H&M and digitization of supply chain trends – will the [fashion] show go on?

H&M, the second largest fast fashion retailer in the world is facing challenges as consumers expect fashion to be increasingly fast-paced, affordable and personalized. The emergence of new fast fashion retailers such as ASOS and Boohoo coupled with the constant threat from its main rival Inditex has made H&M’s dual supply chain approach increasingly obsolete. How should H&M re-position its supply chain to stay competitive in the era of digitization?

H&M and digitization of supply chain trends – will the [fashion] show go on?

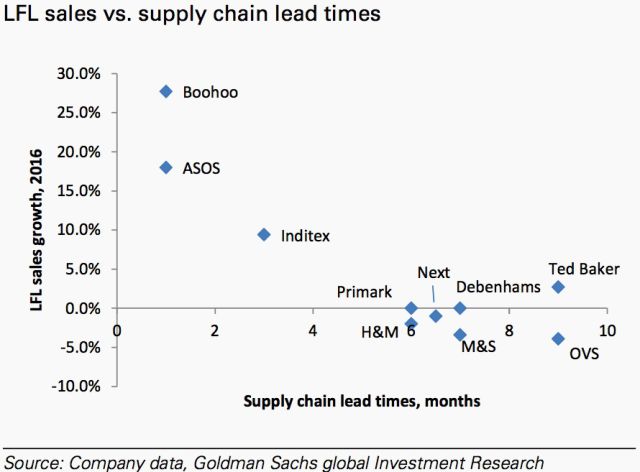

H&M, the second largest fast fashion retailer in the world is facing challenges as consumers expect fashion to be increasingly fast-paced, affordable and personalized. The emergence of new fast fashion retailers such as ASOS and Boohoo coupled with the constant threat from its main rival Inditex has made H&M’s dual supply chain approach increasingly obsolete. H&M sources basic clothes collections from Asia (accounting for ~80% of its sourcing) and the more trendy collections from factories mainly in Europe [1]. The heavy reliance on Asian production makes its supply chain lead-time 100% longer than that of its main competitor’s; Inditex [2]. Historically, the advantage of this model has been lower prices compared to its main competitors while the challenges have been a lower trend sensibility and capability to adapt the supply chain to variabilities such as weather shifts.

In the age of rapid digital transformation three of H&M’s main competitive advantages within its supply chain operations diminish in value. First, the automation in the manufacturing processes of apparel evaporates H&M’s historical cost advantage as automation makes production cheaper and labor cost a smaller fraction of the total production cost – making its offshoring strategy less advantageous [3]. Although the apparel industry has been slower to adopt production automation than for instance the automobile industry several promising start-ups leveraging robotics and 3D-printing technology show that full automation is within reach [4]. Secondly, its ability to match supply and demand by employing skilled in-house designers and buyers whose work is to predict and capitalize on trends will decrease in value as predicative analytics will play this role in the future. Thirdly, H&M’s know-how in distribution to a global network of stores will be less relevant as consumers increasingly seek to shop online.

To address these issues the company’s CEO has predicted that advanced data analytics and AI technology will change how H&M currently predicts trends, forecasts inventory and communicates with customers [5]. H&M has indeed taken steps to digitize its supply chain by large investments in IT and system integration across its supply chain [6]. As H&M doesn’t own any of its factories, the automation efforts haven’t been focused on production but rather taken the form of investments in automation of logistics and digitizing its inventory management. More specifically, H&M has invested in warehouse automation, metadata analysis and wants to introduce RFID technology tagging of its cloths in 2018 to better match supply and demand, hence avoiding shortages and oversupply leading to unwanted mark-downs and margin erosion [7]. In order to shorten lead-time in its core market: Europe over the next years, the company has also announced that it will likely increase local production [7].

As for the adaptation of its distribution model to better accommodate for online demand, H&M has expanded its online store offering (as of July 2017 providing online sales in 41 of its 68 markets) and plans to continue online expansion [6]. It also aims to integrate its online and offline distribution by expanding in-store pick-up/returns of online orders and mobile services such as Image Search – enabling customers to take pictures of clothes they like to match them with similar clothes offered by H&M through image-recognition technology [8].

Although these efforts are relevant, H&M seems to be slowed down by historical competitive advantages. For instance, instead of making incremental changes to inventory management and relying on its designers to predict customer demand it should acknowledge the benefits of radically changing its approach to customer demand forecasting. In essence, the company should adopt predictive analytics as a central part of its design process and make sure to integrate the technology across its supply chain. There are already competitors leveraging AI and predicting algorithms to produce and deliver fashion apparel within ~10 days from indicated customer interest. By using own data but also acquiring data from search engines and social media these companies are predicting what customers want even before the customer has placed an order [9]. If H&M wants to stay relevant in the fast-fashion industry it has to adopt to this way of predicting demand.

In the medium-term perspective, H&M should embrace the opportunities within manufacturing automation in the apparel industry by investing in its own factories and build up this capability or partnering with factories that are innovative enough to leverage the technology. As mentioned above, robotics that manufacture complete garments already exist and will increasingly make offshore manufacturing less cost-advantageous. This will allow the company to move closer to its core markets and hence decrease its supply chain’s lead-time.

Although some of the suggested measures will help H&M stay relevant an important remaining question is; what will be H&M’s future competitive advantage in this new setting? Furthermore, what are the strategic partnerships and acquisitions that H&M can make to boost the process of supply chain digitization?

Word count: 799

[1] Verbergt, Matthias. H&M Earnings Fail to Weather Heatwave (2016, Sep 30). Wall Street Journal. Retrieved from https://www.wsj.com/articles/h-m-earnings-fail-to-weather-heat-stronger-dollar-1475221801

[2] Felson, Sajonas. H&M and Zara Are Not The “Fastest” Retailers in Fast Fashion (2017, Apr 6). Hypebeast. Retrieved from https://hypebeast.com/2017/4/hm-zara-not-fastest-fast-fashion-retailers

[3] Schrauf, S and P. Berttram. Industry 4.0: How Digitization Makes the Supply Chain More Efficient, Agile, and Customer Focused (2016). PWC Strategy&

[4] Rina, Raphael. Is This Sewing Robot The Future Of Fashion? (2017, Jan 24). Fastcompany. Retrieved from https://www.fastcompany.com/3067149/is-this-sewing-robot-the-future-of-fashion

[5] Carlsson, Sven. H&M:s vd: Så kommer digitaliseringen att påverka oss (2016, Oct 17). Dagens industri. Retrieved from https://digital.di.se/artikel/hms-vd-sa-kommer-digitaliseringen-att-paverka-oss

[6] H&M 6 month report (2017, Jun 29). Retrieved from https://about.hm.com/en/media/news/financial-reports/2017/6/2602314.html

[7] Ringstrom, Anna. H&M invests in supply chain as fashion rivalry intensifies (2017, Mar 30). Reuters. Retrieved from https://www.reuters.com/article/us-h-m-results/hm-invests-in-supply-chain-as-fashion-rivalry-intensifies-idUSKBN1710PM

[8] H&M News Article in Press Room (2017, Oct 26). http://about.hm.com/en/media/news/general-2017/h-m-adds-image-recognition-in-more-markets.html

[9] Laws, Nancy. This New Industry Disrupt Fast Fashion? (2016, March 2). Huffingtonpost. Retrived from https://www.huffingtonpost.com/nancy-laws/can-this-new-industry-dis_b_9362344.html

It is interesting to see that the terms “fast fashion” and “low price” are often mixed up in the case of H&M where they are not really a fast fashion player with such a large share of their production in Asia. It seems that H&M has built their company and operations around what the world looked like twenty years ago. They were very successful in building that business and have been able to sustain good financials even though the world has gradually changed over time. Now, it seems that they have suddenly woken up to several different challenges at the same time and are acting in a reactive way as it is pointed out and they are losing some of their key competitive advantages. Would it rather make sense for H&M to take a step back to have a holistic view on how they should best operate in this new world?

I would like to emphasize your point on leveraging existing stores to provide a better client service (e.g. in-store pick-up/returns of online orders) as this is a trend that is becoming more and more dominant in the ecommerce space. Many companies are implementing online-to-offline (o2o) strategies, which are designed to bring online customers to brick and mortar stores. These strategies use online marketing and advertising methods to identify customers, create awareness of products and services, and ultimately entice the customer to visit a physical store to make a purchase.

Whereas pure online play used to be the way to go to scale aggressively at a low cost, ecommerce companies have now realized that they also need to develop an offline presence in order to provide top service quality to their customers that are more and more demanding and picky. As a result, Amazon have recently expanded its retail footprint with the acquisition of Wholefoods and is also expanding its Amazon Books library stores.

I think H&M could implement certain services that competition has adopted. For example, clothing company Bonobos offers 1-on-1 meeting with a guide who advises the client on style and places the order [1]. Obviously given its scale and positioning, H&M can’t provide that to every single client but it could do this for a few customers and create some buzz. The goal here is to provide a differentiated experience due to the deep engagement and interaction with the client. I believe that by providing new mobile services such as Image Search, H&M is heading in the right direction and is currently focused on making shopping at H&M stores more enjoyable and distinctive.

1. http://www.thinkwrap.com/blog/online-to-offline-what-we-can-learn-from-innovative-companies-china

I was struck by H&M’s placement in your first figure, indicating that their delivery time is actually longer than many other companies with whom they compete. We often refer to H&M as the example of “fast fashion,” but it’s clear that their production in Asia means they are not quite fast enough. I do think that H&M’s real customer promise is not necessarily about fast fashion, but more about fashionable clothing at an affordable price. Their investment in Image Search seems to be a perfect link to their value proposition. This technology will allow consumers to find a style they like, but then locate a more affordable alternative through H&M. This is still valuable even as design potentially becomes more ‘commoditized’ as it is based on predictive analytics more than in-house designers. I think the trend towards predictive design actually helps H&M, as it increases the likelihood that H&M has an alternative to a more expensive product.

You also indicate that the cost differential will come down over time, as apparel production costs are allocated more to technology than to human labor. While that is true, the true production costs are the only drivers of apparel pricing. I think that luxury and higher-end brands actually create customer experiences and price points that exude status. I think a pricing differential will always remain between H&M and high end brands for this reason. Those who do not want to pay the higher price points can find what they like in a luxury store, use the Image Search technology, and then purchase a similar style more affordably.

In the end, I think that H&M can actually preserve, if not enhance, it’s place in the fashion market by remaining the affordable option with style. The industry trends you outline are real, but it appears that H&M is committing to its customer promise and I expect they will continue to thrive.