Schneider National and Technological Advancements in the Trucking Industry

With advancements in customer technology platforms and the rise of e-commerce players such as Amazon, the trucking industry has been forced reevaluate the way it does business. What investments must carriers make now to stay competitive, and how should they evaluate continued technological advancements in the future?

“If you got it, a truck brought it”

While it lives in the background of industry, trucking is the heartbeat by which manufacturers deliver goods to businesses and consumers throughout the United States. As the dominant method of goods transportation, trucking accounted for more than 70% of the total domestic tonnage (10.5bn tons) in 2015, and trucking firms generated $726bn in revenues in the same year1. While the U.S. has seen consolidation across an array of industries, trucking remains extremely fragmented, with more than 90% of carriers (firms that provide trucking services) operating with 6 or fewer trucks1. This lack of consolidation points to the industry’s low competitive advantages as well as minimal historical advantages to scale, as purchasing power and other size benefits have been offset by increased administrative costs of larger scale operations.

Generally defined as a slow-moving industry, trucking is experiencing a seismic shift driven by the rise of the digital age. Customer requirements have increased dramatically, and carriers are being forced to ship more customized loads at faster speeds for a lower cost. This change has been led by e-commerce giants such as Amazon, who promise 2-day free shipping to customers, increasing delivery expectations and sending shockwaves up the supply chain2. Carriers must also integrate with customers who are increasingly turning to digital and/or automated software to manage their supply chains to decrease costs and improve efficiency3. Finally, the comparatively low barriers to enter the industry have allowed new, nimble, technologically savvy players to emerge, which in turn has increased competition and forced existing players to evolve (or face risk of elimination)4.

Schneider, one of the largest players in the Full Truckload carrier market5, has recognized these industry shifts and has made substantial technological investments to improve existing operations and gain a competitive advantage in the space. In its S-1 filing for its 2017 IPO, Schneider management provided detail on Quest, its $250mm “comprehensive business process and technology transformation program”6. Per its S-1 filing:

“Our state-of-the-art Quest platform allows us to make informed decisions at every level of our business, providing real-time data analytics to optimize network density and equipment utilization across our entire network, which drives better customer service, operational efficiency and load optimization. […] Our Quest platform allows us to assess our entire network every 90 seconds, resulting in real-time, round-the-clock visibility into every shipment and delivery, route schedules, truck and driver capacity and the profitability of each load/order. Our Quest platform enables us to minimize unbilled miles, optimize driver efficiency and improve safety, resulting in increased service levels and profitability.”

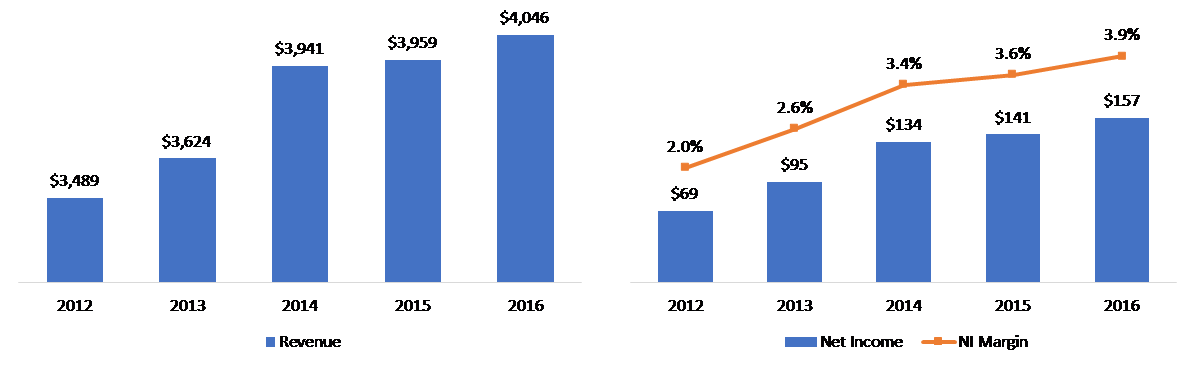

As shown below, this investment in technology has paid off for Schneider, as net income margin doubled from 2012 to 2016, and allowed Schneider to achieve a 23% compound annual growth rate (CAGR) on net income on only a 4% revenue CAGR over the same period.

Schneider financial performance ($000s):

Source: SEC filings data, November 2017

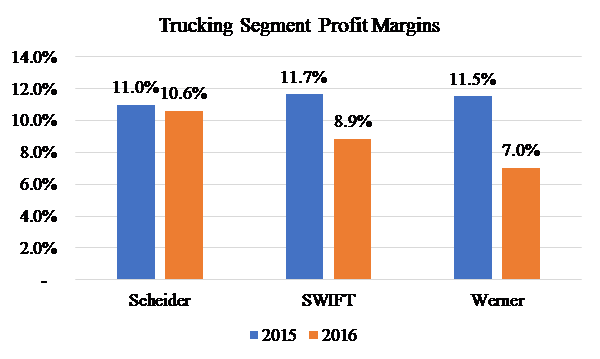

Additionally, through increased asset utilization, Schneider was able to maintain trucking operating margins throughout 2016, while competition saw material margin decreases in a year categorized by general overcapacity resulting in depressed prices across the industry.

Source: SEC filings data, November 2017

Going forward, Schneider’s response to increased digitization is twofold. First, the company plans to build upon its existing technology investments to (i) increase interaction with its customer base, driving “enhanced user experiences”, (ii) leverage data analytics to anticipate customers’ and drivers’ needs, and (iii) leverage the platform to incorporate innovative technologies and maintain their competitive edge. The company is also focused on capitalizing on the growth of e-commerce. In June 2016, Schneider acquired Watkins & Shephard and Lodeso, both of which focused on the “final mile” of delivery services, as the company focuses on becoming the leading “first, final, and every mile” carrier in the industry6.

While Schneider has made effective technology investments, they should also look to aggressively scale the business via acquisition going forward. Scale benefits have increased in the new industry landscape as (i) smaller players cannot easily make the large technology investments necessary to remain competitive, (ii) network density increases in importance as carriers look to improve efficiency, and (iii) larger players are more equipped to negotiate with a consolidating consumer base. Schneider could also likely benefit from decreased purchase prices, as smaller players deal with temporary capacity overhangs and increasing regulatory demands. This industry consolidation has already begun, with the announcement of the $6bn Swift (#1 player) and Knight (#11) merger, the largest of its kind in industry history7.

Given this context, important questions remain:

- Should Schneider look to partner with Amazon going forward? This could drive strong growth, but may also lead to significant customer concentration, lower negotiating power, and ultimately thinner margins.

- How should Schneider stay ahead of technology advancements going forward? Timing of significant advancements, such as autonomous trucking, are hard to predict, but could have a significant impact on existing operations.

Word count: 796

Endnotes

- “Reports, Trends & Statistics”, American Trucking Association, 2017 http://www.trucking.org/News_and_Information_Reports_Industry_Data.aspx, accessed November 2017

- Deborah Lockridge, “How E-Commerce is Changing Trucking”, February 2017, http://www.truckinginfo.com/channel/fleet-management/article/story/2017/02/how-e-commerce-is-changing-trucking.aspx, accessed November 2017

- Gerhard Nowak, “The era of digitized trucking: Transforming the logistics value chain”, September 2016, https://www.strategyand.pwc.com/reports/era-of-digitized-trucking, accessed November 2017

- Andrew Tipping and Jonathan Kletzel, “2017 Commercial Transportation Trends”, https://www.strategyand.pwc.com/trend/2017-commercial-transport-trends, accessed November 2017

- William B. Cassidy, “JOC Top 50 Truckload Carriers: Larger fleets outperform market”, August 2017, https://www.joc.com/trucking-logistics/truckload-freight/joc-top-50-truckload-carriers-larger-fleets-outperform-market_20170815.html?destination=node/3338846, accessed November 2017

- Schneider National, Inc., IPO Filing, April 2017 https://www.sec.gov/Archives/edgar/data/1692063/000119312517113914/d238359d424b1.htm, accessed November 2017

- Samuel Barradas, “Knight And Swift To Merge For Largest Acquisition In Trucking History”, https://www.thetruckersreport.com/knight-swift-merge-largest-acquisition-trucking-history/, accessed November 2017

Great article! I agree with your recommendation for Schneider to continue rolling up the trucking industry due to advantages offered by scale and their proprietary Quest platform. In response to your questions:

1) I would encourage Schneider to work with Amazon for a few reasons:

a) Partnering with Amazon will help Schneider to build additional scale, and thereby spread costs and investments (like the Quest platform) across a larger revenue base.

b) Amazon captured more than half of total e-commerce growth last year [1]. In an industry with GDP+ growth rates, having a customer growing in the teens every year is very valuable.

Shipping rates are relatively commoditized, so

c) By not partnering with Amazon, Schneider will cede the above advantages to competitors who could then become more competitive in other shipping sectors (e.g., by developing their own Quest Platform)

2) I would also encourage Schneider to partner with Tesla or other self-driving auto companies in order to be the first shipping company to market with these technologies, influence how the economics work and hopefully derive some economic benefit in exchange for using their enormous fleet to pilot some of the technologies.

[1] https://www.cnbc.com/2017/02/01/amazon-captured-more-than-half-of-all-online-sales-growth-last-year.html

Great article! I would just like to respond to your final questions on whether Schneider should partner with Amazon.

I think the fragmentation in the trucking industry is unsustainable and many small players may be facing veritable threats from bigger players going forward, as consolidation catches up to the trucking industry as well. At present, there are very few barriers to entry for the trucking industry, but as you mention, customer demands are only getting more complicated and customized and this will require larger players with sizeable investments and capabilities in data management and bigger fleets to be able to respond to this changing customer demand. Secondly, the continued unabated growth of e-commerce platforms such as Amazon and the increasing consolidation in that field will inevitably necessitate a few players with enough scale to be able to serve giants such as Amazon. Amazon will likely more and more move towards larger trucking providers that will be able to fulfill their needs in a more seamless, integrated way.

As regards partnering with firms like Tesla, I think there is an opportunity for partnership but I believe it may be a lot further in the future than currently envisaged, mainly by Tesla itself. Schneider should definitely be looking at the possibility of partnering but should also have its own strategy in place going forward as the autonomous truck space is still frontier territory and not many people have a strong sense of what it would look like. There is a white space for companies like Schneider to be innovative in their own right, whether it will invest in their own technologies or seek to partner with other innovators in the space, including Tesla, as a long term strategy action.

Matt, great article on an extremely relevant, often overlooked, industry. As lightly discussed above, I think in the short term, it makes sense for Schneider to pursue acquisitions in this space in an effort to grow market share and create value. Their embrace of digitization and consequent over performance on margins indicates to me that they have a competitive advantage over other, smaller carriers, and by pursing those acquisitions and instituting their systems over a larger scale, they have opportunity to create value.

For the long term, Scheinder needs to actively and aggressively pursue investment in autonomous vehicle technology. This should be done in joint ventures with vehicle developers to ensure that they, the end user, has a say in the design of the vehicles so they fit their need. It also gives them the opportunity to bake in certain strategic advantages ( ex. in the form of software platforms) in the design of the vehicles to increase the defensibility of their market position once autonomous vehicles arrive.