Mad Men in the Digital Age

As the industry moves toward digitalization at a rapid speed, traditional advertising agencies need to find new ways to add value for their clients or face the risk of being left behind.

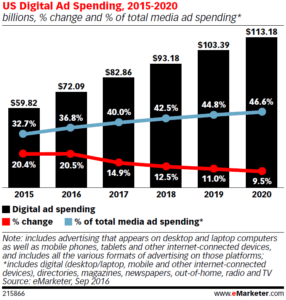

The popular AMC television series, “Mad Men”, took us back to one of the most transformational periods in advertising industry – fueled by the emergence of television, computers, and other technological advances. Now 40 years later, we find ourselves again in the midst of another transformational wave in advertising: the rise of the digital era. By the end of 2016, for the first time in history, total digital advertising spend in this country will surpass that of TV. Consumers’ total digital media usage through smartphones has increased by almost 80% over the past 3 years. Furthermore, an adult on average owns close to 4 electronic devices and consumes 5.5 hours of content per day. Every minute, 48 hours of video are uploaded onto YouTube, 600,000 feeds are shared on Facebook, and more than 100,000 tweets are sent.

With record amounts of customer data growing every second, marketing agencies with advanced data analytics capabilities that can extract valuable insights will be able to help clients produce more relevant advertising content and more accurately target the right audience based on shoppers’ online and offline behavior. While having an omni-channel presence is at top of mind for most companies, the strategy proves to be challenging in a fragmented marketing technology ecosystem where each marketing channel (paid search, display, social, TV, etc.) has its own group of publishers, ad-serving platforms, and data tracking systems. Therefore, the advertising agencies with the best technology, most integrated digital platforms, and most comprehensive analytics capabilities will have a significant advantage over others.

Publicis Groupe, a 90-year old French advertising conglomerate with deep-rooted expertise in TV, print and traditional advertising, is one example of an agency that will have to make drastic changes in both its business and operational model in order to keep up with the global shift toward digitalization.

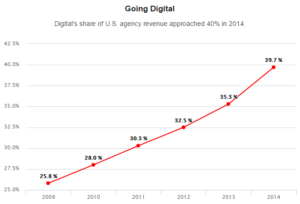

- Digital Expansion: Publicis has grown its digital capabilities through aggressive acquisitions of big digital marketing players in the recent years including Razorfish (2009), LBI (2012) and Sapient (2014). These acquisitions have increased Publicis’ digital revenue exposure to 52%, compared to that of its biggest competitors, WPP at 38% and industry average of 40%.

- “One-stop Shop”: The Company has historically operated as a holding company, composed of independently-run advertising agencies. However, recognizing the clients’ need for more holistic and streamlined marketing solutions, Publicis is undergoing a significant operational restructuring (aim to be completed by 2017), which will combine all of its previously siloed agencies into just four main divisions based on marketing solutions. Each client will have easy access to all of Publicis’ marketing services in both offline and online media. In addition, the acquisition of Sapient has strengthened Publicis’ technology offering in web and app development, content management, and e-commerce – putting Publicis in the lead as an end-to-end marketing services provider. Finally, the restructuring will allow agencies to combine back-office functions and increase the Company’s media-buying power, further reducing advertising cost for both themselves and for its clients.

- Data Monetization and Measurement: Publicis has expanded its data analytics capabilities through partnerships, acquisitions, and internal development. It’s partnerships with Adobe and Tencent for example, allow Publicis to access Adobe’s data cloud storage and analytics platform and Tencent’s rich, online behavioral data. Recently, the Company launched a new data intelligence system, COSMOS, which was built to solve the challenges of disparate data and fragmented audiences by combining intelligence from online and offline data to create a single view of the customer.

While Publicis has taken steps to better prepare itself for a more digitalized world, the Company must not abandon its core marketing competencies, which is its strength in story-telling and creative production. In order to remain competitive, Publicis needs to increase its investment in human capital.

- Cross-function Training: Offering its employees training and knowledge-sharing across its different divisions will ensure more seamless collaboration among the companies’ developers, data scientists, and consultants. This could include periodic marketing industry conferences, beginning classes in SQL, Python and other programming languages for non-tech employees, and story-telling and presentation workshops for non-consultants.

- Maintaining a Creative Edge: Story-telling and brand management is more important than ever as companies may now have many more interactions and deeper engagement with its consumers. Management should not only push for more “out of the box” thinking from its employees, but encourage more collaboration among its creative teams and its research, data analytics, and technology teams. Implementing an agile team structure will help promote fast idea generation and iteration, which helps its team members produce more creative, customer-centric, and data-informed products for clients.

- Talent Retention: In order to attract and retain talent, Publicis should adopt bonus incentives much like those in consulting companies, and shift its focus from low margin media-buying business into more profitable, marketing or analytics consulting based model.

(786 words)

Bibliography

Damian Radcliffe, “Nine trends in US media consumption”, theMediaBriefing, May 3, 2016, [https://www.themediabriefing.com/article/nine-trends-in-us-media-consumption-in-charts], accessed November 17, 2016.

Chris Buxton. “More Growth, More Margin, Less Risk”, JPMorgan Cazenove Research (June 8, 2016).

Alissa Lorentz, “Big Data, Fast Data, Smart Data”, Wired, [https://www.wired.com/insights/2013/04/big-data-fast-data-smart-data/], accessed November 17, 2016.

“Razorfish launches new data intelligence platform Cosmos”, ETBrandRquity, June 29, 2016, [http://brandequity.economictimes.indiatimes.com/news/digital/razorfish-launches-new-data-intelligence-platform-cosmos/52968458], accessed November 17, 2016.

“Publicis Groupe and Tencent Sign Historic Global Partnership”, PRNewsWire, June 1, 2016, [http://www.prnewswire.com/news-releases/publicis-groupe-and-tencent-sign-historic-global-partnership-300293418.html], accessed November 17, 2016.

“US Adults Spend 5.5 Hours with Video Content Each Day”,eMarketer, April 16, 2015, [https://www.emarketer.com/Article/US-Adults-Spend-55-Hours-with-Video-Content-Each-Day/1012362], accessed November 17, 2016.

Bradly Johnson, “State of the Agency Market“, AdvertisingAge, April 26, 2015, [http://adage.com/article/digital/datacenter-agency-report-2015-charts/298214/], accessed November 17, 2016.

Publicis Groupe, 2015 Annual Report, [http://yearbook2015.publicisgroupe.com/], accessed November 17, 2016.

Great post! To me, your post is highlighting an industry-wide trend on how owning the CMO relationship requires connecting customer strategy to digital advertising execution. Shortly after Publis (advertising) bought Sapient Nitro (tech consulting) for $3.75B Cash!, Deloitte Digital (digital consulting) bought Heat (advertising company). Read more here: http://www.wsj.com/articles/deloitte-digital-buys-creative-agency-heat-1456761163 Given that Publicis isn’t the only firm taking this strategy, it should also look to increase it’s core strategy consulting competencies in addition to it’s creative edge.

Fascinating post. As digital CPMs trail those of traditional media, do you think there will be a convergence of prices? YouTube, for example, has relatively low CPMs compared to those of traditional media. While there are a few creators who are popular enough to make a decent living from YouTube alone, the majority of creators cannot. Given relatively lower production and distribution costs on a digital platform like YouTube, there’s an argument to be made that CPMs will remain naturally lower than on traditional platforms. Furthermore, is there a movement away from “impression” to a metric that better captures engagement (e.g., shares on FB or retweets on Twitter)? With clicks easily spoofed, it’s hard to understand what a “view” actually represents.