Harvard Corporation’s Ethical and Financial Dilemma- Fossil Fuel Divestment

While other academic institutions like Yale and Stanford have begun divesting in fossil fuels in the face of increased pressures, Harvard has increased its investments. Is that the right decision?

“Those students have done a remarkable job in garnering overwhelming student support for divestment, and the faculty too have delivered a strong message. But so far [Harvard] has not just refused to divest, they’ve doubled down by announcing the decision to buy stock in some of the dirtiest energy companies on the planet.” – Open letter to Harvard University from 36 notable alumni including Natalie Portman, Darren Aronofsky, Susan Faludi, Robert F Kennedy Jr.1

The State of Fossil Fuel Divestment

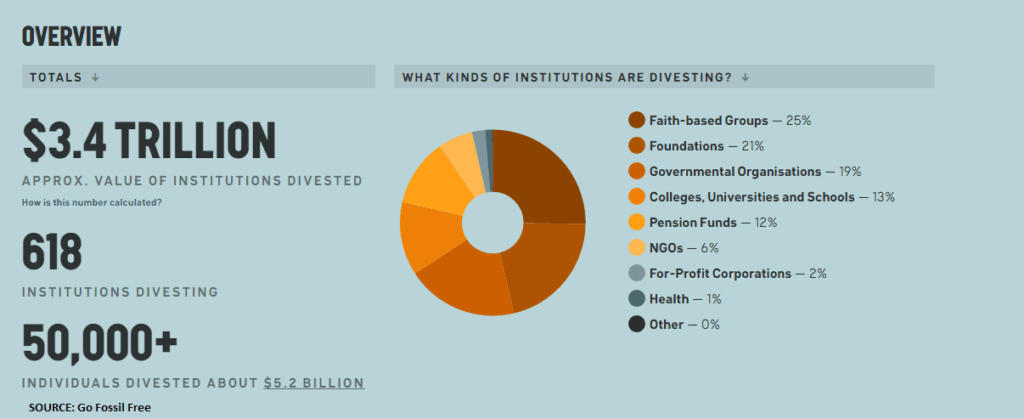

Among the investment community, growing demand exists for divestment in fossil fuels. In 2015, it was the fastest growing divestment movement ever reported2. By November 2016, 618 institutions valued at $3.4 trillion and more than 50,000 individuals had divested in fossil fuels3, with 13% of divestment coming from Universities, Colleges and Schools.

However, action by prominent academic institutions has been slow4: among those with endowments greater than $1 billion, only Stanford, Yale and the University of California system have begun fossil-fuels divestments5,6,7 after community pressures. In contrast, in the face of similar pressures, Harvard University has increased its fossil-fuels investments in the last several years8. This position has been taken despite student referendums, open letters from faculty members and celebrity alumni, activist lawsuits, and multiple campus protests.

However, action by prominent academic institutions has been slow4: among those with endowments greater than $1 billion, only Stanford, Yale and the University of California system have begun fossil-fuels divestments5,6,7 after community pressures. In contrast, in the face of similar pressures, Harvard University has increased its fossil-fuels investments in the last several years8. This position has been taken despite student referendums, open letters from faculty members and celebrity alumni, activist lawsuits, and multiple campus protests.

Harvard’s Challenge

For the Harvard Management Company, the question of fossil-fuels divestment is complex. There is a question of what it means to divest in fossil fuels – does such mean divesting in any company that significantly pollutes? Any company that directly profits off environmental destruction? Any hedge fund that does not openly commit to activist investing?

Another challenge that arises is the financial and ethical impacts of such investment restrictions – How financially important are fossil-fuel portfolios? Does divestment have a meaningful industry impact? How does it impact Harvard’s image? What ethical value may exist? These questions have been hotly debated among the community, with certain key positions that have formed.

Industry Debate

A principle methodology for divesting in fossil fuels originated from the University of Toronto in direct response to internationally agreed climate goals set by the 2015 Paris Agreement. The university argued for “targeted and principled divestment from companies in the fossil-fuels industry that meet certain criteria…[including companies] that blatantly disregard the international effort to limit the rise in average global temperatures to not more than 1.5 degrees Celsius above pre-industrial averages by 2050.”9

Using these metrics, various positions from the investment community have been taken. From a financial standpoint, some investors have argued that fossil-fuels investment, independent of moral implications, is unwise. Financial policy experts with HSBC and the Bank of England10 have submitted that valuations of fossil-fuel industries are over-inflated due to lack of correction for stranded fossil-fuel assets that are unusable due to their environmental costs, creating a “Carbon Bubble”. A recent study11 also cautioned that stigmatization caused by divestment movements increases volatility and “uncertainty surrounding the future cash flows of fossil-fuel companies.” Indeed, one analysis from an investment firm that offers fossil fuel-free funds12 assessed that Harvard’s coal, oil and gas stocks lost $21 million between 2012-2015 when the Divest Harvard movement began.

Using these metrics, various positions from the investment community have been taken. From a financial standpoint, some investors have argued that fossil-fuels investment, independent of moral implications, is unwise. Financial policy experts with HSBC and the Bank of England10 have submitted that valuations of fossil-fuel industries are over-inflated due to lack of correction for stranded fossil-fuel assets that are unusable due to their environmental costs, creating a “Carbon Bubble”. A recent study11 also cautioned that stigmatization caused by divestment movements increases volatility and “uncertainty surrounding the future cash flows of fossil-fuel companies.” Indeed, one analysis from an investment firm that offers fossil fuel-free funds12 assessed that Harvard’s coal, oil and gas stocks lost $21 million between 2012-2015 when the Divest Harvard movement began.

Others have taken opposing viewpoints. A study funded by the petroleum industry13 calculated that Harvard would lose $108 million each year it divested from fossil fuels, arguing that divestment hurts an institution’s ability to diversify its portfolio. Supporting that position, a study by the former Dean of the University of Chicago Law School14 calculated that the average portfolio would forego 0.5% in annual returns by ruling out oil, gas and coal companies. Even still, some asset managers have calculated that the economic risks of divestment from fossil fuel companies are “statistically irrelevant”15.

Ultimately, regardless of financial impact, a common opinion held by the community including Harvard President Drew Faust has been that the question of moral transgression is moot because “divestment is likely to have negligible financial impact on the affected companies”.16

The Divestment Decision

Taken together, this discourse has led Harvard Corporation to ignore calls for divestment. But I submit a key long-term risk factor Harvard has miscalculated in its investment decision is the impact on its brand. Beyond following the morally appropriate action, Harvard’s reputation will come in serious question if it does not divest.

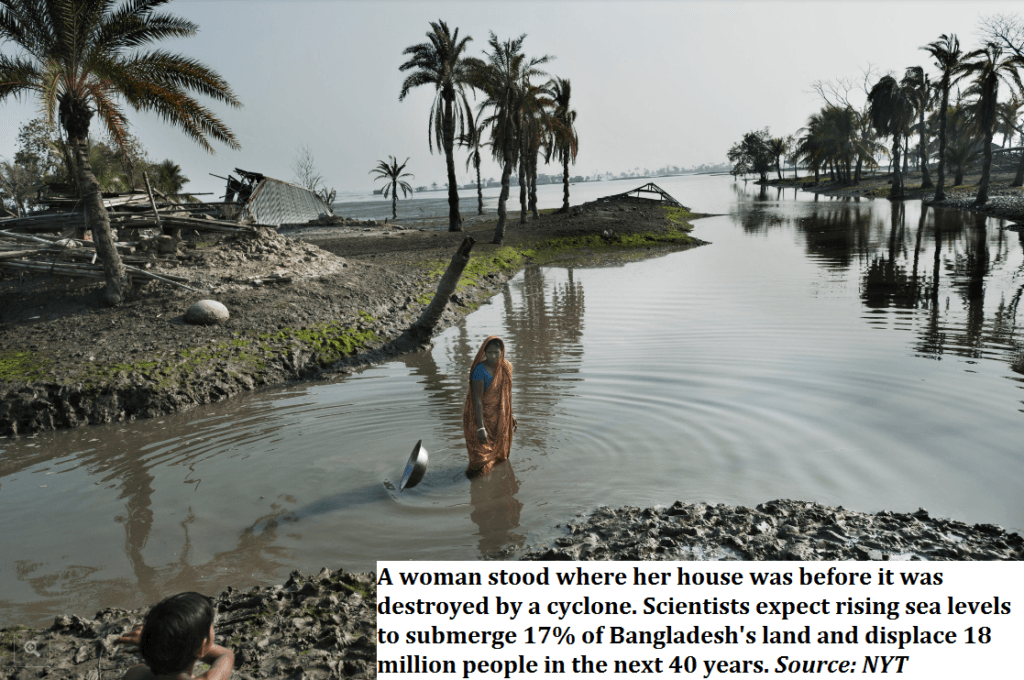

The question of fossil-fuels divestment transcends debates of immediate financial impacts on investors or fossil-fuel companies. Fossil-fuels investment is a question of profit off an industry with enormous unethical externalities—externalities that those privileged with elite educations and loudspeakers have a duty to lead the world away from, not be complicit in. The challenge is that the ethical dilemma fossil fuels pose can be lost through deceptive degrees of separation. But ultimately, the most vulnerable pay profound direct, though delayed, costs of climate change. As a NYT report on Bangladesh revealed17, this issue has directly led to disappearing farmlands and economic conditions where mothers have been selling their children into servitude to ensure they do not starve. The more we invest in companies that have an edge on cheap, dirty and unregulated operations, the more they invest in ways to grow their business model. Like was the case with slavery, there is a direct moral duty to not be a part of that if even in small, “negligible” ways. But unlike slavery, the costs of such myopathy may be too great to reverse. (798 words)

1.) “Open Letter to Harvard Community.” Letter. 2015. <http://harvardheatweek.org/letter/>.

2.) Vaughan, Adam. “Fossil Fuel Divestment: A Brief History.” The Guardian. Guardian News and Media, 08 Oct. 2014. Web. 03 Nov. 2016. <https://www.theguardian.com/environment/2014/oct/08/fossil-fuel-divestment-a-brief-history>.

3.) “Commitments.” Go Fossil Free. Web. 2016 <http://gofossilfree.org/commitments/>.

4.) Elizabeth Douglass, Phil McKenna, Sabrina Shankman, David Hasemyer, Elizabeth Douglass, Katherine Bagley, Zahra Hirji, Leslie Kaufman, Lisa Song Nicholas Kusnetz, Bob Berwyn and Zahra Hirji. “Map: Tracking Academia’s Fossil Fuel Divestment.” Map: Tracking Academia’s Fossil Fuel Divestment. <https://insideclimatenews.org/news/20032015/map-tracking-academias-fossil-fuel-divestment>.

5.) Wines, Michael. “Stanford to Purge $18 Billion Endowment of Coal Stock.” The New York Times. N.p., 6 May 2014. <http://www.nytimes.com/2014/05/07/education/stanford-to-purge-18-billion-endowment-of-coal-stock.html>.

6.) Fabrikant, Geraldine. “Yale Advances in Shaping Portfolio to Address Climate Change.” The New York Times., 12 Apr. 2016. Web. <http://www.nytimes.com/2016/04/13/business/energy-environment/yale-advances-in-shaping-portfolio-to-address-climate-change.html>.

7.) Gordon, Larry. “UC Sells off $200 Million in Coal and Oil Sands Investments.” Los Angeles Times. Los Angeles Times, 9 Sept. 2015<http://www.latimes.com/local/education/la-me-ln-uc-coal-20150909-story.html>.

8.) Goldenberg, Suzanne. “Harvard Defies Divestment Campaigners and Invests Tens of Millions of Dollars in Fossil Fuels.” The Guardian. Guardian News and Media, 14 Jan. 2015. <https://www.theguardian.com/environment/2015/jan/14/harvard-invests-tens-millions-dollars-fossil-fuels-face-divestment-campaign>.

9.) Bryan Karney, Peter Burns, Graham Coulter, Andrew Green, Matt Hoffmann, Arthur Hosios, Mohan Matthen, Carl Mitchell, Rita O’Brien, Barbara Sherwood Lollar. Report of the President’s Advisory Committee on Divestment from Fossil Fuels. University of Toronto 2015

10.) Harvey, Fiona. “‘Carbon Bubble’ Poses Serious Threat to UK Economy, MPs Warn.” The Guardian. Guardian News and Media, 06 Mar. 2014. <https://www.theguardian.com/environment/2014/mar/06/carbon-bubble-threat-uk-economy-fossil-fuels-mps>.

11.) Atif Ansar, Ben Caldecott and James Tilbury, “Stranded assets and the fossil fuel divestment campaign: what does divestment mean for the valuation of fossil fuel assets?”, University of Oxford, 11 March 2015.

12.) “Harvard’s Investment in Fossil Fuels: Neither Warranted nor Wise | Trillium Asset Management.” Trillium Asset Management. 30 Apr. 2015. <http://www.trilliuminvest.com/harvards-investment-in-fossil-fuels-neither-warranted-nor-wise/>.

13.) Cornell, Bradford. “The Divestment Penalty: Estimating the Costs of Fossil Fuel Divestment to Select University Endowments.” SSRN Electronic Journal SSRN Journal 2015

14.) Fischel, Daniel R. Fossil Fuel Divestment: A Costly and Ineffective Investment Strategy. Rep. 2015.

15.) Geddes, Patrick. “Do the Investment Math: Building a Carbon-Free Portfolio.” AperioGroup. 2013. Web. <https://web.archive.org/web/20130203053752/http://www.aperiogroup.com/system/files/documents/building_a_carbon_free_portfolio.pdf>.

16.) Faust, Drew. “Fossil Fuel Divestment Statement.” Office of the President, Harvard University. October 3, 2013. <http://www.harvard.edu/president/news/2013/fossil-fuel-divestment-statement>.

17.) Harris, Gardiner. “Borrowed Time on Disappearing Land.” The New York Times. 28 Mar. 2014. <http://www.nytimes.com/2014/03/29/world/asia/facing-rising-seas-bangladesh-confronts-the-consequences-of-climate-change.html?smid=pl-share+Source:+Go+Fossil+Free>.

Sharif, thank you for your fascinating and thorough post on the divestment decisions faced by university endowments. I agree with your points that prominent universities such as Harvard enjoy a high degree of visibility, which implies an obligation to prioritize ethical decisions and set moral standards for managers of smaller portfolios. I acknowledge that there is a degree of hypocrisy involved when research institutions like Harvard, which are tasked with making a positive difference in the world, are financing operations that have negative long-term environmental implications.

However, I ultimately disagree with your conclusion that Harvard must divest, in keeping with its morals and reputation. Harvard University does not have an official mission statement, but the mission of Harvard College is “to educate the citizens and citizen-leaders for our society.” I believe that the success—and consequently the brand—of Harvard should depend on how well it achieves this educational goal.

You acknowledged in your write-up that Harvard Management Corporation faces a trade-off between optimal investment returns and the sustainability of its investments. That is, if Harvard divests its “unsustainable” assets, it will be implicitly accepting lower returns for the university’s endowment, ultimately impairing its ability to execute its mission “to educate citizens… for our society.” To use an extreme example, what if HMC’s decision to divest fossil fuels took scholarships away from underpriviledged high school students? Are you willing to deprive those students of an Ivy League education?

As an outside observer, I would be vastly more appalled if Harvard became a bastion for wealthy undergraduates, dropping support for less financially secure applicants, all in the name of a “negligible financial impact on the [unsustainable] companies.”

Finally, I think you may be underestimating the human resources required to completely eliminate unsustainable investments from HMC’s portfolio. I have a close friend who has worked in university endowments for many years, and he has been tasked with compiling a list of the universities’ “unsustainable” or “sensitive” investments across the entire portfolios. This work is very difficult! It comprises collecting data on several sub-portfolios held by hedge funds, mutual funds, private equity portfolios, etc., many of which may be unwilling or unable to share a high level of granularity. Adding a labor-intensive task to the investment process may further strain HMC’s investment team, exacerbating the potential for sub-optimal returns that limit the University’s ability to further its educational mission.

I agree with Elizabeth, and I might even take the argument a step further: Harvard actively should continue to invest in fossil fuels. There are pragmatic reasons for this, and there are ethical reasons for this.

Pragmatically, and she points out, it’s hard to figure out how to divest. What exactly is fossil fuel investment? Maybe it’s easy to say that Harvard shouldn’t invest in companies like ExxonMobil, but what about car companies that are developing, but haven’t fully developed, green technologies? What about commercial builders that only target LEED Silver certification as opposed to LEED Gold? What about Uber? The definition of divestment is dubious as best.

You may recall the childhood adage: “if you give a mouse a cookie, he’s going to want a glass of milk.” If you’re going to divest from fossil fuels, disgruntled alumni could and would certainly ask for more. What about tobacco? Alcohol? Companies whose executes support policies or politicians you disagree with? The Harvard Corporation and Harvard Management Company have an obligation to remain apolitical and above the fray, as their job is to maximize returns for the benefit of the University, not to assuage the alumni. The Harvard Alumni Association is tasked to do that.

Futhermore, the Harvard endowment isn’t just a Schwab account with $35 billion in assets lying around. Harvard owns land, invests money through hedge fund managers, and operates 1000s of different subsidiary companies and LLCs [1]. Even if you could determine what divestment means — and again, you can’t — that information isn’t readily accessible, and sometimes isn’t accessible at all.

But even beyond that, there is an ethical argument to be made for not divesting. During apartheid in South Africa, universities and non-profit endowments globally divested from the country. Those actions were well-intended stance in the fight against an injustice far worse than fossil fuels. The problem, however, is that money talks. As long as people had money in the country, South Africa’s government was ultimately accountable to outside investors, and while their actions were reprehensible, they were still accountable to those outside parties who had the ability to put their foot down every now and again.

As more and more parties divested from South Africa, there was less oversight, and the government and specific companies started behaving more erratically becuase they weren’t accountable to these outside third parties.

Fossil fuels aren’t great. But if Harvard is a shareholder, they’re in a better position to effect change, because it’s easier to change the world from the inside than from the out.

—————

[1] http://www.guidestar.org/FinDocuments/2015/042/103/2015-042103580-0cc53892-9.pdf

I really appreciate the opposing views shared above. They provide a great counterbalance to my submission, but I think on many of the points made, we do not disagree. I had originally discussed several of the points above, but I had to cut them out due to word limits.

As brought up a couple times, a very significant challenge in confronting divestment is the question of what exactly divestment means. This is not a question taken lightly by involved parties and there are several academic papers that have offered perspectives on this challenge, including raising the points EBS makes. A great methodology I have referenced is the Toronto Principle. But nevertheless, I do not think it’s fair to completely oppose divestment on the grounds that the question of how divestment should be executed is challenging. I would argue that those challenges warrant a discussion on what is pragmatic in divestment, but not whether divestment should be done.

The morals at hand are tricky and complicated. But I propose the following thought experiment to anyone thinking about the morals of this issue. Imagine we were in early 19th century America and Harvard was investing in industries profiting off the slave trade. Let’s say Harvard invested in everything from cotton plantations labored by slaves to clothing manufacturers depending on slave-picked cotton to holding slave equity to everything in between. Similar challenges arise in that situation: which investments are actually unethical, if any? How feasible or even possible is it to collect data on sub-portfolios and subsidiaries to see if Harvard’s money is investing in the company that’s using exclusively non-slave labor or conversely has a strategy of growing and selling slaves like cattle? If Harvard and similar institutions openly invested in the slave industry throughout the 19th century, would that have made any difference in the geopolitical climate surrounding slavery, when it was ultimately abolished, and how its roots seeped into American culture for many years to follow?

I would challenge anyone to think about fossil-fuels divestment from a similar perspective because the actual fundamental impact of the two industries on human lives is very similar. The degrees of separation between the moral issues neuters the emotional outrage we may otherwise instinctively weigh-in. It’s the classic trolley problem of ethics: if a trolley is about to kill five people on a track, we are more likely to pull a lever that kills one person and saves the five people than we are to push a person in front of the trolley to save the five people. Whatever viewpoint held, I simply caution others to correct for those inclinations. The true costs of climate change is otherwise very easy to rationalize away since a few degrees in temperature here or there can otherwise seem innocuous and the noise of the world’s turmoil can hide its direct impacts.

Sharif, your reply is a great framework for thinking about climate change’s impact. Many of these endowments already do have certain ethical boundaries set into their investment strategies. For example, Yale’s Advisory Committee on Investor Responsibility (http://acir.yale.edu/) established guidelines that still drive Yale’s investment strategy today. Yale’s proxy voting is expected to support companies’ initiatives to reduce social injury (as long as they do not cause material competitive disadvantages), which in many cases could go against the best return on investment that company could achieve. Once we accept that there are attractive, legal, unethical investments in which Yale already chooses not to invest, we are really just deciding where to draw the line. Framing climate change as a social issue on a scale we have likely never seen in history could lead us to think about it more on the bad side of that line.

Pointing to a mission statement as a way to absolve institutions of ethical improprieties is not the best standard to set. Mission statements can’t be myopic goals. It is a great point that the large friction costs related to divestment could actually impair Harvard’s mission statement, but there are also plenty of unethical and legal learning opportunities the university actively shies away from. Stanford’s infamous Zimbardo prison experiment, or Yale’s infamous Milgram experiment, were tremendous learning opportunities, so why shouldn’t Harvard continue that work? Framing climate change as a more serious social issue could mean the incremental value generated may not be worth furthering the mission statement.

However, I ultimately believe that a well-established company (such as major oil and coal companies) will generate similar cash flows regardless of its investors, implying that its value is unchanged if Harvard invests or not. The end result of Harvard giving up these opportunities is not just that it will lose out on the incremental returns, but that an individual or institution with lower ethical standards will get those returns instead, shifting economic resources toward the exact type of people who will be more likely to use that extra money for less-ethical purposes. As a result, I somewhat agree that divestment has the potential to do more harm than good.

I actually can’t argue with this logic. I think you fundamentally changed my position Michael. I really have to scratch my head on this.

I find this to be a truly interesting discussion. Thank you for taking the time to put it together. While others have taken a hard stance defending the need, or benefit, of investing in fossil fuels, I find it more interesting to initiate the debate. Given portfolio optimization theory and the needs of diversification, I find it hard to argue a benefit to NOT investing in fossil fuel based securities. However, to your point, there is a definitive way in which one can invest in those who have made an effort to proactively fight for climate change through actions that fit within the best interest of their shareholders. I look at Exxon as an interesting example. While their impact on global C02 emissions is clearly massive, they have made substantial investments in sustainable energy. One can argue that the R&D in sustainable energy from companies like Exxon may be the most impactful in the long run given the size of their balance sheets coupled with the academic resources held in house.

Nobody will doubt the need for companies like Exxon. We all rely on transportation fueled by such companies. At what point does actively arguing against such companies become hypocritical given the general populations’ support of such companies? While people may be opposed to the companies themselves, the goods with which they interact on a daily basis have all touched oil within some respect. Does that mean we should not use our iPhones or not take the bus to school?

Thank you for the thought provoking blog.

Thanks Sam! Those are some great points. Yeah, I think you bring up how challenging it is to think about the ethics of divestment and what its end goals are. I would, however, challenge the notion that ExxonMobil’s R&D initiatives will truly be gauged toward sustainable energy since that’d be undercutting their own business. They’d invest inasmuch as sustainable energy or environmental initiatives are in line with their bottom line, and the vast majority of the time they are diametrically in conflict (like the valdez oil spill, their promotion of climate change denial despite knowing better, etc) – https://en.wikipedia.org/wiki/ExxonMobil_climate_change_controversy.

Thanks Sharif for this interesting post!

I totally agree with you that a wealthy and powerful institution like Harvard should play a major role in sustainable investment allocation, to support industries and sectors which have a positive impact on the economy and the environment, and on the contrary avoid investing in sectors with demonstrated negative impact.

However, aggressively and immediately divest from fossil fuel would be in my opinion a mistake. First, as noted in the comments above, all fossil fuel companies are not evil, and some of them are necessary to the economy. Second, it’s not enough to divest from a sector: you must make sure that substitutes to this sector already exist. For example, we can’t stop all activities in fossil fuels as long as convincing, efficient and sustainable other energy resources have not been found.

This is why although I’m convinced that on the longer term, Harvard should consider divest from fossil fuels, it should not give in to current pressure, and should divest progressively from selected areas of fossil fuel, while looking to other but still profitable substitute areas like renewable energies.