Starship Technologies: Last-Mile Delivery at the Ground Level

U.K. based startup, Starship Technologies (Starship), is tackling last-mile delivery for retailers.

U.K. based startup, Starship Technologies (Starship), is tackling last-mile delivery for retailers.

Its solution: an autonomous, robotic, self-driving vehicle. The design is lightweight and simple. The autonomous vehicle weighs 44lbs (20 kg), utilizes its dynamic six-wheels to climb curbs, and operates at low speed for the safety of people, pets and itself.

The knee-high, self-driving robot, although still nameless, has key design elements that make it most efficient in delivering consumer goods, groceries, and prepared foods directly to consumers within suburban areas. Founder and CEO, Ahti Heinla, suggests that these personal courier robots are not currently equipped for densely populated, urban environments[1]. Optimally, the robot operates best when customers are within a 2-3 mile radius of the retailer and in cities in which pedestrians do not interfere with the robot’s curbside navigation [1]. When in full operation, delivery can be remotely scheduled for the most convenient time for customers, helping to solve many of five key consumer demands of shipping, as articulated by Ahti during the Supply Chain Conference in 2016.

Consumer Demands[1]:

- Free Shipping

- Hassle Free Returns

- Same-Day Delivery

- Delivery Tracking

- Personal Service

Addressing Consumer Demands:

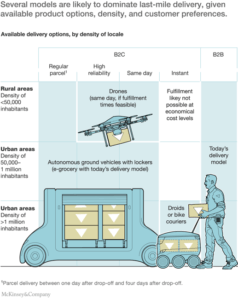

For retailers and companies of the supply chain, these pain points in consumer demands are exacerbated by increasing e-commerce demands from consumers. Digitalization of the supply chain is essential to survive rising consumer demand, as well as capturing more value from customers for new and efficient delivery services. “Nearly 25 percent of consumers are willing to pay significant premiums for the privilege of same-day or instant delivery.”[2] As a consequence, companies such as Amazon and DHL are exploring and have tested Autonomous Vehicle Technology and Wearable VR to develop efficiencies in processes at corporate warehouses to decrease the delivery time of products to consumers.[3]

Starship is providing a solution to retailers and companies with direct consumer delivery cost and will help retailers deliver to customers at a low price point. Currently, the company has partnered with Domino’s, JustEAT, Postmaster, etc. to roll out direct consumer delivery. [4] The personal self-driving vehicle service is priced to customers at 3 Euros per delivery [1]. As the robotic courier scales and technologies that makeup the production of the robot develops, the price is expected to decrease to 1 Euro per delivery. [1] These costs are not only shared at the consumer level, but, also, at the company level as the total cost of delivery will be impacted across the supply chain. In short, delivery costs currently strain margins of companies; however, efficiencies and innovation in last-mile delivery could increase customer willingness to pay for speedy delivery while decreasing delivery costs at each level of the supply chain.

As Starship continues to push to develop robots that target the last mile delivery, there are three concerns that management of the organization should work to address in expanding within the market: Competition, Regulation, and Scale.

Competition in the last-mile delivery space is becoming increasingly crowded as companies and startups in both aerial- and land-delivery are working to attain first-mover advantage. Currently, Starship has aggressively pursued product testing and exposure of its autonomous vehicles: testing in 100 cities and encountering more than 12million people. [5]. Nonetheless, Starship’s ability to scale over the next several years will be contingent upon how it incorporates ever-changing autonomous innovation best practices while navigating city-specific regulations.

In some cities, Starship Technologies has managed to overcome obstacles in regulations; however true opportunity in scale is linked to Starship’s capability to pass law/policy in more cities across the United States. Many cities currently do not have the current policies in place for autonomous, self-driving vehicles. Recently, Starship helped Washington D.C. area pass a law allowing for the capabilities of autonomous vehicles on the sidewalks and crosswalks. [6] Unlike stringent Federal Aviation Administration’s (FAA) regulation that plays a major role in the aerial last-mile delivery system, land-based regulations are arguably easier to change policy and give Starship Technologies a competitive advantage in the last-mile delivery race.

Currently, Starship is focused solely on retailers in the last-mile delivery space; however, the technology has capabilities outside of the last-mile delivery arena that would work well in acclimating consumers to the technology. In the short-term, scaling this technology within companies to transport parcels and items within large warehouses or hospitals versus last-mile delivery to customers could increase consumer touchpoints and familiarization with autonomous, land-based delivery vehicles. While working on this short-term exposure to customers by integrating technology within companies, Starship has the opportunity to develop Company Champions that support this product, who can help design internal and external policies and who can become long-term partners in this work. To curb future and vast competition in this space, Starship must consider now the dynamic corporate relationships who can promote their product and be future customers of Starship Technologies. (804 WORDS)

Further Questions:

- How do efficiencies in last-mile delivery impact integral employment and workforce opportunities? If there are major implications, what are transferable roles within or across industries for former workers?

- Are customers ready for last-mile delivery? Is this the right time for robots to interact with customers on such a personal (at-home), ground level?

Footnotes:

[1] Supply Chain Conference 2016, “Starship Technologies”, https://www.youtube.com/watch?v=gWwbsAHV2RI, accessed Nov 2017

[2] McKinsey & Company, “How Customer Demands are Reshaping Last Mile Delivery”, https://www.mckinsey.com/industries/travel-transport-and-logistics/our-insights/how-customer-demands-are-reshaping-last-mile-delivery), access Nov 2017.

[3]Variety Media, LLC, “Amazon Job Offers Hints at Plans for Virtual Reality Shopping Apps”, http://variety.com/2017/digital/news/amazon-vr-shopping-app-1201962695/ , accessed Nov 2017.

[4] CBInsights, “Automating The Last Mile: Startups Chasing Robot Delivery by Land and Air”, https://www.cbinsights.com/research/autonomous-drone-delivery-startups/, accessed Nov 2017.

[5] Starship Technologies, “Facts and Figures”, https://www.starship.xyz/company/, accessed Nov 2017.

[6] Engadget, “Virginia is the First State to Legalize Delivery Robots”, https://www.engadget.com/2017/03/02/virginia-is-the-first-state-to-legalize-delivery-robots/?sr_source=Twitte, accessed Nov 2017

Highly illuminating post, thanks Brandon. At 3 Euros per carton, and eventually at 1 Euro per carton – Starship is/will stay a highly expensive service for shipping low-value & low margin consignments. If they were to counter this concern by only using this as a niche service to deliver high-value high-margin goods on, they might be able to achieve the scale and utilization levels required to make the service cheaper over time. Additionally, they run the risk of failure in areas with poor civic infrastructure (image processing based navigation systems may not work as intended) and also a grave risk of theft/damage to their assets (vehicles) on the streets. How should they go about thinking about these concerns?

Brandon, thanks for the post. Agree with Steven that the price will make it prohibitively expensive for smaller-value packages, so how will customers feel about this yet-proven technology focusing on their high-value packages? Also, I wonder who assumes the liability at each point in the way for the carried parcel? I like your point around how land-based regulations should be easier to maneuver than air-based regulations. This seems to be a point of real competitive differentiation over many technologies I’ve read about in the news over the last few years.