Nike’s Play in the Digitization of Fitness

In the mid 2000’s Nike seemed poised to be a leader in the athletic and fitness digital revolution. In 2014 the company found itself exiting the wearable technology device market with the failure of its Nike+ Fuelband. How did Nike become an early leader in the fitness digital space, why did the FuelBand fail, and what can we learn from it all?

I chose to research Nike for this blog post because in my memory Nike has operated on the forefront of the digital revolution over the last two decades. Back in high school I remember designing my own shoes on Nike.com. Later on I started to see the Nike+ brand in more places, from an app icon on my iPod to the treadmill I ran on at the gym. And when the wearable trend took off a few years ago, Nike was right there in the mix with the Nike+ Fuelband (though I chose FitBit). However, while Nike made early and aggressive moves to capitalize on the digital revolution and evolve its business model, they also stumbled in places, and today are not the digital leader in athletic and fitness that I thought they would be a decade ago.

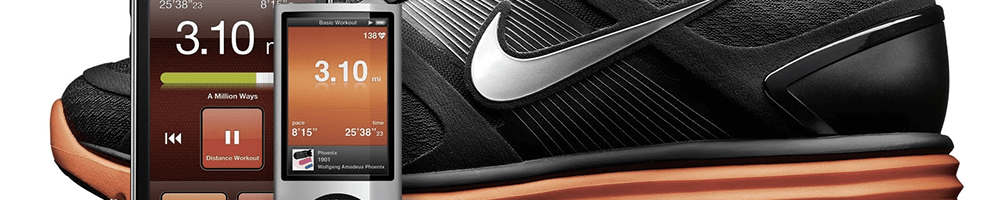

In 2006, as the iPod was becoming commonplace in many young adult’s lives, Nike took its first big leap into the digital age when it joined forces with Apple to develop the Nike+ app. The Nike+ initiative was on the forefront of the fitness data revolution and was a significant departure from Nike’s historical business model of providing superior and stylish athletic equipment to consumers. Now Nike was adding value for consumers through fitness data. The application gathered data on running performance from a sensor in the shoe allowing tracking and analysis of your historical activity. It enabled consumers to connect better with their running experiences and set up a feedback loop that could be used to set and achieve fitness and health goals. As the Nike-Apple partnership continued, Nike+ would evolve to continue to bring value consumers through new capabilities such as running course mapping and music integration.

Nike was able deliver the Nike+ platform by partnering with an established tech giant instead of going it alone. This was a strategic operating model decision to leverage Apple’s talent, resources and expertise in tech design, hardware, software development and big data to deliver this new value proposition to the consumer. This partnership enabled Nike to stay focused on its core capabilities of delivering superior athletic goods while quickly bringing to market a digital application that added value to consumers.

In 2012, Nike entered the newly emerging activity tracking “wearable” segment with the Nike+ Fuelband. The Fuelband was a fitness-oriented tech device which brought value to consumers by allowing them to set fitness goals, monitor their progression, and compare themselves to others, all with integration into Nike+ online community and phone application. This was a huge move for the company, which invested heavily to evolve its operating model by hiring talent and acquiring capabilities in hardware, software, cloud computing and big data to support the product. No longer just an athletic apparel and software company, Nike had now capitalized on the digital revolution to enter an entirely new segment.

Sadly, Nike’s venture into the wearable space did not last long. Three years after the launch, Nike Fuelband was discontinued. In launching the Fuelband, Nike had entered a complex business that was radically different than manufacturing and selling running shoes. The product failed on “Fuel Points,” which confused consumers who could not understand what a fuel point meant in relation to specific physical activity. Nike also struggled to retain many of the talented engineers and designers that were hired for Fuelband, who frequently departed Oregon for high tech jobs in Silicon Valley. With a lack of talent and capability, the organization was not able to keep up with the innovation of its competitors like FitBit, which developed methods to collect and turn data into a valuable product for corporate wellness departments and health insurers.

Finally, and perhaps the biggest contributor to the Fuelband failure, was the conflict that was created with Apple, who was still a key partner on the Nike+ platform. In 2014 it became clear that Apple had intentions to enter the wearables market with the Apple Watch. The timing of the Fuelband’s exit suggests that the conflict with such a key partner had contributed. It seems that Nike, already struggling in the wearables segment, stepped aside in an effort to maintain close ties with the company that it heavily relied on to deliver it Nike+ application to consumers.

So what can we learn from Nike, who in 2006 seemed poised to be a leader in the athletic and fitness digital revolution? There are many opportunities to create and capture value from the digital revolution. For companies like Nike, seizing on these opportunities can require drastic change to the business model. Strategic partnerships, like the one between Apple and Nike, can be extremely valuable for firms to quickly flex their operating model and leverage unique competencies to deliver digital innovation. However, these partnerships can be risky and need to be carefully considered and managed because overlap in product or service offerings can cause conflicting interests to get in the way. <818 words>

George- thanks for sharing this super interesting story about Nike’s foray into new digital technologies. I actually hadn’t realized that the Fuelband had disappeared but it makes sense now.

The story about Nike’s inability to maintain the wearables technology talent and capability in-house reminded me of the Li & Fung case we recently reviewed in class. Namely, the fact that Nike was trying to extend its business model into an area that was totally new to them and, ultimately, eluded their capabilities. As we learned in Li & Fung, it’s important to think carefully about how you execute such a go-to-market. It doesn’t necessarily mean that the decision to go-to-market is wrong. Perhaps, one option for Nike would have been to license its Nike+ brand to Fitbit in its early days for use. I imagine that Fitbit’s key problem in early days was brand recognition and customer acquisition, something Nike could have offered in exchange for the capabilities and talent to support a wearable technology.

As Nike continues to move forward, it will be interesting to see how they continue to leverage digital technology given this failure. In an effort to “stick to what they know” one initiative could be to leverage Nike+ data and technology to provide personalized fitness recommendations in Nike retail stores. Such personalized consultations could help lead to apparel and equipment recommendations that help improve a customer’s fitness regimen. Another idea could be for Nike to integrate a pedometer function directly into the Nike+ app. This would be a way to provide a lot of the insight that comes from a wearable without the need for any new hardware. Recent developments in mobile phone technology have enabled this type of step tracking.

I’ll be sure to keep an eye out on how Nike moves forward with digital technology. It’s been interesting to see the development of the Nike+ Run Club as an extension of the app to create a tighter social network. Thanks again for sharing George- this was great!

Its interesting to see another example of how a digitization attempt by a well funded company failed. Something I’ve been thinking about as we’ve looked at a number of these failures is that ventures into new spaces by a large company is essentially like a startup. They have some good ideas, but do not have market share and it is not always clear if they will be able to monetize their technologies. Just like many startups do not succeed, many brand new ventures into new spaces do not succeed. One lesson that I’ve learned from these set of failures is to be careful as a company manager on how much money to spend on brand new ideas that have an unproven revenue stream.

Thanks for the comments! Forgot to add my sources to the post when I submitted. See below.

http://web.b.ebscohost.com.ezp-prod1.hul.harvard.edu/ehost/detail/detail?sid=0f6b3733-3d82-4a5e-b24fc0d86f8784b7%40sessionmgr107&vid=7&hid=115&bdata=JnNpdGU9ZWhvc3QtbGl2ZSZzY29wZT1zaXRl#AN=95735397&db=bth

http://web.b.ebscohost.com.ezp-prod1.hul.harvard.edu/ehost/detail/detail?vid=9&sid=0f6b3733-3d82-4a5e-b24f c0d86f8784b7%40sessionmgr107&hid=115&bdata=JnNpdGU9ZWhvc3QtbGl2ZSZzY29wZT1zaXRl#AN=109570754&db=bth

http://news.Nike.com/news/Nike-launches-first-accelerator-program

http://news.Nike.com/news/Nike-accelerator-companies-pitch-investors-and-leaders-at-Nike-whq-demo-day

http://www.techstars.com/content/blog/announcing-the-Nike-accelerator-powered-by-techstars/

http://www.forbes.com/sites/teradata/2014/12/12/how-big-data-is-blurring-industry-lines-at-companies-like-Nike/#7aeff415c3b6

https://www.wired.com/2009/06/lbnp-Nike/

Very interesting post – I had never heard of the Nike Fuelband, and it seems with good reason. I completely agree with your analysis and the comments above dissecting why it failed. I’d note that more generally, wearables are a very difficult space. Analyst estimates about the performance of the Apple Watch are all over the place, and Fitbit’s stock is trading around its lowest level in a year. With that said, we’re evaluating Nike with the benefit of hindsight. Ex-ante, the decision to enter wearables through an in-house solution might have made some strategic sense. Nike has strong in-house product design capabilities, and wearables are as much (if not more) about fashion and comfort as they are about technology. In addition, as you mentioned, Nike had been experimenting with and learning from the Nike+ platform already, so digital fitness wasn’t entirely new to them.

Great post George! We put so much value on the stories of the successful, but it is in the failures where we can learn the most. It really is quite surprising that Nike failed in the wearable space considering the dominance they already owned in the athletic apparel market. I drew many tangents from this article back to discussions that we have had in Lead, and how critical it is to be able to attract, motivate, and retain top talent – and the same applies to partnerships. It appears here that the critical blow was the conflict of interest with Apple. I wonder if Nike had gone at this alone, entirely in house, if they would have been able to rival FitBit??

Thanks for sharing George. I couldn’t agree more that now that Nike has missed the boat with Fuelband, they have to leverage new partnerships with established wearables and hope to extract value from this market as a brand some other way. That said, I think Nike missed a HUGE opportunity to capture marketshare as consumers started to adopt this technology. No other company I know of has more entrenched, meaningful, relationships with professional and amateur athletes and if they had built something even marginally useful for consumers, they could have put themselves in a position to be the market leader faster than any other company in fitness-related wearable technology.

This is very interesting. As you mention, somewhat of an enigma that Nike was a first mover in the wearable and fuel idea, but they ultimately failed. I agree with you that the two main takeaways are: i) you must always anticipate what your customers will and will not understand. Once people didn’t get fuel points, even a great interface / product was doomed; and ii) talent is everything in an organization – especially in tech when rapidity of innovation is very real. The fact that retention to other companies for engineers was an issue must have posed a real challenge for Nike. Thanks for writing this GH.

Interesting problem, shame to hear that so much research and the first-mover advantage didn’t pay off here! I agree with many of the key reasons for the failure of the Nike initiatives – losing talent to Silicon Valley, partnering with a company that has similar ambitions, creating a confusing system for tracking exercise progress. An additional reason I think this technology failed was that it was brand-specific. A lot of individuals use non-Nike apparel but are still interested in tracking their performance and improving. This might be where Fitbit was at an advantage – it can be paired on any mobile device with any brand of workout apparel & equipment. While I’m sure Nike was hoping to drive sales of its other products in addition to the Fuelband, this may be a scenario where creating a platform that is revolutionary may be able to penetrate the market more quickly if it is not associated with an existing brand.

Great post George. As we learned in Marketing, Nike probably asked itself.. are we in the sports and sports wear business or are we in the wearables business. I think it became evident to them that the wearables market is so cut-through due to low technology development and manufacturing costs from best-cost manufacturing countries and especially because of continuous technology obsolesce and innovation that it probably made sense for a strategic partner with a better marketable strategy to take charge of the technology.

George, Thanks so much for the interesting post.

I agree with your assessment of the FuelBand. It seems crazy to me that they deviated from tracking steps or calories like every fitness tracker. Why add an additional barrier to adoption and comparability to other products by straying from the metric of energy exertion that everyone already knows (calories), it just added an additional hurdle that created no incremental value. I actually think the fuel brand was a much better looking wearable and with the Nike cool factor, I would have thought it would be a no brainer.

Another aspect of Nike’s foray into the digital transformation that you did not discuss is the NIke + Run Club app. I find it to be the most useful run tracking app on the market and it is available for free in the app store. I think its an interesting strategy to provide such an excellent app for free to a population that otherwise uses none of their products (I have never bought nike running shoes)- I would be super curious to learn what their plan to monetize that app is? It seems that their strategy in digital is a bit mixed up…

Hi George, great story about Nike Fuelband failure! It’s interesting to see how Nike has learned from its mistakes and leveraged its partnership with Apple even further to find its space in the wearable category. With the Apple Watch Nike+ released earlier this year (see: http://www.wareable.com/apple-watch/apple-watch-series-2-nike-plus-release-date-price-specs) Nike and Apple have launched a joined product on top of the technology which combines Nike’s expertise in fitness data management and Apple’s expertise in hardware and software. The initial sales results are promising!

Super interesting post!

We used the Fuelband in a one-month office challenge in 2014. Although being given the fuel band as a gift I have never used it since, while I am in general very fond of these kinds of tracking tools. For me the Fuel points never seemed like something transferable or desirable. Whereas when I use Runkeeper or Runtatstic to track my runs I can always see how fast, long or often I go compared to my friends. I believe in order to create the buy-in you need for a product like this, the “rewards” need to be highly desirable, where the Fuel points to me always felt very arbitrary.

What an interesting post George! I remember seeing the Fuelband in stores and wondering how it was any different from the other wearables on the market that already seemed to have cult-like followings. Your analysis on the failure of the band makes perfect sense. We’ve seen how difficult it can be to balance priorities when creating 2 sided marketplaces and partnering with other companies. With the band’s success in direct conflict with Apple’s watch it is no wonder Nike had to put an end to it. I’m interested to see how their Nike+ app plays out. There are so many fitness apps available, it will be difficult for Nike to distinguish themselves. One way they’ve done a good job of this is through their partnerships with professional athletes. The app sometimes features workouts designed and “led” by these individuals which I haven’t seen done by competing apps. That being said, the workouts have I’ve seen on the app haven’t been that great… While I love Nike I don’t think they’ve done a great job of embracing tech; though I’m glad to see they are trying! Here’s to hoping their new endeavors are more successful 🙂

Thanks for sharing George. This is a very interesting post. I was actually surprised to read that Fuelband had been discontinued. I remember when Nike and Apple first partnered to launch the Nike+ platform. I thought this partnership was going to be extremely successful given the growth in popularity of the iPhone at the time as well as all of the social initiatives to increase physical activity. Although I never owned a Fuelband myself, I believe that the Nike+ platform failed due to an inability to leverage network externalities. I think that the ease and access of use provided by other competitive wearables like Fitbit led to the platform’s ultimate demise despite the brand strength and functionality of the Nike / Apple combination.