In the name of transparency: TransferWise says “Bye Bye Banks”

Banks hide a lot. Especially their fees to transfer money overseas. Now there's a clever new way, with nothing to hide. Digitalization has enabled online (non clandestine fee) money transfer service TransferWise.

The pain of the international money transfer

TransferWise was inspired by the personal experiences of Estonians, Taavet Hinrikus, employee number one at Skype, and financial consultant, Kristo Kaarmann.

Taavet had worked for Skype in Estonia, so was paid in euros, but lived in London. Kristo worked in London, but had a mortgage in euros back in Estonia. They devised a simple scheme. Each month the pair checked that day’s mid-market rate on Reuters to find a fair exchange rate. Kristo put pounds into Taavet’s UK bank account, and Taavet topped up his friend’s euro account with euros. Both got the currency they needed, and neither paid a cent in hidden bank charges.[i]

“There must be others like us,” the epiphany went.

And the rest is TransferWise.

TransferWise founders Kristo Kaarmann, right, and Taavet Hinrikus.1

The company, one of London’s “unicorns”, is backed by high-profile investors such as the venture capital firm Andreessen Horowitz, the billionaire Sir Richard Branson, and Peter Thiel and Max Levchin, the co-founders of PayPal[ii] — observers say it faces the same challenge of building scale that many fintech startups do. The company says it transfers more than $1 billion a month on its network.[iii]

Opportunity for the business model – clandestine banking fees

The hidden cost of money transfers exposed

Sending money abroad is deceptively expensive. Banks hide huge charges in unfair exchange rates. [iv] Here’s what it really costs to send GBP to EUR to name and shame a few.[v]

www.transferwise.com

“No fees”, “0% commission”, “one small fee” – it’s not true!

Banks often claim they charge no fees to send money abroad. In reality, they take money from customers by marking up exchange rates.[vi]

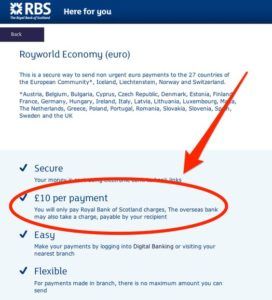

Here RBS is advertising a flat fee for international money transfers. Unfortunately for customers, sending money abroad with RBS will not end up costing £10. When breaking down their fee structure, RBS neglect to disclose that customers will lose money through their exchange rate markup.

www.rbs.com

Here, Citibank makes a strange distinction between ‘free’ and ‘fee-free’. Since banks and brokers are not obliged to be transparent and call the money they make from exchange rate markups ‘fees’, adverts like this can look accurate. They are misleading as they encourage the customer to think that transfers are actually fee-free – resulting in a nasty shock when they look at their bank statements.

https://online.citi.com

Western Union are one of the worst offenders for falsely advertising free transfers. They claim that you won’t incur any fees when you send money abroad with them. But as we have learnt, ‘fees’ don’t seem to include Western Union’s more clandestine exchange rate markup.

https://www.westernunion.com

Opportunity for operating model – a fair service fee and the real mid-market rate for conversion

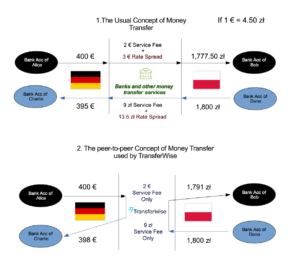

From the customer’s point of view, money transfers with TransferWise are not so different from conventional money transfers: the customer chooses a recipient and a currency, the money to be transferred is taken from his or her account, the transferring company charges for the service, and some time later, the recipient receives the payment in the chosen currency. The difference lies in how TransferWise routes the payment.[vii]

“Your” money never actually moves across a border — it’s rerouted to someone who’s being sent a similar amount by someone overseas.[viii] Your foreign recipient, meanwhile, receives their funds from someone trying to send money out of their own country.

TransferWise’s genius is that its customers never have to deal with this peer-to-peer complexity. TransferWise’s technology finds someone who wants to transfer money in the opposite direction (euros into pounds). The system automatically matches the currency flows at the real mid-market exchange rate (as you would find in newspapers or at xe.com) and then pays out from the local euro or pound account.[ix]

Regular money transfer versus peer-to-peer money transfer.[x]

TransferWise, allows you to transfer money up to 8 times cheaper than with the bank. The business product comes with no sign-up costs or monthly fees. Just a 1% fee per transaction, and 0.7% for amounts over $5,000.

www.transferwise.com [xi]

Additional Steps – from “Bye Bye Banks” to “Hello”

“Silicon Valley is coming,” JPMorgan CEO Jamie Dimon warned in his annual letter to shareholders last year. “Rest assured, we analyze all of our competitors in excruciating detail — so we can learn what they are doing and develop our own strategies accordingly”.[xii]

A partnership with a big bank would make sense for TransferWise to build the type of disruptive business it really wants to be. The big volume would give the company immediate scale, something that many fintech startups hunger for. Of course, those same banks may be uninterested in disrupting their existing business models.[xiii]

Alternatively, regional banks might be a particular sweet spot for TransferWise. Few see foreign money transfers as a profitable business line; the ones that are in the business are often doing it to serve their customers who ask for it. Small, innovative banks, the type that already have several fintech partnerships, are also a possibility as they look to build out their product offerings.[xiii]

Protesting hidden bank fees, celebrating the solution. TransferWise – money transfers with nothing to hide

TransferWise organized a guerrilla marketing campaign early last year where it led people on a run through Manhattan in their underwear “in the name of transparency.”[xiv] Just a few days ago, 100 TransferWise revolutionaries took to the streets of London with nothing to hide.[xv] Will Jamie Dimon be the only person with his clothes on? Probably.

Over 200 people hired by TransferWise stripped down to their underwear during a busy lunchtime in Manhattan and marched through Wall Street.

Words: 799

References

[i] Transferwise.com

[ii] http://www.americanbanker.com/news/bank-technology/money-transfer-startup-turns-to-banks-for-boost-1080850-1.html

[iii] http://www.businessinsider.com/fintech-transferwise-launches-business-offering-in-the-us-2016-10

[iv] https://transferwise.com/gb/blog/sir-richard-branson-joins-our-mission-to-stamp-out-hidden-fees

[v] All data was obtained independently by market research company TNS. The fieldwork was carried out between July-September 2015 and shows the overall quoted costs of sending £1,000 internationally through UK banks via online transactions.

[vi] https://uk.pinterest.com/transferwise/exposed-the-hidden-cost-of-foreign-exchange/

[vii] https://boostcompanies.com/fintech/

[viii] http://www.transferguides.com/transferwise-review/

[ix] http://www.telegraph.co.uk/money/transferwise/how-does-it-work-and-is-it-safe/

[x] https://en.wikipedia.org/wiki/TransferWise#/media/File:TransferWise_peer-to-peer_money_transfer.png

[xi] https://transferwise.com/pricing#?from=USD&to=GBP

[xii] http://www.businessinsider.com/jamie-dimon-shareholder-letter-and-silicon-valley-2015-4

[xiii] http://www.americanbanker.com/news/bank-technology/money-transfer-startup-turns-to-banks-for-boost-1080850-1.html

[xiv] http://www.techworld.com/news/startups/transferwise-leads-naked-march-on-wall-street-3599853/

[xv] https://transferwise.com/gb/blog/last-week-we-got-naked-in-the-city-of-london-heres-the-video

Cordelia, this is a great example of how digitization is revolutionizing the flow of remittances and human migration across countries. As the world is becoming increasingly globalized, it is my perspective that the ease of international remittance through start-ups like TransferWise are not only enabling migrants to send money home, but also fueling the total amount of money being sent across borders. Prior to digitization and the emergence of digital players, consumers were forced to use Western Union or MoneyGram, which charge consumers exorbitant fees (ranging from 8% to as high as 20% in certain corridors) to send money home to loved ones in developing countries [1]. By charging a 1% fee per transaction, TransferWise is producing tremendous social value by spurring economic development in recipient areas, while also creating very healthy profit margins for itself. Its a model for how the era of digitization-led companies is having an enormous positive impact in the world in which we live in. The question remains, how will TransferWise differentiate its business model from players like Xoom (acquired by PayPal) and Remitly who are aggressively capturing market share? Do you think it will have to adapt its business and operating model to compete as more competitors enter the space?

[1] Dilip Ratha. “Understanding the Importance of Remittances.” http://www.migrationpolicy.org/article/understanding-importance-remittances, accessed November 2016.

I also love TransferWise!

I think your point about bank partnerships is really interesting. We see this all the time in the FinTech space – FinTechs started out as enemies and existential threats, and now they are – if not friends – then at least taken a little less seriously by the banks. I can see that a partnership would make sense here, because the key thing banks hold which these startups don’t to the same extent is customers, and more specifically customer data. If TransferWise wants to increase penetration (which they probably do, especially given Pallavi’s point above about aggressive competitors), or if they want to introduce spin-off products, then these customers and their data make banks a really valuable partnership prospect. The issue is: is that really smart? Is it really viable? From a ‘smart’ perspective: a large-scale, public bank partnership makes the customer promise for TransferWise seem a bit sketchy. Their entire value prop is set up antithetical to banks. From a viability perspective – are we talking about one partnership? If so, how to choose? If not, are we talking about this technology being in place in all banks? If that happens, are TransferWise really value-add at all, or could the banks not all develop a uniform system (like they’ve done with regular transfers)? To me, TransferWise are potentially stuck between a rock and a hard place here. But I am rooting for them!

Fascinating post, Cordelia!

Effectively, TransferWise is building a marketplace model of currency transactions, and removing the middleman such as banks or money transfer agents. Since they do not actually transfer the currency, their cost reduces. Also, not maintaining an inventory of currencies would minimise their hedging costs, which is another reason why banks and agents charge a significant markup.

One question which arises is how they will deal with the ticket sizes, i.e. will they have set packages for transfer (e.g. $100, $500, $1000, etc.) or will any denomination be allowed? In the latter case, how will they marry demand and supply?

As an international living abroad from my ‘home’ country, I definitely understand and have benefited from the value proposition that TransferWise provides!

Alongside the points that others have made above (to Siddarth’s point, matching demand with supply; to Lizzie’s point how to approach partnerships with the ‘big’ banks), I also think they face a couple of further challenges in their business model:

1. How do they protect themselves against the risk of facilitating ‘bad’ transfers across borders such as money laundering? As a user of TransferWise myself, the only safeguard I see is them asking ‘what is this transfer for?’ which to me seems to be a relatively low barrier for someone transferring money with ulterior motives. Do they have the capabilities/plan in place to acquire these to protect themselves from a scenario that could result in irreversible bad PR for the company?

2. As a start-up looking to grow to scale rapidly, how can TransferWise continue to convince new customers that it is a reliable and secure method of transferring money? Although it appears to have captured the attention of the price-sensitive millennial generation, how can it tap into the deeper pockets of the older generations who are becoming increasingly tech savvy, but still suspicious on non-traditional businesses. Will a partnership with a formal banking institution help with this?

Amazing post. The business model seems great but I can see a couple of risks.

a) it assumes that the supply and demand for any given currency match on the long term. If there is actually an imbalance in the short term, how does the company hedge for that risk? Does it acquire currency the same way as banks do? In that case, does the company’s margin suffer and is that sustainable?

b) Also, what are the barriers to entry? The technology part seems advanced but also quite easy to copy. I can imagine that as any marketplace where supply and demand need to be matched, growing both sides of the marketplace is challenging but once it’s done it can create an important barrier to entry.

Great post Cordelia! I wish I had known of this service before moving to the US since I had to make numerous JPY-USD transfers.

TransferWise is really creating value for the customer, by tapping into this space where traditional establishments have been treating their customers unfairly for far too long.

Looking ahead, I like your idea of partnering with a big bank. By getting access to the sheer volume of FX trade orders that these banks accumulate from their corporate clients, it provides liquidity and reduces the risk of a supply and demand mismatch in the long term, as JM mentions.

It is going to be exciting to see how they navigate their way ahead – however they end up, I hope this puts pressure on the banks to come up with a system that better serves its customers in overseas wire transfers.