Machine Learning: Schneider Electric Positions Itself to Lead Digital Transformation of Infrastructure

Demand for applying digitization and machine learning to current operations has increased significantly for manufacturing companies today. Can one company expand its reach to help all industries reach their goal of digital transformation?

Digitization.

This buzzword is boasted by many industrial manufacturing companies today, being showcased in headlines of company webpages and included in company goals for the future. An industry survey by Strategy& found that 72% of manufacturing companies said they are dramatically increasing their level of digitization and expect to be able to be ranked as digitally advanced by 2020.[1] This demand to offer customized digital capabilities has created a market opportunity. One company that has positioned itself to fill this market void is Schneider Electric.

Schneider Electric (SU.PA) is a French company headquartered in Rueil-Malmaison, France with over 140,000 employees in 100 countries. Founded in 1836, Schneider Electric was originally focused on steel, heavy industry and transportation equipment, but has evolved to focus on the electrical industry and, more recently, digitization.[2] After undertaking a series of strategic acquisitions in the electrical and digital space (including 17 since 2011), Schneider Electric is vertically integrated in the market to provide the software and hardware needed to improve manufacturing operations using machine automation.

Digitizing manufacturing companies is no easy feat, as there is not an obvious one-size-fits-all approach for the industry. Per Schneider Electric’s 2017 financial statement, it targets four industry segments: Low Voltage, Industrial Automation, Medium Voltage and Secure Power. Table 1 provides information from their 2017 finance statements. Each industry segment poses its own set of challenges to break into the market and supply meaningful innovation to its customers.

Table 1: 2017 Schneider Electric Financial Statement[3] (revenues in EURm)

| Industry Segment | 2017 Revenue | % 2017 Revenue | % 2017 Organic Growth | % 2018 Projected Growth | 2017 EBITA Adjusted Margin |

| Low Voltage (Building) | 10,812 | 43.7% | 4.4% | 4.5% | 20.6% |

| Industrial Automation (Industry) | 5,816 | 23.5% | 5.9% | 5.1% | 17.6% |

| Medium Voltage (Infrastructure) | 4,500 | 18.2% | -2.2% | 2.9% | 10.0% |

| Secure Power (IT) | 3,615 | 14.6% | 2.1% | 3.0% | 16.6% |

| GROUP | 24,743 | 100% | 3.2% | 4.1% | 4.1% |

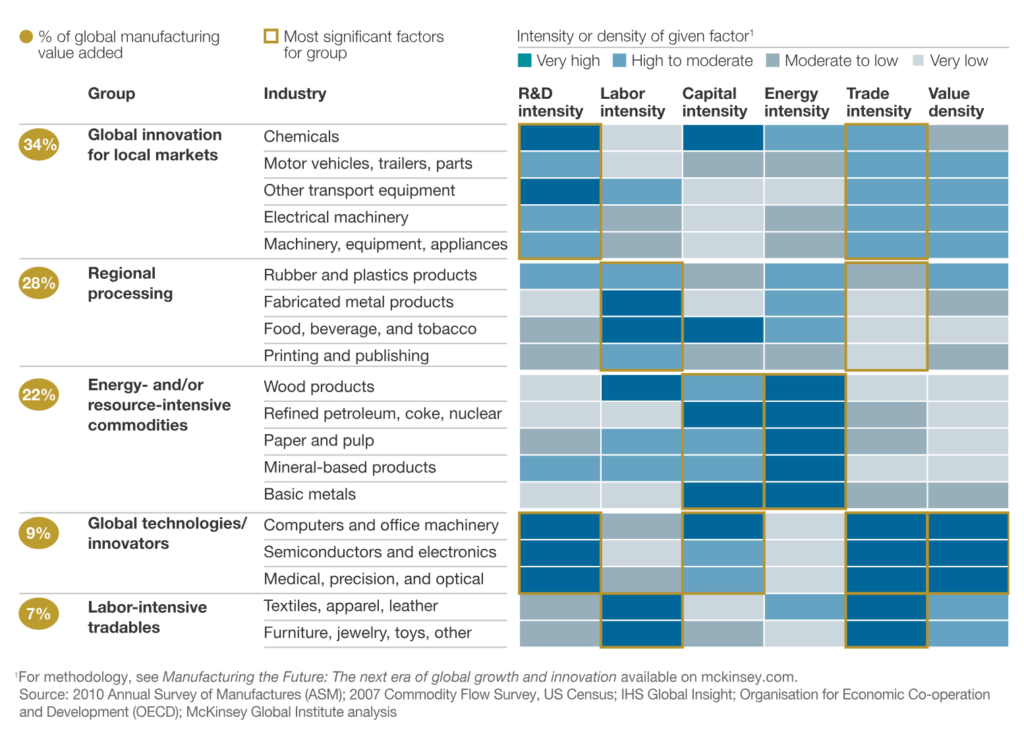

Arguably one of Schneider Electric’s most prominent industries for early trail in digitization is the chemical sector. As part of the Schneider Electric’s industrial automation industry segment, the chemicals sector offers a large capital budget and high R&D intensity (See Figure 1). Given that Schneider Electric has a lasting relationship with chemical companies in providing electrical and hardware components, Schneider Electric has started offering these companies more automation services and capabilities to meet their safety and energy efficiency needs. One example project in Schneider Electric’s portfolio is an upgrade of manual compressors and turbines to an automated control system, while meeting applicable industry safety standards. Revenue from these types of project can be earned through software programs, hardware for installation, and training modular for new equipment.

Although the chemicals industry serves as a relatively easy market for Schneider Electric to break into, current projects are highly customer-based and difficult to scale. However, performing small customer-based projects has been an essential for Schneider Electric’s ability to trial and refine its technology. The types of projects that Schneider Electric will want to transition to in the chemical market are new capital infrastructure projects. The benefit of these projects is that they are much larger in size and Schneider Electric can design equipment with digitization in mind before the infrastructure is even built. Additionally, designing for digitization pre-build could allow Schneider Electric to more easily scale its services. It is essential to chemical companies that the digital technology has been proven before risking downtime or project deadlines on a €1+ billion project. Given Schneider Electric’s current portfolio of products and services, they are well set up to lead the digital transformation for chemical companies and hopefully can transition that knowledge to other industrial markets.

Figure 1: Manufacturing Diversity[4]

As Schneider Electric continues to expand its automation services for its customers it will be important for the company to invest in cloud infrastructure or partner with an existing company. Schneider Electric goals in digital transformation significantly increases the data quantity and therefore data storage requirements. Additionally, given the demand for digitization projects across diverse industries, Schneider Electric will need to continue to join forces with companies that provide complementary services. Currently, Schneider Electric has formed alliances with Microsoft, AWS, Salesforce, Accenture, Cisco, and Intel[5] in efforts to meet customer needs and expand their project capabilities.

On paper, serving the growing demand for machine learning seemed like an easy pivot to Schneider Electric’s existing capabilities. Although a large organization, Schneider Electric has kept its capabilities innovative through acquisitions and continuing to utilize its size and scale. However, if we are approaching a digital transformation, why are Schneider Electric’s growth projections only averaging 3.4% the next three years[6]? Maybe the transition period to a digital world is farther than we think.

As Schneider Electric’s leadership team reviews successes and failures of past digitization projects, they will have to predict whether digitization transformation will continue to be customer-based for Schneider Electric or if they can provide a scalable automation service. Is there a future where we design capital infrastructure for digitization? Or will each digitization project need to include a local customer-based approach?

(760 words)

[1] https://www.strategyand.pwc.com/media/file/Industrial-Manufacturing-Trends-2018-19.pdf

[2] https://en.wikipedia.org/wiki/Schneider_Electric

[3] https://www.schneider-electric.com/ww/en/documents/finance/2018/03/20-release-annual-results-post-consensus-tcm50-370945.pdf

[4] https://www.mckinsey.com/business-functions/operations/our-insights/the-future-of-manufacturing

[5] https://blog.schneider-electric.com/energy-management-energy-efficiency/2018/07/13/the-rise-of-the-extended-enterprise-in-todays-digital-economy/

[6] https://www.schneider-electric.com/ww/en/documents/finance/2018/03/20-release-annual-results-post-consensus-tcm50-370945.pdf

Interesting read on Schneider Electric! There have certainly been lots of advances in technological development that should enable traditional manufacturers (in this case, chemical manufacturers) to produce more efficiently. One of the challenges I see in this space that could also become a hurdle for Schneider Electric is the effectiveness of technologies adoption by large enterprises. Many large companies have been introduced to the new and powerful software and technologies, however, they are not fully tapped into the promised capabilities and benefits. I believe partly due to the difficulty faced in integrating of new technologies into their existing platform; partly due to the lack of talents both willing and able to implement and utilize. I believe these issues need to be addressed before SE can look into designing significant capital infrastructure for digitization.

Interesting article about a great company! I had no idea Schneider was so proactive about digitization of their clients, thanks for sharing.

The use of AI and machine learning in the manufacturing space is always tricky because OEMs like Schneider can enable companies to collect data, but ultimately the end-user (SE’s client) is in a better position to leverage the data and optimize their asset management. At the same time, SE may have more data because they sell to a large number of clients that may share their data with them.

In terms of offer, is SE going to just collect and supply the data to customers, or will they also take care of the analytics/ recommendations part? In the latter case, they would have to worry about the integration of their product with the IT systems of clients, which is often a very intricate issue and tremendously different from one organization to the next. More generally, I’d be interested to see how SE explains and sells their “digital services” to potential clients.

Finally, given the great variability of clients and industries served by SE, I doubt that a “one-size fits all” approach to digitization would work: even in the chemicals industry, there are many sub-segments that display a lot of variability as you point out. Is SE going to develop specific digital products for each of these or are they going to go for a “case by case” approach (in which case it may be more difficult to sell than a well-packaged product or service offering).

Thanks, Julien! On your comment about not knowing that SE was so proactive about digitization… they actually just rebranded this year!