesco should leverage its scale to try to partner with the British government to create the best possible regulatory environment for British food retailers. These efforts should take two forms. First, Tesco should partner with other food retailers to ensure that Brexit negotiators are very aware of some of the very real risks a hard Brexit poses for both the British food industry and the British population. Tesco’s CEO Dave Lewis is already taking some positive steps in this direction. He outlined that “in a no deal scenario, if there were to be tariffs, then actually that could impact the price of food. That’s clear, everybody knows that, we’ve been very clear and we’ve shared with the civil service and policymakers how that actually works.”[9] They also need to work with the government to develop more efficient infrastructure for imports and customs into the UK. Although the UK has floated plans to develop computerized systems to optimize the current customs process for business imports, the plan is vague and Tesco needs to partner with the government to develop an effective logistics program.[10]

What does the future hold for Tesco and the British food industry?

One open question related to Tesco’s upcoming supply chain challenges with Brexit is how aggressively Tesco should hedge against the risk of Brexit. Should Tesco make large-scale investments now to protect against potential Brexit scenarios? Another open question is what the long term implications of Brexit will mean for the dynamics of the British food industry? Is Tesco set up to stay the most competitive in whatever post-Brexit scenario becomes reality?

![Is Your Supply Chain Ready for Brexit? [Infographic]](https://blogs-images.forbes.com/baininsights/files/2017/03/supply-chain-brexit-infographic-forbes.gif?)

Source: Bain Insights, “How Will Brexit Affect Your Supply Chain?,” Forbes.com, March 30, 2017, https://www.forbes.com/sites/baininsights/2017/03/30/how-will-brexit-affect-your-supply-chain-infographic/#628f227d7e11, accessed November 2017.

Word Count: 764

[1] Bain Insights, “How Will Brexit Affect Your Supply Chain?,” Forbes.com, March 30, 2017, https://www.forbes.com/sites/baininsights/2017/03/30/how-will-brexit-affect-your-supply-chain-infographic/#628f227d7e11, accessed November 2017.

[2] Ben Bold, Tesco brand ‘most associated with Brexit’,” campaignlive.co.uk, March 29, 2017, https://www.campaignlive.co.uk/article/tesco-brand-most-associated-brexit/1429028, accessed November 2017.

[3] Rob Davies, “Tesco pulls Sol, Amstel and Tiger from shelves in Brexit price row,” March 29, 2017, https://www.theguardian.com/business/2017/mar/22/tesco-sol-amstel-tiger-brexit-heineken-price-increases, accessed November 2017.

[4] Sam Chambers, “Brexit Retail Mess: You Can’t Move Supermarkets to Frankfurt,” October 30, 2017, https://www.bloomberg.com/news/articles/2017-10-30/brexit-s-retail-mess-you-can-t-move-a-supermarket-to-frankfurt, accessed November 2017.

[5] Oscar Williams-Grut, “Brexit could cause food disruption ‘unprecedented for an advanced economy outside of wartime’,” BusinessInsider.com, July 17, 2017, http://www.businessinsider.com/brexit-uk-food-supply-eu-report-sleepwalking-crisis-2017-7?r=UK&IR=T, accessed November 2017.

[6] Thomas Kwasniok, Peter Guarraia, Michael Gastka, “Is Your Supply Chain Ready for Brexit?,” Bain.com, February 6, 2017, http://www.bain.com/publications/articles/is-your-supply-chain-ready-for-brexit.aspx, accessed November 2017. href=”https://www.forbes.com/sites/baininsights/2017/03/30/how-will-brexit-affect-your-supply-chain-infographic/#628f227d7e11″>

[7] Sam Chambers, “Brexit Retail Mess: You Can’t Move Supermarkets to Frankfurt,” October 30, 2017, https://www.bloomberg.com/news/articles/2017-10-30/brexit-s-retail-mess-you-can-t-move-a-supermarket-to-frankfurt, accessed November 2017.

[8] Ibid.

[9] Oscar Williams-Grut, “Tesco CEO: Ex-Sainsbury boss is wrong on Brexit – but ‘no deal’ could push up food prices,” October 5, 2017, http://www.businessinsider.com/tesco-ceo-dave-lewis-brexit-supermarkets-food-prices-2017-10, accessed November 2017.

[10] Sam Chambers, “Brexit Retail Mess: You Can’t Move Supermarkets to Frankfurt,” October 30, 2017, https://www.bloomberg.com/news/articles/2017-10-30/brexit-s-retail-mess-you-can-t-move-a-supermarket-to-frankfurt, accessed November 2017.

[11] Bain Insights, “How Will Brexit Affect Your Supply Chain?,” Forbes.com, March 30, 2017, https://www.forbes.com/sites/baininsights/2017/03/30/how-will-brexit-affect-your-supply-chain-infographic/#628f227d7e11, accessed November 2017.

Interesting read, Amanda!

Very much agree with your points. To one of your questions, if I were Tesco, I would hold off on making any large-scale investments to deal with potential Brexit scenarios. There is still a lot of uncertainty around how the regulations will change and it is tough to know exactly which issue (tariffs, labor, etc…) will be most detrimental. There is a potential positive spin for Tesco as well. Being a UK grocery chain, they are likely better positioned than their EU competitor’s (e.g. Aldi, Lidl) presence in the UK. If Tesco has more locally sourced products and more equipped to grow these relationships, they could maintain reduced prices as compared to their competitors and gain market share.

Amanda – I think you did an extremely good job at providing recommendations for how Tesco should move forward. I fully agree with you that the two key paths forward include building and strengthening relationships within the food and grower community as well as working closely with the British government to ensure that the regulatory environment remains at least somewhat advantageous. Perhaps the customs / logistics program could include importing foods from “pre-approved” countries to help speed up the timeline and increase the efficiency of the supply chain. Similar to how the concept of global entry works, a “global entry” for supplies that Tesco is importing could help improve their processes in the post-Brexit world. To answer your question about if Tesco should hedge and invest capital now, I do think that they should. I believe that some of the upfront work they could do now could be beneficial regardless of the outcomes of Brexit. As we both mentioned, strengthening and building supplier relationships is something that could only ultimately help the business and I think finding investments of that caliber makes sense for them as of now.

Interesting reading!

Retail in general, but groceries in particular is facing major challenges in the UK due the Brexit consequences. I do agree with your arguments and the remaining challenges that Tesco needs to face in the near future, but I would like to highlight some opportunities that arises for Tesco from this protectionist policies.

It is not a secret that Tesco has been struggling in the last few years; not only it has lost market share against it’s traditional brick and mortar competitors in the UK, but also the company is having a hard time in the eCommerce landscape competing against pure online players as Ocado and Amazon.

For several reasons Tesco has been losing competitiveness in the market and Brexit can represent a breaking point to start turning over the results. It is clear from your essay that companies that wants to compete and win in the UK after Brexit are going to need to reshape their business model; from product mix in the shelves to marketing communication to consumers, everything will change and the company that can adapt to this new environment faster can be the winner in the long term. And here is where I think that Tesco could have a first mover advantage over it’s competitors.

Great article, Amanda!

Beyond the supply chain implication for Tesco of Brexit, this article made me consider how restricting international trade makes the entire market for food (and other goods) less efficient. By limiting the number of international options, especially in nearby Europe, competitive advantages don’t have the same effect as they do with open trade. Less efficient options may need to be selected due to artificially high prices because of government tariffs, etc., which will drive up prices and reduce quality in the market.

This was a really fun read and a blast from the past – I was working at Tesco for the better part of 2016, including during Brexit. It was a fascinating time to be inside an organization that was already going through so much turmoil as a result of the political volatility. Observing how much of a distraction / disruption it was for senior management even in the days following the announcement was worrying.

Our perspective at the time, which I think remains the case, is to focus on the ‘no regret’ moves highlighted above, and do some initial investigation into the option set for larger investments and big bets, but not make any fundamental changes before the real definition of what Brexit will be is written in stone. The reality at the time and still today is that there are just too many unanswered questions about how it’s going to work, when it’s going to happen, and what the true operational implications will be. I would continue to advise them to be cautious and tread lightly, while investigating what they can without distracting their teams from operating the core business. They’re a big enough player that they’ll have power to really control the market on this, so they’ll want to do so thoughtfully.

To your first question, I think Tesco should definitely start investing in measure to protect them against potential Brexit scenarios. As Tesco has a global footprint, they should work with their global supplier to strike contracts which allows for lower costs globally. They should send in Tesco team exports to help their suppliers to improve their supply chain and efficiency. They should also share information with their local suppliers in order to see where costs can be further cut. These measures will help Tesco to be competitive in the long term in both the Uk market and globally.

Brexit will definitely have impact on the food industry in both positives and negatives way. It will reduce competition for domestic players especially for Tesco which is in the best position to innovate in comparison to their competitors. Negatively it may lead to strained relationships with suppliers as they demand higher prices and margins. Tesco will need to implement measures to best capitalize on the Brexit scenarios and address the risks.

This is a really interesting read Amanda – thanks for a great article! Working for a company that supply Tesco, I full agree with the issues that are outlined above. The impact on food imports and subsequent price implications could be significant, placing further stress on an industry that is already struggling with significant margin erosion. Another potential impact could be on labor costs as Tesco employs a significant number of low wage frontline employees, a significant portion of this is immigrant labour from the EU. If hard migration controls are imposed, this could limit low cost labour supply. However, given the uncertainty in the outcome of Brexit negotiations and specifically whether there will be a ‘hard’ or ‘soft’ Brexit, there is an argument for Tesco to hold off on significant actions at this stage.

Thanks for sharing this article, Amanda. It was super interesting to read and learn about the impact of Brexit on Tesco! I agree with all your recommendations for Tesco including domestic sourcing and and inventory management to maintain profitability post Brexit. I think the question you raise about long- term implications of Brexit on dynamics of the British food industry is an important one. I’d like to highlight two implications that stood out to me.

Firstly, Europe is UK food and beverage industry’s most significant export market and 55% of all UK farm income is derived from European subsidies [1]. If we take away European subsidies, only the largest-scale and most intensive greenhouse-gas-generating British producers are able to compete in globalised commodity markets. To counter thus, we would need an imaginative new system of subsidy that gives public money to farmers for public goods, or we risk driving them off the land in droves.

Secondly, the UK food and beverage industry is heavily reliant on migrant workers from the EU and without free movement of labour as many as 25% of the workforce could be lost [2]. To counter this, options such as a seasonal worker scheme such as a visa-controlled permit scheme to allow seasonal agricultural workers employment in the UK would need to be considered.

[1] https://www.theguardian.com/commentisfree/2017/jun/26/brexit-watershed-farming-food-industry-michael-gove

[2] https://www.willistowerswatson.com/en/insights/2017/04/UK-food-and-drink-industry-post-Brexit