Optoro: How Supply Chain Digitization is Helping Retailers Recoup Millions through Reverse Logistics

Digitization of information has created greater efficiency in many parts of the supply chain. Optoro, a reverse logistics company founded in 2010, has created a digital supply chain platform that aims to help retailers recoup millions of dollars by optimizing the resale value of returned goods. The PwC’s Supply Chain Operations Reference (SCOR) model, which consists of planning, sourcing, making, delivering, returning, and enabling, provides a useful framework to evaluate the impact that improving the return process through supply chain digitization has on the retail industry1.

One of the biggest challenges that retailers face today is processing an increasing amount of online returns. According to a 2015 National Retail Federation report, $260 billion, or 8 percent of total U.S. merchandise purchases, is returned every year2. Estimates of e-commerce returns suggest that upwards of 50 percent of all online apparel purchases are returned3. This creates financial and logistical nightmares for businesses that must determine what to do with returned items. Typically, companies have several choices once an item is returned: the item can be restocked in the primary retail channel, returned to the manufacturer, sold through clearance or discount outlets, donated to charity, or disposed of outright.

Historically, companies used little analytical rigor to determine the optimal channel to resell a returned item. Optoro executives suggest that traditional logistics channels can cause retailers to throw out as much as 30 to 40 percent of returned items4. Optoro’s founders recognized that supply chain digitization could improve a retailer’s ability to recoup money on returned items while improving visibility and control over inventory. To combat this issue, the company developed a software platform called OptiTurn that routes returned items to the most effective resale channel and optimizes prices based on several factors including condition, sales data, and product attributes. In addition, Optoro uses Blinq, its proprietary direct-to-consumer discount goods network and Bulq, its proprietary business-to-business network, to resell items5.

In the short term, Optoro is focused on using its software, and these two networks, to recoup more money for retailers by optimizing the reverse logistics chain. To this end, the company has created partnerships with traditional logistics providers, such as the United Postal Service (UPS), to handle the transportation of returned items. This allows Optoro to focus on its longer-term goal of creating more streamlined supply chains by cutting out the inefficient middlemen in the current return ecosystem4.

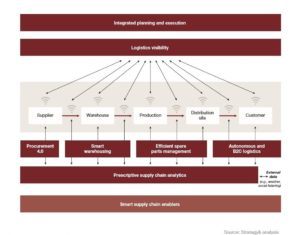

Moving forward, Optoro can provide even more value to its customers through the digital supply chain. Due to Optoro’s unique position within the broader supply chain, the company can collect very valuable and useful data on all returns processed. I believe Optoro can further leverage this data to help its customers better manage their own supply chains, evaluate consumer trends, and increase customer lifetime values for retailers. One of the largest benefits Optoro provides its customers is improved logistics visibility. As the PwC exhibit below suggests, enhanced logistics visibility creates better communication and coordination throughout the supply chain, from suppliers to customers. This allows for more integrated planning and execution, thereby improving efficiency and decreasing costs1. More efficient supply chains in turn create less waste and allow for greater utilization of assets.

Optoro could also use its platform to aggregate the data on consumer preferences and product resale values to sell to third parties. Finally, by increasing the weighted revenue per sale (taking into account the probability that a customer keeps an item or returns an item that has to be resold) and reducing the overall cost to service that customer, Optoro is effectively increasing customer lifetime values. This is another concrete example of how digital supply chains improve outcomes.

At a high level, there appear to be strong secular trends and tangible benefits associated with reverse logistics and greater digitization of supply chains. E-commerce sales continue to increase while physical retail businesses continue to face existential challenges. However, one of the main questions facing Optoro is how retailers will evolve as they continue to generate a greater percentage of their revenue online. How will companies adapt as more people order multiple items with the explicit purpose of trying them out? Will retail companies vertically integrate supply chains and develop internal capabilities to resell returned items more efficiently or will they increasingly rely on reverse logistics providers such as Optoro? Can Optoro convince retailers to handle more of their inventory or will the company have to grow through new customer additions?

Word Count (736)

Footnotes:

1. PwC Strategy&. 2016. “Industry 4.0: How Digitization Makes The Supply Chain More Efficient, Agile, And Customer-Focused.”

2. National Retail Federation and The Retail Equation. 2015. “Consumer Returns in the Retail Industry.”

3. Adams, Susan. 2017. “Optoro Is Building A Billion-Dollar Business Helping Companies Cope With A Glut Of Rejected Stuff”. Forbes, 2017.

4. Desormeaux, Hailey. 2017. “Reverse Logistics Takes Off”. American Shipper, 2017.

5. “Optoro – The World’s Leading Reverse Logistics Platform”. 2017. Optoro. http://www.optoro.com.

George, thank you for your article. Reverse logistics is a fascinating business proposition in our day of increasing ecommerce. I think you allude to this, but I wonder what is to keep retailers from developing their own reverse logistics processes. As it stands, it sounds like Optoro is offering a service that processes return and redistributes via their own channels, thereby alleviating any burden to the retailer. It would be ironic for Optoro, who positions itself on cutting out the middleman, to eventually be cut out as retailers adapt OptiTurn like technology and redistribute through their own retail channels. I suppose this is tantamount to retailer’s current return process, just in a smarter way.

Great article, Georgio. To answer your last question, I don’t think the majority of retailers will bring this capability in-house. It seems the software and framework Optopro has built is quite sophisticated to bring in a variety of inputs to calculate the likelihood of a return being used to generate more revenue in the future. Given that this isn’t a retailer’s core competency, as long as retailers are coming out ahead using their software, I believe they should continue to focus on the core operations of their business rather than build out sophisticated algorithms to calculate the likelihood and manage this process.

What could be interesting is if other software companies that help manage and optimize deliveries, such as Narvar, either buy this company or build out their own technology in this space; this company already has broad market penetration through a relatively cheap initial product and could easily get into this adjacent space, especially since software development is a core competency for them.

Taking a cue from Fasten perhaps the advantage that Optoro can develop is knowledge rather than logistics. The supplier has part of the equation but might not be able to get the remaining pieces in such a way that they can cut out the middle man. But agree with your sentiment and some of the comments, that they have to work to make sure they aren’t so successful so quickly that the results are easily replicated by the companies they serve. if Optoro builds a proprietary knowledge base then they own the niche.