JD.com: Building the Smart Logistic System for the Future

How will the second largest e-commerce player in China digitalize the logistic system to thrive in the future?

It was two minutes past mid-night November 12, 2017. Richard Liu – the Founder and CEO of JD.com, the second largest e-commerce platform in China – sat back at his oversized desk in his office in Beijing, waiting anxiously for the final sales number of JD.com during Singles’ Day (an annual 24-hour buying frenzy that takes place in China on Nov.11) and its run-up.

“$19.14 billion [1], up 50 percent from a year ago!” This number, higher than the combined sales for Black Friday and Cyber Monday in the United States, brought a smile to Richard’s face, however, can JD.com’s logistic infrastructure manage such a large volume of deliveries?

Go Digital!

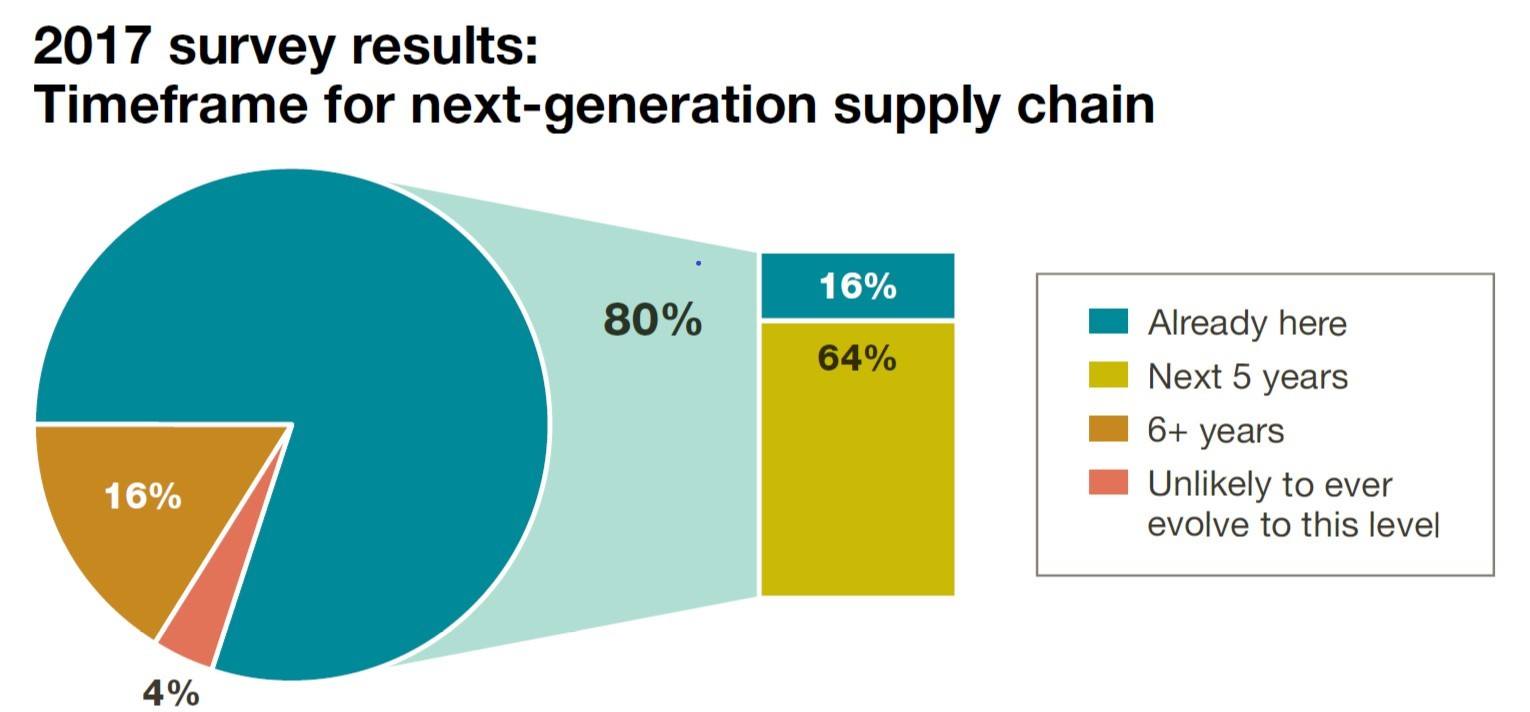

With the penetration of e-commerce, the supply chains become more complex and customers more demanding. According to MHI’s 2017 annual survey on next-generation supply chains, 80% of respondents believe that the digital supply chain will be the predominate model within the next five years – with just 16% saying it’s happening today. [2]

Source of the Picture: The 2017 MHI Annual Industry Report

Therefore, a growing number of companies, including JD.com, are turning to technologies to help them manage their supply chains more efficiently. The proof is in the numbers: the market for supply chain management (SCM) software grew by 9% in 2016, and the SCM market is expected to exceed $13 billion in total software revenue by the end of 2017, with Cloud-based applications growing by 20% [3] annually. By implementing data technology, e-commerce platforms can obtain better diagnostic information, manage internal resources that are beyond control, and reduce demand variability and cycle times.

On the hardware side, the development of internet-of-things is further enhancing the efficiency of logistics by allowing machines to “think” and then communicate with each other. For instance, the adoption of advanced robotics – featured by artificial intelligence, full automation, and machine-to-machine (“M2M”) technology [4] – in the storage and warehouse management has significantly reduced the lead time and labor cost by 10% to 20% [5]. Looking forward, people believe that the use of drones for delivery and driver-less lift trucks for distribution centers automation will together bring the supply chain efficiency to the next level.

The “Three Arrows” of JD.com

Unlike China’s other e-commerce giant Alibaba, JD.com is focused on building its own supply chain infrastructures. By the end of 2016, JD.com operated 7 fulfillment centers and 335 warehouses across the country, covering 2,691 counties and districts. By leveraging its state-of-the-art distribution centers, JD.com successfully fulfilled over 1 billion orders generated by 258 million active customer accounts [6] in 1H2017.

Source of the Picture: JD.com 1H 2017 Investors Presentation, Capital IQ, August 2017

To lower cost and improve customer service, JD.com has been consistently investing in digitalization, including the “smart” warehousing system, automated drones, and cloud-based platform.

Smart Warehouse – To boost efficiency and better cater the growing demand, JD.com has decided to push for full automation of distribution centers. As its first step, JD.com launched a flagship “smart” warehouse, which is equipped with an army of robots, in Huiyang, Guangdong province in October 2017 [7].

Automated Drones – To provide a cost-effective solution for the last-mile delivery, JD.com has pioneered in the development of automated drones, including a pilot program of building 150 operational sites for drone deliveries in Sichuan province. “Wages are going up and the R&D cost is going down,” said Bao Yan, director who manages JD.com’s logistics network. “We want to have automation throughout, from the fulfillment center to transportation and for last-mile delivery.” [8]

Cloud Computing – To compete against Alibaba, the largest cloud service provider in China, JD.com has invested heavily in cloud computing [9]. As part of its long-term strategy, by inviting third-party partners to its cloud-based platforms, JD.com can sign up for a longer menu of logistics services with better fee arrangements.

Source of the Pictures: JD.com

Source of the Pictures: JD.com

What’s Next?

The digitalization game just started. Almost all the major e-commerce players, including Amazon and Alibaba, are betting on data technology, robots, and automation. To differentiate itself from other competitors and provide high-quality services to customers, JD.com needs to focus on not only the speed but also the quality of the roll-out of its next-generation logistic network. For instance, the real-time tracking system coupled with sensors built into robots and drones would help reduce the loss and damage of goods. Also, by analyzing the data collected from warehouses and drones, JD.com will be more effective in the site selection of new distribution centers.

“JD.com will use AI, big data, and automation to redefine the potential of e-commerce logistics once again.” [10] Richard Liu expressed his ambition during a recent interview. Looking ahead, however, Richard and his team are still facing many challenges. The cloud-based platform sounds exciting, but how will JD.com share its data with business partners while maintaining the security of customers’ personal information? In addition, how could JD.com work together with regulatory authorities to come up with a set of industry standards that ensures both drone flight safety and minimal disruptions to the existing transportation system?

(Word Count: 797)

Endnotes:

[1] Matthew Miller. “China’s JD.com, Alibaba rival, reports $19.1 billion in shopping event sales.” Thomson Reuters, November 12, 2017, via Factiva, accessed November 2017.

[2] Robert Michel. “The evolution of the digital supply chain.” Logistics Management, May 2017, ABI/INFORM via ProQuest, accessed November 2017.

[3] Bridget McCrea. “6 ways big data is enhancing the global supply chain.” Logistics Management, September 2017, ABI/INFORM via ProQuest, accessed November 2017.

[4] Szozda N., 2017 “Industry 4.0 and its impact on the functioning of supply chains.” LogForum 13 (4), 401-414. http://dx.doi.org/10.17270/J.LOG.2017.4.2, ABI/INFORM via ProQuest, accessed November 2017.

[5] “Industry 4.0. How to navigate digitization of the manufacturing sector.” 2015, Report of McKinsey& Company, https://www.mckinsey.de/files/mck_industry_40_report.pdf, accessed November 2017.

[6] JD.com 1H 2017 Investors Presentation, August 2017, Capital IQ, accessed November 2017.

[7] Fan Feifei. “Robots and drones will untangle delivery network.” China Daily-Hong Kong Edition, November 8, 2017, via Factiva, accessed November 2017.

[8] Brenda Goh and Pei Li. “China’s deliverymen face robot revolution as parcel demand soars.” Thomson Reuters, November 10, 2017, via Factiva, accessed November 2017.

[9] Brian Deagon. “These 3 Top Chinese Internets Get New, Bullish Coverage.” Investor’s Business Daily, September 27, 2017, via Factiva, accessed November 2017.

[10] Catherine Shu. “JD.com creates new unit for its logistics services.” TechCrunch, Apr 25, 2017, https://techcrunch.com/2017/04/25/jd-com-creates-new-unit-for-its-logistics-services/, accessed November 2017.

Bill, great read! JD.com’s investments in warehouse robotics and in drone delivery seem like exciting, forward-thinking strategies (and they seem to be quite serious about making drones a practicable logistics method [1]), but I do wonder if JD.com is getting too far outside its e-commerce core. You might say that JD.com is just doing what Amazon has done very successfully, i.e., succeeding as a logistics company as well as a marketplace in a synergistic fashion, but I’m not convinced that e-commerce companies can also be successful, innovative tech companies. I wonder if a partnership or acquisition model to develop these capabilities might be more effective than internal R&D. To that point, you mention that Alibabi is not investing in its own supply chain in the same way – meaning, Alibaba do not own the supply chain itself – and that makes me wonder what the merits are of becoming a logistics (and tech) company versus a matching marketplace (the origin of these companies). It does appear, however, that Alibabi is getting closer to owning its own supply chain and taking more direct control of its logistics to reduce costs and improve the customer experience [2], so I could well be wrong to doubt JD.com and the company is actually ahead of Alibaba here…

[1] https://www.popsci.com/jd-com-builds-worlds-biggest-delivery-drone

[2] https://www.supplychaindive.com/news/alibaba-cainiao-supply-chain-logistics-network/505958/

Very informative read — thanks Bill! I find it interesting that while e-commerce marketplace by nature is an asset-light business model, top players are now competing on heavy capital investments in infrastructure and digitalization. The benefits of a highly automated supply chain is easy to imagine — an increase in the speed of sorting / picking / packing, coupled with a decrease in the number and types of errors historically caused by human labor. However, with these benefits also come some social cost. Specifically, what will be the fate of warehouse employees (of which Amazon alone has 125,000)? Some argue that in today’s smart warehouses, robots relieve employees of the most physical and repetitive tasks, allowing employees to work on less taxing and more fulfilling jobs [1]. But what will happen when these systems become fully automated?

Lastly, given that the competitive edge in this space is now concentrated in digitalization and automation, both of which are highly capital intensive — do you foresee further consolidation of players in the space?

[1] https://www.nytimes.com/2017/09/10/technology/amazon-robots-workers.html

Thanks Bill. It is great to learn about JD’s overall “smart supply chain” strategy in your article. Agreed with all your points – one concern I might have for JD is whether its current strategy of investing heavily in logistic infrastructure with reliance on in-house R&D capability is a better use of capital, given its increasing pressure of meeting profit targets. Instead, to some extents, JD may seek for partnership with other companies with expertise in relevant areas?