#MexicoStrong – Global Automotive Supply Chain Resilient on NAFTA Negotiations

On the evening of Sept. 19, the hashtag #FuerzaMexico (#MexicoStrong) took off across the internet after a 7.1 magnitude earthquake struck Central Mexico. Mexicans raced to the scene of disaster and lined up to help incessantly for the next few weeks. Videos of their collective spirit took over the media – the world was astonished. Such scenes did not come as surprise for Mexicans, whose heritage of resilience supports most aspects of our lives – from facing internal injustices to dealing with external political threats.

Current NAFTA renegotiations are not the exception for Mexico’s strong and resilient position in the global automotive supply chain. Especially in the case of Nemak (“The Company”), the largest independent producer of high-tech aluminum components for the global automotive industry.1

With US$4.3bn sales in 2016, supplies over 50 customers worldwide through 36 manufacturing plants in 16 countries. 90% of the Company’s sales were exported to the US, mainly to the Detroit giant-OEMs (GM, Ford, and FCA) under NAFTA’s free trade scheme. Uncertainty around the potential cancellation such agreement and the uncertain shape trade is made across between Mexico and the US crystalized as a concern for Nemak’s management since November 8th, 2016, date of the US Presidential Election, especially as investors reaction has already driven Nemak’s share price down ~60%2.

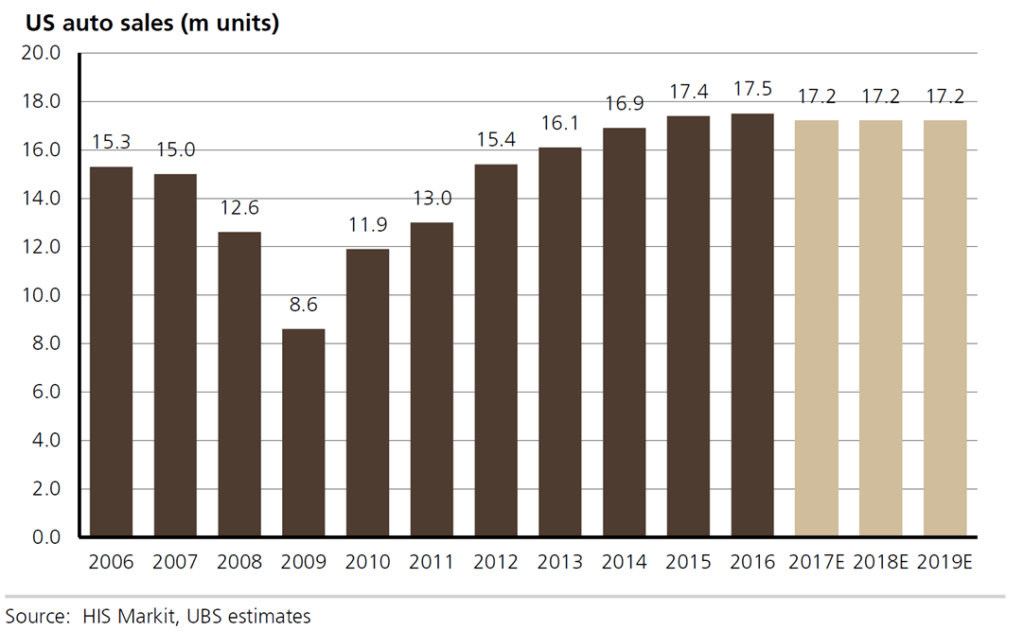

Even when Nemak exports autoparts (not assembled cars) to US OEMs under a Free On Board scheme (OEMs are responsible for transportation and logistics, including border taxes), assuming a full pass-through of higher prices to final customers are expected to lower the demand for new cars in the US market. Increased inventories are expected to force OEMs to reduce production by 3% due to NAFTA, according to HIS Markit (GM is expected to fall 18%; Ford 1%; FCA 7%). North America represents close to 60% of the Company’s sales. As September 30, 2017, Nemak has already lost ~1 million units of management expected reduction in production of 1.2 million units for 2017.3

In response of the risks that NAFTA represents to the Mexican automotive industry, Nemak’s management has already implemented short term and medium-term strategies to successfully address its uncertain future.3

In the short-term – leveraging the company’s global footprint of production facilities, its strong relationships with European OEMs (and raising relationships with Asian OEMs), and its global leadership in the development and manufacturing of aluminum components –, the Company has undergone a company restructure under a “new global organization” to shift focus to OEMs in these regions and capture growth opportunities on the increasing demand for lightweight solutions for next generation of hybrids and full electric vehicle models. Looking to offset the potential reduction on the demand from the US market, Nemak appointed a new Vice President based in Europe that is responsible for strengthening the Company’s capabilities in these regions. This strategy has already shown results: so far Nemak had accumulated a book order of about US$280 million for electric and structural components.3

Targeting a medium-term objective to reach approximately US$1 billion in contracts in Europe and Asia by 2022, the company has planned a capacity and production lines expansion plan across these regions to support new program launches.3 Analysts expect this expansion strategy will require ~US$500m capex per year from 2018 to 2025 (including maintenance). Nemak expects to fund the expansion with internal cash flows, without compromising leverage and dividends.4

In addition to the Company’s management strategies to capture demand for capacity in Europe and Asia, and leveraging its strong financial position, I would recommend Nemak to remain vigilant of potential consolidation opportunities in the Mexican automotive industry. With a “firepower” of ~US$505 million for potential M&A – comprised by US$130 million in cash5 and potential additional leverage of US$375 million by increasing its leverage from target levels of 1.5x Debt/EBITDA by EoY 20173 to 2.0x (assuming a 2017E EBITDA of US$750 million6) – Nemak could acquire smaller and financially troubled players (affected by NAFTA renegotiation outcomes) with contracts to supply non-US based OEMs from Mexico. Analysts consider that non-US based OEMs such as Toyota, Mercedes Benz, BMX and Infinity, will keep sourcing components from Mexico, mainly benefiting from lower auto parts salaries (e.g. 88% lower than the US).1 In this way, Nemak could further protect its capacity and cash flows not only from its global but also from its local footprint.

Industry analysts are confident that a resilient Nemak is poised to offset the impact of potential border tax adjustments resulting from NAFTA renegotiations.1 However, should Nemak’s management assess potential reductions on global demand for producing lightweight components for hybrid and electric vehicles resulting from other countries deciding to follow Trump’s administration intent to relax the rules governing greenhouse gas emissions on new model cars produced between 2021 and 2025?7

(784 words)

Endnotes

1 Mauricio Serna, “Nemak: Slowdown in North America engine makes for a fairly priced stock,” UBS AG, June 27, 2017, via Thomson Reuters, accessed November 2017.

2 Bloomberg LP, accessed November 2017.

3 THOMSON REUTERS STREETEVENTS, “EDITED TRANSCRIPT: NEMAKA.MX – Q3 2017 Nemak SAB de CV Earnings Call”, October 17, 2017, via Thomson Reuters, accessed November 2017.

4 Mauricio Serna, “Nemak: What can reignite its engine beyond a dim 2017?,” UBS AG, September 28, 2017, via Thomson Reuters, accessed November 2017.

5 Nemak S.A.B. de C.V., Quarterly Report 3Q17 (Monterrey, Mexico: Nemak, 2017)

6 Carlos Louro, “Nemak: 3Q17 Results: Metal Lag and Weaker Volumes Pressuring Operational Figures – ALERT,” J.P. Morgan Securities LLC, October 16, 2017, via Thomson Reuters, accessed November 2017.

The potential end of NAFTA would certainly be of impact to NEMAK and a key obstacle for the company’s prospects, but this essay also touches upon the opportunities that such an event could have in terms of sparking consolidation in the industry with smaller players who would not be able to survive without the access to North American markets via NAFTA. Could this consolidation lead to a more integrated and cost-efficient Mexican OEM player? This essay is also thought-provoking when it comes to the stickiness of the auto-supply chain. Would NAFTA cause producers to immediately disrupt the supply chain or would the preference be to pass along the additional costs to end consumers? If so, how long would that cost be sustained before a more integrated (foreign) player enters the market similar to Toyota in the 20th century?

Great topic and write-up.

If the US were to go through with a drastic, unfavorable revision to NAFTA, it would be interesting to see whether not there is a large blowback on the Trump administration that potentially forces a repeal. Given how much the US auto industry is concentrated with and dependent upon its Mexican parts suppliers (Nemak is sole supplier of roughly 85% of the products that it sells) and the low likelihood of a low-cost alternative, this could lead to meaningful price increases for US automobiles and consumer outrage. When the average American ends up paying for this policy, will that reduce the nationalist fervor that is helping to give Trump’s NAFTA agenda legs.

In regards to the Europe/Asia expansion plan, I wonder if M&A as opposed to a greenfield strategy would be an effective way to build a foothold in these markets? Nemak is a large, well-capitalized company (though that could change if stock price keeps declining) and has financial wherewithal to acquire a big European and Asian player, which would not only further accelerate its global diversification but also provide local expertise that may be helpful in operating in these new markets.

Thanks for the interesting read. One thing that Hemak should be considering as a measure is lobbying against NAFTA changes together with other automotive and manufacturing companies. An increase in tariffs resulting from a cancellation of the NAFTA agreement would inevitably lead to: 1. A rise in consumer prices as manufacturers pass on increased logistics costs to costumers; or 2. a cut in labor costs or quality of products as the increased tariffs eat into margins. Both scenarios would work directly against the plan of the current US administration to provide a better life for US citizens.

Nice article. While elimination of NAFTA could have drastic impacts on Nemak’s long-term future, I do think that the impact could be softened in the near term by a potential supply glut. It would take a long time for competitors to build replacement component factories in the US, so if OEMs are not able to source cheaper components domestically at a pace that matches consumer demand, Nemak would still be the optimal international vendor of choice given it’s proximity to Detroit. I do agree that the best defensive mechanism is to be the vendor of choice for hybrid and electric vehicle components. Consumer demand for these automobiles anticipated to rise to 25% of all auto purchases by 2025*, which could be a significant advantage for Nemak if they build out the competencies now for building these components.

*http://www.goldmansachs.com/our-thinking/technology-driving-innovation/cars-2025/, accessed 11/30/17

Great article! I was able to understand impacts of free trade elimination on Mexico economy and Nemak, depending on US automotive companies. The management’s immediate response to diversify clients is also reasonable in terms of increasing negotiation power.

I strongly agree with David’s points. Nemak could indirectly push US automotive companies, making them worry about increasing sourcing costs. To monitor replacement factories in the US, Nemak could convince them that the elimination of FTA would surge the costs, eventually weakening the competencies of US automotive industries. US automotive companies, with a great lobbying power, could influence the decision making of governments.

I also thought about eyeing on LATAM markets. To capture the growth of the market, a significant number of carmakers build factories in LATAM region. To illustrate, Hyundai Motors has a plan to expand its capacity in Brasil. In terms of clients diversification, LATAM regions could be an alternative strategy for Nemak.

It’s interesting to consider the Mexican supplier perspective with relation to the auto industry, as I wrote my essay on the perspective of the US auto industry (GM) reacting to the same issue! While I appreciate Thomas and Seo’s exploration of either direct or indirect lobbying, I think that this could perversely hurt Nemak’s prospects. The underlying push to change NAFTA so dramatically is driven by the President’s desire to save face on his campaign promise to help Americans over Mexicans, rather than a deep economic analysis of the situation. Thus, I could see the fact that a Mexican supplier is opposing this change actually be used as a tool by the President to show that this deal would “hurt” Mexico and “help” America (even though the actual impact would also hurt American consumers and suppliers). I think this soundbite could be used to further his resolve.

Great article and nice touch on the resilience. The auto market in Mexico has grown in the past 2-3 decades at an exponential rate and the US industry’s dependence on that market cannot be taken lightly. If NAFTA was to demolish, there will be more of a negative impact (dollar wise) on the US economy and OEM’s than Mexico by the simple fact that US OEM’s are the consumers and Mexico companies are the suppliers, so the lower cost material is being produced in Mexico (e.g. If cost of component sold by Nemak is $x, the OEM’s product using that component would be a multiple of x and therefore, a much larger portion of economy will be impacted).

I believe despite the administration’s efforts to remove NAFTA, there are more knowledgable economists and advisors in charge (even within the Trump administration) that have a better picture of this impact. The most intriguing part of the article was the quick reaction Nemak has had and their approach to diversify their customer base.

Arturo, how would simple geography limit the ability of Nemak to compete with the incumbent suppliers to European and Asian OEMs due to the added costs of shipping that would come with providing parts to these manufacturers in their countries of final OEM manufacturing completion? It’s worth considering if that cost can be overcome. Separately, is it possible that even with a steep tariff, there is still too great of a difference in labor costs between the US and Mexico for US suppliers to compete, and instead the tariff simply raises prices for consumers without efficiently narrowing the labor cost gap enough to produce the intended effects? Lastly, would it just be possible to either through a greenfield strategy or through M&A obtain a manufacturing presence within the US that prevented Nemak from being exposed to tariffs at all?

Great read – but sad to see that the best Nemak can do is to divest its presence both in terms of applications (traditional car vs. EV) and geography (US vs. Others), I do feel the struggle as business leader when political environment changes…This brings me to the question that is it fair for business leader to pursue their “best-bet” on future business leaders through sponsoring, so to possess a favorable political environment to their business. Think of it deeper, isn’t it a “distorted democracy” when elected political leaders are actually driven by their sponsors rather than the public? And one level deeper, isn’t it why the recent favored political leaders emphasized on “no strings attached” to large businesses, such as US President Mr.Trump and our Taipei Major Dr. Ko. Whether Nemak shall do as next step is entirely based on the shoes we wear – the company or the public, and the tangled issues between politics and business require our collective wisdom to resolve.

Arturo, thanks for the bringing this perspective to the ongoing NAFTA re-negotiations. One thing that remained a question for me was how are Nemak’s customers responding and dealing with these potential changes? I believe that would be a key pieces of information to determine what path Nemak should pursue. Overall, it sounds like most American OEMs are against a wholesale change to NAFTA, having recently organized a coalition to lobby the Trump Administration during this re-negotiation process [1]. However, it does appear some are preparing for drastic changes, with Fiat Chrysler CEO saying “the company has designed its future truck production strategy so that trucks currently made in Mexico could be made in the United States if NAFTA is scuttled” [1]. Getting in touch with my customers would be my first priority, as the economic benefit, and potential economic damage, has been and will be felt by them as well.

[1] Shepardson, David. “Auto industry tells Trump ‘We’re winning with NAFTA'”, Reuters, October 24, 2017. , Accessed November 2017.