Netflix and Chillin’ in the Mile High Club

Netflix has long resisted offering content for offline viewing, despite being widely requested by consumers. With Amazon’s recent entry into the streaming subscription model, and most recently offering downloadable content, Prime Video has finally given customers what they have asked for. Will Netflix’s emerging dominance in original content be enough of an answer or is it time to change up their business plan?

Will Netflix take chillin’ to cruising altitudes?

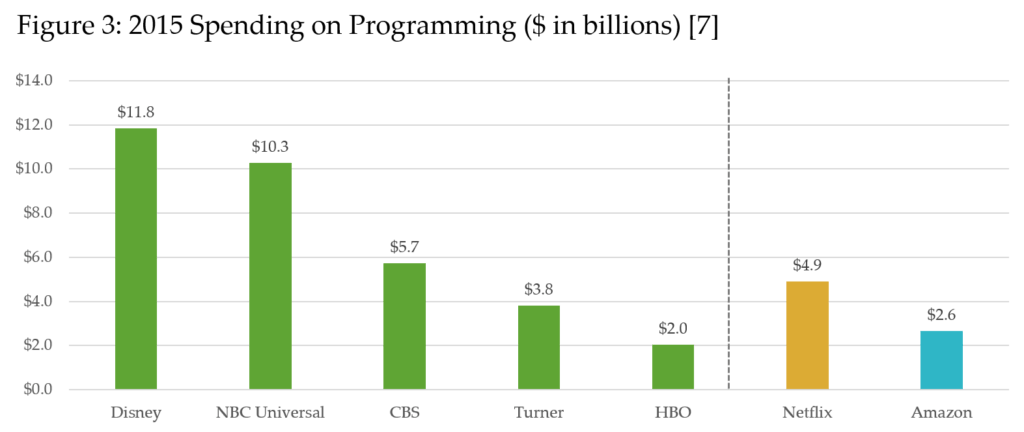

Netflix claims to be the “world’s leading Internet television network, with over 75 million streaming members in over 190 countries enjoying more than 125 million hours of TV shows and movies per day.” (See Figure 1) [1] With this value proposition in mind, Netflix derives revenues primarily from monthly membership fees for streaming content – offline viewing has never been offered by Netflix, despite being a highly requested feature. However, it finally seems the company may be considering incorporating this capability for its users. Unfortunately, we are not the users they seem to have in mind.

Netflix defines its success as capturing consumers during their moments of free time, or “winning moments of truth.” [8] It appears to be this definition of success that has dictated Netflix’s choice to not offer content for download, a choice that the company has maintained a clear stance on over the past few years. Chief Product Officer Neil Hunt has argued that offering offline playback would introduce “considerable complexity” to consumers’ choices, and that a more complicated, multi-step service might even “paralyze” viewers. Citing the Paradox of Choice, Hunt claims that “every time you add a control, you reduce the total number of users who use them.” [2]

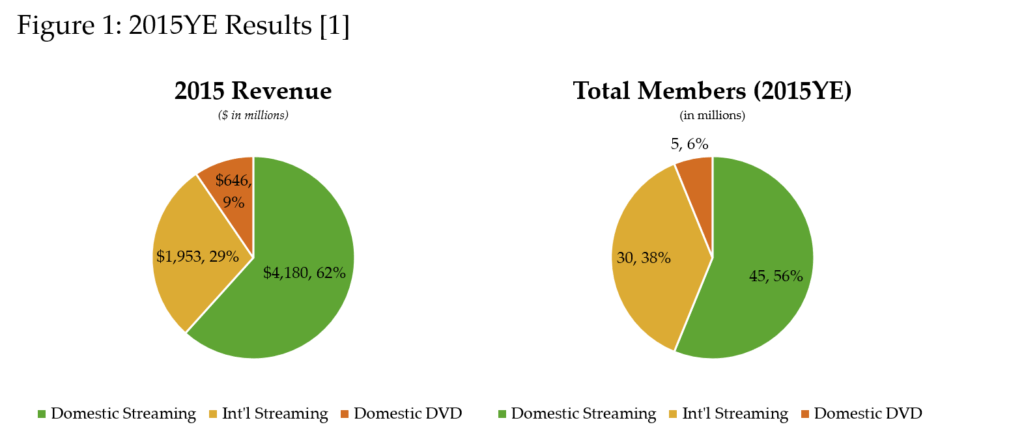

Hunt’s competitors have taken a different view. Joining smaller players like BBC iPlayer and 4oD, that had already offered offline viewing capabilities, Amazon made a game-changing announcement on September 1, 2015, when it announced that Prime members could download movies and shows to their Android and iOS devices for offline playback. [3] The development was widely viewed as a means to lure an incremental batch of consumers, including frequent travelers and parents needing distractions for traveling children, away from reigning streaming king Netflix. [4] In April 2016, with another surprising move, Amazon announced it would spin-off Prime Video as a standalone service for $8.99 a month, going to head to head against Netflix. See stock price performance in Figure 2.

Netflix appeared to maintain its stance against downloadable content until earlier this month, when the company finally made an indication that it is considering offering offline viewing. However, the service appears to be considered in conjunction with Netflix’s launch in emerging markets that have varying levels of broadband speeds and Wi-Fi access. According to Netflix’s Chief Content Officer Ted Sarandos, consumers in these target markets have adopted a “downloading culture,” and offline viewing could “become more interesting” for those particular demographics. [5] Other than that, the company still appears reluctant to offer an offline streaming service for its traditional, domestic consumer base. [5]

Given Amazon’s recent announcements, I think Netflix’s decision will be a hugely detrimental mistake. Consumers have long requested this feature, and Netflix has consistently denied them. Consumers are already supplementing streaming subscriptions with at least one additional streaming service [7] and I believe this could be a major blind spot in Netflix’s model. In an increasingly global and mobile population, time spent traveling will only have a greater role in dictating how people consume media and in order to stay relevant, Netflix needs to maintain a role in consumers’ content libraries, both on the ground and in the air.

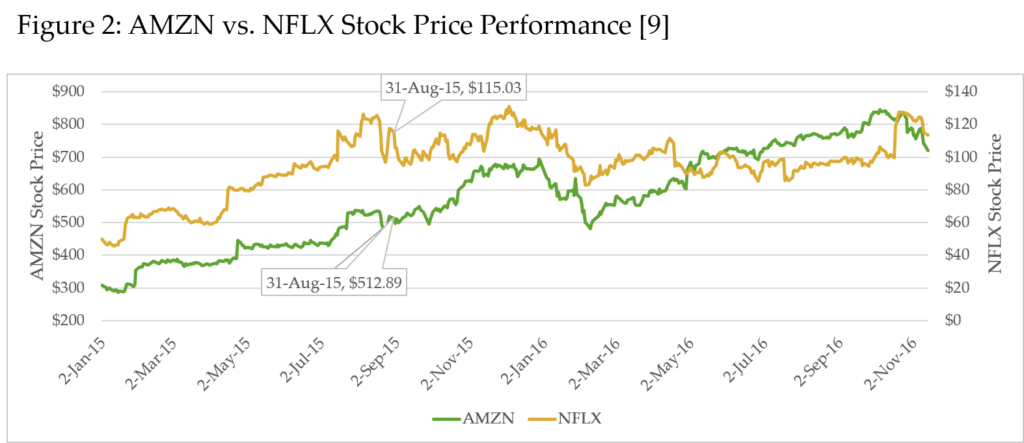

As viewers continue to shift from traditional TV consumption modes to digital channels, Netflix and its competitors will continue to focus on building the best library, with an increased focus on developing original content. The quality of programming for TV streaming services, along with growing availability of net TV packages from services such as Sling TV, continues to entice customers to “cut the cord” from pay-TV providers.  As many as 800,000 pay-TV customers are expected to cancel their cable subscriptions over the next 12 months, costing cable providers as much as $1 billion in revenue. With cable networks such as AMC stepping up the competition to retain their customers, Netflix and Amazon have ramped up their spending on movies and TV programs with such fury that they are surpassing many traditional networks. Spending a combined $7.5 billion on programming in 2015, they were outspent only by Disney and NBC. (see figure 3) [7] In its 3Q 2016 earnings, Netflix announced it expects to spend up to $6 billion on content in 2017. [1] Largely driving the dramatic increase is an effort to develop its own original content, as it did with Stranger Things, rather than paying other studios. Other online platforms, like Hulu, have also increased their investments in original programming and acquisitions. [7]

As many as 800,000 pay-TV customers are expected to cancel their cable subscriptions over the next 12 months, costing cable providers as much as $1 billion in revenue. With cable networks such as AMC stepping up the competition to retain their customers, Netflix and Amazon have ramped up their spending on movies and TV programs with such fury that they are surpassing many traditional networks. Spending a combined $7.5 billion on programming in 2015, they were outspent only by Disney and NBC. (see figure 3) [7] In its 3Q 2016 earnings, Netflix announced it expects to spend up to $6 billion on content in 2017. [1] Largely driving the dramatic increase is an effort to develop its own original content, as it did with Stranger Things, rather than paying other studios. Other online platforms, like Hulu, have also increased their investments in original programming and acquisitions. [7]

As media consumption continues to evolve in terms of how, when and where consumers are viewing, there is no doubt that Netflix is wise to understand that content is likely to remain king. However, as a frequent flier, I eagerly await the chance to Netflix and chill at 30,000 ft.

[799 words]

Sources:

- Netflix, Inc., 2015 Annual Report.

- Lynch, Gerald. “The Real Reason Netflix Won’t Offer Online Downloads.” Gizmodo, September 7, 2015. http://gizmodo.com/the-real-reason-netflix-wont-offer-offline-downloads-1729146143, accessed November 17, 2016.

- Amazon.com, Inc. “Amazon Expands Prime Video Downloads to iOS and Android Platforms—The First and Only Subscription Streaming Service to Offer This Feature.” Press release, http://phx.corporate-ir.net/phoenix.zhtml?c=176060&p=irol-newsArticle&ID=2084036, accessed November 2016.

- Barrett, Brian. “Amazon Prime Lets You Download Videos and Watch Offline Now.” Wired.com, September 1, 2015. https://www.wired.com/2015/09/amazon-prime-lets-download-videos-watch-offline-now/, accessed November 2016.

- Kharpal, Arjun. “A Netflix Offline Mode Could Be On The Way…But Not For U.S. Users.” CNBC News.com, November 2, 2016. http://www.cnbc.com/2016/11/02/netflix-offline-mode-could-be-on-the-way-but-not-for-us-users.html, accessed November 2016.

- Spiteri, Andre. “Netflix vs. Amazon Prime vs. Kodi vs. Hulu Plus Review: Best Streaming Service in 2016?” N4bb (blog), August 13, 2016. http://n4bb.com/netflix-vs-amazon-prime-hulu-best-streaming-services-2016-update-august/, accessed November 2016.

- IHS Markit. “Netflix and Amazon Outspend CBS, HBO and Turner on TV Programming, IHS Markit Says.” Press release, October 17, 2016. IHS Markit website, https://technology.ihs.com/584722/netflix-and-amazon-outspend-cbs-hbo-and-turner-on-tv-programming-ihs-markit-says, accessed November 2016.

- Netflix, Inc., 3Q 2016 Annual Report.

- Google Finance, accessed November 2016.

This is an excellent example of fast adapting companies and how they maneuver to change their business model incorporating the technological advantages that the current ecosystem offers. I believe that Netflix has been a key player in disturbing the TV industry in past years and gained a lot of strength as the industry leader. Regardless of that, having leadership does not exempt you from being disrupted too and I think that Netflix is now having a taste of its own medicine!

I wonder if offering the ability to download a movie and view it offline would be in violation of the agreements Netflix has reached with content providers. The ability to download feels more like ownership compared to streaming online. If I was a movie studio head I would demand more royalties.

Interesting post. Netflix has a history of disrupting itself — video and DVD rentals first, then streaming. As we have seen in the entertainment and media space, consumers will demand content when and where they want to watch, and companies must be responsive to changing habits. Additionally, if Netflix does not expand into offline downloads, they may find themselves needing to partner with companies like Facebook and Google that are investing in low-cost Internet distribution methods such as drones and balloons. This strategic decision about downloading content will put further pressure on the dynamics in the cable, telecom, and digital media industries.

I’m going to have to agree with you here: this move is long past due for Netflix. As someone who suffers from the Paradox of Choice (more like Paraylsis, for me) every time I open up Netflix, I don’t see how adding downloadable content to the mix will further heighten that paralysis. The indecision that Netflix users feel stems from the vast variety of content that is available to them, not the manner in which they can ingest them. Keith’s point above — that “Netflix as a history of disrupting itself” — is worth keeping in mind. It may be that, in this case, it’s competition that leads them to disrupt their current business model.

Download and watch offline is probably a feature that will come soon – the biggest hurdle is obviously the copyright agreement. Some ways to get “work around” it is creating content that can be downloaded and viewed for a 24-hour or 48-hour period, similar to iTunes allowing users to “rent” movies online.

Interesting that Netflix has yet to offer offline viewing. It does explain a huge part of why Netflix is struggling in emerging markets as competition offers these downloads to viewers in these countries where internet is unreliable. I wonder though how this step to make offline available to emerging markets will affect their customer base in developed nations. Will it make these consumers alienated and realize that Netflix has always had this capability and just choose not to provide it to developed markets because of their capability to pay out more money for less features? It will be interesting to see how Netflix’ PR try to explain this difference. Fierce competition in emerging markets has led them through this path. Perhaps Netflix just needs a bigger challenge from its competition before it yields to this demand of the consumer.

Great post. I think you’re totally correct that Netflix is overdue for a download option, and disagree with some of the other comments about the need for different copyright rules (thinking of iTunes’ “rent” feature, which allows offline viewing for a limited period of time). To me, this as a short-term problem with big consequences. My guess is within the next 2-3 years, Internet speeds at all altitudes will be fast enough to support streaming content. In the long-run this won’t be a problem for streaming-only content providers. But, for the reasons you describe, Netflix risks diminishing market share in the meantime.