“MONEY AIN’T A THANG”: WARNER MUSIC GROUP IN THE STREAMING ERA

Warner Music Group in the Spotify and YouTube era

(title inspo: Shawn Carter/Jay-Z)

FROM NAPSTER TO SPOTIFY AND YOUTUBE

The music business has long been used as an example of an industry disrupted by digitization. When Napster launched in 1999, consumers gained access to unlimited amounts of music for free on peer-to-peer file sharing networks.

Source: Daily Mail

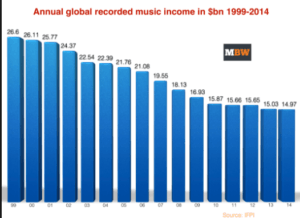

A business previously glamorized by decadent MTV music videos suffered a protracted decline, from $27Bn in 1999 to $15Bn in 2014 [1]. The launch of iTunes by Apple in 2001 somewhat mitigated the decline of CD sales. After a 10-year reign, however, downloads began to lose customers to all-you-can-eat streaming services, paid and free, such as Spotify and YouTube.

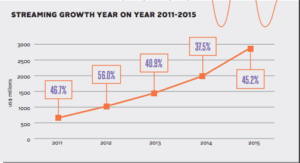

The rise of streaming, which has grown nearly 500% from 2011-15, has changed the business in two main ways by 1) reducing short-term economics and 2) making data critical to a creative business [2]. Earning back your investment takes much longer in the streaming world as labels and artists get paid fractions of pennies per stream versus dollars on downloads [3]. The vast amounts of data from streaming services have also greatly impacted record label operations. My last employer, Warner Music Group, home to Bruno Mars and Ed Sheeran, is an example of a company that has embraced new technologies and has adapted to prepare for future disruptions.

EMBRACING NEW PLATFORMS…AND RETURNING TO OLD ONES

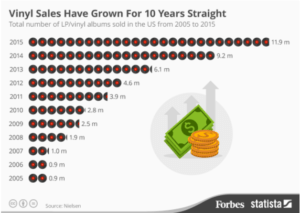

Instead of living in denial about the inevitable death of downloads, Warner has proactively made changes to its business and operating model to optimize in the streaming world, while also diversifying by doubling-down on vinyl, which has experienced double-digit growth recently [4].

Warner has embraced platforms where users consume music, no matter their nature.

Source: Snapchat

Despite early resistance to Spotify’s free tier, Warner entered into a global agreement, allowing millions of consumers to access free, unlimited music. It also negotiated deals with tech companies that were not pure-play music services – musical.ly, Snapchat, and Interlude [5,6,7] – so fans could interact with music on social media.

DATA-DRIVEN CREATIVITY

A big challenge Warner faced was how to get creatives to start making data-driven decisions. How could science be used to create art?

A&R

A&R (artists and repertoire) is the heart of the business, and historically has depended on employees going to concerts to discover new superstars, relying on their intuition to offer record deals. Because many new acts like Justin Bieber and Shawn Mendes were discovered on YouTube and Vine, however, Warner negotiated a deal with music-recognition app Shazam to get access to huge amounts of data that could identify unsigned artists who were gaining momentum. With over 88 million users and 500 million Shazams each month, data about songs that are being tagged is now used to find the next breakout star [8].

Marketing

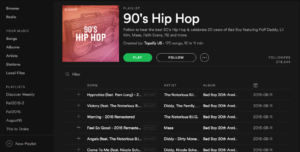

An important part of traditional music marketing has been convincing radio DJs to play your music. The new radio DJ, though, is an online curator – a Spotify user that has created playlists with lots of followers.

Source: Spotify

Getting songs on influential playlists is critical to driving consumption and thus, revenue. As a result, Warner acquired playlists.net, a network of playlists on Spotify with over 1 million monthly listeners [9]. These playlists are now stacked with Warner content, driving artist awareness and revenue.

Research & Analysis

Warner has built out a robust Research & Analysis team to give creative employees the tools to make data-driven decisions. The team digests and analyzes the firehouse of data it gets such as streams, purchases, and consumer demographics from streaming partners, social media accounts, and artist websites, and communicates it to employees in a digestible way. This has proven critical in creating a data-focused culture.

NEXT STEPS

While Warner has taken action to become more resilient to future disruption, there are more steps it can take to lock in its critical position in the supply chain.

Warner’s artists have helped build the audiences of services like YouTube, and social media platforms like Facebook, but it is still at risk of being disintermediated from the fans by the platforms. Netflix’s original content in the TV industry should serve as a warning sign. Warner and its competitors need to develop direct-to-consumer services – whether it’s a mobile app or a digital radio station – to maintain ownership of the customer relationship and associated data. This will be critical to warding off the threat of a Spotify creating original music content in the future.

Warner also needs to evolve its content offering to meet the demands of mobile consumers. The music video format worked well in the MTV days, but Warner needs to create more bite-sized, diverse types of content to compete for the attention of fickle mobile users. They experimented with this on Snapchat’s “Discover” platform, but ultimately failed and were removed [10].

With a continued dual focus on creating engaging, premium content, and using its vast amounts of data to make informed decisions, Warner is poised for success no matter what form music listening takes in the future.

WORD COUNT: 798

SOURCES

- Music Business Worldwide. 2015. GLOBAL RECORD INDUSTRY INCOME DROPS BELOW $15BN FOR FIRST TIME IN DECADES. [ONLINE] Available at: http://www.musicbusinessworldwide.com/global-record-industry-income-drops-below-15bn-for-first-time-in-history/. [Accessed 17 November 2016].

- 2016. Global Music Report. [ONLINE] Available at: http://www.ifpi.org/downloads/GMR2016.pdf. [Accessed 16 November 2016].

- Paul Resnikoff. 2015. My Song Was Streamed 178 Million Times. I Was Paid $5,679…. [ONLINE] Available at: http://www.digitalmusicnews.com/2015/09/24/my-song-was-played-178-million-times-on-spotify-i-was-paid-5679/. [Accessed 17 November 2016].

- Niall McCarthy. 2016. Vinyl Sales Have Grown For 10 Years Straight. [ONLINE] Available at: http://www.forbes.com/sites/niallmccarthy/2016/01/11/vinyl-sales-have-grown-for-10-years-straight-infographic/#3d56c7996f3c. [Accessed 17 November 2016].

- Dan Rys. 2016. Fresh Off a Big Funding Round, Musical.ly Signs Its First Major Label Deal with Warner Music. [ONLINE] Available at: http://www.billboard.com/articles/business/7423281/warner-music-group-deal-musical-ly. [Accessed 17 November 2016].

- Shea Kopp. 2015. SHARE TWEET JAN 29, 2015 SNAPCHAT INTRODUCES DISCOVER, TEAMS UP WITH WARNER MUSIC GROUP. [ONLINE] Available at: http://www.lessthan3.com/news/snapchat-discover-warner-music-group. [Accessed 17 November 2016].

- Warner Music Group. 2014. Warner Music Group Becomes Founding Major Label Partner in Interlude Music. [ONLINE] Available at: http://www.wmg.com/news/warner-music-group-becomes-founding-major-label-partner-interlude-music-19996. [Accessed 17 November 2016].

- Ben Sisario. 2014. Warner in Deal to Sign Acts Found on Shazam. [ONLINE] Available at: http://www.nytimes.com/2014/02/19/business/media/warner-in-deal-to-sign-acts-found-on-shazam.html. [Accessed 17 November 2016].

- Steve O’Hear. 2014. Playlists.net Acquired By Warner Music Group. [ONLINE] Available at: https://techcrunch.com/2014/10/16/playlists-net-acquired/. [Accessed 17 November 2016].

- Andrew Flanagan. 2015. Snapchat Drops Warner Music and Yahoo From Discover, Adds iHeartRadio and BuzzFeed. [ONLINE] Available at: http://www.billboard.com/articles/business/6642187/snapchat-discover-warner-music-yahoo-iheartradio-buzzfeed. [Accessed 17 November 2016].

Very interesting post! I had never thought of the other side of the equation and how Warner could lever technology to find artists and enhance distribution. Do you think that these initiatives are enough to offset declining revenues as people start using more streaming services and are less willing to pay for content?

Fantastic post. I am really interested in your idea about creating “direct to consumer” channel for Warner Music. A few of the cable networks have done this and not been very successful because they can only provide their own content and the customer wants a one-stop-shop. How would you think about overcoming this issue?

Great post! Seems like there has been a race to the bottom in content cost, instigated by Napster and Spotify. At some point, though, distribution technology will become so widespread, that content will become the main value driver – I wonder when balance is reached.

Really interesting post! I find it especially intriguing how Warner is embracing digital to source new artists via YouTube and other amateur friendly platforms. I wonder what your thoughts are on Warner artists using the data it has access to in order to refine their creative process for future endeavors. Is this something they are open to or is it seen as a hindrance on the creative process to try to create something that is too targeted?