The Global Supply Chain of Capital: How JPMorgan Chase Will Cope with the Rise of Isolationism

Restrictive trade policies and associated limitations on capital flows will inhibit the ability of banks, such as JPMorgan Chase, to effectively provide capital, make financial markets, and facilitate commerce within and across national boundaries.

Introduction

The global rise of isolationism will create significant headwinds for international trade and the supply chain of financial capital. As the primary intermediaries between the owners and users of capital (see Figure 1), banks serve as allocators of capital. Restrictive trade policies and associated limitations on capital flows will inhibit banks’ ability to effectively fulfill this function.

Challenges of Isolationism for JPMorgan Chase & Co.

JPMorgan Chase & Co. (“JPM”) provides capital, makes financial markets, and facilitates commerce (e.g. via payment processing) for its clients within and across national boundaries. To illustrate, a Germany-based car manufacturer could operate a plant in the United States, and source raw materials from China, Japan, and Mexico.[1] Banks such as JPM play a critical role in operations like this – providing leverage to fund plant construction, extending lines of credit for manufacturers to manage their working capital, and serving as processors of payments to suppliers. Isolationist policies challenge JPM’s ability to perform these functions and thus to generate profitability.

Isolationist policies will challenge JPM’s ability to perform its core functions for several reasons:

- The rise of isolationism creates global macroeconomic uncertainty, limiting the willingness of companies to invest and households to spend. With lesser trade and consumption, JPM could face a reduction in demand for its services.

- Isolationist policies can generate the need to alter corporate structures, requiring JPM to reposition its operations. For instance, following Brexit, JPM may no longer be able to easily serve its German clients from its London office, creating significant logistical and cost challenges for the company.

- Restrictions on the flow of capital across national boundaries can increase the cost of lending and transacting payments, potentially inhibiting JPM’s ability to provide the same services to its current clients going forward.

JPM’s Response to Isolationist Pressure

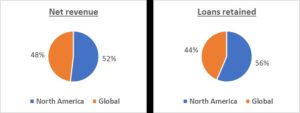

JPM’s profitability relies significantly on its ability to serve its global clients whose businesses transcend national boundaries (see Figure 2). Consequently, the company is actively taking steps to address these rising geopolitical risks:

- Relocating workers and offices based on actualized isolationist policies: In the short term, following Brexit, JPM has decided to move hundreds of London-based bankers to offices in Luxembourg, Frankfurt, and Dublin.[2] Given the uncertainty created by isolationism, the company is planning for a “hard exit by the United Kingdom” – a costly albeit responsible approach.[3]

- Communicating with clients to anticipate exposures and develop contingencies: Over the short term, JPM is actively engaging with its largest, multinational clients to assess their business risks and JPM’s ability to serve them under tighter trade conditions.[4] Brexit-like scenarios transform “within-border” transactions and relationships to “cross-border” ones, driving up operational expenses and altering the regulatory treatment of assets, potentially limiting JPM’s willingness to provide certain services.[5] As such, JPM is communicating with its counterparts up and down the capital supply chain to communicate and explore these exposures.

- Expanding selectively into new geographies: When JPM expanded into Saudi Arabia, the company was required to open a domestic data center as regulation required storing customer information locally.[6] This isolationist policy stands in contrast to the company’s cost-saving efforts in 2016 to consolidate existing data facilities into one global center.[7] As such, over the medium term, the company continues to assess geographic expansion cautiously – assessing profitability potential with appropriate sensitivities (e.g. increased regulatory cost burdens) considered.

Additional Short and Medium Term Proposals for JPM

JPM should also consider additional steps in the short and medium term:

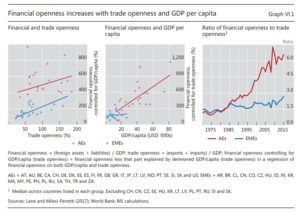

- Lobby governments to limit the impact of isolationism: Leveraging its scale position in the capital supply chain (and its role as a lender to governments), JPM can work in the short term to communicate the ramifications of isolationist policies to policymakers and trade negotiators. Specifically, the company should highlight the positive correlation between GDP and financial openness, as shown by the Bank for International Settlements (see Figure 3). However, JPM will need to cautiously utilize its valuable political capital. This will require performing sensitivity analyses to assess which isolationist policies would be most detrimental to the business, and prioritizing lobbying efforts accordingly.

- Reprioritize client relationships: In geographies where isolationist policies have been enacted, JPM should consider reprioritizing its client relationships over the medium term. For instance, following Brexit, certain British corporate clients may transition over time to sourcing raw materials locally, and may no longer rely on JPM for banking services. Instead, it may choose to partner with a local British bank, whose transaction costs (and accordingly, its pricing) may be lower given its less globalized operations, relative to JPM. In short, JPM will critically need to account for changes in its competitive landscape under a more isolated global trade paradigm.

These steps could serve to incrementally help JPM cope with isolationist trends. However, should the company also consider supply chain de-integration (i.e. divestitures) of its subsidiaries in countries where geopolitical risks loom largest? How does this affect its brand as a global financial institution?

Word count: 797

Figure 1: The Global Supply Chain of Financial Capital

Figure 2: JPM’s Corporate and Investment Banking Business by Geography[8]

Note: In Mexico and China – two key American trading partners that have been discussed as targets of U.S. protectionist policies – JPM generates $400 million and $700 million in revenue, respectively, serving local, American, and international clients who do business in those countries.[9]

Figure 3: Correlation between Financial Openness, Trade Openness, and GDP per Capita[10]

Source: “Bank for International Settlements, 87th Annual Report.” Bank for International Settlements. 25 June 2017. Page 98. https://www.bis.org/publ/arpdf/ar2017e.pdf

[1] LeBeau, Phil. “BMW adding 1,000 jobs at South Carolina plant”. CNBC. 26 June 2017. https://www.cnbc.com/2017/06/26/bmw-adding-1000-jobs-at-south-carolina-plant.html

[2] Martin, Matthew; Finch, Gavin. “JPMorgan to Move Hundreds of Staff to Three EU Offices on Brexit” Bloomberg. 3 May 2017. https://www.bloomberg.com/news/articles/2017-05-03/jpmorgan-to-move-hundreds-of-staff-to-three-eu-offices-on-brexi

[3] Dimon, Jamie. “JPMorgan Chase & Co. 2016 Annual Letter to Shareholders.” JPMorgan Chase & Co. Page 11. https://www.jpmorganchase.com/corporate/investor-relations/document/ar2016-ceolettershareholders.pdf

[4] Dimon, Jamie. “JPMorgan Chase & Co. 2016 Annual Letter to Shareholders.” JPMorgan Chase & Co. Page 11. https://www.jpmorganchase.com/corporate/investor-relations/document/ar2016-ceolettershareholders.pdf

[5] Agathocleous, Alexis; Evagorou, Clea. “Leaving the EU: What will it mean for banking and

the financial services industry?” Deloitte. Page 7. https://www2.deloitte.com/content/dam/Deloitte/cy/Documents/financial-services/CY_FinancialServices_Brexit_Noexp.pdf

[6] Monga, Vipal; Demos, Telis. “U.S. Banks Want Freer Flow of Data in Nafta Pact”. The Wall Street Journal . 2 Nov 2017. https://www.wsj.com/articles/u-s-banks-want-freer-flow-of-data-in-nafta-pact-1509624001

[7] JPMorgan Chase & Co. Management Team. “JPMorgan Chase & Co. 2016 Annual Report.” JPMorgan Chase & Co. Page 2. https://www.jpmorganchase.com/corporate/investor-relations/document/ar2016-lettertoshareholders.pdf

[8] JPMorgan Chase & Co. Management Team. “JPMorgan Chase & Co. 2016 Management Discussion and Analysis.” JPMorgan Chase & Co. Page 62. https://www.jpmorganchase.com/corporate/investor-relations/document/Management-discussion-analysis-2016.pdf

[9] Dimon, Jamie. “JPMorgan Chase & Co. 2016 Annual Letter to Shareholders.” JPMorgan Chase & Co. Pages 11-12. https://www.jpmorganchase.com/corporate/investor-relations/document/ar2016-ceolettershareholders.pdf

[10] “Bank for International Settlements, 87th Annual Report.” Bank for International Settlements. 25 June 2017. Page 98. https://www.bis.org/publ/arpdf/ar2017e.pdf

Interesting article. This trend represents a significant risk to JPM’s brand. If they just adapt their strategy for an isolationist world, they may be contributing to the problem by supporting this type of political environment. This could cause some of their global clients to come into conflict with the brand, and perhaps take their business elsewhere. I believe it is the role of JPM, as a large international company, to try to combat detrimental isolationist policies. They should use their scale and influence to lobby governments and other organizations, in an effort to support their clients multi-national needs and preserve their global brand. The key question is: how can JPM exert it’s influence most effectively?

Creating a robust and scalable capability to form local partnerships strikes me as one of the most effective methods for JPM to navigate isolationist policies. Although current trends have seen more isolationist outcomes gaining steam, it’s not necessarily clear for how long those trends will continue. Strong local partnerships can help JPM stay connected to important markets in the meantime – but given the complexity of modern finance it’s important to have transparency and alignment with partners. It seems global banks may be cooperating to build out these cababilities:

https://www.bloomberg.com/news/articles/2017-11-14/jpmorgan-wells-fargo-form-company-to-handle-partnership-vetting

Interesting read on how a rising tide of isolationism globally might affect one of the world’s biggest and most integral banks. Does isolationism pose any opportunities or potential benefits to JP Morgan that might offset some of the challenges mentioned? In particular, perhaps moves such as Brexit create a greater need to advise global companies on how to navigate the new environment. Will companies need to divest operations and therefore demand certain advisory and transactional services from banks like JP Morgan? Frictions in economic activity may create opportunities for banks to step in as a facilitator.

Interesting article and comments. While I agree that isolationist policies will disrupt the way global banks currently link capital, I think like most barriers to trade, it will create opportunities for local banks to gain business and/or form partnerships, which will affect the end user more than JP Morgan by increasing transaction and capital sourcing costs. So I totally agree with you that it is the responsibility of these massive global banks to work with and educate local governments and regulators as they make these changes. I also expect more consolidation across the entire financial services space as we’re trending towards an environment where only the fittest will survive.

Isolationism and investment banking – certainly an interesting combination. When I worked in banking, our goal was to connect people with capital, and it’s very clear to see through your article that isolationism creates impediments to this. While I do think this could be viewed as an challenge, I think it also poses an opportunity. Banks willing to be flexible and adapt to the ever changing global market will have reduced competition in environments that are increasingly isolated from the world economy. This enables those banks that are able to navigate these barriers to entry effectively to have a competitive advantage to their peers. To this end, I think JPM’s efforts in adapting to isolationist moves such as BREXIT shows their resilience in ensuring their long-term sustainability on the world stage.

This is a very interesting article. As you mentioned above, I also wonder what the role of the global subsidiaries will be in helping to minimize the effects of isolationism. In my opinion, subsidiaries present a unique opportunity to mitigate disruptions. For example, many financial service providers already operate in locations around the world and are able to ramp up operations in other regions. These firms are able to leverage the existing structures, relationships, and operations that are already in place. As a result, in many ways, the company can maintain its brand as a global firm while also catering to the requests of its clients. In my opinion, banks like J.P. Morgan will always be global. The rise of isolationism provides a unique opportunity to improve its competitive advantage.

Very interesting article but I would dare to respectfully disagree with the underlying assumption that isolationism in the banking sector is universally a bad thing. I would argue that it can also be a rational policy decision.

All the benefits of trade you list are correct, but what this entails is a much larger complexity of the system which not only makes it more obscure so that fewer agents understand how it works making it more prone to failure (as in the housing market during the 2007-2009 period), but it also propagates any tumbles across the interconnected network. A bank can be seen as a platform linking the lenders (providers of capital) with borrowers, then a degree of isolationism can make sure that the capital provision is not entirely free to move out of the country potentially starving the companies of funds for growth.

See the following for Brookings’s analysis of the role of a large Polish state-owned bank (it is not allowed to make significant forays for foreign markets) in helping avoid recession in Poland in the 2009-2012 period. Its main argument is that it operated in a degree of independence from the turmoil in the rest of the world and was able to provide credit to the Polish economy when the global banks were reining the lending in across the board and shifting capital from the peripheries (such as Poland) to the increasingly capital-strapped mother companies in the developed countries engulfed in recession ( https://www.brookings.edu/blog/future-development/2015/06/12/four-ways-polands-state-bank-helped-it-avoid-recession/ ).

At which point the harms of isolationism outweigh the benefits is a trillion-dollar-question.

Considering financing as a supply chain affected by isolationism is very interesting. I am curious under what circumstances isolationism is good for financing. Perhaps when a country is not an attractive place for investment, restricting the movement of capital out of the country may be a good thing. This may also come with a basket of negative consequences.

I think isolationism in financing, while negative for JPM, creates great opportunity for local banks. In Hawaii there is no retail banking presence from any mega-banks such as JPM. Hawaii has somewhat natural isolation from capital because of it’s distance from the mainland, its relatively small population, high real estate costs, and stiff local competition. [1] The two largest banks, First Hawaiian Bank and Bank of Hawaii, are both local with a combined 68% market share. Is this good for consumers? Is this good for the local economy? While retail banking is only one segment of banking, I think a study of Hawaiian natural banking isolation could shed some like on the affect of isolationism on capital.

[1] Ellis, Blake. “Hawaii: No paradise for the Megabanks.” CNN Money. Turner Broadcasting Systems. 28 Nov 2012. Web. 1 Dec 2017.

Very interesting article on the supply chain of capital! I was surprised to learn that even investment banks could be affected by isolationism. I agree that the isolationism will potentially break the linkage between global banks and their clients. As mentioned in the essay, these banks could become more flexible to adapt these changes, and work closely with clients to build mitigation plans to address future exposures. I wonder if global banks could leverage their financial power to slow down or even avoid isolationism. It will hurt a global company’s financial capabilities at other locations if it breaks the relationships with a big investment bank such as JPMorgan at one location.

I appreciate the thoughtful article. The author raises an interesting point about the macroeconomic consequences of isolationism; I’d note that in addition to impacting JP Morgan, the implications of such macroeconomic headwinds are broadly generalizable to global businesses across industries. Uncertainty regarding protectionism has impeded investment in certain industries in the US (e.g., solar); it similarly has influenced companies to defer strategic transactions and large-scale investments in the UK in the wake of Brexit.

Isolationist policies have the potential to considerably weigh on economic growth. Persistent protectionism compresses economic growth, interfering with countries’ ability to specialize in their comparative advantage. Combined with the author’s concerns regarding increased transaction costs and reduced consumer spending, the result is that businesses with the greatest reliance on frictionless international markets have much to lose [1].

—–

1. Zandy M, Lafakis C, White D, Ozimek A. The Macroeconomic Consequences of Mr. Trump’s Economic Policies.; 2016. https://www.economy.com/mark-zandi/documents/2016-06-17-Trumps-Economic-Policies.pdf.