Super Mario, Zelda, and a Broken Supply Chain

On March 3, 2017, Nintendo released Switch, an innovative video game system that provided both mobile and living-room gaming access [1].

https://www.youtube.com/watch?v=CdWd8fUC71g

Video: Nintendo Switch [2]

Only weeks after the release, Switch was out of stock at most retailers [3]. Nintendo cited the shortages were due to multiple issues with their supply chain ecosystem [4]. Can Nintendo rebound and address these critical problems before their next product release?

No Digitalization = No Mario For You

A supply shortage is not a new concept for Nintendo. In 2016, Nintendo released the NES Classic Mini, which was an instant gem in the gaming community. However, Nintendo failed to forecast properly, resulting in massive supply shortages, and forced the product to be discontinued in 2017 [5].

Root Concerns and Nintendo’s Response

One of the key issues stems from multiple bottleneck chokepoints with their suppliers. Alps Electric, which provides components for Switch controllers, is struggling to respond to the immediate and surprising requests from Nintendo for parts [10].

Nintendo is also directly competing against other companies, such as Apple, for the same manufactured parts. Toshiba, for instance, provides flash memory to many industry-wide competitors. The competition can offer better terms to the manufacturers since their orders are of higher volume than Nintendo’s. This, coupled with Nintendo’s lack of transparency on orders, results in inefficient turnaround from suppliers [11].

Additionally, Nintendo struggles to understand the demand for their products. After the launch of Switch, Reggie Fils-Aimé, president of Nintendo of America, said:

“But what I don’t know is what the demand is going to be. And there is a potential that demand is going to outstrip supply.” [12]

These scary words stem from Nintendo using historical data to predict future demand. This is a slippery slope as they have had mixed historical performance over the years. For instance, in 2012, Nintendo launched the Wii U, which significantly under performed. Relying on data from these types of launches will inevitably lead to incorrect demand predictions [14].

Nintendo’s short and medium-term plans appear to be the same: They are continuing to work on improving their data collection, forecasts of demand, and relationships with their suppliers. Yet, this has been their approach for years, with multiple flawed launches. What else can be done to address these issues?

Recommended Path Ahead

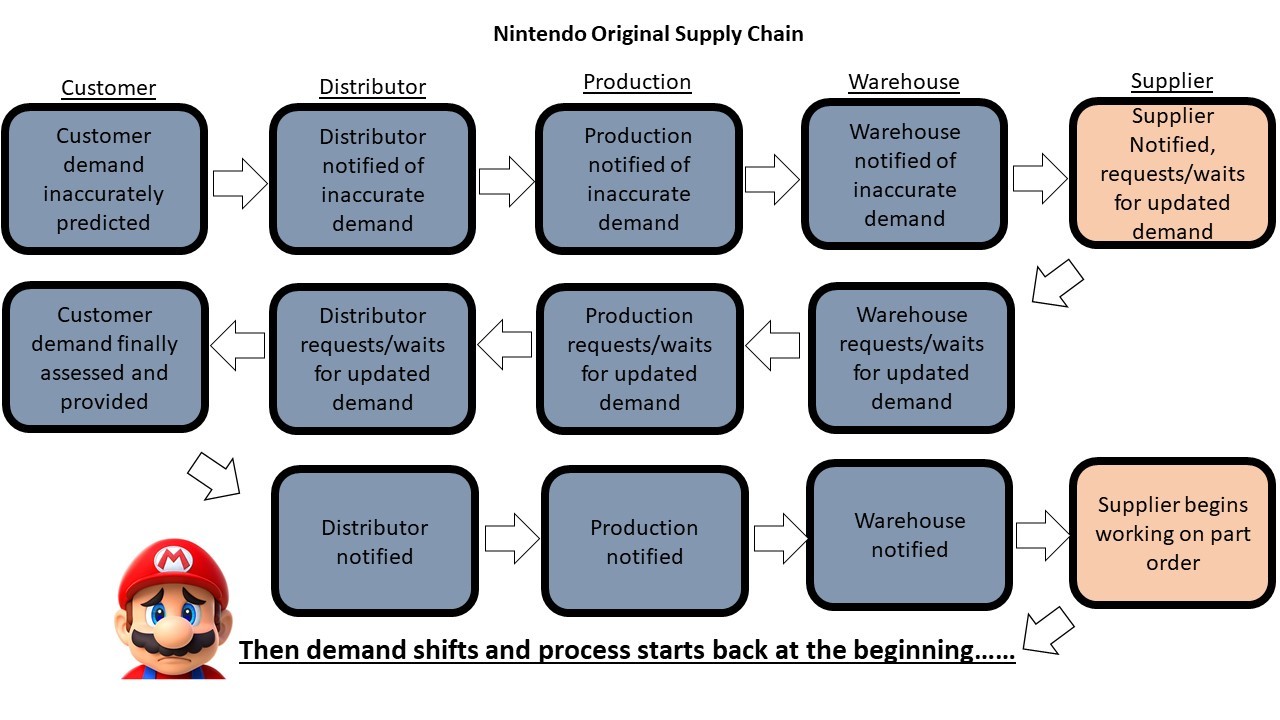

Nintendo’s short-term goal needs to immediately integrate data across the supply chain. It is evident by the aforementioned product releases that this is NOT currently happening. Rather, each division is acting independently within their own silo, increasing the amount of time it takes for information to flow throughout the chain. With this digital supply chain, as soon as customer demand shifts, planners within Nintendo can assess the impact and share it with their suppliers immediately to reduce component manufacturing bottlenecks [15]. Additionally, if Nintendo can make the communication seamless with their suppliers, it will promote a healthy relationship that will perhaps give Nintendo a competitive edge over competition when trying to get parts.

Their medium-term goal should focus on their poor supply and demand predictions. Nintendo MUST adopt predictive analytics in demand planning. This strategy will allow the company to analyze thousands of demand-influencing variables, ranging from trends on social media networks to sensor data. The collection of this data may take time, hence a 2+ year deadline. With this information, Nintendo can model the complex relationships from the derived data and create an accurate demand plan, reducing forecasting errors by 30 to 50 percent [16].

Questions to Consider

*Is Nintendo strategically limiting their supply to increase demand, thereby creating more of a buzz around their product?

*Will increased transparency be enough to compete with Apple and other companies for premium access to suppliers?

Word Count: 796

[1] Needleman, Sarah, “Nintendo’s switch hit: Game console is in short supply ahead of holidays,” Dow Jones Institutional News, August 2017, http://search.proquest.com.ezp-prod1.hul.harvard.edu/docview/1932698613?accountid=11311, ABI/INFORM via ProQuest, accessed November 2017.

[2] YouTube, “Nintendo Switch Super Bowl LI Commercial-Extended Cut,” https://www.youtube.com/watch?v=CdWd8fUC71g, accessed November 2017.

[3] Needleman, “Nintendo’s switch hit: Game console is in short supply ahead of holidays”

[4] “Nintendo (NTDOY) Falters With Preorders for SNES Classic,” Zacks Investment Research, August 2017, http://search.proquest.com.ezp-prod1.hul.harvard.edu/docview/1931289630?accountid=11311, ABI/INFORM via ProQuest, accessed November 2017.

[5] Ibid.

[6] BGR, “NES Classic Edition Back In Stock on Amazon for Five More Cities,” bgr.com/2016/12/15/nes-classic-edition-amazon-more-cities/, accessed November 2017.

[7] “Nintendo (NTDOY) Falters With Preorders for SNES Classic”

[8] YouTube, “SNES Classic Edition (aka Super NES Mini) Announced By Nintendo -Talk About Games,” https://i.ytimg.com/vi/NrzH4LAPO5E/maxresdefault.jpg, accessed November 2017.

[9] Needleman, “Nintendo’s switch hit: Game console is in short supply ahead of holidays”

[10] Bradshaw, Tim, “Component Bottlenecks Hit Nintendo’s Switch,” Financial Times, September 2017, https://www-ft-com.ezp-prod1.hul.harvard.edu/content/7bafad44-95cd-11e7-a652-cde3f882dd7b, via Financial Times, accessed November 2017.

[11] Mochizuki, Takashi. “Nintendo Fights a Parts Shortage,” Wall Street Journal, May 2017, https://search-proquest-com.ezp-prod1.hul.harvard.edu/businesspremium/docview/1903693833/abstract/B9861BE051A34271PQ/1?accountid=11311, ABI/INFORM via ProQuest, accessed November 2017

[12] Bradshaw, “Component Bottlenecks Hit Nintendo’s Switch”

[13] https://www.dualshockers.com/wp-content/uploads/2016/06/Reggie2.jpg

[14] Lewis, Leo, “Switch success drives huge jump in Nintendo profits,” Financial Times, October 2017, https://www-ft-com.ezp-prod1.hul.harvard.edu/content/04bac110-bd69-11e7-b8a3-38a6e068f464, via Financial Times, accessed November 2017.

[15] Schrauf, Stefan and Phillip Bertram. “Industry 4.0: How Digitalization Makes the Supply Chain More Efficient, Agile, and Customer-Focused,” https://hbs.instructure.com/courses/3724/files/247334/download ?verifier=YDmBuPuFfQiqyNZsKti91mspjDiMTFLb8J3xztwC&wrap=1, accessed November 2017.

[16] McKinsey & Company, “Supply Chain 4.0 in Consumer Goods,” https://www.mckinsey.com/industries/consumer-packaged-goods/our-insights/supply-chain-4-0-in-consumer-goods, accessed November 2017.

[17] Leahey, Mark. Unpublished document, Harvard University.

[18] Morris, Chris, “Nintendo Might Be Working on a Gameboy Classic Edition,” Fortune.com, September 2017, http://web.a.ebscohost.com.ezp-prod1.hul.harvard.edu/ehost/detail/detail?vid=2&sid=911def19-68d6-4767-9c07-c7a24fc1d052%40sessionmgr4006&bdata=JnNpdGU9ZWhvc3QtbGl2ZSZzY29wZT1zaXRl#AN=125605549&db=bth, Business Source Complete, EBSCO accessed November 2017.

Hey Mark! I’m a huge Nintendo and Switch fan and I loved your article.

One thing that comes to mind about the supply chain issues is how much leverage Nintendo actually has over the supply chain. Looking at their hardware competition, they have Microsoft (Xbox) and Sony (PlayStation) both of which have other electronic devices. This allows them to hold inventory of common electronic components, significantly smoothing any manufacturing issues.

As you pointed out, this has been a significant problem for Nintendo. They only have a few products with a massive spike for demand initially that then tapers off. That’s a nightmare for the rest of the supply chain.

Potentially Nintendo may need a more drastic business model change than sharing data. But sharing data can’t hurt.

Hey Mark, great article!

I had heard about these supply shortages from Nintendo in the past and always wondered how a company of its stature could let it happen. As you mentioned, it creates an incredibly frustrating customer experience. I am surprised to read about what sounds like an over-reliance on historical product launches to inform demand predictions. I fully support your suggestion toward more predictive analytics, but think they should be able to do it, at least in a simplified form, in less than the 2+ years you mentioned. Highly analytical demand prediction was something I encountered in my prior work experience, and in today’s world there is so much information available to predict consumer demand. You mentioned social media, which is a great place to start, and I have a few other suggestions: 1) search traffic (even just google trends as a starting point) 2) page hits related to Nintendo products on popular video game websites 3) traffic to the product’s wikipedia page. These type of metrics should be better demand predictors than past product launches.

Very interesting article Mark, especially in light of the Beer Game exercise we did a few weeks ago. It seems that Nintendo is suffering from both the issues that we encountered in that game – lack of POS visibility and large lead times. I agree with you that predictive analytics will be able to solve many of the problems it is facing. Machine learning is already being used by companies to help forecast demand (https://blog.toolsgroup.com/en/five-ways-machine-learning-can-improve-demand-forecasting) and Nintendo will certainly benefit from adopting it into its own forecasting techniques.

Mark – thanks for the unique, interactive article! This reminded me a lot of a project I worked on at Disney, thinking about how to leverage data to better predict consumer products sales following the release of a blockbuster movie release. Your proposal that Nintendo should be using predictive analytics to inform its suppliers about demand is similar to our thesis at time. However, one of the challenges we faced was the boom-bust pattern due to content popularity of content-driven business (i.e. movies and games). It is tough to estimate the resonance that a piece of content will have with consumers, even with the best predictive analytics. My take is that unpredictable consumer preferences is the real reason that Nintendo cannot (and should not) use historical data for demand planning. If that is the case, I wonder, if increasing data transparency with its suppliers will truly solve Nintendo’s product delivery issues.

Agree that year after year of these shortage seems almost bizarre. I do wonder if, as you postulate, there might be some genuinely bad strategy in here around increasing hype (and stock prices) through shortages. I’d also imagine that these shortages put uncomfortable pressure on suppliers, but not in ways that benefit Nintendo (I’d bet suppliers layer on a premium). This isn’t a totally merit less concern–Nintendo did something similar with their NES Classic Edition. Though the company says the issue was that they “could have done a better job communicating that was gonna be a limited run” (Source: https://arstechnica.com/gaming/2017/06/nintendo-switch-shortages-are-definitely-not-intentional/). Customers aren’t fickle but thy do get sassy. I’d encourage Nintendo to take the steps you recommend and for leadership to stop resting on their historical laurels and sort this out.