OYO Rooms: Disrupting the Indian hospitality industry

OYO rooms is India’s largest branded network of hotel rooms with 14,000 rooms across India. It’s an incredible feat given that OYO was founded 2 years ago by a 21-year-old and hasn’t built a single hotel!

So how do they get the rooms?

OYO approaches affordable hotels and buys their unsold inventory for a minimum guarantee amount. For a hotel to sell their rooms to OYO, they have to meet OYO’s standardization guidelines that include free Wi-Fi, clean white linen, flat screen TVs, included breakfast. The hotel is then branded an OYO Hotel while preserving its own hotel name as well. OYO then lists these as OYO rooms on it’s own tech platform as well on other OTAs like MakeMyTrip.

Why it works especially well in India

The unorganized hotel sector is massive and fragmented. There are 1 million rooms and a lack of branding across hotels to signify quality. Moreover, the quality of stay is highly variable and mostly falls short of expectations. The average Indian customer is lost when coming it comes to choosing affordable hotel options! By looping these unbranded hotels under the OYO umbrella, the company signals trust, predictability and quality to consumers.

The benefits of the operating model are:

- Low CAPEX: They’re simply applying their brand name to hotels once the hotel hit standardized benchmarks. They don’t have any expenses associated with the stay – they don’t build anything; they don’t provide staff or incur maintenance expenses.

- Ensures high-quality without any associated costs: OYO provides the checklist of quality measures that OYO must meet but the hotel bears the cost to standardize.

- The hotels benefit too:

OYO solves the problems of excess inventory. Once OYO buys the excess rooms from hotel, it has a commitment to pay the hotel even if OYO can’t sell the room. Furthermore, for small, less-tech savvy hotels, the OYO stamp is brand accretive and the OYO website where the rooms are listed is a powerful marketing channel. As we’ve seen in our marketing course, keeping members of the distribution channel happy is critical to long term success.

OYO solves the problems of excess inventory. Once OYO buys the excess rooms from hotel, it has a commitment to pay the hotel even if OYO can’t sell the room. Furthermore, for small, less-tech savvy hotels, the OYO stamp is brand accretive and the OYO website where the rooms are listed is a powerful marketing channel. As we’ve seen in our marketing course, keeping members of the distribution channel happy is critical to long term success. - Multiple channels for sales: OYO sells the rooms on it’s website and via other Online Travel Agents (OTAs). They are an OTA themselves but by positioning themselves as a brand, they can also embed themselves within competitor websites.

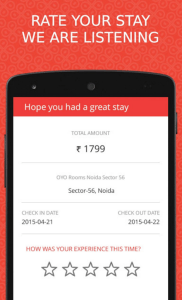

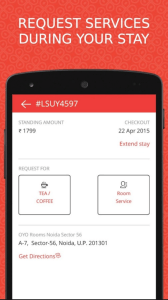

- Technology-enabled convenience: An OYO consumer is able to check-in, check-out, order room service, file a complaint all via the OYO app. This reduces the pressure on hotels, improves the customer experience (check-in time down to 4seconds) and provides OYO with real-time data on cross-hotel experiences.

- A method to prevent shopping around: When a consumer visits OYO rooms website to book a room, the name of the hotel is not shown to him till he or she actually books. Only the price and destination from core landmarks is displayed. This eliminates the risk of a consumer going directly to a partner hotel or other competitor OTAs and cutting OYO out of the equation. This is important because the hotel typically lists only part of its inventory on OYO.

OYO continues to innovate on operating models. They are now in the process of launching OYO Café. They are planning to list select partner hotel restaurant menus on food delivery websites (think Seamless) and brand the food as being from ‘OYO Cafés’. This will lead to increased utilization of labor, time and raw materials in OYO hotel kitchens.

From 1 hotel in May 2013 to 3500+ hotels in October 2015, OYO is by far the hottest start-up in India that is disrupting the hospitality industry in India. While the prospects are fantastic, their success fundamentally lies in building a brand that is synonymous with high-quality. This is difficult in India and even more so considering the limited control OYO has over partner hotels.

————–

Sources:

http://yourstory.com/2015/05/oyo-rooms-review/

Thanks for posting on a company that many of us have likely not heard of before. I really like the idea and it seems like a similar concept may be applied to other sectors in developing markets where quality is of major concern. I am only wondering how costly it is for them to inspect hotels to ensure that they meet the OYO standards, assuming they also likely have to check back often to ensure quality standards are maintained.

Very interesting article, Adwaita! Very curious to see how the OYO brand evolves over time and how partners’ collaboration changes with it. If OYO continues growing rapidly, do you foresee it cannibalizing the sales from hotel websites in the future? Is pricing usually similar or cheaper to the hotel’s website?

Thanks for sharing! Really enjoyed reading it!

Great post, Adwaita! OYO Rooms is actually my FIELD 2 company in New Delhi so it was fascinating to read your take on how their business model and operating model align. I completely agree with your point that trust and quality seem to be the most important value created by OYO, particularly for the Indian market. I actually hadn’t known about the OYO Cafes – and forwarded your post to the rest of my team! One element of their ever-evolving operating model that I think you’ll find interesting is that they’re trying to establish a new consumer base of “extended stay” consumers (i.e., consumers who stay at a given hotel for >5 days) – this should even further improve the benefits to the hotel that you mentioned, as it’ll ultimately decrease operating expenses from cleaning fees, etc., all the while increasing the “basket size” if you will for guests at their residences. Great read!