Shiseido: How a 150-year-old responds to digital transformation

With online DTC newcomers already taking up a considerable market share, traditional beauty giants try to stay ahead. Shiseido invests in data and digital research and machine learning for product development, acquisitions of AI startups and launched their own Venture Fund – but is it enough?

Direct-to-Consumer Brands Challenging Traditional Players

Over the last decade, direct-to-consumer brands have appeared in several industries and are now growing rapidly. Even the beauty industry, traditionally dependent on in-store trials and offline purchasing, this is also the case. Companies like Glossier, Birchbox and Curology now represent 10% of the market and are growing 4 times faster than traditional players. [1]

Instead of an engaging offline experience, they have data. These newcomers use artificial intelligence and data analytics to deliver individualized products and personal recommendations, making up for their lack of brick and mortar. Glossier uses machine learning to customize user experience to increase conversion. ModiFace matches a user’s selfie to over 200,000 images to recognize shapes and colors and then allows the user to change hair colors and test different makeup products. [2]

Shiseido’s Response to Digital Transformation

Shiseido is one of the most traditional beauty companies in the world. Founded almost 150 years ago in Japan, Shiseido’s cosmetics and skincare brands are sold in 120 countries and it is the 5th largest cosmetics company in the world. [3] Beauty shoppers, especially younger generations are shifting to online channels and searching for personalized products and engaging digital experiences. In China, e-commerce represents 25% of Shiseido’s business, with an expected increase to 40% by 2020.

In “Vision 2020”, Shiseido emphasized the company’s focus on growing the DTC channel and capturing and leveraging consumer data to improve CRM. [3] As part of this effort, Shiseido is partnering and acquiring beauty tech startups with existing data analytics capabilities and traction with millennials. In-house, it is developing its own technology and building in in-house data and digital capabilities.

The launch of Optune

In late 2017, Shiseido announced Optune [4]. The system scans and captures information on a user’s skin conditions regarding various attributes (e.g. hydration, tone, level of oils, oxidation) and environmental factors (e.g. weather, pollution, humidity). It then recommends a personal skincare kit, with specific ratios of active ingredients most suitable for that person. Users continue to track their skin condition while using the products and feed the information back to Optune, which adjusts recommendations based on progress for each skin type.

Acquisition of MatchCo and Giaran

In early 2017, Shiseido acquired MatchCo. The app allows users to scan their skin with a camera, then it crosses the pigmentation information with a larger database and produces an individualized foundation that matches user’s tone of skin exactly. [10] In order to expand data-driven personalized recommendations to all products, Shiseido acquired Giaran at the end of 2017. The app uses predictive modeling, machine learning and computer vision to identify skin tones, develop virtual makeover and recommend products. [8]

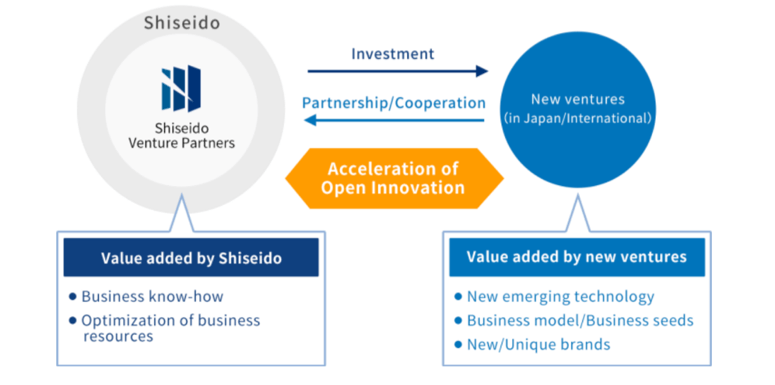

Shiseido Venture Partners and Open Innovation Scheme

As part of Shiseido’s Open Innovation initiative, the company launched a US$26 million fund in 2017 to invest in beauty tech startups. Shiseido supports the ventures with financial support and with industry and business expertise, while employees can be involved in the startups’ operations in order to develop an entrepreneurial mindset. The first company to receive funding was Dricos, which analyses a user’s biometric and anthropometric data to develop individualized supplements with the recommended nutrients. In August 2018, the fund invested in FiNC, a healthcare startup that provides preventive services using artificial intelligence. [7]

Not a competitive advantage – yet.

Shiseido is not the only company investing in augmented reality, deep learning and in their own venture fund for startups. L’Oreal has a digital team of 1,700, acquired augmented reality company ModiFace in 2017 and has its own accelerator program. Estee Lauder partnered beauty technology startup Perfect Corp, also focused on augmented reality. LVMH launched a program to support beauty entrepreneurs called La Maison des Startups [6]. So far, Shiseido has invested in companies and proprietary technology focused mainly on online experiences. However, the technologies currently available to support these innovations in beauty are still far from being realistically able to mimic offline experiences. Also, user interest and adoption rates for AR and VR in this market are still very low. The company should potentially consider technologies that enhance the offline experience, such as apps for sales reps to help customers with recommendations. Also, as any company that aggregates and analyses consumer data, they should be cautious about protecting user’s privacy.

Given the current scenario, are these traditional companies placing too many bets early on? Will the customer experience in the beauty market always be predominantly offline?

(736 words)

1) McKinsey Consumer Packaged Goods, “What beauty players can teach the consumer sector about digital disruption”, April, 2018, https://www.mckinsey.com/industries/consumer-packaged-goods/our-insights/what-beauty-players-can-teach-the-consumer-sector-about-digital-disruption, accessed November 2018

2) “L’Oréal buys ModiFace”, March 2018, https://www.gcimagazine.com/business/marketers/acquisitions/LOreal-Buys-ModiFace-477090603.html, accessed November 2018

3) Shiseido Investor Relations, https://www.shiseidogroup.com/ir/, accessed November 2018

4) Shiseido Japan, News Release, “Shiseido Releases a New IoT*1 Skincare System, “Optune,” that Delivers Personalized Skincare”, December 2017, https://www.shiseidogroup.com/news/detail.html?n=00000000002331, , accessed November 2018

5) Bruce Einhorn and Lisa Du, “Beauty giant Shiseido snaps up technology startups to draw young shoppers”, April 2018, https://www.japantimes.co.jp/news/2018/04/18/business/corporate-business/beauty-giant-shiseido-snaps-technology-startups-draw-young-shoppers/#.W-pESpNKhhB, accessed November 2018

6) Mintel, “The Beauty Consumer Report”, February 2018, http://academic.mintel.com.ezp-prod1.hul.harvard.edu/display/860255/, accessed November 2018

7) Shiseido Venture Partners, https://www.shiseidoventurepartners.jp/en/, accessed November 2018

8) Deanna Utroske, 8 Nov 2017, “Shiseido Americas acquires AI tech company Giaran”, https://www.cosmeticsdesign.com/Article/2017/11/08/Shiseido-Americas-acquires-AI-tech-company-Giaran, accessed November 2018

9) Shiseido-MatchCo, “A New Age of Personalization and A.I. for Beauty”, January 19 2017, https://www.gcimagazine.com/business/marketers/acquisitions/Shiseido-MatchCo-Herald-A-New-Age-of-Personalization-and-AI-for-Beauty-411206225.html, accessed November 2018

10) The Harbus, April 25 2018, “Interview with Marc Rey, CEO of Shiseido Americas”, http://www.harbus.org/2018/interview-with-marc-rey-ceo-of-shiseido-americas/, accessed November 2018

As you mentioned in the article, it feels like every “digitally native” brand nowadays is trying to somehow also label itself a tech company by including a couple buzzwords about machine learning and data science in their investor materials. It seems reasonable that you could teach an algorithm how to respond to various skin conditions, but I have an issue with the efficacy. Does this actually work? Is there any tangible proof? Kiehl’s has been offering “skin tests” in their stores for years which did the exact same thing – tested your skin and magically found that you were in dire need of 3-4 Kiehl’s products immediately! This kind of system makes it easy to abuse customer trust. Additionally, I am concerned that this kind of technology actually hampers innovation in the future. Over-reliance on machine learning could lead you to only iterate on existing products, instead of trying to introduce new products based on fresh science and research.

Really interesting trend you’ve spotted here. I agree that it’s not obvious that these traditional companies are not very targeted in the technology capability of their newer acquisitions. There are benefits in better understanding consumer preferences and skin conditions / complexions, however I wonder if this will actually result in improved products or enhanced R&D processes. I think it may be easier for these traditional companies to roll out newer brands that communicate it’s new focus on product enhancement / efficacy through leveraging big data, however as a consumer it’s a little harder for me to believe that these traditional brands will be able to change the way they formulate / develop products with this influx of new data.

Fascinating article! It was interesting to read about the merger of beauty and technology. To address your question around whether the customer experience in the beauty market will always be predominantly offline, I think that Shiseido needs to invest in educating the consumer and to be more proactive in making the benefits of machine learning in beauty known. What I find appealing about MatchCo is that the system is using an image that is unique to the consumer to give a recommendation. Having recently wasted over thirty minutes in Sephora looking for the perfect concealer match, I value the efficiency and ease that Optune offers. In order to convert consumers to buying beauty products online, Shiseido should consider arming its sales people in the stores with Optune, MatchCo and its other machine learning technology so that they can demonstrate to consumers the benefits that machine learning brings to the decision-making process when buying beauty products.