Quick On Its Feet: 100+ Year-Old Boot-Maker L.L. Bean Embraces the Digital Supply Chain

Iconic American retailer L.L. Bean strives to sustain its best-in-class customer service in the face of ever-increasing consumer expectations straining its supply chain

In 1912, when 90 of the first 100 boots Leon Leonwood Bean shipped were returned, he refunded his customers and fixed the products.[1] Over 100 years later, L.L. Bean’s commitment to customer service is challenged by strains on its supply chain. Specifically, today’s “me-commerce” era reflects growing consumer expectations: consumers want the products they like, when they want them, and where they want them, with no tolerance for delays.

During the 2014 holiday shopping season, L.L. Bean crumpled under the weight of consumer demands when it sold out of its popularized winter boots.[2] The company immediately increased labor shifts and ramped production, but holistic changes were needed. Indeed, many companies have failed and shut down because of poor supply chain management practices.[3]

They See What We See – Creating Supply Chain Visibility

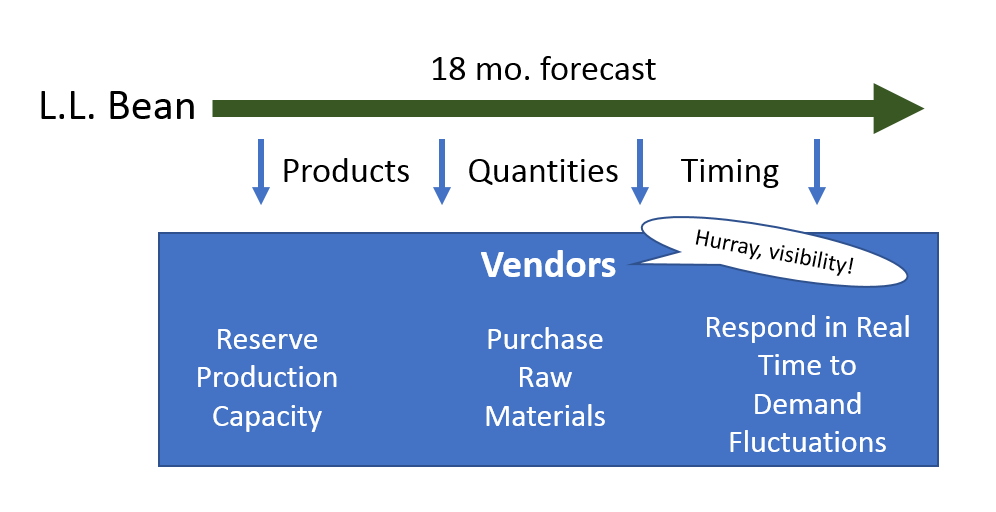

L.L. Bean’s management is addressing these challenges by optimizing its supply chain. Kirsten Piacentini, VP of Inventory Management at L.L. Bean, explains the implementation of new forecasting and fulfillment tools. With these tools, L.L. Bean creates a rolling 18-month forecast that generates a net need for vendors. When this data is shared with vendors, the vendors can more efficiently reserve production capacity and purchase raw materials. Importantly, vendors can respond in real time to backorders by reprioritizing work. In its pilot with select vendors, L.L. Bean has seen quantifiable improvements. One vendor in Peru was able to reduce the lead time it needs to process a P.O. by 4 weeks. This allows L.L. Bean more time to get a sense of the market before committing to styles.[4]

Enhanced forecasting capabilities also allow L.L. Bean to invest in the right products for the upcoming season. Rachael Kennedy, Process Lead at L.L. Bean, explains how new tools have optimized inventory levels.[5] This capability reduces lost sales and unnecessary inventory builds, improving the company’s cash conversion cycle.

Encouraged by these early signs of success, management is developing a longer-term roadmap to further enhance its capabilities. In the medium-term, the company plans to implement assortment planning tools, which helps maximize revenue by putting the right products in the right channels. Over the longer-term, the company plans to add tools for promotions and mark-down planning.[6]

Building the Supply Chain of Tomorrow

L.L. Bean’s management has rightly focused on visibility and integration, which is consistent with other managers’ priorities according to the 2016 SCDigest Supply Chain Digitization Benchmark survey.[7]

Source: Digital Supply Chain for Dummies eBook [7]

Moving forward, management should create performance measurement systems to evaluate the efficacy of the new supply chain tools. Specifically, management should include measurements of resources, output, and flexibility (how well the system reacts to uncertainty) in its assessment of success.[8]

A bolder recommendation is to rethink digitalization of the product itself. Other apparel companies are already adding technology to clothing. Nadi X yoga pants have embedded technology that guides users through yoga flows.[9] Jacquard by Google has collaborated with Levi to create a smart jacket: a tap on the sleeve will play music or send an incoming call to voicemail.[10] L.L. Bean should consider incorporating similar technology into its products: technology to capture miles or elevation hiked, or technology suggesting when an apparel item needs replacement. This type of technology creates new revenue opportunities through after-sale services.[11]

While successful thus far, management faces difficult decisions. To remain relevant in the next 100 years, will L.L. Bean be able to provide consumers a sufficient fulfillment experience, or must it partner with a third-party firm? If the company were to incorporate technology into its products, what brand messaging should it adopt to elegantly infuse technology with traditional, durable products?

(word count: 781)

[1] L.L. Bean, “Company History,” https://www.llbean.com/llb/shop/516918?lndrNbr=516884&nav=leftnav-cust, accessed November 2017.

[2] “L.L. Bean’s Already Sold Out of Snow Boots,” https://www.yahoo.com/lifestyle/l-l-beans-already-sold-out-of-snow-boots-104339063493.html, accessed November 2017.

[3] M. Aabid A Majeed and Thashika D Rupasinghe, “Internet of Things (IoT) Embedded Future Supply Chains for Industry 4.0: An Assessment from an ERP-based Fashion Apparel and Footwear Industry,” International Journal of Supply Chain Management Vol. 6, No. 1 (March 2017): 25, Google Scholar accessed November 2017.

[4] JDA Software, “L.L. Bean – JDA Real Results,” YouTube, published November 8, 2017, https://www.youtube.com/watch?v=FY6Ex0y0MdU, accessed November 2017.

[5] JDA Software, “L.L. Bean – JDA Real Results,” YouTube, published July 26, 2016, https://www.youtube.com/watch?v=bUWmVRyQRZU, accessed November 2017.

[6] JDA Software, “L.L. Bean – JDA Real Results,” YouTube, published November 8, 2017, https://www.youtube.com/watch?v=FY6Ex0y0MdU, accessed November 2017.

[7] Digital Supply Chain for Dummies eBook, https://jda.com/knowledge-center/collateral/digital-supply-chain-for-dummies, accessed November 2017.

[8] Benita M. Beamon, “Measuring supply chain performance”, International Journal of Operations & Production Management, vol. 19 issue: 3, p. 275-292, (1999) https://doi.org/10.1108/01443579910249714, accessed November 2017.

[9] Wearable X, https://www.wearablex.com/pages/nadix, accessed November 2017.

[10] Jacquard by Google, “Jacquard and Levi’s. A Perfect Fit,” https://atap.google.com/jacquard/levi/, accessed November 2017.

[11] Michael E. Porter and James E. Heppelmann, “How Smart, Connected Products Are Transforming Competition,” Harvard Business Review, (November 2014).

The bullwhip effect in action! A great example of how sharing information with suppliers can yield real benefits to both parties. By giving suppliers more visibility of forecast production capacity requirements, the supplier should be able to reduce its costs over time as it increases utilisation, and presumably at some point some of these cost savings will be passed on to LL Bean, creating a virtuous circle. Your suggestion of digitising the product is interesting, but as far as the supply chain is concerned I think that there is a separate, linked opportunity, which is to introduce blockchain tracking, giving real time visibility of raw materials / WIP / finished goods throughout the production process, which in turn can drive further efficiency.

This is an excellent article that showcases how innovations in supply chain management can be introduced and pushed downstream effectively. In Barilla SpA, we learned that changes in the management of supply chains can sometimes be difficult to implement.

LL Bean first found a way to utilise available data itself by creating an 18-month forecast. In a second step, it shared relevant parts of information with suppliers who could immediately see the benefit for themselves as they could react to demand by LL Bean faster and more precisely. On the long run, suppliers should be able to reduce inventory holding costs and excess production. LL Bean can try to capture some of this value and decrease its costs. If trust between LL Bean and suppliers remains stable and suppliers keep believing in this system, this is a win-win situation. It only makes sense to further refine supply chain visibility by introducing more detailed measurement tools.

Really interesting post that highlights the importance of sharing information with upstream elements of the supply chain in order to minimize disruption.

I actually disagree that integrating technology into the product itself is necessary or even desirable. There’s a lot of buzz in the media about “the internet of things”, but I think we’re a long way away from real value additions derived from integrating technology into otherwise mundane products. I think certain wearables have managed to gain traction (primarily fitness trackers and some backpacks with integrated battery back up for mobile phones). Nevertheless, absent a significant value proposition for integrating digital platforms into wellies and snow boots, it would be difficult for LL Bean to convince consumers that such products demand a premium.

I agree with SVT above, in that I’m not sure integrating technology in the product itself is the right move. I think LL Bean would need to first assess if making a change like this would align with its customer promise and their core strategy/target market. My sense is that the LL bean customer may value heritage of the brand and product quality above these types of innovations, and that adding this type of tech may complicate the supply chain further. But it is certainly an idea they would want to test with their customers. One idea that could help in managing customer expectations around delivery, would be to gamify the customer order process. I do think customers now are less patient, but I think one way to mitigate this is to have them feel like they are part of the process with you. Is there a way to add an element of customization to the product, such that the customer feels like they are co-creating with you, and you create a platform that allows more transparency into the product design, development, and delivery process. I think customers are more patient when it is something that is seen as less of a commodity and more of a unique product.

The opening anecdote of this essay (about L.L.Bean selling out of boots) raises an important point as it relates to the evolution of their supply chain: channel management. This was touched on briefly in the essay, but warrants further discussion.

Forecasting demand is a difficult task, and required a mastery of how the different channels you sell through perform. Without that, even the most advances supply chain cannot save you. L.L.Bean needs to build a strong feedback loop between trends in their customer’s shopping habits and how they vary by channel, what they know about seasonality from past data and what that means for what they need their supply chain to do when.

Also on this note, given that L.L.Bean is a heritage brand that is growing quickly, they may be at a point when even they are surprised by how shopping behavior by channel. They are increasingly offering their boots in a growing number of retailers, and they may not know how shoppers across each differ. To contend with this, they should consider industry benchmarking.