The Next Era for NextEra Energy: Dealing with Climate Change as an Energy Company

Steps NextEra can take to become a clean energy leader

When you log onto the NextEra Energy, Inc. website, the company proudly declares itself a “leading clean energy company.” However, at this stage, this may be more of an aspirational statement than a veritable one. While they are on an admirable trajectory, more steps could be taken to make them a leader in clean energy and climate change recognition and remediation.

NextEra Energy Inc. is the result of a 2010 rebranding and re-organization of Florida Power and Light Group and is still comprised of two major subsidiaries:

- Florida Power and Light (FP&L) – a regulated utility founded in 1925 that is the third largest in the US by electricity sales and number of customers, [i] provides electricity to over 9 million Florida residents, and accounting for 66% of Nextera’s revenues[ii]

- NextEra Energy Resources (NEER) – a developer, owner, and operator of power plants with a particular focus in recent years on renewable energy

Given both their location and their line of business, NextEra is a clear example of an organization that will be affected by the both physical manifestations, as well as regulations surrounding climate change.

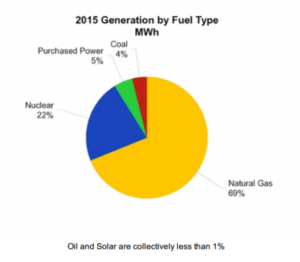

The FP&L business is where NextEra’s claim to be a clean energy leader is most debatable and also where NextEra faces the greatest negative impacts from climate change. The FP&L generation fleet consists of ~25,000 MW of electricity generating capacity, of which nearly 22,000 MW are fossil fuel (primarily natural gas) while renewable energy made up less than 1%. In spite of this, their CO2 emissions are 35% lower than the U.S. power industry average.[iii]

FP&L Generation Mix, 2015 (Source: NextEra 2015 10-K, p. 8)

It is very likely that federal or state regulations to reduce emissions intensity will begin to impact the operations of FP&L. NextEra admirably submitted a brief in favor of the Clean Power Plan (CPP).[iv] While this legislation is currently held up by a Supreme Court stay, if approved, the state of Florida would be required to reduce its CO2 emissions intensity by about 22% from status quo between 2020 and 2030 (made up in large part by FP&L reductions).[v] However, studies have shown that Florida would be able to do this without any impact on electricity rates through increases in energy efficiency and renewable energy.[vi] While FP&L is actively undertaking some CO2 reduction strategies, such as purchasing and retiring old coal plants,[vii] more should be done to improve efficiency and roll out clean energy within their own territory, regardless of the outcome of the CPP.

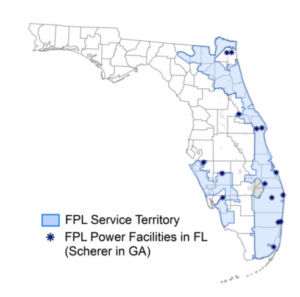

FP&L’s service territory covers the majority of the east coast of Florida, as can be seen in the figure below. This is an area historically prone to extreme weather events, and the severity of these events is likely to become worse through the impacts of climate change. This is very likely to cause FP&L to incur significant additional costs for grid repair in addition to improving grid resiliency either voluntarily or as mandated by regulators (though many of these costs will be passed through to ratepayers). In the much longer term, if sufficient action is not taken, sea level rise presents an existential threat to FP&L, particularly due to their footprint. While their annual report discloses both of these risks, they are nestled neatly in one paragraph within 10 pages of risks[viii], and an effort to increase NextEra’s disclosures around sea level rise in particular was defeated at the most recent annual meeting.[ix]

FP&L Service Territory (Source: Company 10-K, 2015, p. 5)

NEER, on the other hand, is where NextEra does live up to its clean energy claims. With 21,000 MW of generating assets in 27 states and three countries, only 23% of these come from fossil fuel systems, and this number is trending downwards.[x] With NEER, NextEra has opportunistically taken advantage of federal and state policies and regulations designed to change the US generation mix away from carbon-based fuels and increase the proliferation of renewables. Given their profitability from both business units, they are able to monetize the federal wind and solar tax credits, increasing their competitiveness as an energy developer and further supporting their bottom line.

As a key player in the electricity sector and one whose operations are seriously at risk of the physical effects of climate change, NextEra, and particularly FP&L, should increase their disclosures and become a louder advocate for regulations surrounding climate change. This will not only de-risk their business and support their operations, but support their claims of being a leading clean energy company.

[728 words, excluding citations]

[i] NextEra Company Factsheet [http://www.nexteraenergy.com/company/factsheet.shtml], Accessed November 2016.

[ii] NextEra Energy, Inc., 2015 Annual Report (Juno Beach, FL 2006), p. 79.

[iii] Ibid, p. 16.

[iv] West Virginia vs. EPA. USCA 15-1363, 1587423, (US Ct. App., DC Cir., 2015),[https://www.edf.org/sites/default/files/content/2015.12.08_power_companies_response_in_opposition_to_motions_for_stay.pdf], accessed November 2016.

[v] US EPA “Clean Power Plan Toolbox”, [https://www3.epa.gov/airquality/cpptoolbox/florida.pdf], accessed November 2016.

[vi] Advanced Energy Economy, “Model shows clean power plan could have no cost impact on florida ratepayers”, [https://www.aee.net/articles/model-shows-clean-power-plan-could-have-no-cost-impact-on-florida-ratepayers], Accessed November 2016.

[vii] “FPL announces plans to buy and phase out another coal-fired power plant, saving customers millions of dollars and preventing millions of tons of carbon emissions” (NextEra Press Release, Juno Beach, FL June 20, 2016), accessed electronically, [http://newsroom.fpl.com/2016-06-20-FPL-announces-plans-to-buy-and-phase-out-another-coal-fired-power-plant-saving-customers-millions-of-dollars-and-preventing-millions-of-tons-of-carbon-emissions]

[viii] NextEra Energy, Inc., 2015 Annual Report (Juno Beach, FL 2006), p. 28.

[ix] Mary Ellen Klas, “Shareholders of FPL’s parent company reject climate change report”, Miami Herald, May 19, 2016, [http://www.miamiherald.com/news/business/ceo-compensation/article78721212.html], accessed November 2016.

[x] NextEra Energy, Inc., 2015 Annual Report (Juno Beach, FL 2006), p. 79.

Thanks for posting BAL. I am glad people are taking the time to provide criticisms to the US energy companies. I truly believe energy providers need to step up and play a bigger role in decreasing carbon emissions, especially in the US. I’m curious as to why there is such separation between the energy generation portfolios of FP&L and NEER. It seems like the holding company isn’t taking sustainability very seriously if they aren’t going to make clean energy a priority across their subsidiaries.

You should check out this report on benchmarking utilities on their clean energy deployment (https://www.ceres.org/resources/reports/benchmarking-utility-clean-energy-deployment-2014/view). The report ranks energy companies by their renewable energy sales, cumulative annual energy efficiency savings, and incremental annual energy efficiency savings. It was interesting to see how the different companies stack up against each other (FP&L ranked low).

I didn’t see much regarding NextEra partnerships, but they would probably benefit from working with innovative companies in the solar and wind departments and battery storage areas. This would allow them to ramp up their renewables percentage within their portfolio mixes. You’d be surprised how cheap some of the new wind technologies are, at ~$.75 – $1.5 per Watt for a utility scale farm (http://sheerwind.com/product-line).

Anthony and BAL,

The reason NextEra is structured as such is because in the public markets, regulated utilities are seen as the lowest risk business out there, since they are monopolies with a guaranteed rate of return and a captive consumer base. The FP&L business allows NextEra a very low cost of capital which allows it to invest in renewable energy projects in deregulated markets. The biggest challenges I see with NextEra expanding its renewable approach to its FP&L side are the following:

1-NEER owns and operates renewable assets. As a power generator in competitive markets, they operate as technology agnostics and will go towards the most attractive cash flow projects, which happen to be wind and solar projects – this trend is likely to continue going forward. As a vertically integrated utility; however, FP&L cannot be technology agnostic, as it must bear the cost of any grid upgrades which must be done in order to accommodate the increases in grid fluctuations caused by increased renewable penetration. It can be argued that these costs should be seen as less than the costs implied by the rising sea levels, but I still see this dilemma as a factor which will hold back renewable development in FP&L for the next few years.

2-Would investors see this diversification of their utility business as a step away from the reliable business model and therefore bump up NextEra’s cost of capital?

Jaime