How blockchain technology is transforming the traditional financial services operating model

The distributed ledger technology behind bitcoin is now disrupting traditional asset transfer.

For context, what are DLTs?

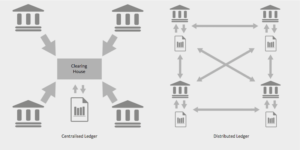

I spent this last summer at The White House researching the potential impact of new and innovative financial technologies. During my time, some of the most interesting innovations I came across were distributed ledger technologies (DLTs). DLTs are generally databases of information, usually assets that are shared across a network of nodes.[1] As opposed to a centralized ledger – which requires the storage of assets in a “clearing house” (a central and secure database) – a distributed ledger allows the owners of the assets to control their assets directly through a network in which copies of the same ledger are stored locally at each node.[2]

So, why should we care about the blockchain?

Because DLTs present an opportunity to disrupt the traditional movement of assets processed by financial institutions. One such DLT is called the blockchain (the name coming from the fact that each block of assets is added to a transparent and permanent chain of transactions that keeps accumulating). You may have heard of the blockchain because it was the underlying platform for the transfer of the first successful digital currency – bitcoin. Fundamentally, the blockchain represents a different way to transact anything – data or assets – that disintermediate the clearing house and provide an ownership and transfer experience that potentially provide more control, security, access, and speed. In financial services, this means it’s possible that blockchain technology could force banks to change the way they have stored and transferred principals’ assets.

How a blockchain company is helping financial services institutions move to the new way…

One blockchain company – Chain – has been working over the last two years to develop and introduce to the marketplace a specific blockchain platform called the Chain Core.[3] Chain Core is “enterprise software that enables institutions to issue and transfer financial assets on permissioned blockchain networks”.[4] Chain serves customers in the financial institutions space from payment processors like Visa to banking institutions like Citigroup and yet others in between.[5] To help these customers realize the benefits of their proprietary technology, Chain partners with them to develop bespoke blockchain networks that have a varied set of protocols, controls, and network operations.[6]

Chain serves as an example of how blockchain technology can help financial institutions operate in a new way. In the old operating model, payment processors and banks use a system of intermediaries to store and transfer value. This means investing in the security of these clearing houses, ensuring high levels of trust between parties involved in the transactions, and taking extra time to verify transactions (especially large ones) even after they have been preliminarily processed. The new operating model begins to change this. Because there are no clearing houses, security investments can be reduced to the cryptographic keys and the network itself, a system of protocols can be developed so that trusted external parties are not needed, and the speed of transactions can increase due to quick verification by the network itself as opposed to a stage-gate.

Next steps for Chain

Of course, Chain must focus on developing its technology, gaining a strong client-base, and delivering on its product’s customer promise. However, Chain has numerous lateral opportunities to help large players in spaces outside of financial services transform the way they deliver value. Below are some high-potential financial and non-financial use cases Chain could pursue next that would maintain its enterprise focus and strong development capability.

- Financial use cases

- Escrow service – Digital assets are created, stored, and managed by a custodian or set of custodians.

- Trading platforms – Individual and institutional players can execute trades on a decentralized platform with protocols that allow for smart execution of contracts and faster trades.

- Peer-to-peer value transfer – The network serves as a system of payments through which enterprise and individual nodes can pay each other.

- Non-financial use cases

- Marketplace for sale of assets – A network protocol allows for secure and fast execution of sales of assets with clear ownership rights and transfers.

- Records management – Records systems are no longer stored and owned by single parties with decentralized but private networks of records for use cases such as healthcare records.

- Election voting – A semi-private network allows citizens to vote in elections through creation of fixed voting “assets” that can be transferred within a given time frame.

(Word Count: 720)

[1] https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/492972/gs-16-1-distributed-ledger-technology.pdf

[2] https://ripple.com/insights/santander-distributed-ledger-tech-could-save-banks-20-billion-a-year/

[3] https://chain.com/faq/

[4] Id.

[5] Id.

[6] Id.

Great post, Bhargav. I’m also fascinated by blockchain technologies. One thing that worries me here is the nascent regulatory environment, which presents the following risks: 1) inconsistent regulations across borders (and even states), 2) adoption risks given regulatory uncertainty and 3) development risks. Have there been any frameworks proposed to-date?

Interesting post, Bhargav! I can definitely see the benefit of the dis-centralized secure framework has on financial institutions. I am curious to see what are the types of financial assets that can be transferred through Chain Core blockchain network. My rudimentary understanding of blockchain is that it is the framework that is specific to bitcoin management and transaction. If this technology is broaden to the other asset classes, its impact is going to be significant.

Awesome post, Bhargav! I really appreciate the simple explanation of DLT’s and the financial and non-financial uses. Two questions that popped up is that 1) what are the main challenges for mass consumer adoption? and 2) would this require businesses to adopt this technology first or is it driven by customer demand and which businesses would be the first to adopt?

Thanks, Bhargav! Thought-provoking post. As I read the post, I kept wondering whether this is a winner take all market? Currently, there are many early stage companies, but given the need for the financial system to be inter-operable and comply with government regulations, will a single digital currency emerge?

Great post, Bhargav. Block chain technologies can clearly do a lot to increase transparency and speed in financial transactions. Do they pose any unique security challenges that the industry is weighing against these benefits?

Great Article. We’ve seen some controversies erupt in companies spearheading the use of block-chain tech in financial services e.g. Mt. Gox. Curious to know if there are any similar or related vulnerabilities which may exist for the Chain Core?

Great post! Blockchain has been another overused buzzword used among tech enthusiasm, but not many people actually knew what it was. Thanks to your post I now have better understanding of the topic.

My main concern about blockchain is about security risks to assets and information. How would a blockchain system vulnerabilities compare to the system that our financial institutions are currently using? If there are new operational security risks, which parts of the system will be responsible for security failures?

Bhargav, thanks for walking through the various steps and complexities involved in the process.

I buy into the ideals laid out—namely being able to layer, indefinitely, onto what effectively becomes partially public data to ensure data continuity and transparency. I can’t help but wonder, however, if there is a way to achieve nearly the same result but in a more controlled manner (i.e., keeping some form of centralization)?

When considering this, I appreciate that the “clearing house”/equivalent component becomes a de facto bottleneck, but would be concerned about removing all government/“officially sanctioned” layers from the process entirely, particularly once the field moves into the reach of healthcare records and voting. Curious to see the degree to which governments may share this view.