No Longer One Single Shade: Sephora and the Beauty Industry

The face of beauty is changing with increased customization- will traditional retailers keep up?

“Beauty is a very personal thing. People don’t want to be told. They want to choose what looks good.” – Nhu Le, Founder of Finding Ferdinand

The face of the beauty industry has been changing drastically over the past twenty years. In the makeup industry, a 7.3B market, we’ve seen an increase in the diversity of products offered, the need for trial-ability, and the emergence of increased customization [1].

In 1998 Sephora, a subsidiary of the French luxury conglomerate LVMH and the no.1 beauty retailer in the world, launched its North America presence. In 2014, the company had 343 North America stores with 3 regional centers supplying all locations [2]. In 2016, these distribution centers stocked over 14,000 SKU’s to replenish stores and additional SKU’s to fulfill online orders. Each store had, on average, 9,000 unique SKU’s. [3]

Given the high SKU count and variability in demand, Sephora’s distribution network faces many challenges. Sephora is often carrying excess inventory in its distribution centers and retail locations because of its inability to accurately forecast demand and its reliance on a monthly ordering schedule [4]. In 2016, Sephora’s planning team used average store demand and average forecast to determine the orders they placed. This rolled up average had an accuracy that was less than 55% from vendor to distribution channel and 80% from distribution channel to store. [4] Coupled with 14 day lead times, this results in an incredibly inefficient distribution system; a system where it could take 16 days to put an SKU back on the shelf [4]. Analysis of Sephora’s distribution system by Envista in 2016 highlighted operational bottlenecks at distribution centers due to the system of monthly buys and labor cost inefficiency due to lack of visibility on inbound transportation [4]. This fragmented, assumption driven system is a major weakness for Sephora.

Paradoxically, the retailer has heavily invested in building a high tech in-store and online experience to meet the rising trends of customization and enforce its “try more buy more ethos” [5]. Sephora has launched Color IQ in store- a technology that allows customers to scan their faces and receive a reference color to find products that match their skin tone [5]. In addition, customers can answer a series of questions in an in-store iPad to receive a set of recommendations on bundled products that they can add to their shopping cart. Sephora has also launched an augmented reality app that allows customers to virtually try on various shades of lipstick in store. All this technology enables Sephora to bring real-time customization to the hands of its customers and drive product purchases.

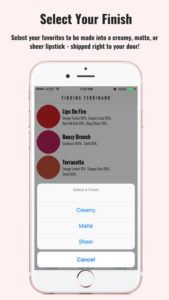

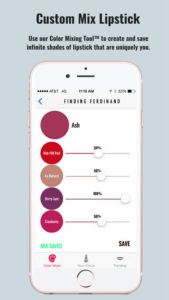

In contract to Sephora’s emphasis on trial-ability, competitors have emerged focusing on creating a highly customized one product fit. One such company, Finding Ferdinand, creates custom lipstick shades. A customer can visit their website and select a series of color combinations for their custom shade of lipstick. This order is then sent to their Santa Monica fulfillment center and within minutes the color is blended and ready for shipping [6]. Finding Ferdinand has grown 150% annually in the last three years with plans for product expansion underway [6]. With competitors like these in the market, Sephora cannot afford to have an inefficient inventory management system that could easily drive customers away when the products they want to try aren’t available in store.

A digitized supply chain would enable Sephora to be more efficient in the following ways:

- Creating automated warehouses that provide continuous information flow will allow Sephora to better forecast demand and determine the optimal levels of inventory for each store.

- Autonomous transportation would enable transparency into transit updates and reduce the labor costs associated with uncertain drop-off volume and times.

- Distribution centers with weight sensors will enable the company to predict inventory needs and improve the cycle time from vendor to distribution center to store shelf.

In order to address these challenges in the short and medium term, Sephora’s management has implemented the following:

- Moved from monthly OTB to a bi-weekly OTB schedule [4].

- Three times a week store re-stocking with smaller shipments rather than 80% of shipments arriving in the first week of the month [4].

In addition, I’d recommend the organization’s management also take the following action:

- Utilize IoT technology in individual stores to track real-time inventory changes and communicate inventory needs to their distribution centers. This will allow them to better predict demand and create a profile of their customers purchasing behavior in each market.

- Use the data gathered from their in-store tech experiences to predict customer demand and better inform their ordering and inventory management.

Question:

- Sephora’s new facility in Maryland has provided 610 full time job opportunities for the locals of Harford County. What degree of digitalization can we justify at the cost of taking away people’s jobs?

Word Count [798]

It is interesting to see that Sephora’s diversity of products offered is its key competitive advantage while at the same time a major weakness to its supply chain management. Other than investing in digital initiatives, I think that Sephora should optimize its product portfolio by expanding its private label products since it has higher control and visibility of its product and supply chain. Because of the difficulty of predicting demand for other brands, Sephora should implement effective marketing strategies to influence customer purchasing behaviors. Forming partnerships with other big retailers such as JC Penney and department stores will also help Sephora to gain access of customer demand data within the broader beauty industry.

While digitalization may pose a threat to existing jobs, I think that there will be new jobs created that require digital skills such as artificial intelligence programmers and data scientists, who not only build the required infrastructure but also apply such skills to continuously improve and innovate business designs. The bigger challenge is how Sephora will reallocate its capital to invest and make a successful transition to a digital business.

Sephora’s need for customization of experience, definitely seems really crucial. One of the key things I thought was really interesting was contrasting data collection and this customization. Data is powerful yet expensive thing to harness – I think one of the things that I would be curious about is the ability to develop systems and processes that can sift through what is crucial, and what is detrimental. Creating a platform to designed customized beauty products can develop incredibly efficient systems, but it could also increase the amount of specific production, leading to slower development of the product, and longer turn over times. Data, therefore, can be extremely cumbersome, and could lead to a slower production line. In Sephora’s case, my largest concern, therefore, is their actual ability to implement these changes.

To answer to your question, I do not believe that promoting jobs creations and investing in digitalization are mutually exclusive.

I do believe that weaknesses in Sephora inventory management in stores leads to substantial cost, either in the form of missed sales or in the form of shelf space cost incurred by holding unsold inventory for long period of times. Investing in digital solutions to be able to get a more accurate view on demand per SKUs and per location would enable stores to achieve higher turnover of their inventory while the same amount of labor content would be required to handle these inventories.

I would even argue that digital solutions create new job opportunities. A virtuous circle may enable companies which invest in digital solutions to create new jobs, to manage data generated for instance, as the result of operational cost savings achieved.

I feel viewing digitalization from the lens of job destruction is the wrong way to go. I would argue digitalization is a matter of survival for Sephora. With stiff competition from Ulta, and the beauty industry being viewed as one of the top performing industries of 2016 and 2017 more and more competitors are looking at how they can enter and disrupt this industry. By investing in digitalization for not only inventory management but also customer experience enhancement, Sephora is ultimately setting up barriers to entry. The magnitude of job losses from a company no longer being able to compete are far greater than the magnitude of job losses that may, which is a big may, occur from digitalization.

Thank you for sharing! This is a very relevant and common problem for several companies. Supply chain digitalization is a great solution for Sephora and all the initiatives make sense, however, playing the “Devil’s advocate” role, I would ask if instead of simply trying to become more digitized to supply so many SKUs, Sephora should not try to rationalize its portfolio and decrease the inventory management complexity. I believe there is an optimal number of SKUs for which a company increases its sales by having a wide supply of options. However, Sephora may have reached the point in which a SKU sales is cannibalizing others’. Additionally, Sephora could consider having a smaller subset of SKUs at the stores and install in-store digital platforms so customers could buy any product and receive it at home. This would educate customers to use the e-commerce channel more often, and would decrease complexity by keeping most of the SKUs at the distribution centers.

Regarding the question, I don’t believe that this is an issue. Not all jobs would be eliminated. There would only be a shift in the kind of skills required to the employees. Additionally, although it may seem harsh and the company may face some resistance from the local government and population, ultimately this would benefit the overall society. Since this would make the company more efficient, it would imply in higher profits and / or more accessible products to the end consumer, which would probably help Sephora to grow, probably leading to the generation of more jobs.

This was such an interesting read in the digitization that impacts the retail operation and inventory management of Sephora. Thank you for your analysis and insights! As Sephora suffers to accurately forecast the demand to become more efficient in inventory management, I think that the nature of the product makes it difficult. Seasonal shopping trend is one data point to help, however, with diverse customers it is difficult to assume the demand at SKU level. One suggestion I have is that Sephora should eliminate the number of SKUs carrying. The store does add value by providing a wide array of products however, I think this can harm the ability to put a stringent control over inventory. Also, I am concerned that each store at Sephora completely differs in product demand pattern. My suggestion in this area is to use the technology to signal the demand from the store just in time, Sephora can also take an advantage of the customer reward system they developed to connect the personal data of the customer to the purchased product immediately.

To your question, I think that digitalization of the supply chain can move the focus of the labor toward strategy. Achieving efficiency can be relied to the technology, and the actual human labor should focus on providing extra customer service in the store where human power works better than the technology.

For Sephora, competition only grows to be more harsh. In the make-up and personal care category, brand competes with an e-commerce giant like Amazon. I think that the speed to achieve efficiency and innovation is the key to Sephora’s further success.

Thank you for sharing, Alaa(?)! This is absolutely fascinating. Regarding your “IoT” recommendation to keep track of inventory level, my question is whether it is worth it to put a $1 chip on a $15 lipstick when the margin is only probably $5 (using Ulta’s 35% operating margin) + the server/computing cost. I’d rather train my sales people to direct customers to other SKUs when the SKUs that they want run out.

Regarding the recommendation, one potential alternative is to go the opposite way. Instead of carrying a huge number of SKUs and making sure all the SKUs are in stock all the time, Sephora could separate the store into high volume/everyday SKUs (think classic popular products such as Clinique yellow gel or Estee Lauder brown bottle eye cream) and boutique/exploration SKUs. For high volume SKUs, Sephora can carry an inventory balance to make sure they always have them in stock. For exploration SKUs, the expectation for something being in stock is probably low, because customers don’t even know that they need them. In that case, sales people can curate the experience and push for a smaller number of products based on 1) what they want to push and 2) what’s in stock.

In terms of store layout, Sephora can put the high volume SKUs closer to the back of the store and the exploration SKUs closer to the entrance of the stores (similar to IKEA where customers need to walk through the whole store). That way, Sephora can drive store traffic with high volume products but also give its sales people an opportunity to push new products if the customer is in exploration mode. On top of that, Sephora can design the layout of the store in such a way that high volume SKUs don’t need to take up as much shelf space (i.e. more efficiency on rent).

Sephora can do that because as a retailer, it knows exactly which SKUs sell the best (and sells by itself) and hence can reduce the rent/sales people allocated to those units accordingly. In addition, such a strategy can also give Sephora more negotiating leverage against cosmetics brands as Sephora the retailer plays a bigger role in what products get sold. Sephora can also diversify its sales contribution from different brands to reduce brand concentration risk.

Risks to my recommendation:

1) Sephora needs to train its staff to educate customers about the new store layout as most customers are probably still accustomed to sorting by product and sorting by brand

2) The tasks of the workforce also need to adapt – merchandising becomes important; flexible display becomes important (what do I push this month? how do I display the products to best represent this boutique brand?); knowledge of the sales people become important (should Sephora consider letting sales reps from the boutique brand into the store and sell instead given better knowledge? how does Sephora ensure good practice among those sales reps? if Sephora uses its own staff, how to make sure they are well equipped with new product knowledge more frequently than before?)