The Ever Expanding Reach of Blockchain

A quick look at blockchain and the limitless opportunities it presents

What is Blockchain?

“The blockchain concept aims to combine the peer-to-peer computing ethos of Silicon Valley with the money management of Wall Street.”[i]

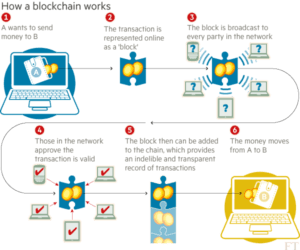

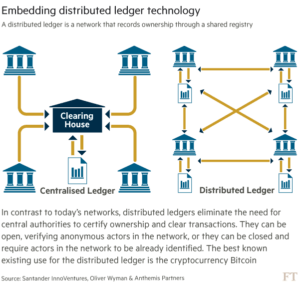

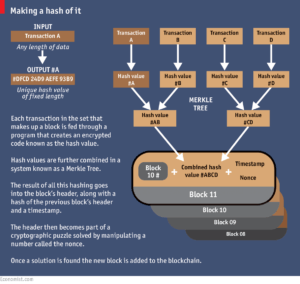

Although up to this point blockchain has largely been used to facilitate bitcoin transactions, the applications of the technology go far beyond bitcoin. Blockchain is a shared database technology that uses a network of cryptographically connected computers to record blocks of transactions, which tend to be in standardized contracts. Once completed and approved by all computers on the network, each block of transactions is recorded sequentially and forms a chain. The security of this chain is based on the interconnected nature of these individual blocks as the chain, in its entirety, must match all ledgers (known as distributed ledgers) in the system. Should any one ledger become inconsistent with the other ledgers in the network (due to hacking activity for example), it can easily be spotted, isolated and rectified.

Although up to this point blockchain has largely been used to facilitate bitcoin transactions, the applications of the technology go far beyond bitcoin. Blockchain is a shared database technology that uses a network of cryptographically connected computers to record blocks of transactions, which tend to be in standardized contracts. Once completed and approved by all computers on the network, each block of transactions is recorded sequentially and forms a chain. The security of this chain is based on the interconnected nature of these individual blocks as the chain, in its entirety, must match all ledgers (known as distributed ledgers) in the system. Should any one ledger become inconsistent with the other ledgers in the network (due to hacking activity for example), it can easily be spotted, isolated and rectified.

How does Digital Asset Holdings use Blockchain?

Digital Asset Holdings uses blockchain to “improve post-trade processing efficiency for banks and other financial institutions,” according to company head, Blythe Masters.[ii] Blockchain allows for the near instantaneous creation of a single record as opposed to the current norm of numerous records that must in turn be reconciled. Not only does this alleviate many of the issues associated with a process that is time consuming, expensive and cumbersome it also immediately highlights discrepancies in trading positions between two financial institutions. In an industry where margins are falling and trading errors can cost banks hundreds of millions of dollars[iii], the technology offers immediate, apparent benefits.

Digital Asset Holdings uses blockchain to “improve post-trade processing efficiency for banks and other financial institutions,” according to company head, Blythe Masters.[ii] Blockchain allows for the near instantaneous creation of a single record as opposed to the current norm of numerous records that must in turn be reconciled. Not only does this alleviate many of the issues associated with a process that is time consuming, expensive and cumbersome it also immediately highlights discrepancies in trading positions between two financial institutions. In an industry where margins are falling and trading errors can cost banks hundreds of millions of dollars[iii], the technology offers immediate, apparent benefits.

Additionally, the company has partnered with JPMorgan in hopes of using the technology to address liquidity mismatches with the bank’s loan funds. At the moment, investors can take money out of the funds relatively quickly while the underlying loans often take much longer to sell. With the use of blockchain’s standardized contracts and rapid settlements, JPMorgan and other banks may soon be able to liquidate fund assets at a rate more commensurate with investors’ redemption timelines.

What are the opportunities for Digital Asset Holdings in the future?

Many proponents of blockchain believe its applications could lead to billions of dollars in savings for the financial services industry as it fills a variety of needs ranging from removing system inefficiencies to eliminating the need for trade insurance. A recent report done by Santander, Oliver Wyman and Anthemis estimated the technology could cut costs for the banking industry alone by $15-20 billion by 2022.[iv] The chief executive of Accenture’s financial services operating group estimates blockchain could save 10 – 20% of investment banks’ technology costs which total an estimated $100 billion, annually.[v]

Many proponents of blockchain believe its applications could lead to billions of dollars in savings for the financial services industry as it fills a variety of needs ranging from removing system inefficiencies to eliminating the need for trade insurance. A recent report done by Santander, Oliver Wyman and Anthemis estimated the technology could cut costs for the banking industry alone by $15-20 billion by 2022.[iv] The chief executive of Accenture’s financial services operating group estimates blockchain could save 10 – 20% of investment banks’ technology costs which total an estimated $100 billion, annually.[v]

As the Bank of England notes at the end of a report published in 2014, “the application of decentralised technology to this platform of digital information could have far-reaching implications…The impact of the distributed ledger on the financial industry could be much wider than payments.”[vi]

And as the FT built upon that sentiment in an article last year, “applications range from storing client identities to handling cross-border payments, clearing and settling bond or equity trades to smart contracts that are self-executing, such as a credit derivative that pays out automatically if a company goes bust or a bond that regularly pays interest to the holder.”[vii]

Beyond the world of finance, I envision Digital Asset Holdings using the know-how necessary to service the banking industry and the cash flow the industry provides to launch a company unprecedented in scope within in the FinTech world.

The ability to immediately cash settle standardized contracts means that Digital Asset Holdings could quickly become a competitor to marketplace companies like Ticketmaster, eBay and Amazon while simultaneously taking market share from payment service companies like PayPal and Venmo. The standardized contract allows users to both transact painlessly and to monetize quickly. To give an example, the company could create a contract that allows counter parties to exchange reservations and thus, to easily monetize something that has not traditionally been capitalized on. In a world of ever expanding markets that are increasingly efficient, Digital Asset has the ability to create markets we’ve never seen before.

(699 Words)

[i] https://www.ft.com/content/e0a32840-4f68-11e6-8172-e39ecd3b86fc

[ii] https://www.ft.com/content/7498c8ba-d4e0-11e5-829b-8564e7528e54

[iii] http://www.cnbc.com/id/100976404

[iv] https://www.finextra.com/finextra-downloads/newsdocs/the%20fintech%202%200%20paper.pdf

[v] https://www.ft.com/content/7498c8ba-d4e0-11e5-829b-8564e7528e54

[vi]http://www.bankofengland.co.uk/publications/Documents/quarterlybulletin/2014/qb14q301.pdf

[vii]https://www.ft.com/content/eb1f8256-7b4b-11e5-a1fe-567b37f80b64

Illustration 1 https://www.ft.com/content/eb1f8256-7b4b-11e5-a1fe-567b37f80b64

Illustration 2 https://www.ft.com/content/e0a32840-4f68-11e6-8172-e39ecd3b86fc

Illustration 3 http://www.economist.com/news/briefing/21677228-technology-behind-bitcoin-lets-people-who-do-not-know-or-trust-each-other-build-dependable

I’ve always been intrigued by blockchain and its ability to really transform the financial system. It seems like a really great opportunity to not only cut costs, but also to create better operational management. There also seem to be opportunities to use blockchain outside of the financial industry, such as government management.

However, I wonder why blockchain technology hasn’t really taken off, especially given the major cost savings for banks, who would likely have the capital to invest in building systems. Blockchain was first thought of in 2008 [1]. Even being generous by giving this technology a couple of years to take off, I’m surprised that every bank isn’t currently employing it today. I’d be interested, @Quinn, as to what you think is the cause of this, given your expertise with the industry.

[1] http://www.economist.com/news/briefing/21677228-technology-behind-bitcoin-lets-people-who-do-not-know-or-trust-each-other-build-dependable

@kdegs – there are a number of reasons blockchain hasn’t taken off (this will be coming from a payments/cash settlement/anti-bitcoin perspective, but I think some of the ideas apply to other use cases for the protocol).

First, it still takes way too long for a transaction to occur – chains are produced every ~10 minutes or so. In comparison, cross-border transactions take Visa seconds to authorize – and the impact to customer/merchant interactions are very sensitive to time taken at txn. https://www.cryptocoinsnews.com/3-solutions-instant-bitcoin-confirmations/

Second, the ways bitcoin miners (aka the participants that validate txns) are incentivized and selected to participate are relatively convoluted. For example, miners are selected by lottery, and in the case of bitcoin, receive monetary rewards for their selection. This monetary reward represents the creation of a bitcoin which is then put into circulation. Under the uncertainty of a lottery process, the miners with the most presence/who can bring the most computing power to bear are generally favored. Also, as bitcoins are created when they are provided as rewards, early adopters pf bitcoin or those that can scale with massive computing power directly benefit. As such, there is an inherent bias as benefits are centralized to certain players in the system. http://www.coindesk.com/blockchain-lottery-miners-rewarded/

Finally – and I think most importantly, is the issue of regulation. One of the upsides (depending on who you’re asking) of having a centralized system of record is the ability to influence and assert control over that entity. It would be difficult for a regulator of any sort to regulate a dispersed network of actors that they can’t ‘see’ – but surely they’d try. Add in the fact that blockchain was created by and is being innovated on by software developers that will always be one step ahead of any regulatory attempts, you’ll likely end up with a highly decentralized/shadowy ecosystem that tries to skirt regulation while also maintaining absolutely critical records (e.g. currencies, financial records, etc.). Imagine bit torrent, but instead of your free music files, it has your social security number. One could argue that private blockchains may very well be the solution to this in future use cases, but how would the efficiency gains purported by blockchain then be realized? http://www.coindesk.com/dont-need-blockchain-regulation/

Quinn – solid post on a topic that’s becoming increasingly relevant.

Outside of the technological and regulatory barriers facing widespread adoption of blockchain systems, I wonder to what extent perception issues play a role. I’d be concerned that “blockchain” as a concept will continue to suffer – at least in the near term – from its close psychological association with bitcoin. Unfortunately, bitcoin carries with it negative connotations related to its use in illicit darknet transactions, drug trafficking, hacking scandals (e.g. Mt. Gox), and the much-publicized suicide of First Meta’s CEO, Autumn Radke.

I see some parallels to Apple’s elevating of the mp3 through the original iPod. Until its release, mp3s were tightly connected to music piracy and illegal file-sharing in the public imagination. Only through its association with a high-profile, credible company like Apple was the format legitimized. Do you think there could be a similar partnership in the financial (or other) industry that could strip blockchain of its problematic ties to bitcoin? And does Digital Asset Holdings have the name-check to do it?

[1] http://www.forbes.com/sites/jonathanchester/2015/12/28/how-one-bitcoin-startup-is-changing-public-perception-of-bitcoin/#4e5c1bad43f7

Quinn, great article!

I recently learned more about Bitcoin and Blockchain during a presentation by a recent Harvard Alum who has started a bitcoin exchange startup in Mexico. The company is called Bitso, the recent alum is Daniel Vogel ’15. One of the things I was most curious about was the actual use case for bitcoin outside of facilitating transactions between banks. He explained one such case that I found fascinating. There are many teenagers in Mexico who do not have access to credit cards, and whose parents will not allow them to use their credit cards to make purchases online. These teenagers want to pay for access to video-game portals such as Valve’s Steam store which we recently learned about. It turns out that Steam accepts bitcoin, so every month, several thousand Mexican teenagers go the the local convenience store and buy Bitcoin which is placed in their Bitso account. They can then use their Bitcoin to make purchases internationally. This use case was an unintended one, and i thought it was fascinating how people find ways to leverage technology and sometimes find new creative uses for it.

http://www.bitso.com