For Elon Musk and Tesla, the Future is All About Timing

Tesla faces an operational challenge as ominous as the climate change it hopes to curtail. Will this influential electric car company innovate away from it's looming financial issues or be stomped out by big-auto?

Climate change is happening – the facts are undeniable. However, what isn’t so certain is how quickly governments and private markets are going to do anything about it. In this game, finding success is all about the timing.

Let’s back up. Currently, energy is pretty cheap with oil at ~$45/bbl.[1] However, given the recent democratic administration, the U.S. has already started to pass legislation regulating CO2 emissions. In 2015, the U.S. enacted the Clean Power Plan (CPP), which primarily imposes higher taxes on states relying on non-sustainable energy sources.[2] The CPP and carbon credit incentive plans are starting to make sustainable solutions look much more attractive to companies across the country. While some feel that regulation will do little to change energy demand,[3] many companies have responded by creating sustainability programs or exploring other carbon reduction techniques to get ahead of the changing landscape. However, some companies are way ahead – companies like Tesla.

Tesla’s business and operational model are dependent on this trend, and they are betting that the world is about to change in a big way. Tesla currently designs, manufactures, and sells electric cars, solar panel roof shingles, and the Powerwall – an advanced battery pack designed for home and commercial use.[4] It may seem as if Tesla is perfectly positioned for the upcoming wave of new sustainable energy demand. There’s only one big problem – cash.

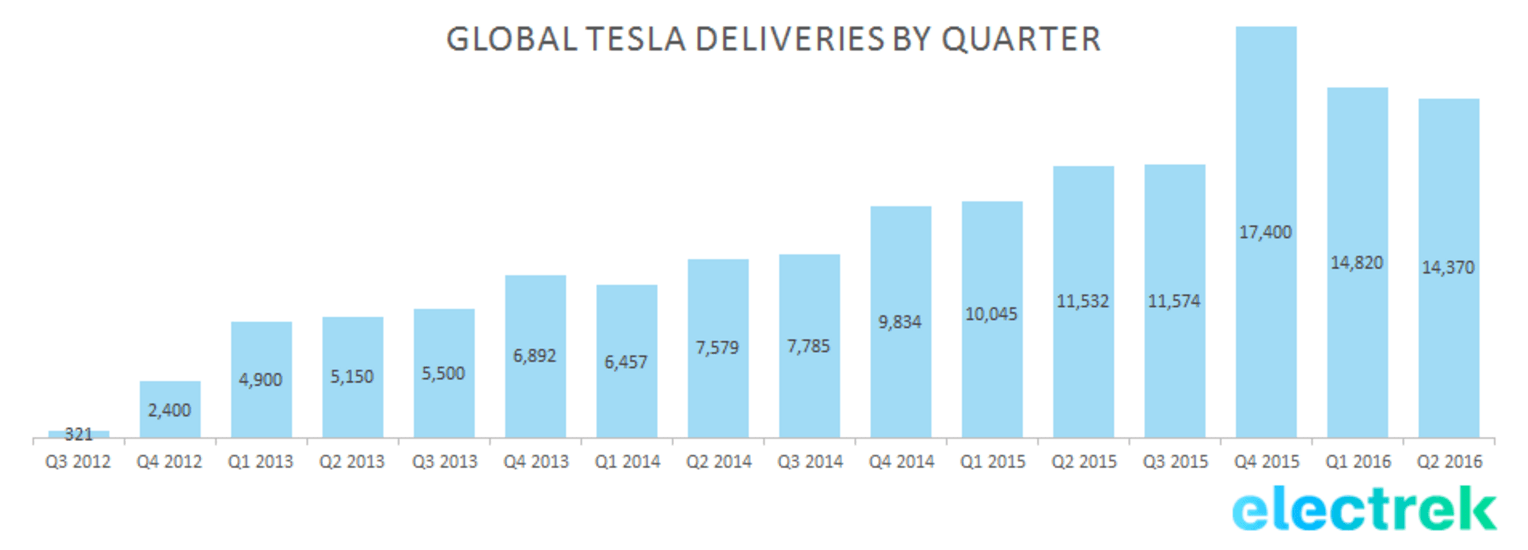

Tesla has been plagued with cash issues since its inception, and has yet to turn a consistent profit, ending 2015 $717M in the red.[5] In Q3 2016, it looked as if they had taken a turn into positive free cash flow territory, but under closer inspection it seemed as if the cash flow was only due to an extension in payables, and Tesla is still “the same capital hungry business it’s always been.”[6] Many of these operational issues manifest themselves in the company’s consistent production backlog. In Q2 2016, the company failed to their predicted numbers of 17,000 cars shipped, coming in at only 14,370: [7]

Even given these issues, Tesla has already made great progress in altering its operating model to find profitability. In 2013, one analyst praised Tesla for acknowledging their production challenges and taking appropriate steps to increase production rates by 25%.[8] More recently in 2016, Tesla has fully embraced operational innovation. Currently producing all of its cars in America, Tesla is challenging a decades old assumption that U.S. based manufacturing can’t be cost effective. To achieve this, they are embracing true vertical integration. Current plans are to build a “supplier park built in the immediate vicinity with a focus on large, heavy parts with extensive variations.”[9] Taking the strategy a step further, Tesla is amid construction of a large battery factory in nearby Nevada, the Gigafactory, which will be able to build batteries for up to 500,000 cars annually once fully operational.[10]

Even given these issues, Tesla has already made great progress in altering its operating model to find profitability. In 2013, one analyst praised Tesla for acknowledging their production challenges and taking appropriate steps to increase production rates by 25%.[8] More recently in 2016, Tesla has fully embraced operational innovation. Currently producing all of its cars in America, Tesla is challenging a decades old assumption that U.S. based manufacturing can’t be cost effective. To achieve this, they are embracing true vertical integration. Current plans are to build a “supplier park built in the immediate vicinity with a focus on large, heavy parts with extensive variations.”[9] Taking the strategy a step further, Tesla is amid construction of a large battery factory in nearby Nevada, the Gigafactory, which will be able to build batteries for up to 500,000 cars annually once fully operational.[10]

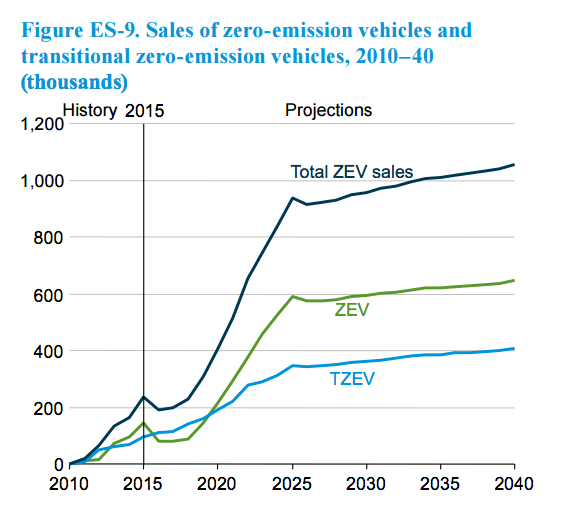

Things brings us to Tesla’s core issue – timing. Tesla’s operational efficiencies through vertical integration rely primarily on economies of scale to be successful. The 2016 EIA Annual Energy Outlook forecasts a substantial rise in electric vehicle demand through 2040: [11]

On the surface, it seems that Tesla is scaling appropriately given forecasts, but what if there are any production delays, as Tesla has been plagued with in the past? How could timing errors affect the prospects of the business? I see two potential outcomes, both with inherent challenges:

Case 1: Tesla ramps up production and demand is lower than expected.

Challenge: Sales are too low to recover large fixed costs. Not enough demand to negotiate low prices with suppliers.

Case 2: Tesla ramps up production and demand is higher than expected.

Challenge: Opportunity for well financed competitors to enter and steal market share.

As onerous as this challenge may seem for Tesla, there does seem to be hope for the future. Timing plays a huge role in this puzzle, as production deviating from the forecasted demand in either direction could spell disaster for the company. However, there are a couple strategies I see that Tesla can employ to give it the highest chances of success.

First, Tesla could double down on vertical integration, attempting to lower costs enough to achieve profitability at small production volumes. This way, even if they can’t achieve scale, at least they will be profitable. Second, they could explore partnerships with other large automobile manufactures to find cost savings until demand rises. Additionally, the partnership could ease the economic pressure on company given that some type of financial deal is struck.

While it may seem that Tesla is perfectly positioned to capitalize on climate change, the behemoth that is the auto-industry will not fall lightly. Let’s just say, I’m sure Elon Musk is spending an inordinate amount of time perfecting his demand forecasts and mastering timing – his company depends on it.

(796 words)

[1] Bloomberg.com. 2016. Energy – Bloomberg. [ONLINE] Available at: https://www.bloomberg.com/energy. [Accessed 03 November 2016].

[2] U.S. Energy Information Administration. 2016. Annual Energy Outlook 2016 with Projections to 2040. [ONLINE] Available at: http://www.eia.gov/forecasts/aeo/pdf/0383(2016).pdf. [Accessed 03 November 2016].

[3] Neanda Salvaterra. 2016. Saudi Minister Says Oil Demand Unaffected by Efforts to Curb Climate Change — Energy Journal – MoneyBeat – WSJ . [ONLINE] Available at: http://blogs.wsj.com/moneybeat/2016/11/02/saudi-minister-says-oil-demand-unaffected-by-efforts-to-curb-climate-change-energy-journal/. [Accessed 03 November 2016].

[4] Tesla | Premium Electric Sedans and SUVs. 2016. Tesla | Premium Electric Sedans and SUVs. [ONLINE] Available at: http://www.tesla.com. [Accessed 03 November 2016].

[5] Tesla. 2015. Tesla Fourth Quarter & Full Year 2015 Update. [ONLINE] Available at: http://files.shareholder.com/downloads/ABEA-4CW8X0/1814099442x0x874449/945B9CF5-86DA-4C35-B03C-4892824F058D/Q4_15_Tesla_Update_Letter.pdf. [Accessed 03 November 2016].

[6] Seeking Alpha. 2016. Is Tesla Actually Cash Flow Positive? – Tesla Motors (NASDAQ:TSLA) | Seeking Alpha. [ONLINE] Available at: http://seekingalpha.com/article/4016421-tesla-actually-cash-flow-positive. [Accessed 03 November 2016].

[7] Electrek. 2016. Tesla (TSLA) missed on deliveries in Q2 with 14,370 vehicles and production of 18,345 vehicles | Electrek . [ONLINE] Available at: https://electrek.co/2016/07/03/tesla-tsla-missed-on-deliveries-in-q2-with-14370-vehicles-beats-production-with-18345-vehicles/. [Accessed 04 November 2016].

[8] Forbes.com – Ucilia Wang. 2013. A Manufacturing Lesson From Tesla Motors. [ONLINE] Available at: http://www.forbes.com/sites/uciliawang/2013/08/08/a-manufacturing-lesson-from-tesla-motors/#6dac27f262ea. [Accessed 3 November 2016].

[9] Forbes.com – Kevin O’Marah. 2016. Tesla And The 21st Century Supply Chain. [ONLINE] Available at: http://www.forbes.com/sites/kevinomarah/2016/04/07/tesla-and-the-21st-century-supply-chain/#253e5b6b4fa8. [Accessed 3 November 2016].

[10] Tesla | Premium Electric Sedans and SUVs. 2016.

[11] U.S. Energy Information Administration. 2016. Annual Energy Outlook 2016 with Projections to 2040.

It seems like Tesla dominates so much tech and business news that it was really surprising to hear that they are in such a need of cash! This was a very interesting investigation into potential headwinds the company could face due to operational choices it has made. On first glance, I would imagine that case 1 is much more serious since it also signals issues in product market fit. Additionally, it would also mean that all of Tesla’s efforts to combat climate change with new technology would in fact have a negative impact on climate change since there would be excess / unsalable inventory representing a massive waste of resources.

Judging by public interest, it seems that Tesla is more likely to face case 2 in which there would be additional market opportunity for competitors to take advantage of. Thinking about climate change generally, I would love to see case 2 play out since it means the public is receptive to energy saving technologies.

Lastly, you bring up an interesting point with vertical integration and Tesla’s relationship with suppliers. Since Tesla and Elon Musk’s other companies are so focused on creating energy saving technology, I would love to learn more about their supply chain to see whether sustainability is a major factor when choosing suppliers.

Totally with you on this Nick – Tesla’s future chances for success are totally up in the air. It’s an incredible company (not least for it’s ability to dominate the media as TOM_LS points out), but for all it’s progress it is still an absolute minnow in the automotive market. Only a week now until another extremely important vote – that of Solar City’s shareholders to approve or reject the proposed merger with Tesla. It appears that investor sentiment is still pretty divided on the issue – http://www.marketwatch.com/story/the-tesla-solarcity-deal-is-still-dividing-wall-street-2016-11-02 and the result will play a big role in shaping whether Mr Musk really will conquer the world. I can’t help thinking that he’s taking on too many things at once, but then again he’s done pretty much everything he’s set his mind to in the past…. We shall see soon!

As correctly pointed out, Tesla really is at a crossroads with multiple challenges in full sight ahead. Finding the right growth-rate that would allow it to continue growing (slowly and steadily) while staying ahead of the competition in electric car space is critical. It would be really interesting to see how aggressive they will be if Case 2 were to unfold, and how quick the market will jump to capture the opportunity ahead.

Of course one can’t think of Tesla without the imagine of Elon Musk coming up. Like many others, this exceptional human being also has his flaws. Although well intentioned and in the right place, Musk’s progressive thinking may very well drive Tesla down as he looks to bite off more than he can chew…too fast. Musk needs to manage his risk tolerance when analyzing opportunities (not get too caught up in his dreams) and think hard about where to invest in order to stay afloat and manage his cash flows more effectively. In the face of many challenges ahead perhaps Elon must take a step back.

Musk is a visionary thinker however with a vertical overview of the industry’s economics. SpaceX did an incredible job in pushing manufacturing costs way down by making its own rockets, engines and capsules. He has been known to expect employees to question traditional ways of designing for better more accurate products. With sustainable vertical integration, safe innovation and cost reduction this company and Musk deserve to succeed.

Also, over the past two years there has consistently been issues surfacing with regards to Tesla cars leading to a high recall rate. It makes me wonder whether Tesla is trying to innovate at the expense of assured quality to its customers. Could this issue be another way towards Tesla’s own demise? Perhaps biting off just enough is a better way forward.

Thank you Nick for your interesting post on Tesla’s challenges.

Although I agree with you that Mr. Musk is taking some big risks, he has also proven that he is capable of turning old paradigms up-side down, and achieve things that others would have considered impossible.

Take batteries for instance: as the single biggest cost item in manufacturing an electric car, their costs and limited availability was seriously hampering the development of the entire electric car market. What did Mr. Musk do? He completely turned around the situation, by building the single biggest, most advanced battery factory in the world, which alone is expected to bring costs of battery down to $100 per kilowatt-hour from an industry average of $350 [1]. In terms of capacity, the factory will produce in 2020 the equivalent of all battery manufacturers’ capacity in 2013. As reported in Leonardo Di Caprio’s new movie “Before the Flood”, 100 of these factories could transition the entire world to sustainable energy [2].

Even more strikingly, Mr. Musk has removed all protection to his patents [3], making them fully open source. This apparently counterproductive move is once again a clear strategy to turn around the table in the car industry: instead of preventing competition, he encourages it, in an attempt to transition the entire industry to electric-powered vehicles. This, he believes, would no longer make his company a niche player, but rather the first mover and market leader in a new, massive industry.

Mr. Musk has proven that old industry paradigms do not apply to him and has convinced investors that nothing is impossible for him. He might really be invincible, or maybe just lucky. Whatever the truth is, he is changing the world, for the better.

[1] https://www.greentechmedia.com/articles/read/How-Soon-Can-Tesla-Get-Battery-Cell-Cost-Below-100-per-Kilowatt-Hour

[2] http://www.forbes.com/sites/ericmack/2016/10/30/how-tesla-and-elon-musk-could-save-the-world-with-gigafactories/#4da21e4a3727

[3] https://www.tesla.com/blog/all-our-patent-are-belong-you

This is a really interesting post. I used to cover Tesla from the investment side and it has been interesting to see their foray into solar panels as well, which should have a big impact on their business model. These solar panels can replace your roof tiles, and they have even come up with panels that look exactly like high quality roofing tiles, so it will be interesting to see adoption going forward. One issue they might have is how much more expensive these panels are than other regular panels, and how tough adoption will therefore be in convincing costumers that the value proposition is worth it. I do like your points on vertical integration, and wonder if this can be easily applied to other business units. I would love to talk with you and hear more about your thoughts on their other business, and if you think this integration can be applied to the whole company or if they lack the proper size and scale in these units to do this at the current period. Great post!