Nordstrom and Uber: A Match Made in Heaven?

How a luxury department store is integrating ride hailing technology into its supply chain

The Imminent Disruption in Supply Chain

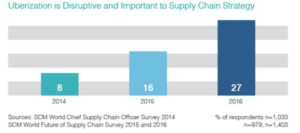

Digitalization is well positioned to disrupt traditional supply chain in a variety of ways. Methods such as big data analytics, internet of things, and cloud computing are digitalization technologies that most business practitioners accept will be major drivers of change. However, only twenty seven percent of practitioners on SCM World’s annual Future of Supply Chain survey in 2016 believe that ride hailing technology, or sharing economy, will be a major supply chain disrupter. With that said, this percentage has grown by nearly 500% in 3 years as practitioners increasingly accept the role ride hailing services could play in the future of supply chain.[1]

Nordstrom Partners with Uber

Nordstrom has been an early adopter in leveraging ride hailing technologies into its delivery network. By providing this service to its customers, Nordstrom has protected itself against potential disruption in traditional delivery methods while reaping immediate benefits for itself and its customers. However, for ride hailing technology to become a long-term solution, Nordstrom must address a few outstanding risks inherent in the current business model.

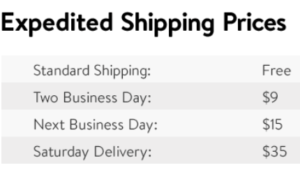

Companies such as Uber are diversifying away from their traditional ride hailing business into a B2B package delivery model. Uber is utilizing its more than 200,000 active drivers, double the size of UPS’s workforce, to offer same-day delivery for department stores such as Nordstrom.[2] To use the service, UberRush, the user simply shops on Nordstrom’s website and during checkout, selects the same-day delivery option for a $15 fee, equal to the fee Nordstrom charges to ship packages next-day via FedEx.[3]

(Source: https://shop.nordstrom.com/c/shipping-methods-charges#anchor-link-expedited)

(Source: https://shop.nordstrom.com/c/shipping-methods-charges#anchor-link-same-day)

These services provide tighter delivery windows, and potentially faster and cheaper delivery methods for Nordstrom’s customers. As the high cost of shipping is a key reason why customers abandon online shopping carts, ride hailing technology is a key differentiator for Nordstrom that will encourage customers to complete their purchases when shopping online.[4] The company has provided this same-day delivery option since 2011 by partnering with other companies, and now Uber allows it to enter lucrative markets like New York, Chicago, and San Francisco[5]. If ride hailing companies continue to lower costs and expand product offerings into next day shipping, traditional delivery companies like FedEx and UPS are at risk of major disruption. Nordstrom is mitigating this risk by integrating Uber and other technology firms into its supply chain as a first mover.

Potential Danger Ahead

Although several advantages are apparent by Nordstrom digitizing its supply chain, several risks exist as well. For this option to be a viable long-term solution, these risks must be addressed. It would be prudent for Nordstrom to address these concerns soon before they represent a significant liability to the company. For instance, UberRush only insures items up to $1,000. As a high end retailer, this limit fails to fully insure several, if not most, items that are bought from Nordstrom. Additionally, the delivery for the New York City market is bicycle.[6]

(Source: https://www.wsj.com/articles/the-50-billion-question-can-uber-deliver-1434422042)

Bicycle riders transporting expensive items could become targets for theft. At scale, the lack of insurance represents a significant liability for Nordstrom, and they should negotiate with Uber to raise the insurance limit, or find a competitor ride hailing service who is more flexible. Second, ride hailing services often rely on independent contractors who are less skilled at navigation and delivery than drivers at traditional delivery companies such as UPS. The lack of skill may translate into late deliveries as drivers struggle to navigate roadways, resulting in an unpleasant customer experience. To combat this risk, Nordstrom must insist that customers receive compensation from Uber, perhaps in the form of a discounted delivery fee or delivery credit, for late products. Finally, Nordstrom is at the risk of Uber’s real-time supply and demand constraints. As a delivery service, UberRush must charge flat fees, offering necessary transparency and predictability to the consumer. During peak shopping times, such as the holiday season, demand for delivery is likely to increase. UberRush cannot implement its effective “Surge Pricing” strategy to attract more drivers, leaving Nordstrom with a promised service that it can no longer deliver to the customer. As a solution to this dilemma, Nordstrom could offer a royalty to UberRush that is partially passed on to drivers, protecting customers from unexpected price hikes while encouraging more drivers onto the road.[2]

Disruptor or Fad

Nordstrom is on the leading edge of diversifying its supply chain into ride hailing services, particularly in the luxury retail sector, thus mitigating risk of disruption in this part of its business. However, given the concerns outlined above, is the ride hailing delivery service a scalable and sustainable part of the company’s supply chain? Furthermore, are there enough customers willing to pay a significant premium for same-day delivery rather than opt for a less expensive next-day delivery option, which traditional delivery services dominate? [Word Count: 795 Words]

Sources

[1] O’Marah, Kevin, “Digitization in Supply Chain: 5 Key Trends,” Forbes, November, 17, 2016, https://www.forbes.com/sites/kevinomarah/2016/11/17/digitization-in-supply-chain-five-key-trends/#628afb54428a, accessed November 2017.

[2] MacMillan, Douglas, “The $50Bn Question: Can Uber Deliver?”, The Wall Street Journal, June 15, 2015, https://www.wsj.com/articles/the-50-billion-question-can-uber-deliver-1434422042, accessed November 2017.

[3] https://shop.nordstrom.com/c/shipping-methods-charges#anchor-link-expedited

[4] Bodenhamer, Jeremey, “What UberRUSH Means for Retailers”, Apparel, December 21, 2015, https://apparelmag.com/what-uberrush-means-retailers, accessed November 2017.

[5] Soper, Taylor, “Uber Partners with Nordstrom, Google, T-Mobile, SAP for UberRUSH Package Delivery Service”, GeekWire, January 28, 2016, https://www.geekwire.com/2016/uberrush-partners-with-nordstrom-t-mobile-others-for-package-delivery-service/, accessed November 2017.

[6] Carson, Biz, “Uber Finally Unleashes Its FedEx Killer, Uber Rush”, Business Insider, October 14, 2015, http://www.businessinsider.com/uber-rush-fedex-killer-released-2015-10, accessed November 2017.

I had no idea that Nordstrom had partnered with Uber for customer delivery, so thank you for writing this article!

Initially, I was really impressed by this partnership and thought it was a smart way to leverage Uber’s platform and network of drivers. However, your section titled “Potential Danger Ahead” raises some great points about the challenges of this model. While on the surface it may seem that transporting goods from point A to point B is similar to transporting passengers from point A to point B, I think that these two tasks require very different skills and entail very different risks.

My overall view is that ride-hailing delivery service is not a scalable and sustainable part of Nordstrom’s supply chain. You outline quite a number of challenges with this model. In addition, Uber is still trying to figure out the best way to get people where they want to go. I do not think Uber has the bandwidth or resources to focus on excelling at delivery, as well. In addition, there are very established and innovative companies whose core business is delivery. My bet is that these companies are investing a great deal in making same-day delivery a feasible option, and that they will prove to be a more reliable and scalable partner than Uber in this domain.

Conner, brilliant article! Like the person above me, I also had no idea about Nordstorm partnering up with Uber. I was also not aware of Uber diversifying away from restaurants and moving into the retail delivery space. You raised some very valid concerns.

Given how this has the potential to significantly disrupt companies such as FedEx, I am surprised they haven’t tried to venture into crowd sourcing local deliveries as of yet. Maybe the big players do not see the model being viable and are banking on this being a fad.

Ridesharing services provide real promises of lowering transportation cost while improving efficiency to riders, as they allow drivers to monetize the idle capacity (e.g. time, space in the car) at minimal incremental cost and at the same time significantly increase supply of transportation capacity in the market.

However, the application of ridesharing in package delivery service is not as straight-forward as many may think. UberRUSH service inserts Nordstrom as a new stakeholder in the ridesharing ecosystem of drivers, customers and platforms. Due to the decentralized nature of driver supply through Uber, Nordstrom has very limited control over the delivery experience through UberRush, be it on-time delivery or security of items delivered. This may potentially put the key competitive advantage and customer promise of Nordstrom – high level of customer service – at risk. Thus, issues mentioned by Conner, such as package insurance and driver incentive alignment, must be addressed to make UberRush an integral part of Nordstrom’s competitive advantage.

Great article! Following up on our class discussion on this:

A ride-hailing company’s biggest cost is labor – across the industry, roughly 60-80% of the fare charged to a rider goes to the driver. So it seems there’s a fast-approaching day where in order to outcompete in the same day, same city delivery industry (either as a third-party delivery service or one integrated into a chain, like Nordstrom’s here), one will need a fleet of self-driving cars.

I predict the war between ride-hailing apps and their delivery competitors will ultimately be won by whoever can most quickly and most meaningfully capitalize on the new technology available here, greatly minimizing costs and quickly scaling up supply at the same time. To Anusha’s point on another post regarding Shake Shack service, yes, one day not so far in the future, we will order a blouse from Nordstrom’s and a robot will deliver it to our apartment building within two hours. Yes, it is no surprise that the win will likely go to whoever has the deepest pockets in this space, likely to be a tech giant.

Interesting article! While I think Nordstrom is smart to look for ways to get their products to the consumer quicker, I would be hesitant to quickly embrace platforms like Uber, as they create various risks for the Nordstrom supply chain.

One of the biggest concerns I would have using Uber is the amount of control over the customer experience I give up. Being a high-end retailer that prides itself on great customer service, Nordstrom would have to rely on drivers who they have not trained and vetted and who will likely be interacting directly with their consumers (essentially becoming representatives of the brand). Similarly, as some of the other comments have alluded to, Nordstrom will have to work with Uber to create an incentive structure for the drivers that ensures Nordstrom will always have a supply of drivers that can be used for same day deliveries. Lastly, while the ride-sharing industry continues to face its various challenges as it continues to grow (especially legal/regulatory related), Nordstrom could find themselves in a situation where they can no longer rely on Uber to deliver their products, causing Nordstrom to have to switch to a high-cost alternative to continue the same-day delivery service (as we learned in our marketing class, it can be very challenging taking something away from a consumer that they have come to expect).

Overall, quicker delivery alternatives for Nordstrom are a great way for it to continue to enhance its customer promise and ride-sharing platforms may be a vehicle to do that, but I think there is still a lot of uncertainty on how services like Uber can be translated to commercial uses.