Raksul, Japanese Uber for Printing

While everyone thinks printing business is dying, Raksuk, a Japanese startup thinks differently.

The Decline of Printing Business

The global printing business was shaken dramatically by the arrival of the internet and digital content. Customers changed the way they consume information, diverging from paper-based media to online or digital media. US daily newspaper weekday circulation dropped by 34% over 10 years from 2006 to 2016 [1]. Demand for printing fell, many companies struggled; for example, the newspaper group McClatchy, who publishes 30 newspapers, has struggled through a strategic transition, as digital publishing pushes out print [2]. From January 2014 to January 2017, the stock price dropped over 74% from $26.56 per share to $6.9 per share [3].

The Hidden Opportunity: Japan

While the world printing market is declining, in August 2016 a Japanese online printing services startup, Raksul, attracted ¥2.1 billion, equivalent to US$20.2 million [4], of investment from Fidelity and other investors [5]. By May 2017, Raksul was the 5th largest startup in Japan by funding [6], with a total funding amount of $71,800,000 [7].

Understanding the digitization trend among the printing industry, Raksul reacted to the trend differently by identifying the right target market and utilizing technology to adapt to the printing needs of its customers.

Raksul’s successes are built on two factors. Firstly, the Japanese culture was still largely dependent on paper. The target market of Raksul, Japanese SMEs, which accounted for 99.7% of all Japanese companies [8], still require bulk printing for brochures and business cards. According to Matsumoto, the printing industry in Japan is worth ¥6 trillion or $50.5 billion [9]. Second, Raksul’s utilization of technology changed the printing process from traditional printing to an online printing model called ‘Web-to-Print’. The Web-to-Print system allows customers to order printing products online and receive products by delivery, providing customers more convenience with less price.

Through digitization, Raksul restructured the supply chain of the printing business to provide more efficient printing services at minimal costs.

Platform Business Model

Instead of operating as a single, capital-intensive printing house, Raksul created an online network of local printing houses and acted as an agent which assigns the jobs it receives from the customers via its online portal to each printing partner. Jobs are assigned based on expertise, pricing, and location of the printing house for maximum efficiency. Raksul then marks up its profits to the end customers.

Optimization

Standardization

To minimize material costs, Raksul set a standard for each type of printing job. Regular-size business cards, for example, is set at 91mm x 55mm with 220gsm thickness [10]. With standardization, Raksul no longer has to carry large inventories and can negotiate better prices from paper suppliers due to the bulk orders.

To support standardization, Raksul integrated design services into its platform, allowing customers to access over 2000 free design templates [12] which can easily be customized to match customers’ needs.

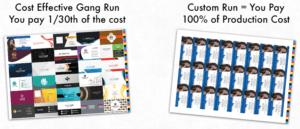

Gang Run Software

Gang Run Printing is a process where printers combine multiple jobs to be printed on the same sheet of paper. This process helps to significantly reduce prices by dividing the production costs across several jobs [11]. Raksul’s software can optimize combinations of different types of printing jobs from different clients and collate them together in one sheet of paper, minimizing empty space.

Lead Time and Pricing

Customers can choose the delivery time for the job. Raksul can offer to deliver in as soon as one business day or more than 7 days. The longer the lead time, the lower the price. Price differences between one-day and seven business days delivery can be as high as 67% for certain printing jobs [12]. More lead time means more opportunity for Raksul to optimize costs by doing Gang Run or aggregate delivery routes and schedules. The increased efficiency gained from the technology is transferred directly to the customers in the form of discounts.

Going Forward

Raksul long-term plan is to scale the platform to other countries with strong paper culture such as Taiwan and Northeast Asia[14].

My recommendation to Raksul would be to expand printing product categories from just office stationery to paper-based packaging in the short-term and to plastic-based packaging in long-term. With digitization and the internet, the Japanese may replace brochures or name cards entirely with digital products. However, digitization creates more e-commerce transactions, meaning that more packaging materials will be required to deliver products.

Future Limitations

Although Asia represents a sizable market for Raksul’s expansion, it is unlikely that the company can expand the model to the USA or European countries who have moved towards a paperless society. Should Raksul stick to its printing business model or should it do something else to utilize its existing technology?

[1] Michael Barthel., “Newspapers Fact Sheet” Pew Research Center (June 2017), Pew Research Center, http://www.journalism.org/fact-sheet/newspapers/, accessed November 2017.

[2] CreditRiskMonitor, “Spotting Bankruptcy Risk In the Printing and Publishing Industries,” https://www.creditriskmonitor.com/blog/spotting-bankruptcy-risk-printing-and-publishing-industries, accessed November 2017.

[3] Yahoo Finance, “Cenveo, Inc. (CVO),” https://finance.yahoo.com/quote/CVO, accessed November 2017.

[4] Peter Rothenberg, “Raksul makes paper sexy again with $20m in fresh funding,” Tech in Asia, August 4, 2016, [https://www.techinasia.com/raksul-funding-20m], accessed November 2017.

[5] Takahiko Hyuga, “Fidelity Invests in Japanese Startup RakSul Before IPO,” Bloomberg, August 2016, [https://www.bloomberg.com/news/articles/2016-08-03/fidelity-invests-in-japanese-printing-startup-raksul-before-ipo], accessed November 2017

[6] Kristie Wong, “Top 5 Startups in Japan by Funding – 2017,” btrax (blog), May 15, 2017, [http://blog.btrax.com/en/2017/05/15/top-5-startups-in-japan-by-funding-2017], accessed November 2017.

[7] Crunchbase, “Raksul,” https://www.crunchbase.com/organization/raksul, accessed November 2017.

[8] Ministry of Economy, Trade and Industry, “White Paper on Small and Medium Enterprises in Japan 2016,” http://www.chusho.meti.go.jp/pamflet/hakusyo/H28/download/2016hakushopanflet_eng.pdf accessed September 2017.

[9] Tech in Asia, https://www.techinasia.com/raksul-series-c, accessed November 2017.

[10] Ruksul, “Steps to create a quote,” https://raksul.com/contact/estimate/, accessed November 2017.

[11] Print Dirt Cheap, https://www.printdirtcheap.com/en/cheap-gang-run-printing.html, accessed November 2017.

[12] Tech in Asia, https://raksul.com/beginners/, accessed November 2017.

Source: Print Dirt Cheap, “What is Gang Run Printing,” https://www.printdirtcheap.com/images/contentimages/images/Cheap_Gang_Run_Compare.png, accessed November 2017.

[14] Tech in Asia https://www.techinasia.com/raksul-series-c, accessed November 2017.

Interesting essay about how startups can leverage digital to tap into a traditional “sunset” industry.

Once Raksul establishes in Japan, I agree that it should start looking for business opportunities in other countries. However, I don’t agree that there is not enough potential in Europe or the US. Printing is still widely used (HBS case printing policy might be an example) and in both regions there are plenty of SME’s companies that would like to see their printing costs decrease. Most of these companies are unable to reduce printing costs because they are not big enough to buy the most efficient technology. Raksul has a good value proposition for them and should better assess the market opportunity before focusing in smaller and more complicated economies.

This is a very interesting essay, focusing on new business model in the deigitalized printing supply chain.

In Japan, SMEs are not only major customers of Raksul, but also printing companies for which Raksul acts as an agent. Therefore, Raksul is connecting fragmented small suppliers with fragmented small customers at B to B level.

This business model is inspiring if we think how we can extend the similar model to outside printing industry in Japan. For example, furnitures might be a potential area to extend this business model.

On the other hand, I wonder if this kind of new business model is preventing the old SMEs to merge and seek more efficiencies with scale of economies. It would be interesting if we can compare impact of improvement in economic effiency between two different scenarios, A) small SMEs connected by Raksul; or B) merger of small SMEs. This kind of study might help to shape government policies and incentives.

This was a fascinating read on how digitalization has created space for a printing business specifically in Japan. It’s interesting that this model works particularly well in Japan because the culture is so strongly attached to printing. I wonder if other countries have cultural ties to printing as well – whether it be through wedding stationery (thank you cards seem to still be sent through physical mail in America), or photo books (like what Google Photos just launched a few months ago).

There still seems to be an appetite for printed products because of their physicality, but at the same time Raksul should build a more defensible business by finding other ways to create value using their digital technology as printed products become less popular over time.

I found it interesting how well Raksul’s founders knew their target market – i.e. Japan is still paper-dependent, and the company is considering expansion to other paper-dependent markets like Taiwan. The business model is also particularly attractive because (as far as I understand it) Raksul acts solely as an intermediary between the customer and the print houses, and so does not incur the same expenses that affect the capital-intensive print shops. Like the commenters above me, I think that this technology could and should be used to expand Raksul’s reach to other industries. Raksul’s technology could be used for things like custom t-shirts and other similar products, where a customer is looking to create a design easily online.

Very interesting essay, particularly from the perspective of the USA which is fleeing paper altogether. I see two next steps for Raksul. First, sprint as fast as it can to win the Asia market. Today, they’re able to achieve scale through efficient operations and first-mover advantage. However, since they are essentially a “middle person” between end customers and printers, their technology could be easily replicated. If done at lower cost, Raksul will use share. Similar to riders with Uber, Lyft and other platforms – there is no reason for those with printing needs, nor the printers, to be loyal to one platform. As a result, Raksul should strike while the Iron is hot.

Secondly, I’m not actually convinced that the world – even developed markets – will be able to operate completely without paper. For one, digital writing and annotating is not advanced enough to supplant pen & paper. Second, I’m not convinced that reading comprehension is the same for text on paper vs. text on screen. Finally, in an increasingly digitized world, there are concerns over security. Transmitting documents over the internet is riskier than disseminating, say, 10 copies of a hard copy presentation and then collecting them after a meeting.

Either way, Raksul should be well positioned to capture share in an evolving market for paper products.

Thank you for a great read! This is a perfect example of the ‘platform’ discussions that we have been having in our recent classes with the added complexity of it being in a dying industry.

While discussing Uber/Lyft/Fasten, we talked about how it can seem like the drivers and riders would not want more drivers/riders since their demand/supply would get affected, but actually it turns out that this isn’t necessarily true from the point of view of building efficiency in the demand and supply networks. What was interesting for me was to see that in Raksul’s case, its two customers – the small printing houses and people/companies needing printing facilities – would want there to be more printing houses/people/small businesses from a cost reduction perspective too! The Gang Run Software, a great example of digitization building efficiency, makes it cheaper for printing houses to print and for the consumers to purchase making the system much more efficient and cost effective!

I would tend to agree with Roger that printing is not really as down in the dumps as we might think and there is definitely huge opportunity to invest in this space. However, I do agree that expansion into plastic-printing will bring long-term benefits to the company.

It was very interesting to see how Raskul embraced digitization to create a niche in a dying industry. This theme is common across many industries. Companies that leverage digitization and change their operating model accordingly survive the test of time. It is interesting how Raskul opted for network of printing houses rather than single central printing house. In the age of sharing economy we see that some companies opt for asset light platform play.

In terms of future opportunities it will be interesting to see how the company could embrace 3D printing. If Raskul can do a similar platform play for 3D printing, it can tap into varied range of use cases beyond traditional printing.