iSow and iReap – the automation and digitization of farming

The times they are a-changin’

In Interstellar, a futuristic movie, Cooper the farmer tends to driverless automated farming machines that sow, fertilize and harvest crop – all guided by GPS, sensors and drones. Take a look at videos of John Deere’s machines below. Could that future already be happening?

https://www.youtube.com/watch?v=gbQhN3QlgPA

Technology’s role in precision agriculture is becoming more significant by the day. One company leading this wave of digitizing and connecting information from the farm to the table is John Deere, a 180-year-old company known the world over for durable tractors. The company has been a leader in hardware innovation; its first product was a polished steel plow that outperformed tools of the time (see picture). However, more recently Deere’s R&D efforts have focused on software and service offerings. “Our customers continue to expect the best equipment but increasingly they want us to provide solutions (to increase productivity and operational efficiency,” says Klaus Hoehn, Deere’s VP of advanced technology and engineering. Deere has grown its analytics team so much that it predicts it will have more software engineers than mechanical engineers in the next five years.[1]

(MachineFinder.blog, Wall Street Journal)

Boys’ toys

Precision farming has a twofold role of (1) sensing inputs and (2) processing and acting on information to the extent that the farmer is comfortable to cede to a machine. The wave of digitization began in 2001 when Deere started fitting GPS sensors on their machines enabling farm managers to pinpoint location to the accuracy of a couple centimeters. This made it possible to stop machines from covering the same ground twice or missing out patches as they rolled up and down the fields, thereby reducing fuel bills (up to 40%) and improving the efficacy of chemical application.

Deere’s machines can plant individual seeds to within an accuracy of 3cm. This precision permits variable-rate seeding, meaning the density of plants grown and depth at which seeds are sown can be tailored to optimize growth conditions. Control is as simple as a touch on the iPad[2] connected via wireless technology to the machines.

Since then, more machine capabilities have been added. High-density soil sampling provide information on plot fertility and accurate contour mapping indicate how water moves around the plots. Additional detectors planted in the soil help monitor moisture levels at multiple depths and some indicate soil nutrient content and how it changes in response to the application of fertilizer.

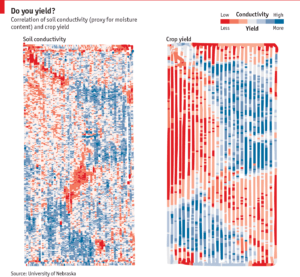

But the real tipping point happens when the crops are harvested. The rate at which grains flow into the harvester’s tank can be measured real time. Combining this with GPS data creates a yield map (see diagram) that shows which bits of land, and the micro-environmental factors and crop treatment had been most productive. This information can be gleaned and fed into the following season’s planting pattern[3].

Data received and generated by these farming machines are beamed via cellular network to the John Deere cloud and can be analyzed on the company’s cloud-based software called Operations Center or shared with other farmers, consultants or customers. Information collection also extends to the Deere machines themselves. Deere’s fleet management partnership with Verizon aims to build on machines’ connectivity to monitor and notify farmers when new parts are needed and how efficiently the machines were used[4]. Farmers can then order new parts via JDLink or contact dealers for questions.

Big Data, Big Issues

Despite AgTech’s promise to enhance agricultural productivity and become the solution to global food shortage, at least two major hurdles prevent widespread adoption. Price is still prohibitive for small farms and especially developing country farmers, where there is more room and need for yield improvement[5].

The other concerns ownership and use of vast amounts of farm data collected[6]. Farmers inherently worry their data may be used against them if shared with rivals, traders and product manufacturers. Already consolidation in the past 15 years, has granted Monsanto and DuPont a combined market share of 70% in the USA. Last year alone, farmers paid 166% of what it was in 2005 for corn seeds, estimates from Purdue University.

At this moment, Deere says it has no plans for farmers to hand over complete control to the cloud, because that is not what its customers want. Deere’s word may not be enough to convince wary farmers. If limited farmers adopt this technology, network effects render it less valuable for users and service providers. Given the relatively new space of precision farming, Deere’s foray into software and service brings it into unconventional competition with seed and chemical sellers[7]. The nature of the service also attracts new tech start-ups who are not affiliated with seed, chemical or machinery producers (e.g. Farmers Business Network). Perhaps a new type of dominant player will emerge?

(798 words)

[1] http://www.businessinsider.com/verizons-telogis-partners-with-john-deere-to-analyze-tractor-data-2016-11

[2] http://blogs.wsj.com/cio/2014/02/25/for-small-farmers-big-data-adds-modern-problems-to-ancient-ones/?cb=logged0.447291023795386

[3] http://www.wsj.com/articles/SB10001424052702304450904579369283869192124

[4] http://www.economist.com/technology-quarterly/2016-06-09/factory-fresh

[5] http://www.businessinsider.com/big-data-and-farming-2015-8

[6] http://www.economist.com/technology-quarterly/2016-06-09/factory-fresh

[7] Software-as-a-Catalyst, by Barry Jaruzelski, Volker Staack, and Aritomo Shinozaki, strategy+business – 25 October 2016

I think that it is very impressive that John Deere is driving so much innovation in the agriculture space. I know that they are a very big name in agriculture and hold a very high market share in agricultural machinery. I was wondering if you found anything about competitors responses or how digital advances are changing the landscape that John Deere operates in. Although John Deere is a major player in agricultural machinery, as this machinery comes closer and closer to robotics, it seems like they might face threats from companies that specialize in robotics, but had not previously entered the agriculture market. One example is a company called Harvest Automation, that is innovating in the greenhouse agriculture space. It seems like as the market moves towards robotics, John Deere might not hold the same competitive advantage as they have in the past.

From a high level, precision farming seems like a great use of the advancement in technology. Efficiency gains on the farm means a greater supply of food and lower food costs across the country. However, the unfortunate loser in this case is the smaller and local farmers who can’t afford the new expensive equipment, and who are going to have an even harder time competing against big AG. This seems to be another classic example of the rich getting richer, which is particularly disturbing when Dupont and Monstanto own 70% of the total market share in the US.

I found the concept about the privacy rights related to the use of the collected data to be particularly interesting. I wonder if this is a case where it would make sense for government to step in and create legislation to ensure that individual farmers’ data is protected. If not, this seems like an opportunity for john deer to aggregate the largest data set of farming data in the world, which can be used to further improve efficiency gains going forward, but could unfortunately again come at the expense of individual farmers (who can afford the equipment) whose trade secrets may become exposed.