Royal Dutch Shell: Oil and Gas for Environmental Sustainability?

Is Shell going to adapt to environmental change or become obsolete?

Large oil and gas conglomerates have historically been the target of social criticism given their role in the production of carbon based fuels. Royal Dutch Shell, as one of the top ten largest companies in the industry, has been no exception. While their recognition of climate change as a serious global issue is public and certain, the question remains whether they are doing enough. While this question can most certainly be asked in the light of social responsibility and morality, I shall seek to assess this question based upon the likelihood of success. More specifically, is Shell doing enough to retain long term business success while supporting global efforts to reach greenhouse gas (GHG) emission reduction targets?

The Paris Agreement, ratified by 97 global parties and taking effect November 4 (today), agrees to hold the increase of global average temperature to well below 2˚C above pre-industrial levels. This requires a significant reduction in the global levels of GHG emissions, likely to be achieved by governments using carbon emissions trading systems and further incentivizing the use of clean renewable energy sources. This is expected to lower demand for fossil fuels.

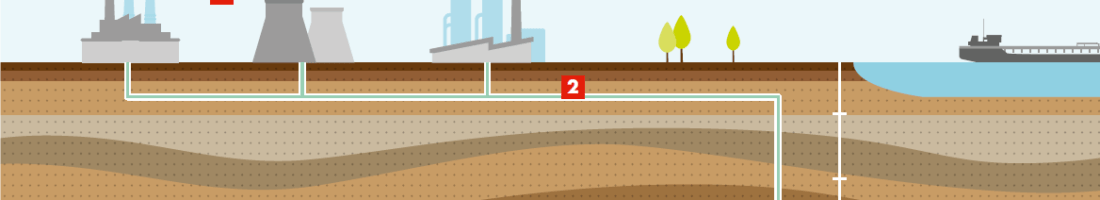

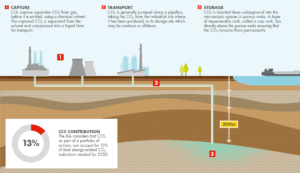

Royal Dutch Shell demonstrates a corporate awareness of the shifting future of global energy through its ‘Shell energy scenarios to 2050’ report. Identifying the critical human conundrum of the day as “more energy, less carbon dioxide,” Shell simplifies our potential futures into two potential scenarios of survival: Scramble, or Blueprints. In the Scramble scenario of the world, global policy makers do not respond sufficiently to the threat of climate change, leading to decisions favoring growth and cheap energy consumption. Energy use is predicted to shift to coal, resulting in severe climate shocks that force the world to evolve into use of biofuels, and ultimately renewable energy sources. In the Blueprints scenario, grassroots efforts originate out the recognition of the need and potential benefit of energy innovation. Local efforts eventually drive national and then international alignment, with carbon capture and storage (CCS) being applied to all fossil fuel energy generators while alternative renewable energy plants scale up. Neither scenario is an ideal or perfectly smooth transition to a sustainable global economy, leading the report to introduce the principle of TANIA: There Are No Ideal Answers. Former CEO Jeroen van der Veer notes in his foreword that in Shell’s perspective, the Blueprints scenario offers the best path towards a sustainable future, urging for ‘clear thinking, huge investment, and effective leadership’.

However, despite all this forward thinking and strategic analysis, it is not clear that Shell has been able to embrace change at the rapid pace necessary for its own forecast. Based upon the Shell 2015 annual report, the business has made incremental investments towards CCS technology. Renewable energy projects remained largely absent from the portfolio as of yearend 2015. In May 2016, a shareholder meeting resulted in a 97% vote rejecting a proposition to invest profits from fossil fuels into renewable energy projects. Shell’s net income attributable to shareholders dropped a steep 87% from 2014 to 2015 due to low oil prices coinciding with rising production costs. CEO Ben van Beurden addressed the challenges of switching to renewable energy sources while maintaining the current business model and satisfying investor demands for consistent dividend payouts: “If collectively we find a way to stay within the 2 degree (Celsius limit), we will still need significant investment in oil and gas…I am talking about up to a trillion dollars every year.” Based upon this, it seems that renewable energy and CCS solutions will remain a minor portion of the business, pending future investor interest or changes in financial incentives.

In May 2016, Shell organized its renewable energy investments into a separate business unit, titled ‘New Energies,’ receiving an annual investment budget of $200 M. This business unit covers investments in biofuel, hydrogen fuel, wind and solar energy. Its CCS joint venture, Quest, received C$865 M from the Canadian government and started operations in Alberta in 2015. Since start-up, Quest has reduced CO2 emissions by 315 kilotonnes. Shell has the potential to continue innovating in CCS technology as well as renewable energies, but has clearly demonstrated a lack of willingness to scale up these efforts unless investors are able to forego payouts, or financial incentives in the sustainability space improve. This bodes poorly for Shell’s long-term dominance in the energy space, as their own energy scenarios have forecasted.

Word count: 731 words

Sources:

Royal Dutch Shell plc. 2015 Annual Report. [http://reports.shell.com/annual-report/2015/], accessed November 2016.

Sustainability Report. Royal Dutch Shell plc Sustainability Report. The Hague, The Netherlands, April 2016.

Shell energy scenarios to 2050. Shell International BV Corporate Report. The Hague, The Netherlands, 2008.

Bousso, Ron. “Shell CEO warns renewables shift could spell end if too swift.” Reuters, May 24, 2016. [http://www.reuters.com/article/us-shell-agm-climatechange-idUSKCN0YF1YP].

Gensler, Lauren. “The World’s Largest Oil and Gas Companies 2016: Exxon Is Still King.” Forbes, May 26, 2016. [http://www.forbes.com/sites/laurengensler/2016/05/26/global-2000-worlds-largest-oil-and-gas-companies/].

Smith, Geof

frey. “Shell Looks for a Hedge Against Climate Change.” Forbes, May 16, 2016. [http://fortune.com/2016/05/16/shell-new-energies-climate-change/].

United Nations. Paris Agreement. Paris: United Nations, 2016.

Exxon has come out with the statement that they are an oil and gas company and won’t be engaging in the shift to renewables. Shell has implied the opposite, but as your post points out, hasn’t really taken steps in that direction. My question is, from an investor’s point of view, is that a bad thing? If I want to invest in renewable energy, there are many companies that will gladly take my money. If I want to invest in oil and gas, Shell is a great option. I don’t need Shell to diversify my portfolio for me. In fact, as oil and gas production declines, I may be happy for Shell to limit additional investment, operate out end of life assets, delist from the exchanges and pay out remaining equity to shareholders. That’s not necessarily a failure – that’s just market forces and it’s possibly a much better option for shareholders than risking capital on new projects outside Shell’s core competencies.

Agreed – from an investor standpoint, not necessary. Classic conflict of interest though – as you can see from some of their publications, their CEO most certainly would prefer to be included in the new wave of energy solutions, given the internal perspective that fossil fuels are on their way out, sooner or later. I may have a personal bias in wanting the company to make a transition into renewables.

Interesting post about oil and gas industry!

Besides generating energy, oil and gas can be used in so many different ways and maybe that is the reason why Shell demonstrated a lack of willingness to invest more on environmental friendly technology. It looks like they do not see the climate change as an urgent risk.

I am wondering what is their growth strategy? Will shareholders changes their mind if the climate change and followed regulations strengthened? It will be interesting to see what decisions Shell will made in the future.