LaCroix-vey! Climate change and the business of (cool) carbonated water

How will today's coolest carbonated water remain relevant (and operational) in the face of climate change?

PROBLEM SETUP

After decades on the market, LaCroix – a fruit-flavored seltzer that has become a cultural phenomenon among Millenials (See Exhibit 1) – experienced a sales boom, putting its parent company, National Beverages (NB), on track to make $1B in revenues this year [i] [ii] (See Exhibit 2). The carbonated water category has more than doubled since 2013 [ii], attracting goliaths like Coca Cola looking to acquire and develop brands of their own [i] [iii].

NB operates twelve U.S. manufacturing facilities and touts its high standards for product development, labeling and manufacturing [iv]. As a beverage manufacturer, it must consider the risks that climate change poses to its supply chain via increasing water shortages, as well as its role in perpetuating greenhouse gas (GHG) emissions through manufacturing and packaging.

Shrinking glaciers, reduced snowpack, and erratic rainfall have heightened expectations of global water shortages, with experts claiming the proportion of land surface in extreme drought could increase to 30% by 2090 [v]. Because water is a critical production input for LaCroix, NB has a vested interest in slowing or reversing the impact of climate change on earth’s water supply; otherwise, it could face rising prices or all-out shortages as supply dwindles and global competition increases.

In addition, NB indicates the price of its raw materials (like aluminum cans) fluctuates based on commodity market conditions, suggesting it lacks control over these inputs [v]. Because much of the world’s energy-intensive industry is located in developing nations (where 50% of aluminum was produced in 2006), this lack of control could amplify downstream climate change risks [vi].

Lastly, given heightened visibility and competition, NB must consider LaCroix in direct comparison to players like Coca Cola, who articulate visible positions on environmental sustainability in marketing efforts [vii].

WHAT TO DO

Though it avoids explicit mention, NB has clearly made several choices to mitigate impacts of climate change: by excluding sugar from LaCroix, NB eliminated the greatest contributor to its process water footprint (See Exhibit 3) [viii]; it utilizes reverse osmosis – an efficient desalination process (though not quite best-in-class) [ix]; and, by primarily using recyclable cans, it eliminated 95% of theoretical aluminum process emissions [x] (though, because NB does not control its aluminum price, one could argue it does not fully manage this process and thus cannot guarantee fully environmentally- and financially-sustainable sourcing).

Water footprint accounting can help NB assess operational risks and opportunities for improved mitigation. Most of the water footprint of a given 0.5L water beverage stems from the supply chain (rather than from direct water product input) [ix], which underscores the need for NB to thoroughly audit its process for inputs like flavoring in addition to water sourcing and aluminum procurement. A better understanding of its footprint drivers, combined with 100% recyclable and controllable aluminum processing and best-in-class desalination, could significantly improve process sustainability.

NB must also consider its communication strategy. Because it claims to have a low carbon footprint without any supportive detail, there exists latent opportunity to capitalize on transparency about sustainable practices. Such messaging would support its brand of “caring for America,” potentially command a higher price point among its Millenial consumer base [vi], and add competitive pressure to others to follow suit, resulting in a win-win for the industry and the planet.

Though NB has begun to mitigate its impact on climate change, opportunities remain to optimize its sustainability practices and to communicate about them. What barriers exist to conducting an internal audit of its water footprint? Why might NB not want to talk about what they do in the realm of environmental sustainability? Are there steps that NB should take to adapt rather than just mitigate change?

(797 words)

EXHIBIT 1: Select social media

Source: Instagram, lacroixwater

Benedict Cumberbatch, Robert Downey Jr., Mark Ruffalo and Benedict Wong on the set of “Avengers: Infinity War” June 2017. Source: toofab.com

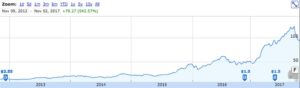

EXHIBIT 2: National Beverage Corp. (NASDAQ: FIZZ) 10 year stock performance

Source: Google Finance. Accessed November 6, 2017.

EXHIBIT 3: Composition of the water footprint of a business.

(A) Operational water footprint = Directly associated with production of the product

- Water incorporated into product as an ingredient.

- Water consumed (i.e. not returned to the water system from where it was drawn) during production process (canning, washing, cleaning, filling, labeling, packing)

- Water polluted as a result of the production process

(B) Supply chain water footprint = Related to production inputs

- Water footprint of product ingredients other than water (CO2, natural flavoring)

- Water footprint of other inputs used in production (can, labeling and packing materials)

(C) Overhead operational water footprint = Water consumed as a result of consumption by employees, water use in kitchen / toilets, etc.

(D) Overhead supply chain water footprint = Water consumed through inputs not directly for production process of product of interest (construction materials, paper, factory energy, etc.)

Original source (abridged): Ercin, Aldaya, Hoekstra. “Corporate Water Footprint Accounting and Impact Assessment: The Case of the Water Footprint of a Sugar-Containing Carbonated Beverage.” Water Resour Manage (2011) 25:721-741. DOI 10.1007/s11269-010-9723-8

REFERENCES

[i] Hensley, Ellie. “Coca-Cola gunning for LaCroix in booming market for sparkling water.” Bizjournals.com, 30 Oct. 2017, www.bizjournals.com.

[ii] Entis, Laura. “Here’s Why It Feels Like You’re the Only Millennial Not Drinking La Croix.” Fortune, 27 July 2017, fortune.com.

[iii] Seeking Alpha. “Why National Beverage Sold Off.” 9 Oct. 2017, http://seekingalpha.com.

[iv] National Beverage Corp 2017 Annual Report. Accessed 7 Nov, 2017, www.nationalbeverage.com.

[v] Henderson, Reinert, Dekhtyar, Migdal. “Climate Change in 2017: Implications for Business.” Harvard Business School. June 27, 2017.

[vi] Worrell, Bernstein, Roy et al. “Industrial energy efficiency and climate change mitigation.” Energy Efficiency (2009) 2:109-123. DOI 10.1007/s12053-008-9032-8

[vii] “Position Statement on Climate Protection.” The Coca-Cola Company, www.coca-colacompany.com.

[viii] Ercin, ALdaya, Hoekstra. “Corporate Water Footprint Accounting and Impact Assessment: The Case of the Water Footprint of a Sugar-Containing Carbonated Beverage.” Water Resour Manage (2011) 25:721-741. DOI 10.1007/s11269-010-9723-8.

[ix] McGinnis and Elimelech. “Global Challenges in Energy and Water Supply: The Promise of Engineered Osmosis.” Environmental Science & Technology. 2008, 42, 8625-8629. pubs.acs.org.

[x] Das, Subodh K. and Green, John A.S. “Aluminum Industry and Climate Change – Assessment and Responses.” The Minerals, Metals & Materials Society. JOM Vol. 62 No. 2. February 2010.

During your essay, I was wondering: “Do NB really need to address climate change issues further?” In fact, one answer to your question might be that 1. people will go after bigger beverages company to address these challenges before they ask you, 2. a strategy for NB is to wait that initiatives from bigger competitors with deeper pockets deliver results to then follow on the same initiatives. Also, another key element would be to understand what NB is chasing: for example, could they be interested in maximizing the value of their company to be acquired by Coca-Cola, in which case let would let Coca-Cola address the issue and not invest funds that would lower their valuation. Do they have the means to conduct initiatives like the reusable water one Coca-Cola is conducting [1] (noting also that Coca-Cola is almost 40 times their market cap)?

[1] http://www.coca-colacompany.com/stories/collaborating-to-replenish-the-water-we-use

Your article is certainly an interesting exploration of some of the things NB will need to consider. One question that came to mind for me was “What is the appropriate baseline to compare against?” That is, should NB hold itself to a firm no-waste standard, or should it compare itself to, say, the environmental impact of bottled water? Is it realistic to expect canned seltzer water to meet such a stringent standard? If so, it begs the question: are we, as consumers, the ones really at fault for non-sustainable product production, by generating market demand for products that, even after great effort, are still not fully sustainable?

Considering the fact that NB is not big as their giant competitors such as Coca-Cola, I agree that it is more difficult for them to spend costs on initiatives that will only lower their profit, but I also thought that this is actually a place that they can take advantage of and differentiate. It depends on what the goal of NB is, whether they want to become a beverage giant like Coca-Cola, or continue to fight only in the seltzer market, but if it is the latter, I believe that there are opportunities to differentiate. For giant companies such as Coca-Cola, it has become a world that you sort of expect them to have good sustainable initiatives without having to raise the prices of their products, but for companies like NB, especially with great marketing capabilities and a sense of “fashion” in their brand, I believe that it is possible to bring in customers who will not only buy a product for the product itself, but for the customers who are also willing to pay a tad extra for their values/initiatives . So in order to do this, I believe that NB should proactively continue to engage in these initiatives and aggressively appeal to the customers through their savvy marketing.

Great article, Katie!

I agree on the way you highlighted many potential win-win strategies NB could use to reduce its environmental footprint and increase its brand awareness and loyalty. Indeed, I believe that if done in conjunction of a good marketing campaign, doubling-down on environmental-friendly policies can serve NB very well to attract more millennial consumers and create a unique and recognizable brand. At the same time, this would be a positive step in getting other larger food and beverage giants interested in a potential acquisition. If this were to happen, the good-to-great sustainability standards set by NB could serve as best in class for its parent company, leading the way to a potential re-think in the entire industry and setting higher standards overall.

Therefore, my suggestion to NB would be very similar to yours: impressive job to-date, still room for improvement that should be pursued for their own interest and the world’s.