Royal Dutch Shell: From Hydrocarbons to Electrons

The future is electric

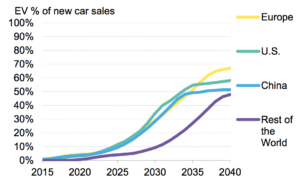

Battery electric vehicles (BEVs) are here to stay. A significant reduction in lithium-ion battery prices, increasing commitment from automakers to prioritize BEVs and supportive legislation are fueling a rapid growth in BEV customer acceptance. By 2040, it is estimated that 54% of new car sales, and 34% of the global vehicle fleet will be electric [1].

From hydrocarbons to electrons

Functionality and competitive pricing play key roles in the global transition to BEVs, but electric mobility at mass scale cannot succeed without the right charging infrastructure. Electricity consumption from BEVs is expected to rise from 6TWh in 2016 to 1800 TWh in 2040 – representing 5% of global power consumption in 2040. This projected electricity consumption would offset fossil fuel demand by 8 million barrels of transportation fuel per day [2]. In addition, electric vehicles will have a different “refueling” profile than traditional internal combustion engine (ICE) vehicles because BEVs are not required to head to the refueling station every time they’re running low on energy. Rather, electric vehicles can take advantage of existing electricity infrastructure to charge whilst parked at home, work or during errands – which on average amounts to more than 90% of a given day [3]. In other words, the weekly trip to the gas station will no longer be as relevant, and charging “on the go” will mainly occur on long distance trips when driving time exceeds a vehicle’s idle time.

To stay relevant in an electric future, gas stations must adapt their supply chain and services. Currently, gas station rely on a complex system of pipelines, rails, barges and tanker trucks to deliver transportation fuels (gasoline, diesel, ethanol, biodiesel). In the future, this supply chain will be swapped out for electrons coming via the grid or via on-site renewable energy sources.

Royal Dutch Shell – looking ahead

Royal Dutch Shell, one of the world’s largest fossil fuel companies, is preparing for the required diversification beyond fossil fuels. Today, the company and its subsidiaries manage Shell gas stations across the world, and service more than 20 million motorist a day [4]. In an effort to accommodate their motorists’ future needs, Royal Dutch Shell just revealed that they are acquiring NewMotion [5], a Dutch electric charge point and charging service provider. NewMotion has installed more than 50,000 charging locations across 22 European countries, and holds expertise in charging solutions for residential, commercial and enterprise purposes [6]. In addition to the NewMotion acquisition, Shell is rolling out “Shell Recharge” to provide fast-charging services at select gas stations in the UK and the Netherlands. Shell has targeted 10 new charging stations by the end of 2017, and will continue expanding through 2018 [7]. Other countries are expected to follow, but Shell has not confirmed a specific European expansion plan [8]. Shell Recharge is mainly targeting long distance BEV travel, which requires fast charging stations to ensure a vehicle can be recharged in 20-30 minutes. Currently, Tesla is considered the most serious player in the fast-charging space with its proprietary Supercharger network. Since 2012, the electric vehicle manufacturer has built more than 5400 Superchargers to enable long distance electric travel across America, Europe, Asia and Australia, and the company is planning to double the network by 2018 [9].

Doing enough?

Acquisitions and small-scale charging station roll outs are all well and fine, but Shell must take big steps if they are to succeed as a leader in the transition from Big Oil to renewables. Deployment-wise, the company should ensure they grow beyond the first two “pilot” countries in an effort to build a network, rather than individual test sites. As laid out above, the BEV charging cycle differs significantly from combustion vehicle needs, and to match their customers’ needs, Shell must focus on innovation and stay clear of simply adapting the “gas station” model to electric vehicles. In other words – a change in supply chain should also lead to an overhaul of their gas station business model. To this end, the company will definitely gain valuable knowledge and experience from NewMotion, but should also seek advice from the most prominent player in the field: Tesla.

Longer term, Shell must focus on the energy production downstream of the charging stations. Current investments include a massive Dutch offshore wind project, and a solar plant fueling activities at an Omani oil production site [10]. Still, their renewable portfolio is peanuts compared to current oil production. A diversified renewable energy portfolio will help Shell remain relevant beyond peak oil.

Some final thoughts

Although the future looks to be electric, the scale and rate of technological advances will impact gas station supply chains and services. Can we rely on current estimates of BEV adoption rates? How will autonomous vehicles impact refueling needs? Are gas stations as we know them a dying breed?

Word count: 799

[1] Bloomberg New Energy Finance, “Electric Vehicle Outlook 2017, Executive Summary” (PDF file), downloaded from BNEF website, [https://about.bnef.com], accessed November 12, 2017.

[2] Ibid

[3] RAC Foundation, “Keeping the Nation Moving, Facts on Parking” (PDF file), downloaded from Rac Foundation (The motoring research organization) website, [http://www.racfoundation.org], accessed November 14, 2017.

[4] Shell, “Motorist,” [http://www.shell.com/motorist/shell-station-locator.html], accessed November 12 2017.

[5] Andrew Ward, “Shell opens its first UK electric vehicle charging points,” Financial Times, October 17, 2017, [https://www.ft.com/content/c95af60c-b33c-11e7-aa26-bb002965bce8], accessed November 2017.

[6] NewMotion, “Charging Solutions,” [https://newmotion.com/en/charging-solutions], accessed November 12 2017.

[7] Andrew Ward, “Shell opens its first UK electric vehicle charging points,” Financial Times, October 17, 2017, [https://www.ft.com/content/c95af60c-b33c-11e7-aa26-bb002965bce8], accessed November 2017.

[8] Shell, “What we do: New Energies,” http://www.shell.com/about-us/what-we-do/new-energies.html”, accessed November 12 2017.

[9] Tesla, “Blog: Charging is Our Priority,” https://www.tesla.com/blog/charging-our-priority, accessed November 14 2017.

[10] Shell, “What we do: New Energies,” http://www.shell.com/about-us/what-we-do/new-energies.html”, accessed November 12 2017.

Great article!

Regarding the deployment of BEVs, I have never thought about the perspective of oil companies. It is stunning that Dutch Royal Shell already has prepared for the next step. I would like to add my thoughts on it.

(1) Shell ought to consider competitive horizon broadly. I still believe that the bottle neck lies in charging time. Thus, consumers should have something to spend their time. In this context, department stores and retailers prepare charging stations in Korea. Shell should create value proportions, such as vehicle-care, to attract more customers.

(2) To get electricity more efficiently, Shell can consider acquiring power plants. As you suggested in “Pilot services”, Shell can establish its vertical value chain by acquiring or building power plants in local countries. I wonder the future of gas stations. Can they survive?

Will the rate of adoption for BEV continue to grow at such high rates if the tax credit in the United States is eliminated? I don’t think gas stations as know them are a dying breed but I do think that major adjustments will need to be made in the upcoming years to accommodate both gasoline and electric vehicles. Also older cars are staying on the road for longer number of years so those vehicles will still need the traditional use of a gas station so a traditional gas station can’t be totally replaced with only charging stations. Autonomous vehicles regardless of whether they are gasoline or electric will need some sort of “base” where they refuel/recharge and a person to do that.

Great post. I think it really displays how the major integrated energy companies of the world are pivoting to view themselves more as energy companies holistically. While I do think providing a system for electric vehicles to charge is a key component for enabling the transition from hydrocarbons to more renewable resources, we still have to remember where the electricity from the grid comes from today. Around 58% of total OECD electricity generation came from fossil fuels in 2016. This means that roughly 3 out of every 5 miles being driven by an EV are being fueled by hydrocarbons, with a good portion still coming from coal. The good news from an environmental perspective is that more and more coal is being replaced by natural gas in the energy mix and that growth in renewable resources is increasing. I will be interested to see in the coming years if Shell and other major oil and gas companies make significant investments in R&D or acquisition of technologies that improve the growth of these renewable resources in order to advance hydrocarbon replacement and truly position them as energy companies, not oil and gas companies.

Thanks, Kristina! I completely agree with you that while Shell’s acquisition of NewMotion is a positive step in shifting their asset portfolio to cleaner energy sources, they are still not doing enough to proactively address the growing concern of climate change. When I worked at Shell, their mission statement was to be “the most innovative energy company in the world.” However, in practice, their general strategy has been to patiently wait while allowing other players develop the new renewable technologies and invest through acquisition once the technology is economically attractive. They proved this back in circa 2012 when they divested the wind energy arm of the business entirely when the business was forecasted to be unprofitable in the short-term. It begs the question as to whether Shell is entering into its acquisition of NewMotion with the noblest of intentions. Further, if they really do claim to be at the forefront of energy innovation, shouldn’t they be doing more?