The Virtual Supply Chain: Instantaneous, Custom & Local delivered by UPS

3D printing and virtual warehousing has the power to improve the consumer offering and increase the efficiency of the supply chain by providing wider product variety with faster delivery while accessing scale manufacturing advantages and reducing inventory holding cost and production waste. This technology will fundamentally change global trade dynamics, consumer buying behavior and business strategy as it enables a shift away from the physical and into the virtual.

The supply chain of the future delivers hyper-customized products on-demand, locally sourced, and taking advantage of economies of scale. How so? Through the immense power of 3D-printing.

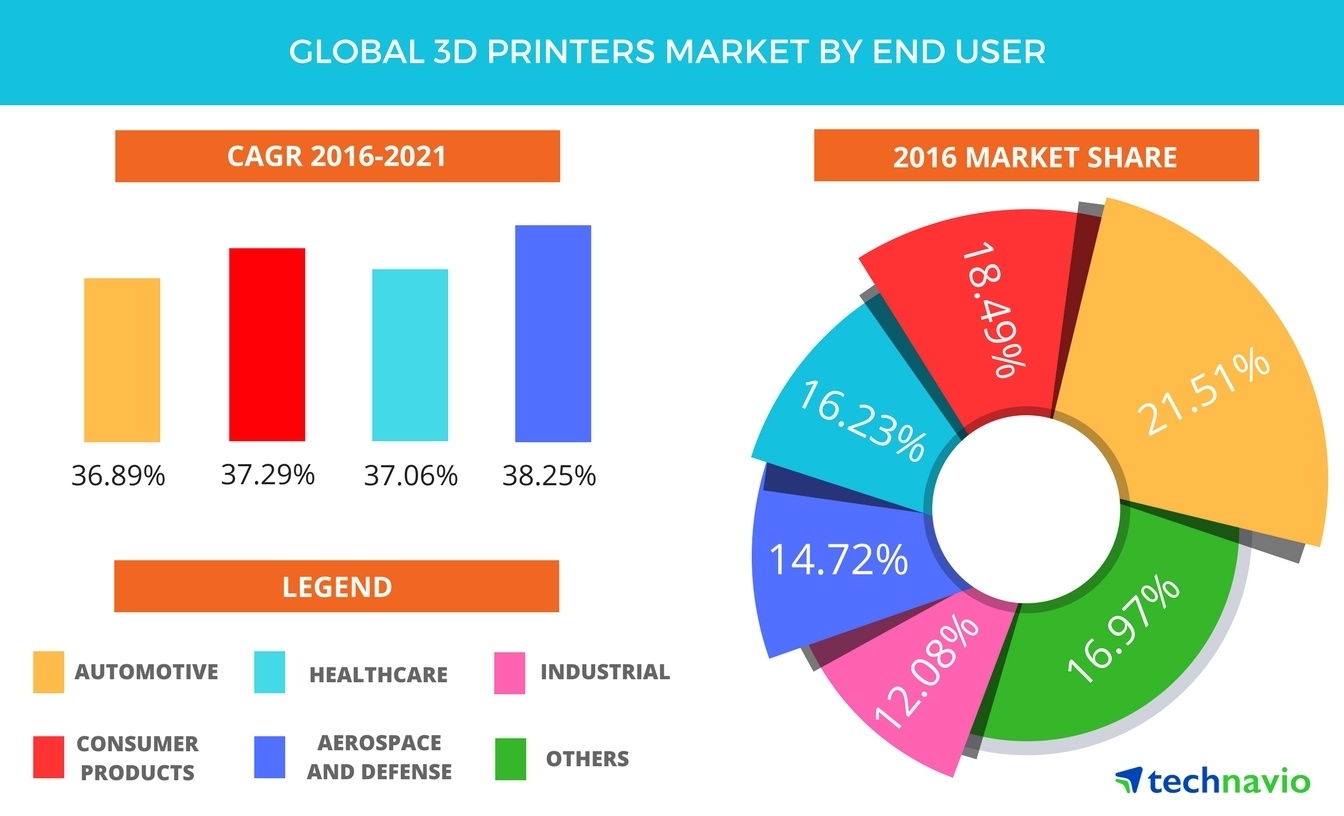

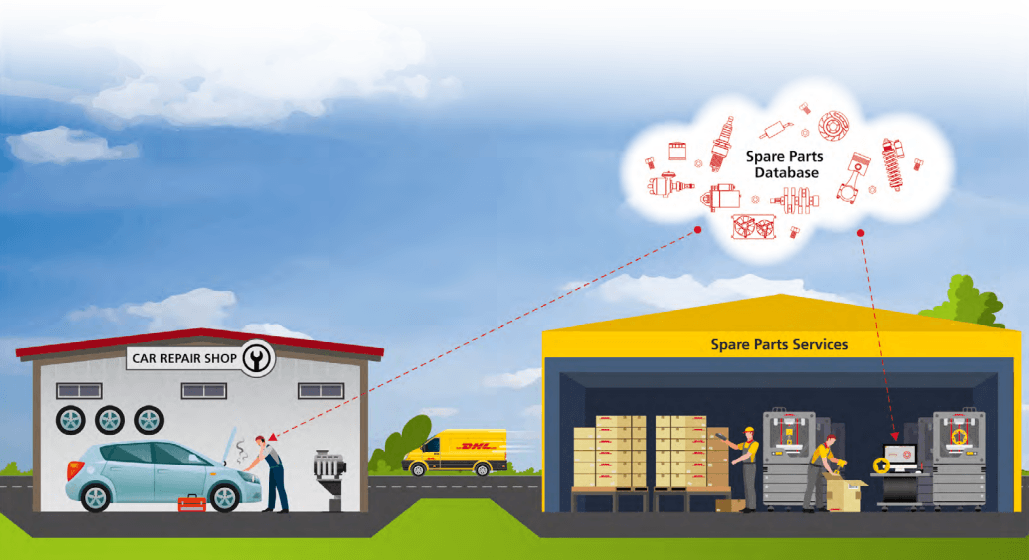

Today less than 1% of all global manufacturing output is created using 3D-printing (also known as additive manufacturing) [1], but 2/3 of US manufacturers are already using this technology in some way, from experimental prototypes to full-scale mass production [2]. It is this shift into 3D final product manufacturing that alarms the logistics providers of the world and led to UPS’ recent foray into ‘end-of-runway’ 3D-printing for its manufacturing clients. Currently UPS generates a portion of its revenue (<10%) from storing and shipping parts for manufacturers [3], primarily smaller spare parts that are critical to operations and therefore require accelerated delivery. Manufacturers have seen the opportunity here and entered this space as well; in August Mercedes Benz Truck initiated 3D-printing metal parts for older series vehicles [4]. While losing this revenue would be detrimental to UPS, it is the threat to its core logistics and delivery service that should concern UPS more, as the opportunity to localize production near end-use demand would mean a decline in global freight and air cargo volumes [5].

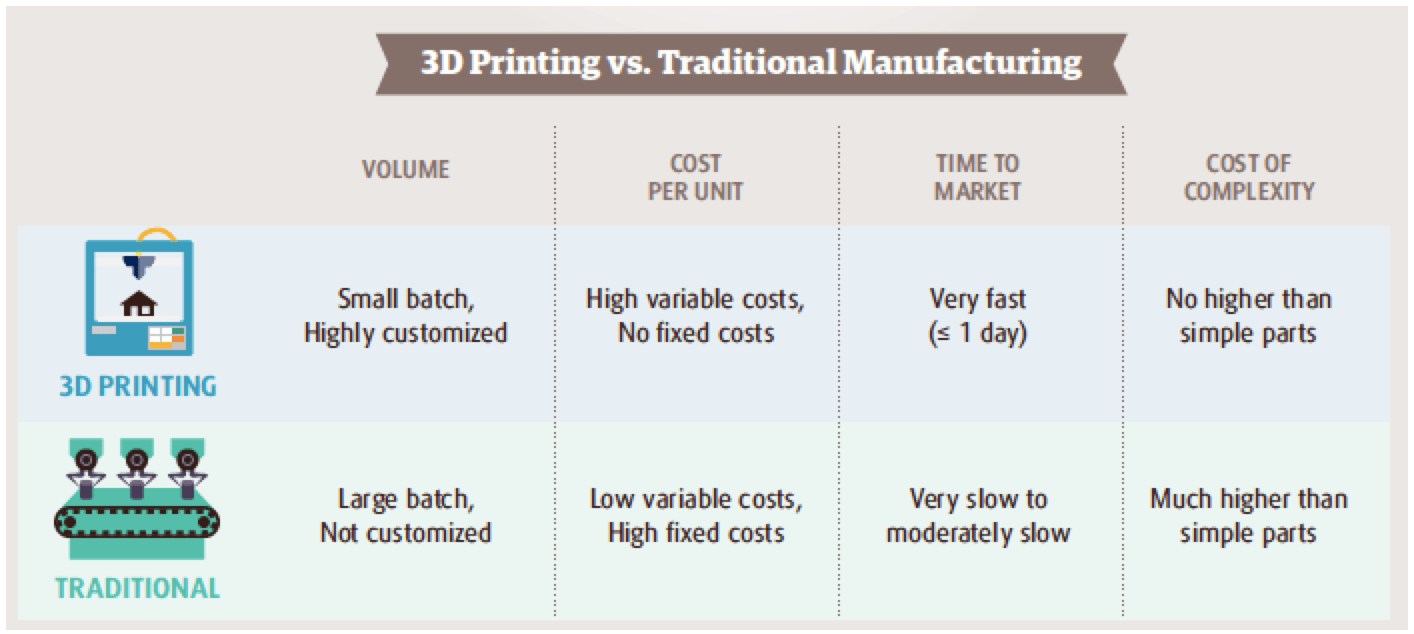

To counter this threat, UPS has partnered with SAP and Fast Radius, a 3D-printing manufacturer, to establish 3D-printing factories at UPS’ air cargo operations in Louisville, KY and Singapore [6]. Not only does this system offer UPS customers extreme lead-time reduction (UPS indicates orders can be shipped as early as same day [7]), but it also gives them access to the immense benefits of complete demand visibility through Just-in-Time production enabled by virtual warehousing. Currently manufacturers estimate demand for spare parts during initial production runs to take advantage of producing at large scale and avoid re-tooling costs. While many items move quickly, there is a long tail of parts that are rarely or never used, not only burdening the manufacturer in inventory holding costs, but also in parts obsolescence cost of having produced the item in the first place [8, 9].

Additional benefits of 3D-printing for UPS’ customers include everything from avoidance of import/export costs through in-country manufacturing, to in the long-term extreme, complete simplification of the supply chain by transforming raw materials straight to finished goods in one location by printing all component parts. 3D-printing also enables manufacturers to offer the hyper-customized products consumers increasingly demand [10], while maintaining mass manufacturing capabilities and avoiding typical re-tooling/mold costs associated with small batch production [11].

UPS’ expansion plans in this space take two paths: 1) replication of the current model in other locations worldwide, with Europe the most likely next step, potentially in their Cologne, Germany air hub [12] and 2) accumulating experience by offering consumer 3D-printing at 60+ locations around the US [13].

This is not enough. UPS’ actions in the space are not commensurate to the threat this technology poses to its business, nor is it sufficiently capitalizing on its advantage (over standalone manufacturers) to access scale in this space via aggregation. While UPS has an edge for now, as key US competitor FedEx has expressed no interest in the space and German behemoth DHL has a similarly small offering, the real threat is lurking in the periphery. Over two years ago, Amazon filed patents for truck-based 3D-printers [14], in a move that would enable not only faster shipping, but also complete product ownership from manufacturing to consumer. Amazon has the power to squeeze UPS out of this space, with a logistical prowess to rival UPS, superior automation and technological expertise [15], and the scale volume to drive itself down the experience curve to improve process time, cost and applicability of 3D-printing creating an incredibly hostile environment for any casual competitor [16].

UPS should double down in this space in two key ways:

- Predictive modelling: Through its partnership with SAP, this program identifies millions of parts currently held in inventory that are recommended for on-demand production [17], yet true cost-savings comes from not having produced these parts at all. SAP and UPS should partner with customers who do periodical re-releases/updates of similar products (e.g. auto manufacturers) to identify in 3D-printing advantaged parts in advance.

- Drive volume by assuming risk/cost: As outlined above, to reach the full benefits of 3D-printing UPS needs to access learnings through increased throughput. UPS should offer a fee-for-service model where it assumes the (currently) higher costs for using 3D-printing as well as the risk associated in exchange for a customer’s manufacturing volume. As costs decline and this service becomes profitable, this should shift to a profit sharing model to further drive customer conversion.

Do you think the ‘Uberization’ of manufacturing is possible, where companies own a product design but outsource manufacturing and distribution via the UPS 3D-printing model?

What knock-on effects might this system have? E.g. design, environmental, labor-force, legal impacts?

(794)

___________________________________________________________________________________________________

[1] PWC, “5 Ways 3D Printing Revolutionizes Manufacturing,” http://usblogs.pwc.com/emerging-technology/5-ways-3d-printing-revolutionizes-manufacturing/

[2] PWC, “3D Printing Comes of Age,” https://www.pwc.com/us/en/industrial-products/3d-printing-comes-of-age.html

[3] Reuters, “UPS expands 3D printing to stay ahead of a threat,” Fortune, September 2016, http://fortune.com/2016/09/19/ups-expands-3d-printing/

[4] Daimler, “Premier at Mercedes Benz Trucks,” http://media.daimler.com/marsMediaSite/en/instance/ko/Premiere-at-Mercedes-Benz-Trucks-New-from-the-3D-printer-the-first-spare-part-for-trucks-made-of-metal.xhtml?oid=23666435

[5] Zen Chen, “Research On The Impact Of 3D Printing On The International Supply Chain”. Advances In Materials Science And Engineering (2016): 2.

[6] Benjamin Zhang, “UPS pact gives companies access to large-scale 3D printing and virtual warehousing,” http://www.businessinsider.com/ups-sap-fast-radius-on-demand-3d-printing-2016-11

[7] “UPS to launch on-demand 3D printing manufacturing network,” UPS press release, May 2016, https://pressroom.ups.com/pressroom/ContentDetailsViewer.page?ConceptType=PressReleases&id=1463510444185-310

[8] John Chandler Johnson, Amir Sasson, “The 3D printing order: variability, supercenters and supply chain reconfigurations”. International Journal of Physical Distribution & Logistics Management 46 (2016): 85.

[9] DHL, “3D Printing and the Future of Supply Chains,” November 2016, http://www.dhl.com/content/dam/downloads/g0/about_us/logistics_insights/dhl_trendreport_3dprinting.pdf

[10] Christopher Perry, Elizabeth Spaulding, “Making it personal: Rules for success in product customization,” Bain & Company, September 2013, http://www.bain.com/publications/articles/making-it-personal-rules-for-success-in-product-customization.aspx

[11] DHL, “3D Printing and the Future of Supply Chains,” November 2016, http://www.dhl.com/content/dam/downloads/g0/about_us/logistics_insights/dhl_trendreport_3dprinting.pdf

[12] Reuters, “UPS expands 3D printing to stay ahead of a threat,” Fortune, September 2016, http://fortune.com/2016/09/19/ups-expands-3d-printing/

[13] “UPS to launch on-demand 3D printing manufacturing network,” UPS press release, May 2016, https://pressroom.ups.com/pressroom/ContentDetailsViewer.page?ConceptType=PressReleases&id=1463510444185-310

[14] Greg Bensinger, “When drones aren’t enough, Amazon envisions trucks with 3D printers,” The Wall Street Journal, February 2015, https://blogs.wsj.com/digits/2015/02/26/when-drones-arent-enough-amazon-envisions-trucks-with-3d-printers/

[15] Nick Wingfield, “As Amazon pushes forward with robots, workers find new roles,” The New York Times, September 2017, https://www.nytimes.com/2017/09/10/technology/amazon-robots-workers.html

[16] Steven Pearlstein, “Is Amazon getting too big,” The Washington Post, July 2017, https://www.washingtonpost.com/business/is-amazon-getting-too-big/2017/07/28/ff38b9ca-722e-11e7-9eac-d56bd5568db8_story.html?utm_term=.e3d1681f5d08

[17] Rick Smith, “Announcements from UPS, SAP, HP and Fast Radius mark historic turning point for manufacturing,” Forbes, May 2016, https://www.forbes.com/sites/ricksmith/2016/05/18/announcements-from-ups-sap-hp-and-fast-radius-mark-a-historic-turning-point-for-manufacturing/#3e1f8cb079e2

Very interesting article!

3d printing is so far from UPS core know-how that it seems far fetched (at first!) to think that they are at risk.

I truely believe that 3D printing will disrupt many businesses and manufacturing can be one of them. However, I beleive that many parts can’t be replaced by 3D printed ones. Indeed, the performances of 3D printed parts are so low that in many cases thet won’t be eligible for replacements of injection molded parts for example (1).

Thus, I believe that this will stay a niche business and that UPS isn’t at high risk.

However, even if I think the probability is low, the severity of such a risk is so high that UPS can’t afford risking anything. Thus UPS is completely right in investing some money on this, just as a preventive action plan.

(1): https://www.creativemechanisms.com/blog/3d-printing-vs-injection-molding

This is a really interesting article! I had no idea that UPS was considering entering into the 3D-printing model. Nevertheless, I shouldn’t be surprised because UPS has a history of looking for creative ways to better serve its clients in an effort to create value for its customers while also creating more client reliance on UPS.

For example, reading this article reminded me of UPS offering in-house repairs and support for Toshiba PC laptops back in 2004. Under this deal, Toshiba customers would be able to drop off PC laptops at a UPS store location and have the laptops repaired and shipped back to them the next day. Essentially, UPS’s 3,300 retail locations and certified technicians would be used to help Toshiba outsource the improvement of its inventory and service operations. [1]

Knowing that UPS at one time allowed its client to outsource the repair of a laptop makes the idea of UPS entering into the 3D-printing manufacturing market less shocking. While I applaud UPS for creative solutions to maintain an advantage over growing competition from Amazon and FedEx, I also worry that moving too far away from its core business also involves many risks/things to consider to include:

• Large upfront capital expenses

• Questionable reliability and durability to parts from 3D printers

• Brand dilution

• Chance that they will not be able to perform this function cheaper than other locations, even with reduction in transportation costs factored in

[1] https://www.cnet.com/news/toshiba-taps-ups-for-laptop-repairs/