Just Do It: The Swoosh Goes Digital

An iconic sports brand doubles down on digital.

Are We Running Today?

Looking down, you see the Nike+ Run Club app logo on the face of your Apple Watch, followed by a guilt-inducing reminder: 3 days, no runs . . . Are we running today? Wearable fitness trackers and mobile fitness applications are nothing new. Yet this watch is different: the integration of the Nike+ Run Club app with the latest Apple Watch represents a unique partnership between Nike and Apple, two of the most iconic brands in the world. For NIKE, Inc. (“Nike,” or “the Company”), however, it represents something more – the Company’s continued push into digital.

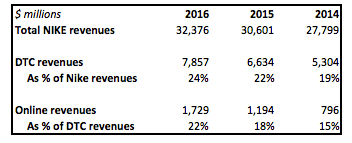

Started in 1964 by Phil Knight and legendary track coach Bill Bowerman, Nike today is one of the world’s most recognizable companies. Although sales through third-party vendors continue to comprise the majority of the Company’s revenues, Nike has, in recent years, made a concerted effort to expand its direct-to-consumer (“DTC”) reach, and digital is an important piece of the Company’s DTC growth goals. Indeed, for the last three fiscal years (2014-2016), Nike’s DTC revenues have grown nearly 20% each year, with digital growing at nearly a 50% clip. (By comparison, Nike as a whole experienced 5%-10% revenue growth over the same period.) Digital revenues now represent 22% of Nike’s DTC revenues and have grown by nearly $1 billion since 2014 [1]. Figure A shows the three-year trend:

Nike has also sought to integrate digital into physical stores. For instance, the Nike+ Run Club app advertises group runs (led by Nike pacers and coaches) that begin and end at Nike stores. In addition, the new Nike Soho store in New York City is, what the Company calls, “a seamless link between Nike’s digital and physical platforms” due to an array of immersive digital trials. Store visitors can, for instance, try out basketball shoes on a basketball court surrounded by images of iconic New York basketball courts and test running shoes on treadmills that offer real-time, on-screen feedback [5].

The new Nike+ mobile app takes the Company’s digital relationship with the consumer one step further. Darren Heitner of Forbes describes the app as “much more than another shoe and apparel company app designed to track performance,” pointing out that “this stand-alone app provides the user with a feed of stories tailed based on inputs of interests, the ability to connect with an expert for training tips, and most importantly a store with highlighted products that makes it easy for a consumer to buy straight from Nike” [6]. Indeed, after installing the app, a user is prompted to enter information about his/her preferences – for instance, whether to follow categories like running, basketball, training, and/or soccer – and provide a shoe size. From there, the user is fed product and training recommendations, and he/she can make purchases directly from the app. If the user wishes, he/she can even place orders for pickup at a Nike store.

The Company’s digital efforts have not all been rousing successes, however. Many may remember the since-discontinued Nike FuelBand fitness tracker. While not exactly a success story in and of itself, many in the wearable technology industry believe it was a product that catapulted wearable fitness technology to the mainstream. For instance, Chris Smith from Wearable, a site dedicated to the wearable technology industry, argues that despite the product’s limitations, “[the wristband’s] importance as a transformative product can’t be understated” because it was “the first high-profile marriage of consumer tech and fitness [in what’s] now a multi-billion-dollar industry” [7].

As it moves forward, Nike needs to focus on differentiation and further digital innovation because, in many respects, competitors face a low barrier to entry to do what Nike has done in the digital space. For example, New Balance recently partnered with fitness app Strava; when New Balance’s MyNB app is linked to Strava, the resulting app operates very similarly to the Nike+ app – just with New Balance products [8]. One potential way to drive innovation could be to focus on new digital product offerings that encompass a greater variety of sports and activities. Although products for multiple sports appear for purchase in the Nike+ app, the focus of Nike’s other apps – notably, the Nike+ Run Club and Nike+ Training Club apps – is predominantly on general fitness and running. Adding skill-based training regimens for sports like basketball and soccer to the Nike+ Training Club app could be a way to appeal to more consumers.

[Word Count: 796 without citations or figures]

Citations:

[1] NIKE, Inc., 2016 Annual Report, p. 76

[2] Ibid., p. 76

[3] NIKE, Inc., “Company News,” http://news.nike.com/news/names-adam-sussman-as-chief-digital-officer, accessed November 2016.

[4] NIKE, Inc., “Company News,” http://news.nike.com/news/nike-digital-studio-2016, accessed November 2016.

[5] NIKE, Inc., “Company News,” http://news.nike.com/news/nike-soho-first-look, accessed November 2016.

[6] Darren Heitner, “Just Do Digital: Nike’s Fundamental Shift to Direct-to-Consumer.” Forbes, August 2, 2016, http://www.forbes.com/sites/darrenheitner/2016/08/02/just-do-digital-nikes-fundamental-shift-to-direct-to-consumer/#3a58edf3707a, accessed November 2016.

[7] Chris Smith, “Nike FuelBand: The Rise and Fall of the Wearable that Started It All,” February 22, 2016, http://www.wareable.com/nike/not-so-happy-birthday-nike-fuelband-2351, accessed November 2016.

[8] New Balance, “My NB Loyalty Program,” http://www.newbalance.com/id/loyalty-info.html, accessed November 2016.

Cover photo credit:

NIKE, Inc., “Product News,” http://news.nike.com/news/nike-plus, accessed November 2016.

Thanks for the interesting read! Thus far, it seems that wearable tech has been limited to the bracelets/watches that serve as fitness trackers. I wonder if companies like Nike can take wearable tech to a new level and apply technology to their shoes or clothing lines to offer value to customers. Can clothes be adjustable based on the amount of heat you’re generating or how cold it is outside? Can sneakers adjust to provide better comfort based on the surface you’re walking on? How can Nike reorganize its staff to get more collaboration between core product development teams and digital technology teams to push the envelope on innovation?

Thanks for writing this! Want to respond to Sairah’s comment…you pick up on a really important dilemma that wearables is facing right now: items like bracelets/watches/rings can only take you so far without disrupting someone’s everyday life. There are actually a bunch of folks working on something called “smart fabrics”: http://www.wired.co.uk/article/smart-fabrics-beat-smart-devices. Google, in particular, in cahoots with Levi’s is working on Project Jacquard (https://atap.google.com/jacquard/), which will enable everyday fabrics to have touch and gesture interactivity literally woven in. So anything from your jean pockets to your placemats can actually become digital surfaces. For me the question is: where do we go from the smart fabrics to needing a screen to view/keep a pulse on whatever our smart products are tracking? How do I see the Nike+ mobile app display if I’m only wearing my smart clothes, but don’t have something with a screen nearby? When will we get to projecting numbers and data onto the air?

I wonder how much capex and R&D expense Nike needs to spend annually to continue to develop and innovate its digital products. Given the intensified competition in this space, the hit ratio will likely decline every year, adding more pressure on Nike to maintain its leadership position in this new growing sub-sector. Also, it seems that the first-mover advantage can be taken away by new entrants relatively quickly, as the technology involved can be copied and even improved by competitors to come up with similar yet more upgraded products. It might be worthwhile for the company to strengthen its efforts to obtain patents for some of the unique features it introduces in order to maintain its advantage and prevent its rivals from taking advantage of Nike’s efforts and creativity that go into its product development.

Totally agree with your assessment about the importance of differentiation, given the relatively low barrier to entry for some of its competitors to replicate this digital effort. That being said – my entry covered IoT onfield in the NFL…strikes me as an incredible market opportunity for Nike to try and enter, edging out Zebra (the company in my piece). The technological capability probably exists in house (far faster impulse times/more sophisticated tracking sensors would be needed than for jogging apps), but it seems like Nike could uniquely profit from increased digital analytic partnering with either the NFL or other pro leagues (i.e. the advertising exposure would well exceed the value of even the substantial revenue that might be generated).

Nice article, Andy. Nike’s marketing style complements very well its push into wearables and both should drive revenue synergies and brand value. Continued engagement beyond the point of sale is something that Nike has fostered through its advertising and sponsorship schemes. Additionally, the “gamification” trend that wearables is encouraging allows users to statistically compare their performance to athletes in the professional arena, strengthening the bond between loyal customers and fans and Nike’s stable of athletes and the swoosh.

Great post! It’s interesting how Nike is using its app and digital tech to enhance its in person experiences with customers. Encouraging people to attend a group run increases the likelihood the consumer will be back into (or at least near) their core operations of the store. I wonder if Nike can further use its tech to drive in-store sales, for example, maybe they can incorporate measuring technology to be able to consumers what size of shoes or clothing to purchase.

I find it interesting that Nike is building its mobile tech in-house while its competitors are partnering with or acquiring tech outside. You mention New Balance, but Under Armour also has acquire apps like Endomondo and MyFitnessPal to quickly incorporate functionality onto its connected fitness platform. I wonder if they are as able as their competitors to add functionality given that they are doing the development in-house.

I agree that it is very difficult for Nike to differentiate themselves on a digital spectrum. I think their current approach is smart in that they leverage the size and popularity of the company by partnering with brands like apple. I think at one point the Nike fitness app came pre-installed on iPhones. It seems Nike is still doing a lot to figure this out, they recently merged their running app and their other fitness apps into one which indicates that they are constantly experimenting on this front. I think overall Nike just has to continue to rely on its name and product team to produce better apps, that are potentially compatible with only Nike wearable products like shoes, and dri-fit clothing to solidify itself in the digital arena.

Very interesting article! I believe that consumer products companies such like Nike will need to actively invest to gain a seat at the “wearables” table. However, I believe that in the coming years this will become a highly competitive market where innovation will be truncated by people’s desire to consolidate all technology into only one device. I wonder if the fitbits of the world are just a fad since most people use their smartphone for always everything nowadays. Perhaps in the future there will be no inherent advantage of using Nike bands compared to just having a couple of apps in your phone.