The Air War: The Isolationist Danger to Global Aerospace in the Era of the Populist Soundbite

In a protectionist political environment, Boeing must adjust its tactics in civil aviation after Bombardier and Airbus outmaneuvered it by forcing it to choose between opposing American jobs and accepting increased foreign competition.

Amid a rising tide of protectionism, businesses must adapt their operations and public communications to a new politicalenvironment. Nowhere is this more evident than in aerospace, where manufacturers deal closely with governments as both regulators and customers. In the last six months, inter-company trade disputes, which were normal only a few years ago, threatened multiple major national defense contracts, drove Bombardier to seek strategic alternatives, and undermined American, British, and Canadian trade ties.

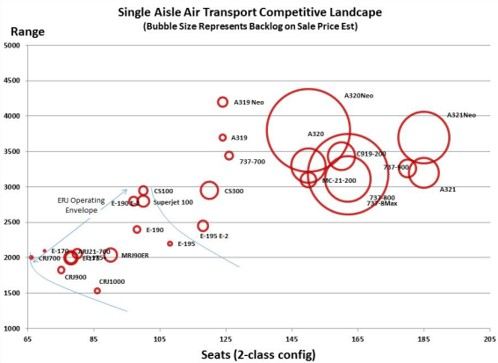

The global commercial aviation market has long been dominated by Boeing and Airbus. Among smaller commercial planes, that dominance eroded and a host of players compete led by Bombardier and Embraer. As those companies grew, they increased the size of the planes they produce, culminating in Bombardier’s C Series with ~100-150 passenger capacities.[1] The C Series was $2bn over budget, requiring $1bn in Quebecois equity and Canadian, British, and Quebecois low-rate debt to keep the project afloat.[2] In 2016, Delta placed the first large U.S. order at 75 planes and over $5bn, marking one of the first major wins for the C Series program.[3]

Boeing, whose 737s are slightly larger than some C Series jets, filed claims with the U.S. International Trade Commission. Boeing argued that the C Series should be tariffed based on unfair government subsidies and initial pricing below fair value.[4] Such trade claims were relatively common in the decades-long battle between Airbus and Boeing. Barely a year ago, the World Trade Organization held that Airbus’ A350 was dependent on EU subsidies, a significant boost to Boeing, to relatively little fanfare.[5] Boeing’s C Series claim engendered a very different response. Discussing Canada’s potential purchase of Boeing F-18 jets to upgrade its air force, Canadian PM Justin Trudeau said he “won’t do business with a company that’s busy trying to sue us and put our aerospace workers out of business.”[6] In the U.K., where Bombardier manufactures C Series wings, Sir Michael Fallon hinted that the dispute risked Boeing’s defense contracts.[7] Finally, Quebec Premier Philippe Couillard declared, “Quebec is attacked, Quebec will resist.”[8]

In a highly politicized environment, aircraft manufacturers and regulators have also internalized the new language of trade. Bombardier argued that Boeing, whose international sales are supported by U.S. Export-Import Bank loans, was hypocritical to attack Bombardier’s subsidies and make trade claims which threaten Bombardier’s American and British jobs.[9] Boeing responded that its supply chain employs over 35,000 British and Canadian workers.[10] When the ITC made its initial rulings to impose 300% tariffs on the C Series, making the planes cost-prohibitive in the U.S. market, Commerce Secretary Wilbur Ross said the government would do “everything in our power to stand up for American companies and their workers.”[11]

Bombardier’s response struck at the core of the populist trade debate. It partnered with Airbus, giving the European giant just over 50% control of the program and CAD 50m in warrants and agreeing to fund the next $700m in program cash costs. Airbus will provide sales and supply chain support and will open a new C Series assembly line at its Alabama plant.[12] While the U.S. found duties should be applied to imported parts,[13] it’s unlikely that Boeing will press trade claims that may deny jobs from Alabaman workers. Bombardier used Boeing’s popular rhetoric against itself and pitted it against American workers, an uncomfortable position for a government supplier.

In a world where isolationism has become a regular political tool, corporate management needs to be ready for their supply chain to escalate into a toxic political debate. Bombardier survived, but Boeing must still mend relationships with Canada and Britain. To that end, Boeing recently launched a campaign to raise awareness of its impact on the Canadian economy.[14] Going forward, aerospace companies will need to rethink whether aggressive pricing and government financial support are worth alienating export markets. They should also refrain from competitively-driven trade disputes which can cause political headaches that jeopardize lucrative defense contracts. Should Boeing press its claim against the C Series or partner with Bombardier competitor Embraer on a similar program? Should the U.S. government approach trade claims differently when they are simply a competitive tool? Two years ago, it would have been absurd for governments to threaten fundamental national security programs for the sake of commercial trade. Now, this is the new world order.

(713 words)

Footnotes

[1] Frederic Tomesco et. al., “Airbus Snaps Up Bombardier Jet in New Challenge to Boeing,” Bloomberg, October 16, 2017, https://www.bloomberg.com/news/articles/2017-10-16/airbus-to-buy-majority-stake-in-bombardier-c-series-jet-program, accessed November 2017.

[2] Konark Gupta, “Bombardier-Boeing Dispute: Politics aside, business as usual,” Macquarie Research, September 28, 2017, via Thomson ONE, accessed November 2017.

[3] Ana Swanson, “In Trump Era, Boeing Trade Case Boils Over Into ‘Multicountry Feud’,” New York Times, September 25, 2017, https://www.nytimes.com/2017/09/25/business/boeing-commerce-department-bombardier-trump.html, accessed November 2017.

[4] Dan Ikenson, “’America First’ Ethos Emboldens Boeing To Battle Bombardier, Benefiting White-Collar Washington,” Forbes, July 12, 2017, https://www.forbes.com/sites/danikenson/2017/07/12/america-first-ethos-emboldens-boeing-to-battle-bombardier-benefiting-white-collar-washington/#259c38c614c7, accessed November 2017.

[5] Peggy Hollinger et. al., “WTO gives Boeing lift with Airbus ruling,” Financial Times, September 22, 2016, https://www.ft.com/content/517850e0-80e2-11e6-bc52-0c7211ef3198, accessed November 2017.

[6] Swanson, “In Trump Era, Boeing Trade Case Boils Over Into ‘Multicountry Feud’.”

[7] Julian O’Neill, “Boeing UK contracts jeopardized over Bombardier row,” BBC News, September 27, 2017, http://www.bbc.com/news/uk-northern-ireland-41397181, accessed November 2017.

[8] Frederic Tomesco et. al., “Bombardier Dives on Blow to $6 Billion Bet-the-Company Jetliner,” Bloomberg, September 27, 2017, https://www.bloomberg.com/news/articles/2017-09-27/bombardier-s-6-billion-jet-takes-hit-as-boeing-wins-u-s-duties, accessed November 2017.

[9] “Boeing’s Hypocrisy,” press release, September 18, 2017, on Bombardier website, http://www.bombardier.com/en/media/newsList/details.binc-20170918-boeings-hypocrite-allegations.bombardiercom.html, accessed November 2017.

[10] “Boeing Statement RE: Commerce Duty Determination on Bombardier Subsidies,” press release, September 26, 2017, on Boeing UK website, http://www.boeing.co.uk/news-media-room/news-releases/2017/september/boeing-statement-commerce-duty-determination-on-bombardier-subsidies.page, accessed November 2017.

[11] John Campbell, “Further tariff of 80% imposed on import of C-Series plane,” BBC News, October 7, 2017, http://www.bbc.com/news/uk-northern-ireland-41532309, accessed November 2017.

[12] Phil Buller et. al., “C-Series – why and what it means,” Barclays Bank, October 17, 2017, via Thomson ONE, accessed November 2017.

[13] Tomesco et. al., “Airbus Snaps Up Bombardier Jet in New Challenge to Boeing.”

[14] “Boeing Launches Outreach Campaign in Canada,” press release, October 10, 2017, on Boeing website, http://boeing.mediaroom.com/2017-10-10-Boeing-Launches-Outreach-Campaign-in-Canada, accessed November 2017.

It really shows how trying to capitalize on populism can quickly lead to a politically motivated trade war. This is a perfect example of trying to untangle a globalized supply chain and figure out what is equitable to populations where jobs are getting scarcer. Its a remarkable case, and even if boeing is not materially hurt by the match-up (and they claim not to be) they still need to embark on a charm offensive in Canada and Europe to reassure people they won’t try and manipulate the protectionist sentiment whenever it suits them.

In this new isolationist world order, companies with cross-border operations are increasingly being politicized. The over-arching question is whether or not these companies should surrender to the current political game, or remain above the skirmishes happening at the moment. My sense is that a degree of protectionism will always exist in large industries, such as the aerospace industry in Quebec that employs a significant number of people.

I agree with you that in the current climate, Bombardier, Boeing and others need to try and avoid engaging in politically motivate trade disputes that are further politicized and publicized given the current government’s emphasis on the issue. Especially now, any moves these companies make risk thrusting them into distracting PR fiascos. For better relations in the future, I hope to see some of these companies stepping up and shaping the current NAFTA negotiations so that they best represent the needs of a complex, inter-linked supply chain, rather than the ideologies of the current political players.

As you mention, Boeing and Airbus have a history of fighting with each other through the WTO regarding illegal subsidies or tax benefits. I would argue that Boeing is actually not hurt significantly by Airbus acquiring 50.01% of the C series program, and in the process of doing so the U.S. economy is improved by bringing final assembly to Alabama. However, Boeing is partially not impacted because the Boeing supply chain does not rely heavily on Canadian product. Smaller portions of the 787 are assembled in China and then finished in Canada before being shipped to Washington, but no major sections of Boeing aircraft are produced there.

What I am much more concerned about is how this story unfolds in the future with COMAC, the largest airplane manufacturer in China. COMAC is even more government-subsidized than the C-series program is. In addition, Boeing’s supply chain is heavily dependent on China. To make matters worse, China is a quickly growing market for Boeing aircraft, and a key to Boeing’s growth 2020-2040. If a similar situation unfolded with COMAC, the results could be much more detrimental to Boeing and the U.S.

I’m not convinced that the root of Boeing’s problems lie in populist rhetoric or isolationism – rather, I think Boeing was outmaneuvered in a strategic narrative by its dominant competitor, Airbus. For quite some time, Boeing has effectively used the cudgel of trade policy and close relationships with the US government to ward off competition within the airplane manufacturing sector. I think Boeing’s rhetoric conveniently ignores its own implicit and explicit subsidies from the US government, and the fact that Boeing doesn’t make a plane that directly competes with the C-series aircraft. Additionally, I find Boeing’s claim that Bombardier sold planes below cost (no judgement from me on whether that is true) to be ironic, since Boeing’s use of program accounting essentially allows it to obscure the true cost of its early airplane models and sell them on a below-cost basis. I think Airbus managed to successfully provide national stakeholders with a dialogue that ran counter to Boeing’s narrative, and turned Boeing’s narrative against it. Ultimately, then, this looks to me more like an unsuccessful attempt to smother a future competitor with anti-subsidy tariffs than a reaction to populist sentiments.

Great article Ben! Do you think populism and isolationist disputes are most likely common for large, complex product manufacturing settings? As mentioned above regarding aircrafts, or seen in auto or technology industries as well. Because, I think there’s a fundamental American attitude that mass-market value products like apparel and hardline goods will be manufactured overseas given labor costs, trade agreements, and manufacturing advantages. In many ways, American’s have accepted that “Made in the USA” clothing or pencils are simply out of the question in the 21st century and proceed with a case-closed mentality than rather fight to bring back jobs or manufacturing in these low costs sectors. However, I do think big-ticket high-tech items like airplanes, cars, iPhones, or steel receive further disagreement often leading to political wars, given the perceived manufacturing complexity and economic impact they can provide for the home countries. Why can one be easily justified, yet the other be a constant fight around the world?

I do think this debate is far from over and current populism and isolationist unrest around the globe will continue to be in news headlines for years to come!

I have some sympathy for companies that object to government support for competitors – after all, the pockets of the goverment are deep, and how can you compete with a competitor that has access to unlimited funds? On the other hand, it should be possible for a government to decide to invest in industries and technologies on behalf of all of its citizens. Slapping on extra tarriffs whenever this happens is unhelpful for innovation from a global perspective.

It would be generally helpful if governments could agree internationally what subsidies are unfair, and which are fair game in support of economic development. Equity investments in private companies are common in some countries, less so in others. Loans can be made at non-market rates: when does this equal an unfair subsidy? As long as we don’t agree on this, standards are likely to differ across the world, leading to an uneven playing field. Ironically, in a climate of increased isolationist forces there seems very little chance of such international cooperation. As a result, stories such as Boeing’s are likely to keep occurring.

Boeing got played by Airbus at its own game, plain and simple! As Ben’s well-researched article articulates, Boeing’s attempt to to leverage the current protectionist political climate to stomp out Bombardier backfired. The end result is that it has lost out on the opportunity to acquire a 100-seater aircraft and must instead compete against an emboldened Airbus in what remains a duopolistic market.

While the C-Series program so far has been a financial albatross on Bombardier’s poorly capitalized balance sheet, it’s strategic significance on the commercial market should not be discounted. Both Airbus and Boeing have historically excelled in producing larger gauge narrowbody aircraft, preferring to cede the segment of smaller-gauge commercial craft to regional OEMs like Bombardier and Embraer. However, as rising fuel and labor costs have largely rendered 50-seat regional jet flying unprofitable, commercial airlines have more recently pursued a strategy of upgauging their fleet from smaller to larger regional aircraft. For the first time in the industry’s history, a 100 seat aircraft like the C-Series fits within these airlines’ fleet strategies. Within the context of the current environment, Boeing’s loss is particularly painful.

Even prior to the Airbus acquisition, Boeing has been trying to undercut Bombardier and the C-Series program. For example, in 2016 it aggressively offered its 737 classic aircraft at rates that are significantly below what Bombardier can afford to offer. [1] It seems to me that Boeing has been trying everything but develop a better product to win in the market. Boeing should have been spending the last few years developing a commercial response to the C-Series. Instead, it wasted its time lobbying the government. Today, it faces the reality of a 100-seater Airbus competing against the 737. Going forward, it will likely have to develop a commercial response, a significantly more costly prospect than what it might have faced if it had allowed Bombardier to continue to compete in the market.

1. https://www.forbes.com/sites/scotthamilton5/2016/03/08/united-boeing-and-the-competitors/#5d56746230da