Predicting the Weather: Insurers are as good as your local weatherman

The insurance industry is meant to spread out risk and minimize it for their clients but what happens when the risk in the world changes dramatically?

AIG (American International Group, Inc.) is one of the largest global insurance businesses that focuses on providing casualty insurance, life insurance and mortgage insurance. Climate change has the ability to completely upend AIG and the insurance industry, more specifically the property and casualty segment. This business and AIG’s ability to effectively underwrite insurance is based on their ability to use historical data and predictive models to price their insurance products accordingly [1]. Climate change will cause there to be higher weather variability and instability [2]. This will in turn create issues for AIG and their ability to predict accurately and price appropriately. At the same time this variability will also create opportunities for AIG to create innovative insurance products to serve this new environment.

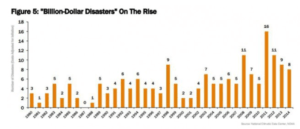

As temperatures rise, extreme weather events are expected to increase which will lead to higher property and casualty damage than what insurers had originally underwritten [3].

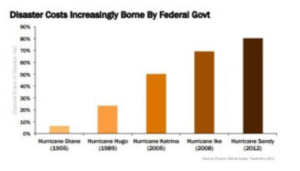

These elevated losses will directly hit AIG’s performance. This increased variability will also make it harder for AIG to price these products in the future. If they price new products too low and actual future losses are higher than expected then they will end up losing money but if they price it too high to protect themselves from this scenario they may not be able to actually sell that policy and they will lose volume. In response, AIG and other insurers have actually come to the conclusion that they are unable to write policies in some high risk areas like South Florida and have retreated from those markets, leaving the government as the only person left to pick up the bill.

They also have reduced limits and increased deductibles which makes the product safer for AIG but less attractive for the insured thereby sacrificing some volume [1]. Finally the last risk AIG will need to overcome is that even if they can get past these prior issues and sell enough product at the appropriate price, there are concerns about the reinsurance and catastrophe bond markets which are vital for AIGs business and allows them to underwrite more policies than they hold. If these markets find this new climate environment and underwriting model to be too risky it will freeze up and prevent AIG from writing more policies since they can only hold so much on their own balance sheet [6].

AIG has had to adjust to these conditions and institute a complementary strategy. First of all, they continue to invest and tweak their risk management and underwriting models and analyze the latest climate science moving away from historical models and towards catastrophe models [3]. This is believed to be a better predictor and if that does prove true the business will be in an advantageous position in the industry since the model is proprietary and different from competitors.

Given the effects climate change can have on the business, the insurance industry has become some of the most vocal corporate advocates in the fight against climate change and are taking actions to help slow it down and prepare the world to best deal with its effects [4][6]. They are also pushing for additional building regulations and planning regulations that will require buildings to be built to better withstand climate change related weather events and prevent construction in some high risk areas. In fact, some insurers have even gone as far as suing municipalities claiming that they had not taken adequate precautions to prevent losses due to weather events to push others to take action [5].

Although AIG is having some issues in certain areas with its traditional property and casualty insurance, climate change has spurred investment and growth in the clean energy industry and AIG has seized on that opportunity and provides insurance to the industry. Another emerging service AIG and other insurers have moved into that was spurred by climate change is carbon risk management and carbon reduction services [1].

It is too early to tell what will happen at AIG and their property and casualty insurance business but the business understood the risks early on, has made efforts to remedy the issues and has also taken advantage of the new opportunities that have arisen. It will be interesting to see how the policies they write today bear out in the future.

(712 words)

References

[1] Mills, Evan. “Responding to Climate Change – The Insurance Industry Perspective”. http://evanmills.lbl.gov/pubs/pdf/climate-action-insurance.pdf

[2] Atkin, Emily. ThinkProgress. “Big Insurance Companies Are Warning The U.S. To Prepare For Climate Change”(2015). https://thinkprogress.org/big-insurance-companies-are-warning-the-u-s-to-prepare-for-climate-change-eb3fdf22d674#.j2kcbr9xb

[3] AIG. “Climate Change: A Call for Weatherproofing the Insurance Industry” (2012). http://www.aig.com/content/dam/aig/america-canada/us/documents/business/industry/ipg-real-estate-climate-change-paper-brochure.pdf

[4] AIG. “AIG’s Policy and Programs on Environment and Climate Change”. http://media.corporate-ir.net/media_files/irol/76/76115/aig_climate_change_updated.pdf

[5] Linden, Eugene. “How the Insurance Industry Sees Climate Change” (2014). http://www.latimes.com/opinion/op-ed/la-oe-linden-insurance-climate-change-20140617-story.html

[6] AIG. “2015 10-K”. http://www.aig.com/content/dam/aig/america-canada/us/documents/investor-relations/december-31-2015-10k-final.pdf

Thanks for the interesting post! Insurance is such an interesting industry to examine – as you point out, they will definitely be impacted as they recalibrate their models, but I also wonder if their customers will be more willing to buy certain types of insurance or pay more for insurance as they start to see others impacted by extreme weather. Apart from their insurance for clean energy and involvement for carbon risk management, has AIG identified any other insurance products for the impacts of climate change? Can you think of any that they should focus on? If climate change is expected to hit different parts of the country differently, can AIG use that variance to diversify its risk?

Great post! Before reading your post, I did not think of the power and opportunity insurance providers have to influence companies to implement sustainability practices.

I think it would be interesting to compare AIG’s efforts against competitors (like Allstate) and understand if what they’ve done is can be replicated easily or done better. Overall, would larger, multinational companies have an advantage to diversify their “climate change risk” globally (similar to what alandon alluded to) as opposed to region and country specific providers?

Wouldn’t think of insurance at all, thanks for this interesting article!

I like the way AIG needs to secure itself pushes it to advocate significant changes related to climate change. It would be interesting to know how aligned AIG climate related insurance with different climate researches, do they have higher premium in riskier areas? In addition, how does it align with the fact that many risky areas usually have lower income populations – how do they align the following components: different climate risks, different geographies and different socio economic status.

Would also be interesting to know if they are looking for solutions in high risk area like Florida, where they can less predict the risk, or the people there just left unprotected?

Very interesting article! When I think of companies facing issues due to climate change I do not immediately think of insurers but it is clear that they are significantly impacted. I wonder how this impacts investment in high risk areas like South Florida. Are AIG and other insurers with the same point of view choking entrepreneurial growth in Florida by refusing to offer insurance? Further are investment firms less likely to invest in Florida-based businesses because securing insurance is becoming more and more difficult? I agree that AIG and other insurers’ decisions to stay out of this market will have the effect of driving innovation in insurance while also opening the door to less risk-averse insurance firms that can charge a high premium to insure against the climate risk. It will be very interesting to watch this industry evolve!