How technology benefits Zenefits

The digitalization of human resources

Zenefits, an online insurance broker and general HR platform provider that was launched in 2013 with the goal of harnessing technology to become a comprehensive HR partner for employers. Beyond their nice front-end platform design, Zenefits is reimagining what it means to be an insurance broker through the use of digital technology.

what is an insurance broker and why do I need one

Broadly speaking, the value of the insurance broker is to help clients (either individuals or corporations) select and implement insurance policies. Essentially, an insurance broker serves as a third party intermediary between the insurance company and the end consumer.

consumer calls broker ⇒ broker gets quotes from insurers & presents to consumer ⇒ consumer buys insurance ⇒ broker processes paperwork

The broker’s value to the consumer: The broker uses knowledge of the industry and leverages partnerships with insurance companies to get you the coverage you need, taking advantage of key discounts you may not have uncovered on your own. They do all the work! You just sign the line and you’re all set up, and if you have any questions about coverage going forward you can just call them up and ask.

How the broker gets paid: The broker likely works with a handful of preferred insurers, and may even have a quota of business to cede to a provider in order to be paid their commission. The broker will get paid by the insurer based on the business it brings to them. [1] Traditional brokerage firms rely on personal contacts (that means in-person / phone conversations) with benefits managers. The more customer relationships, the more insurance companies want to work with them, and vice versa. When asked about Zenefit’s digital-based value proposition, one traditionally employed insurance broker suggested that “Zenefits will never have the personal relationships with employers that is the key to success in the industry.” [2]

the role of technology

Instead of full out rejecting the role of relationships in building partnerships with employers, Zenefits has leveraged and built out digital solutions that enhance each aspect of their business model.

Client acquisition / service: Operationally speaking, insurance brokerage firms must be licensed on a state-by-state basis to sell policies to residents. For traditional brokerage firms, this means having to physically move teams of insurance brokers (often highly skilled, specialized hires) to where the business is. By taking this whole model online, Zenefits turned that process on its head. Zenefits is licensed in all states, but doesn’t need to pay agents to travel to maintain customer relationships – they do it all through their comprehensive digital platform! [2][5]

Client acquisition / service: Operationally speaking, insurance brokerage firms must be licensed on a state-by-state basis to sell policies to residents. For traditional brokerage firms, this means having to physically move teams of insurance brokers (often highly skilled, specialized hires) to where the business is. By taking this whole model online, Zenefits turned that process on its head. Zenefits is licensed in all states, but doesn’t need to pay agents to travel to maintain customer relationships – they do it all through their comprehensive digital platform! [2][5]

Helping choose the policy: through Zenefits’ platform, employers (and in turn, their employees) can compare policy options side by side and access a variety of resources from the all-inclusive portal. Zenefits answers the questions, takes their information, and sources the policies through their software – meaning no paperwork for the employer to fill out and process.

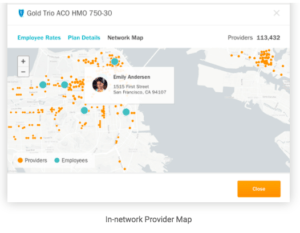

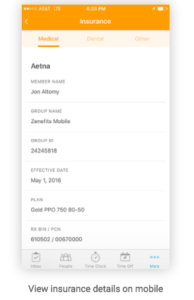

Customizable apps for desktop and mobile: Zenefits manages all of a company’s insurance needs like a traditional broker would, but they do it online. They also have built out a user-friendly tool that helps employers track and manage their policies. With apps like an in-network provider map, Zenefit can help employers choose health insurers that offer coverage where their employees can access it.

There are many additional features built into the Zenefits package, each accompanied by a user-friendly digital platform to manage the logistics of employee HR processes like insurance. Have they thought of everything?

some ideas going forward

- According to IBIS, the percentage of services conducted online is expected to increase from 8.4% in 2011 to 10.0% in 2016. [3] With insurance companies building out their own user-friendly platforms, the broker is at risk of being disintermediated. To address this, Zenefits can establish additional benefits beyond just sourcing policies for employers. Perhaps they could develop a tool that can perform a comprehensive risk analysis (from an HR perspective) for a company.

- As the insurance industry continues to evolve, Zenefits could use its accumulated data to help insurers develop more relevant products for their target consumers.

word count: 686

[1] https://techcrunch.com/2016/05/02/insurance-brokerage-is-broken/

[3] Hoffman, Evan. March 2016. IBISWorld Industry Report: Online Insurance Brokers in the US.

<http://clients1.ibisworld.com.ezp-prod1.hul.harvard.edu/reports/us/industry/default.aspx?entid=4768>

[4] Hoffman, Evan. August 2016. IBISWorld Industry Report: Insurance Brokers and Agencies in the US.

[5] Company website; www.zenefits.com

Christie, great post! I really liked how you frame the technology solution not as a substitute for personal relationships, but rather an enhancer of existing human transactions. Second, I found very interesting your proposal of potentially developing a tool that can perform a comprehensive risk analysis for a company. Given all the data that Zenefits is and can accumulate, this tool’s accuracy can improve over time, and potentially create some network effects. My question for you is: will it be possible to create another avenue of revenue by partnering with insurance companies to understand how they can serve their clients better? or by providing to these same insurance companies market research?

I really enjoyed learning how Zenefit’s has used digital technology in its business and operating model. It’s pretty amazing how complex the health insurance market is. Many SMBs simply don’t have the time or resources to become experts in this space. Zenefits offers them a great solution, and I agree with you that they have already thought about many of the ways they can help. That said, one of the big concerns that I have with their business is around quality control standards. The company has been in the news over the past year for their office culture, especially with regards to their “sell-sell-sell” mentality and cutting corners to get things done. This has landed Zenefits in the hot seat because many of their insurance policies were sold by unlicensed brokers. Going forward, the company needs to build in an incentive system to ensure quality standards are maintained. Also, they could do a better job of using technology to track customer/employee interactions. This could help the company track whether an appropriately licensed broker is engaging with potential customers.

Source: http://www.bloomberg.com/features/2016-zenefits/