Isolationism – Where should Samsung Go?

“Thank you, @Samsung! We would love to have you!” – President Trump on his Twitter

“I certainly support a form of tax on the boarder.” President of U.S., Donald Trump, told Reuters in 2017. As we all know, his intend is to bring the companies back to U.S. and let them hire more employees in the country to revitalize its economy. [1] Isolationism, America First trade policy has impacted Samsung’s decisions in managing its supply chains and factories all over the globe.

Source : Samsung Electronics Homepage

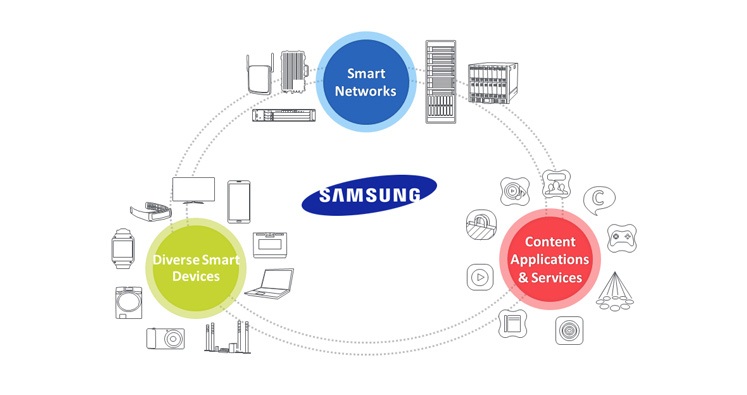

Samsung Electronics leads the global market in high-tech electronics manufacturing and digital media, covering various product lines such as smart phones, home appliances, display panels, and semiconductors. At first, when it was established, Samsung built its factories in Korea, the only market they could sell their products. However, as the sales in foreign countries increased and the labor costs of South Korea become uncompetitive, Samsung started to build its factories outside of Korea. Following the trend of globalization that lowered the barriers of international trade and foreign direct investment, Samsung has clustered its major production facilities in few countries and maximized its efficiency. As the transportation costs decreased and difficulties in procurement became manageable, this clustering strategy gave huge competitive advantage to Samsung. Now, Samsung semiconductors operates its production facilities in Korea, U.S., and China, and Samsung mobile focuses on Vietnam and China for their production bases. However, due to the global economic crisis and wide spreading isolationism, Samsung considers other variables with financial factors in choosing where, when, and how much to invest.

Source : News article in reference [2]

Several months later, Samsung responded to President Trump’s mention with an agreement with the State of South Carolina to open a home appliance manufacturing plant in Newberry County, which costs $380M. [2] However, despite of Samsung’s efforts to support America First movement in Trump administration, Samsung has faced safe guard restrictions, which were filed by Whirlpool regarding its washing machines sales in U.S. The U.S. government may impose or increase tariffs and limit Samsung’s imports to the U.S. [3] Meanwhile, public officers at Ministry of Trade, Industry and Energy of Korea visited Samsung Electronics Vietnam factory, producing more than 50% of Samsung smart phones, to examine the possibility to move the facility back to Korea to revitalize its economy. [4] It’s getting harder for Samsung to make decisions under each governments’ contradictory interests.

In the short term, Samsung is enhancing its cooperation with other entities. Korea government, Samsung, LG, and other companies such as Hyundai motors and Posco who have been struggling from US government’s request to renegotiate Free Trade Agreement, decided to make a coordinated response. On President Donald Trump’s visit to Korea in November, Korea government and major companies presented $75B investment plan in U.S. and requested affirmative actions on safe guard restrictions and FTA renegotiation. [5] In addition to this coordinated response, Samsung should effectively appeal their contributions to the U.S. economy, for example, 10,755 jobs and $16B investment in Austin factory for 20 years and leverage their future investment plans to receive tax cuts or free lands, and to mitigate the risk of higher import duties or safe guard restrictions. [6] Nevertheless, it is highly likely that Trump administration continues its America First strategy to protect their domestic industries during his tenure. And other countries would accelerate isolationism to recover their domestic economy. Therefore, Samsung should enhance their relationships with governments and monitor the changes of their policies by attending debates, council meetings, and policy consultative bodies to respond the changes properly, effectively, and timely.

Source : Samsung Sustainability report 2017

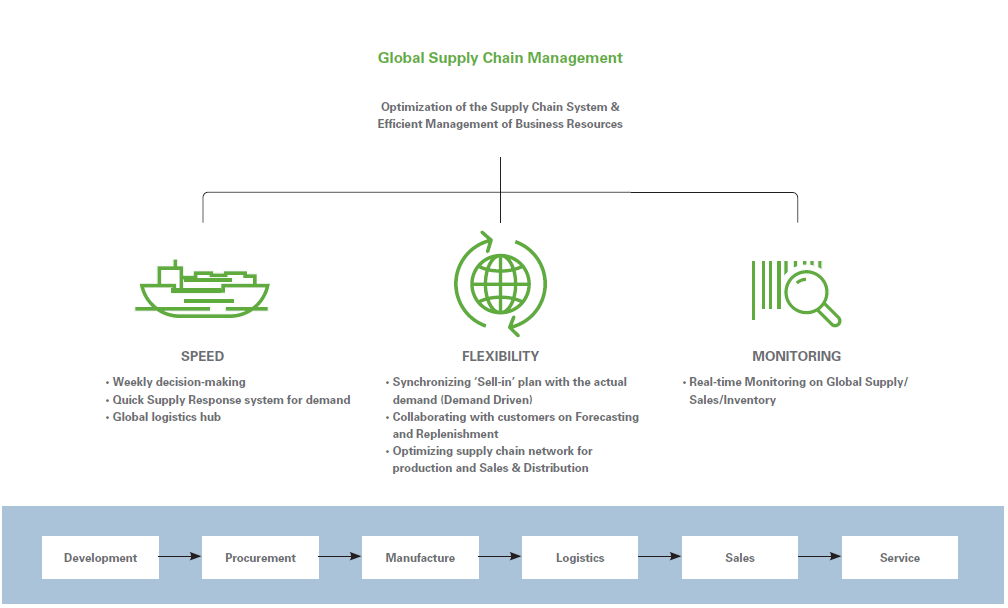

In the long term, Samsung started to move faster to retain overall supremacy. For example, Samsung announced to invest $7B more in Samsung Xian semiconductors factory in China where the President of China, Xi Jinping’s hometown, despite of the tension between Korea and China due to the North Korea’s nuclear threats and the implementation of THAAD(Terminal High Altitude Area Defense). [7] Regardless of Korea government’s concern of technology leakages and the incongruity of Xian as a place for semiconductor manufacturing (Water supply and transportation), Samsung has invested more than $17B in Xian, keeping pace with Xi Jinping’s development plan, “One belt, one road”. In addition to this, Samsung should have more flexibility in its global supply chain management to respond more flexibly to changing policies and unpredictable external factors.

Samsung would face more challenges from U.S. and other countries including its home country, South Korea. Samsung has reported record profits for several years thanks to the super cycle of semiconductors after years of chicken game among competitors and the success of Galaxy series in smartphones. The financial efficiencies of factories in Vietnam and China have been balanced out the financial inefficiencies in certain factories. But, how long would it be sustainable? Could they keep expanding their production in U.S. and South Korea while preserving their price competitiveness? How could they maximize their profits between contradictory interests of each government?

(Words : 799)

[1] Berkeley Lovelace Jr., “Samsung’s planned major investment in US production reportedly influenced by Trump election”, CNBC, Mar 8, 2017, https://www.cnbc.com/2017/03/08/samsungs-planned-major-investment-in-us-production-influenced-by-trump-election-dj-citing-sources.html

[2] BK Yoon, “Samsung to Expand U.S. Operations, Open $380 Million Home Appliance Manufacturing Plant in South Carolina”, Samsung Newsroom, June 28, 2017, https://news.samsung.com/us/samsung-south-carolina-home-appliance-manufacturing-plant-investment-newberry/

[3] Ji-hye Shin, “US safeguard likely to hurt Samsung, LG washer sales”, The Korea Herald, Oct 8, 2017, http://www.koreaherald.com/view.php?ud=20171008000240

[4] Jungmin Park, “Korea government wants Korean companies move their factories back, which is ‘Contradictory”, Munhwa, Sep 18, 2017, http://www.munhwa.com/news/view.html?no=2017091801030821087001

[5] Sanghoon Lee, “$75B investment plan for US vs safe guard restrictions”, Seouldaily, Nov 8, 2017, http://www.sedaily.com/NewsView/1ONI0S2MOG

[6] Samsung Newsroom, “Samsung Austin Semiconductor Continues Central Texas Growth with more than $1 Billion in Investment”, Nov 01, 2016, https://news.samsung.com/global/samsung-austin-semiconductor-continues-central-texas-growth-with-more-than-1-billion-in-investment

[7] Juyeop Han, “Samsung Electronics Decides to Invest $7 Billion into NAND Flash Manufacturing Facilities in Xi’an”, ETnews, Aug 8, 2017, http://english.etnews.com/20170829200003

The increased tariffs that the Trump Administration is seeking to impose on foreign goods are in action, very difficult to impose given that it is likely that end consumers will face higher prices given that goods produced in the U.S. are on average more expensive than their foreign competitors. While these regulatory changes shake up and in order to mitigate the effects, Samsung can look to relocate production from the US to lower cost areas such as my hometown of Juárez, a city along the Mexico-US border that already houses operations for players such as LG, Foxconn, HP, Dell, and others. Additionally, the company can seek to partner with or acquire players in low cost locations to house “high value” operations.

This topic is extremely interesting and a problem that will soon grow in magnitude as countries try to compete with each other. In the long term it is difficult to maintain a profitable and sustainable production when there are so many political issues for producing and selling products. Samsung should test the viability of moving production out of the U.S. and to a smaller country that requires the investment. Currently the U.S. being such a superpower, they have the upper hand in the negotiation and Samsung will find it difficult to win that conversation. Instead, if production is moved to a smaller country, the government will be supportive as Samsung is providing employment, income, investment and growth to the economy. Also, production prices will be lower so even if the U.S. levies import taxes, the price to consumer may still be approximately the same. Though keeping shipping costs in mind, it may be convenient to stay in the Americas, something like Alex’s suggestion of Mexico or their neighboring countries.

It’s a tough choice – leave the U.S. and relocate to lower cost areas, consequently accelerating the “America First” movement and facing higher tariffs OR double-down in the U.S., committing jobs (as in South Carolina & Austin) in good faith that U.S. policymakers will not impose higher import duties. Because of entrenched interests by State Governors and Senators to retain jobs in their constituency, I would advise Samsung to carefully consider where it places its next production facility, accounting not only for financial factors and the job force, but also for the relationships it can develop with key policymakers involved. In addition, Samsung can maintain goodwill by generating non-production related jobs in the U.S., such as careers in logistics, sales, and service. This may have the effect of increasing SG&A, but keeping the unit-costs the same or driving them lower (by relocating to lower cost countries).

I echo with @Edwards sentiments on the importance of developing relationships with State Governors and Senators to lobby potential import duties that could seriously impact the firms price competitiveness. Moreover, if the situation escalates further Samsung could call on international organisations, such as the World Trade Organisation (W.T.O). I recall a similar situation in 2003, were the W.T.O. ruled against steel tariffs that President George W. Bush had imposed following a comparable trade case. Ultimately the US chose to withdraw those measures rather than face retaliation from its European trading partners. Nonetheless, given the current backlog of trade disputes the W.T.O. faces reliance on this strategy could prove unreliable.

Very interesting read. In addition to the previous comments, I think that Samsung can achieve mutual benefits by having a balanced mix of high-tech and low-tech production sites in the respective countries. For instance, Samsung has several assembly sites in China for home appliances. While Samsung can leverage the low-cost labor, China has no incentive to provide the competitive advantage that helps Samsung compete with its major producer Hai’er. On the other hand, China sees Samsung as a major strategic alliance in developing its semiconductor industry (right now Chinese manufacturers are more than 2 generations behind Samsung). In its turn a well-developed semiconductor industry is key to staying competitive in the mobile phone market that is lead by Huawei in China. Carefully balancing out this relationship, Samsung should definitely be able to leverage its technological leadership to maximize its cost benefits.

Interesting post, Dylan. My suggestion would be that, caught between these geo-political crosscurrents, Samsung should not underestimate the leverage it has in dealing with these governments given the sizeable investments it makes, the jobs it creates, and the taxes it pays. While it’s important to actively monitor and try to forecast these trade issues, Samsung should (i) execute relative to its strategy (e.g., build facilities close to customers, etc.) and (ii) take advantage of the best deals it can get from various governments, as it did in China. I strongly believe and hope that such irrational trade-related rhetoric is precisely that – just rhetoric. My sense is it would be very hard to engage in some of the initiatives the Trump administration is proposing and ultimately, administrations come and go. Samsung would be well served to remember that it has been around as long as it has been because they’ve made good global business decisions rather than good global politics decisions.

Thanks Dylan for your post. It is very interesting and I actually don’t know Samsung made this ‘strategic’ move in Xi’an causing a huge amount of money. To some extent, the political legacy of this action will last longer in China vs US due to political differences in the two countries. Thus, entering US will be quite difficult given President Trump’s policies and potential policy changes by another president or party in the future. From Samsung’s perspective, its decision making needs to make economic sense, in terms of economic benefits in the future. It could be related to market entry, cost saving or technology upgrade when it eyed on global investment. Chinese companies are investing aggressively overseas as well and investments in developed countries are more prevalent right now. As Samsung has its business legacy and technology advantage, it should have enough leverage when entering into strategic talks with other nations.

Since we tend to focus on the effects of isolationism on US companies, it is very interesting to learn about the effects of US isolationism on a foreign corporation like Samsung. I believe the tension you mentioned between Samsung’s desire to support American jobs and existing safe guard restrictions will continue to exist in the current administration. Therefore given the unfriendly business environment for Samsung in the US, I wonder if it should start focusing its attention on gaining share in other markets with more favorable policies or more growth opportunities. I certainly agree Samsung should continue investing in China as you mentioned. With smartphone adoption increasing at a rapid rate in developing markets in South America and Africa, it may be beneficial for Samsung to increase its investments in those parts of the world instead of the US.

In a view of a non-US citizen perspective, I don’t like Donald Trump’s American First trade policy at all. It contradicts with everything the world is trying to promote: inclusivity, collaboration, and shared resources. However, no matter how much I dislike the policy, I have to admit that it actually works. At least it somehow successfully led Samsung to build the home appliance manufacturing plant in Newberry County.

To look from US manufacturers perspective, having all suppliers in its hometown yield a lot of benefits both in term of finance and production efficiency. US manufacturers will be able to source at lower prices, bear fewer logistics costs, and impose more control on the suppliers. Within the same country, suppliers can send raw material to manufacturers at a faster rate, decreasing lead time and providing more flexibility to the US manufacturers.

It is interesting to see the way governments are trying to force the private sector to play their game. The governments may be foregoing taxes or put diplomatic pressure to invite companies to invest in areas where they may not have a natural advantage. This may achieve the objectives of the politicians, however, it does undermine market efficiencies and limits the international economy. Instead, if each market play to its strengths, and encourages international free trade, consumers, traders and suppliers will extract more value.

The author displays how the governments of different nations pull Samsung to invest in areas that may not be optimum for it to invest in a free market. Samsung plays to its advantage in the politicized and polarized world. However, Samsung needs to be very careful to ensure that the majority of the investments it makes are conducted in efficient markets. It also needs to focus on the product mix so that it is less disrupted by regional influences to ensure that it remains sustainable in the long run.