Is ADM Ready to Feed a Warmer World?

If ADM wants to retain its position as a leader in agribusiness it will need to face climate change head-on. Climate change will exert unprecedented stress on its highly complex supply chain and the time to act is now.

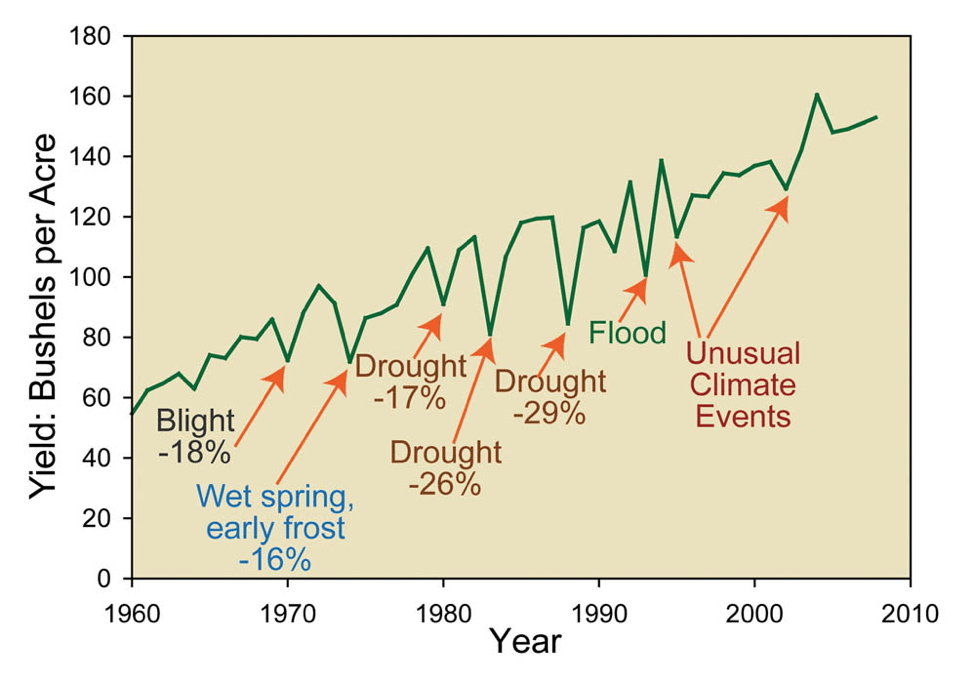

It is no mystery that the agricultural sector is extremely sensitive to climate. Whether through droughts, heat waves, or blight, there is little farmers can do to protect their crops from extreme weather events [Figure 1]. With climate change poised to exacerbate weather fluctuations, is agribusiness giant Archer-Daniels-Midland (ADM) prepared to deal with a volatile future [Figure 2]?

So how does ADM manage these risks? On one hand, it employs traders to find the best deals and by “entering into derivative and non-derivative contracts which reduce the Company’s overall short or long commodity position.”[3]. On the other hand, ADM leverages its global footprint of grain procurement, storage, and transportation assets to take advantage of momentary price fluctuations across geographies[3].

ADM has also made strategic investments, indicating how it thinks it can protect margins going forward. In 2016, it made significant investments in Harvest Innovations, a manufacturer of soy proteins, oils, and gluten-free ingredients; Amazon Flavors, a Brazilian manufacturer of natural extracts, emulsions and compounds; and Caterina Foods, a toll manufacturer of gluten-free and high-protein pastas[3]. In making these investments, ADM sees an opportunity in serving a new generation of customers seeking healthier and more nutritious food options.

Crucially however, ADM’s short-, and medium-term strategies and investments fall short of addressing the major climate change risks its supply chain faces. How will ADM deal with multi-year crop shortages caused by longer-term weather anomalies? How is ADM maximizing returns on its working capital investments in raw material inventories? How is ADM leveraging digital technologies and big data to improve its supply chain?

If ADM wants to thrive in a future marked by uncertainty, these are the kinds of questions it should be asking itself. There are three areas that ADM needs to focus on: 1) thinking about climate change adaptation vs. mitigation, 2) leveraging digital technologies, 3) and forming closer relationships with its crop suppliers.

ADM has made significant commitments to mitigate climate change. From reducing carbon emissions to making more efficient use of water, ADM has been a proponent of mitigation[3]. However, mitigating the effects of global climate change is no longer enough; climate change is happening more quickly than anticipated and organizations need to formulate concrete adaptation strategies. Here, ADM can take a page out of the US Navy’s book, who also has significant assets throughout the world; an example of a strategy that ADM can adapt from the navy is to move freshwater-intensive operations away from drought-prone areas[4]. Alternatively, ADM should invest in crops with longer shelf-lives to minimize losses due to spoilage. This will become increasingly important as long-term weather anomalies turn agricultural product exporters into importers, necessitating more movement of crops over long distances.

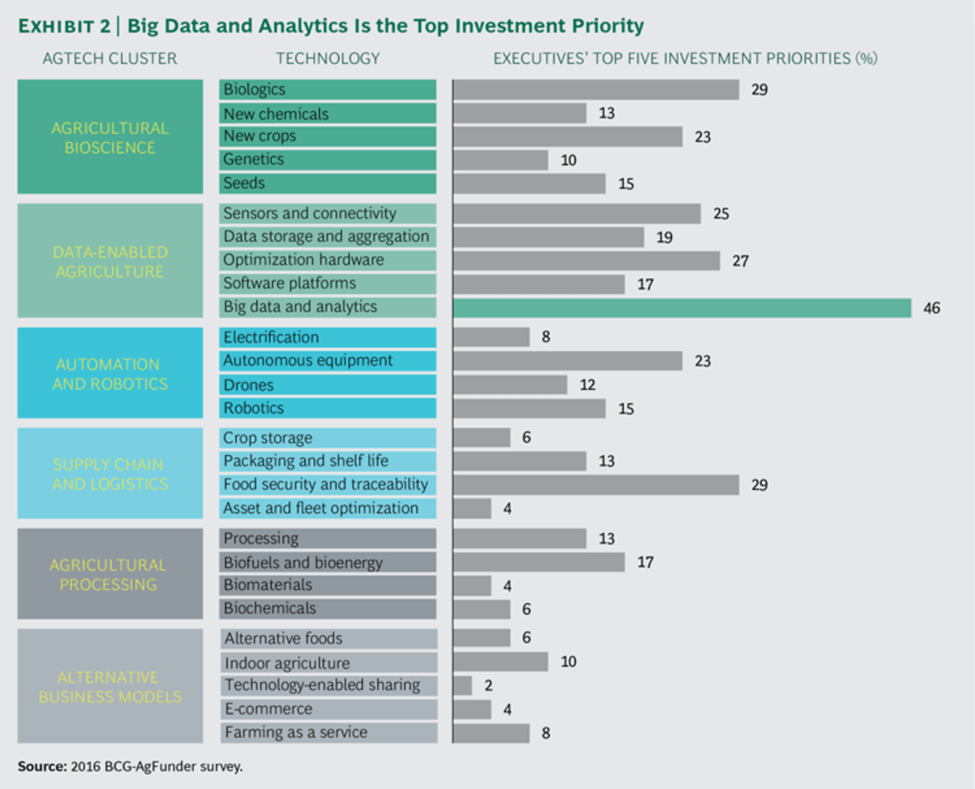

The agribusiness sector is the least digitized industry worldwide[5]. Furthermore, big data and analytics were the number one priority in terms of strategic investments across all agtech clusters [Figure 3]. ADM must match its competitors’ investments in this space to retain its edge and to gain an edge on the increased complexity cause by climate change. For instance, satellite data and advanced weather pattern analyses can help predict crop yields, helping ADM secure favorable futures contracts. Supply chain analytics is another space that has seen tremendous development.

(788 words)

[1] Climate Impacts on Agriculture and Food Supply (n.d.) Retrieved from https://19january2017snapshot.epa.gov/climate-impacts/climate-impacts-agriculture-and-food-supply_.html

[2] IPCC, 2014: Climate Change (2014): Synthesis Report. Contribution of Working Groups I, II and III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change [Core Writing Team, R.K. Pachauri and L.A. Meyer (eds.)]. IPCC, Geneva, Switzerland, 151 pp.

[3] Archer-Daniels-Midland Corporation (2016) Annual Report 2016. Retrieved from https://s3-us-west-2.amazonaws.com/adms3/Investors/Shareholder-Reports/2016/2017-Letter-To-The-Shareholders.pdf

[4] F. Reinhart and M. Toffel (2017): Managing Climate Change: Lessons from the U.S. Navy. Retrieved from: https://hbr.org/2017/07/managing-climate-change

[5] R. Leclerc (2016): Agribusiness Innovation: A Q&A with Boston Consulting Group on Surprising Survey. Retrieved from: https://www.forbes.com/sites/robleclerc/2016/11/29/agribusiness-innovation-a-qa-with-boston-consulting-group-on-surprising-survey/#32fe78de723a

[6] D. Walker and T. Kurth (2016): Lessons from the Frontlines of the Agtech Revolution. Retrieved from: https://www.bcg.com/en-us/publications/2016/process-industries-building-materials-strategy-lessons-frontlines-agtech-revolution.aspx

Title Image: D. Bash, T. Barrett, A. Silverleib (2012): No Drought Aid for Farmers, Ranchers as Congress Breaks for Summer. Retrieved from: http://www.cnn.com/2012/08/02/politics/congress-drought-aid/index.html

I enjoyed reading your essay, Oliver – thanks for sharing! I’ll add extra emphasis to the importance, in my opinion, of bolstering the relationship with suppliers. As they are the ones most at risk due to climate fluctuations, it would seem to me that ADM would want to be aware of their progress each season – and make strategic investments that are in line with maximizing crop yields. For that reason, I was surprised to see prioritization put towards health/nutrition versus sustainability or technology that can maximize yields (as we read about in the Indigo case).

This essay clarified the importance of control and overview of weather for companies that depend on agricultural production. You mentioned that the agribusiness sector is the least digitised sector in the world. Potential for increased information exchange is huge, as companies like ADM could benefit tremendously from quick information availability about the impact of extreme weather events. In this regard, the supply chain of a company like ADM should benefit greatly from integration of weather forecasts and reports with feedback from farmers and suppliers. Additionally, a large company like ADM might look into the potential of weather modification in order to help large suppliers prevent extreme weather events before they destroy crops:

http://www.sciencedirect.com/science/article/pii/S0169809516300552

Oliver, I very much enjoyed your thoughtfully written essay. I agree with your analysis, and believe you can also consider the competitive dynamics and how they shape ADM’s decision-making.

How does ADM face competitive threats in the face of volatile weather and your proposed responses to climate change? Specifically, you discuss change adaptation vs. mitigation, the use of digital technologies, and the formation of closer relationships with its crop suppliers. However, its competitors (Cargill, Wilmar, Olam, etc) are likely doing the same. Accordingly, it would be reasonable to assume that their responses to climate change would (1) drive up prices in the global commodities market while (2) making it harder for ADM to compete. To cite your U.S. Navy example, what happens when all of the global agriculture companies move toward the at-risk drought areas?

To further this point, it appears as though ADM has already been priced out of certain markets as a result of various geo-climate (among other) reasons. In 2016, ADM decided to quite its global sugar-trading activities, citing margin pressures. Somebody else must be entering that market instead (after all, we still have market demand for sugar). What are they doing differently that allows them to remain competitive while ADM exits the sugar market? The article below highlights this phenomenon:

http://www.chicagotribune.com/business/ct-adm-archer-daniels-midland-global-sugar-trading-20160719-story.html

I believe that generally, agribusiness has become more competitive as a result of global warming. ADM cannot view this problem in a vacuum – it must confront the issues in the context of its competitors and their responses as well.

Your essay addresses the pressing issue of food security in face of climate change. The problems and challenges outlined in the essay are applicable to many countries impacted by changes in weather condition.

It is interesting to note that ADM has both food crops and biodiesel under its product portfolio. There is an interesting debate on the use of biodiesel/biofuel as they compete with food crops for fertile land and water. ADM might find itself in a difficult situation where it might be forced to rationalize its product mix.

Furthermore, countries usually suspend or ban export of food crops for period of time to address internal shortages. This will have a significant impact on the global supply chain of ADM.