MOL – Voyage to sustainable future?

Mitsui O.S.K. Lines (MOL), the world’s 3rd largest shipping company, is facing unique challenges and opportunities on climate change. How should MOL set a right course to sail the world with such challenges and opportunities?

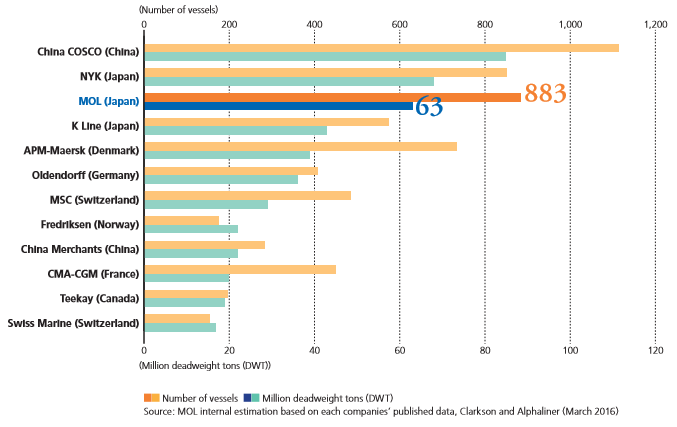

MOL is a Japanese shipping company with the 3rd largest fleet capacity among major carriers in the world (See Exhibit 1). Compared to other major shipping companies focusing on specific fleet type (e.g., Evergreen for containership), MOL manages multiple fleet operations [1]:

- Dry Bulker (52%): Iron ore, coal and wood chip

- Tanker (26%): Crude oil, methanol and chemical

- Containership (10%): Commercial goods with containers

- LNG Carrier (9%): LNG

Exhibit 1: World Major Carriers’ Fleets

Running international business with multiple types of careers, MOL has unique challenges and opportunities on climate change.

Regulation on GHG emission in shipping industry

Shipping is one of the major industries which emit a large amount of GHGs. In 2012, the industry contributed to 800 million tons of CO2, 2.2% of total CO2 emission in the world [2]. Given the impact of the industry on climate change, International Maritime Organization (IMO) has adopted regulations to address the CO2 emission [3]. Under this regulation, every new ship operated by shipping companies needs to follow Energy Efficiency Design Index (EEDI) as defined as below [4]:

- Phase 0: Average of CO2 emission efficiency between 2000 and 2010

- Phase 1 (2015-2019): 10% lower than Phase 0

- Phase 2: (2020-2024): 20% lower than Phase 0

- Phase 3: (2025 onwards): 30% lower than Phase 0

As a major shipping company in the world, MOL needs to ensure it complies with all the environmental regulations. MOL has a strict policy on environment, but it is also costly. In 2015, MOL spent 4.6 bn JPY as environmental investments, while cost reduction in the same year was only 3.1 bn JPY [5].

Energy consumption shift and impact on shipping industry

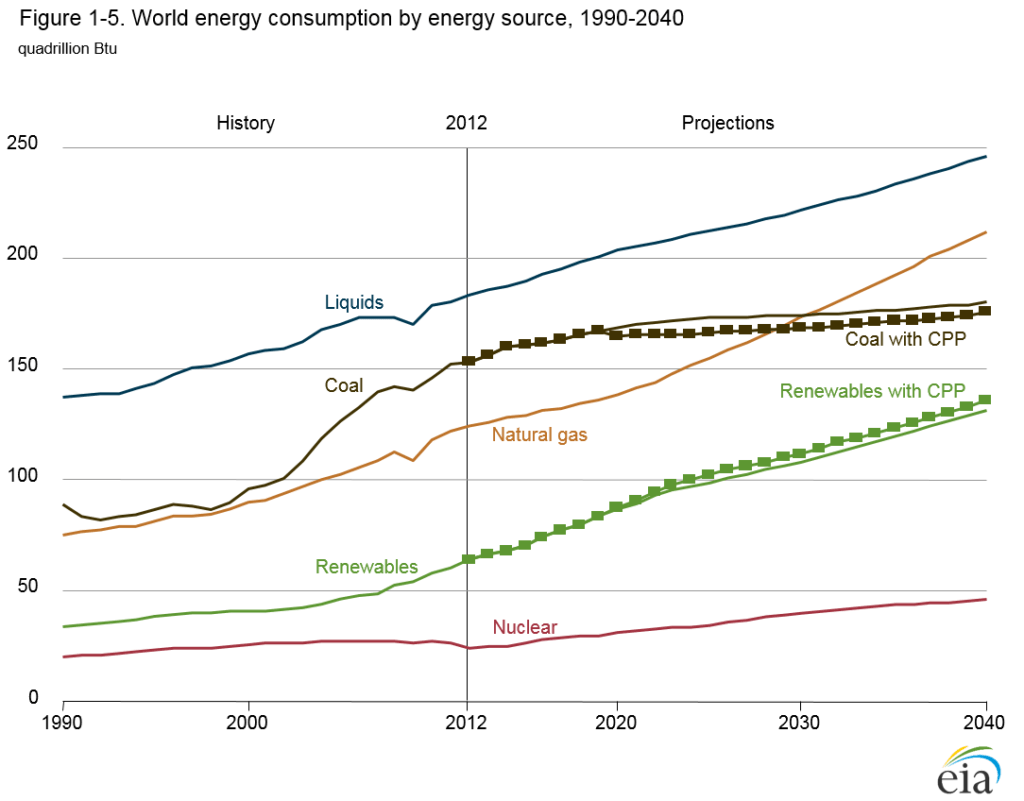

Climate change will also impact on energy consumption in the world. With global efforts to reduce GHGs, the energy mix will shift towards energy with lower GHGs emission. According to U.S. Energy Information Administration, Natural Gas, the least carbon-intensive fossil fuel, will have a higher growth compared to liquids (e.g., crude oil) and coal [6]. By early 2030s, the consumption of natural gas will become larger than that of coal (See Exhibit 2).

Exhibit 2: World Energy Consumption by Energy Source, 1990-2040

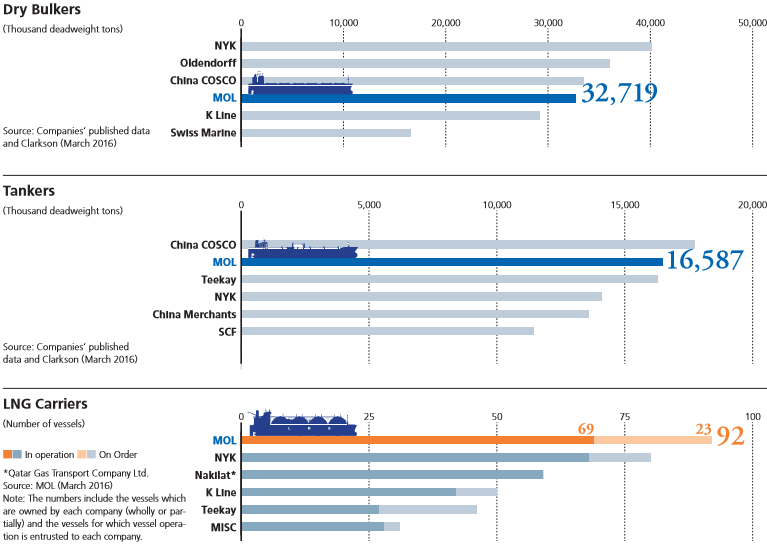

This will impact the shipping demand of fossil fuels. Currently, the biggest business of MOL is Dry Bulker, whose major product is coal. This business has already been struggling in past few years due to the economic slowdown in China, and MOL will see a stagnation in a longer term as well. On the other hand, there will be a higher demand of LNG shipping in a long run. As the world’s largest LNG carrier, MOL has an opportunity to lead this market with strategic investment (See Exhibit 3).

Exhibit 3: MOL’s position by fleet type

New way of adoption? Voyage to Arctic Ocean

MOL is also trying to adopt climate change and to seize new business opportunities. In 2014, MOL announced the plan to build three ice class LNG careers, able to sail in icy seas with maximum 2.1 m ice thickness with ice-breaking capabilities [7]. The vessels will transport LNG from Yamal LNG Plant in Russia to the main LNG markets in the world (See Exhibit 4).

Exhibit 4: Yamal LNG Project Trading Route

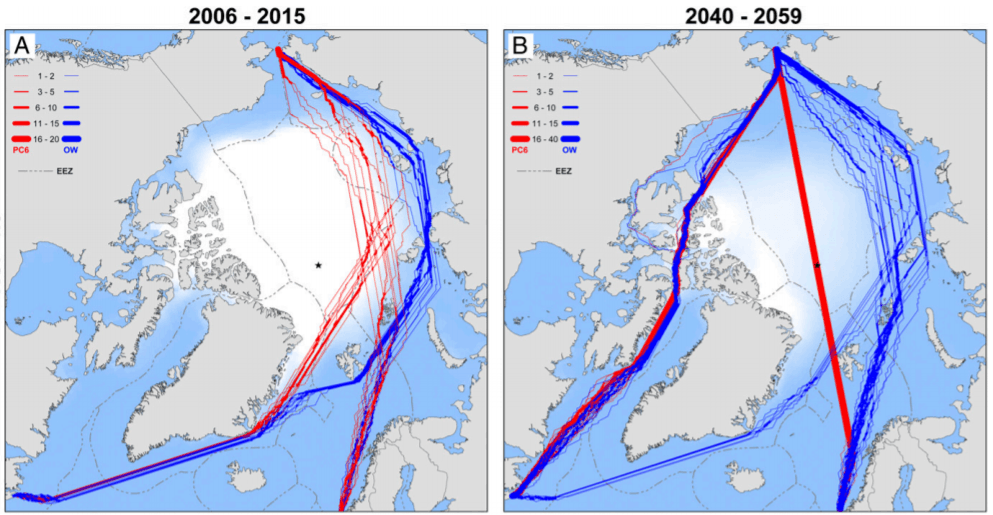

This move will potentially open further business opportunities for MOL. According to a research by Laurence C. Smith from UCLA, changing sea ice conditions will open robust new routes crossing the Arctic along the Northern Sea Route over the Russia by midcentury [8] (See Exhibit 5). This will potentially enable MOL to ship products beyond LNG between Europe and Asia with cheaper cost than before.

Exhibit 5: Navigation Route in 2006 – 2015 vs. 2040 – 2059

Right course to sail for MOL

So what are approaches MOL should take to handle the challenges as well as to seize the opportunities? Here are three suggestions:

- Think regulations as opportunities to become more efficient: Following EEDI can potentially increase the leasing cost of fleets, but it will also help reducing fuel costs for MOL. MOL should work closely with partners such as shipbuilders and ship owners to ensure following the regulatory guideline will lead to benefits for each player in the value chain.

- Shift business mix strategically with long term view: The business cycle of shipping business is long – you need to work with partners for the future capacity plan few years ahead. It is critical for MOL to look at future demands closely and make a plan accordingly. Although coals may still have a short-term demand (e.g., power plant in Asia), MOL should take advantage of current leading positions in LNG and make further investment to capture the growing demands in LNG shipping in the future.

- Find out opportunities climate change will bring: Climate change will affect many global issues and they are interlinked. Shipping industry is also largely affected by multiple factors happening globally. As we see in the case of Arctic Ocean, MOL should try to identify how climate change will bring business opportunities, such as new demands from customers and cost efficient way of operations.

(Word Count: 800 words)

Endnotes:

- Mitsui O.S.K. Lines, ”Mitsui O.S.K. Lines Annual Report 2016.” http://www.mol.co.jp/ir-e/data_e/pdf/annual/ar-e2016.pdf. Accessed November 2016

- Ministry of Land, Infrastructure, Transport and Tourism, Japan, ”Kaiji Report 2016.” http://www.mlit.go.jp/maritime/maritime_tk1_000061.html. Accessed November 2016

- International Maritime Organization (IMO), http://www.imo.org/en/MediaCentre/hottopics/ghg/Pages/default.aspx. Accessed November 2016

- International Maritime Organization (IMO), http://www.imo.org/en/OurWork/Environment/PollutionPrevention/AirPollution/Pages/Technical-and-Operational-Measures.aspx. Accessed November 2016

- Mitsui O.S.K. Lines, ”Mitsui O.S.K. Lines Annual Report 2016.” http://www.mol.co.jp/ir-e/data_e/pdf/annual/ar-e2016.pdf. Accessed November 2016

- U.S. Energy Information Administration, “International Energy Outlook 2016.” https://www.eia.gov/forecasts/ieo/world.cfm. Accessed November 2016

- Mitsui O.S.K. Lines, ” MOL signs Ship Building Contracts with DSME for ice class carriers.” http://www.mol.co.jp/en/pr/2014/14036.html. Accessed November 2016

- Laurence C. Smith and Scott R. Stephenson, “New Trans-Arctic shipping routes navigable by midcentury”, Proceedings of the National Academies of Science, E1191-E1195, 4 March 2013.

Photo & Exhibit Credits:

Cover photo: Career Park, “Mitusi O.S.K. Lines,” https://careerpark.jp/235. Accessed November 2016

Exhibit 1: Mitsui O.S.K. Lines, ”Mitsui O.S.K. Lines Annual Report 2016.” http://www.mol.co.jp/ir-e/data_e/pdf/annual/ar-e2016.pdf. Accessed November 2016

Exhibit 2: U.S. Energy Information Administration, “International Energy Outlook 2016.” https://www.eia.gov/forecasts/ieo/world.cfm. Accessed November 2016

Exhibit 3: Mitsui O.S.K. Lines, ”Mitsui O.S.K. Lines Annual Report 2016.” http://www.mol.co.jp/ir-e/data_e/pdf/annual/ar-e2016.pdf. Accessed November 2016

Exhibit 4: Mitsui O.S.K. Lines, ” MOL signs Ship Building Contracts with DSME for ice class carriers.” http://www.mol.co.jp/en/pr/2014/14036.html. Accessed November 2016

Exhibit 5: Laurence C. Smith and Scott R. Stephenson, “New Trans-Arctic shipping routes navigable by midcentury”, Proceedings of the National Academies of Science, E1191-E1195, 4 March 2013.

Taka – Thanks for the article discussing the risks and opportunities posed by emissions standards in the shipping industry. I would add that customers are also becoming an increasingly important motivation for ship efficiency and sustainability improvements. In April 2015, for example, Cargill announced that going forward it would only use the most efficient shipping vessels with an EVDI rating of A-E. [1] In fact, Cargill had begun chartering cleaner ships preferentially in 2012 using the EVDI Index in partnership with the NGO Carbon War Room. [2]

Cargill is one of the largest lessees of shipping capacity in the world (~500 dry bulk vessels under charter at any one time), meaning Cargill can influence broader industry behavior by changing its leasing preferences. [2] Moreover, this announcement allows Cargill to not only help the planet by reducing emissions but also helps Cargill’s customers hit their own sustainability targets. As a result of the announcement, ship owners are facing increasing pressure from charters who are looking to make their supply chains greener, with Huntsman Chemical and Chinese oil trader Unipec announcing that they do not want their goods shipped on F- and G-rated ships (least efficient vessels) [3]

While ship owners have a long time to comply with regulatory emissions standards (especially for sulphur emissions), customer preferences are changing much quicker. Ship owners must stay in front of these shifts in customer demand if they want to remain relevant in the future.

[1] http://www.cargill.com/products/ocean-transportation/social-responsibility/index.jsp

[2] http://www.cargill.com/news/how-cargill-is-making-shipping-cleaner/index.jsp

[3] https://www.theguardian.com/sustainable-business/2014/aug/01/sustainable-shipping-is-making-waves

Very interesting article on the effects of climate change on the shipping industry and the strategies that they are implementing to adapt. I find it quite ironic that climate change can actually help carriers be more environmentally friendly; as climate change thaws thick arctic ice, it makes it more feasible for vessels to pass through, shorten their routes, and thus reduce the fuel and carbon emissions typically involved in reaching a particular destination. However, I wonder whether there are consequences to sending carriers through the arctic region? According to Canada’s Northwest Territories Environmental and Natural Resources division, shipping through the arctic could actually increase the rate of ice melt as a result of increasing carbon emissions in the region, thereby compounding the issues that climate change presents to the global community (http://www.enr.gov.nt.ca/state-environment/73-trends-shipping-northwest-passage-and-beaufort-sea). Additionally, the impact of carriers would undoubtedly have an effect on the arctic ecosystem and marine biodiversity of the region. This has me question whether arctic shipping is really a bonafide sustainability strategy.