GS Bank: Goldman Sachs’ Online Retail Banking Business

Goldman Sachs entering into online retail banking industry and potentially disrupting how people save and borrow money

Origin of GS Bank

Founded in 1869, Goldman Sachs (“GS”) have grown itself into one of the top two investment banks globally. GS built upon its success by serving mostly institutional clients through its (1) Investment Banking, (2) Institutional Sales and Trading, and (3) Investment and Lending divisions, while also high-net-worth individual clients through its Private Wealth Management division. Never in the company’s 148-year history did GS serve the mass retail customers.

This all changed since April 25, 2016, which marks GS’s attempt to penetrate into the retail banking industry. Through its wholly owned subsidiary GS Bank, the company is now offering online retail banking services to retail customers in the US with a minimum deposit of only $1.

Why Online Retail Banking

The origins of GS Bank could be traces back to the 2008-2009 financial crisis when GS, which previously operate as an investment bank, had to reclassify itself as a bank holding company to gain access to the government’s “bail-out” money. In the next few years, GS continued to operate as before and did not involve itself in retail banking business, but rather relied on wholesale funding from large institutions, whose money is considered riskier.

Last January, Basel III, a new set of international regulations that came into effect categorized retail deposit as the lowest-risk sources of capital given that mass retail savers are unlikely to withdraw funding en masse. Therefore, for GS to lower its capital risk, the company decided to tap into the retail banking market.

Enabled by the internet technology, financial service industry has transformed itself from the brick-and-mortar model into mobile and internet-based service model. Given the massive capital required for establishing offline retail presence, and the already saturated retail banking industry, GS decided to focus only on online retail banking segment.

GS Bank’s Value Proposition

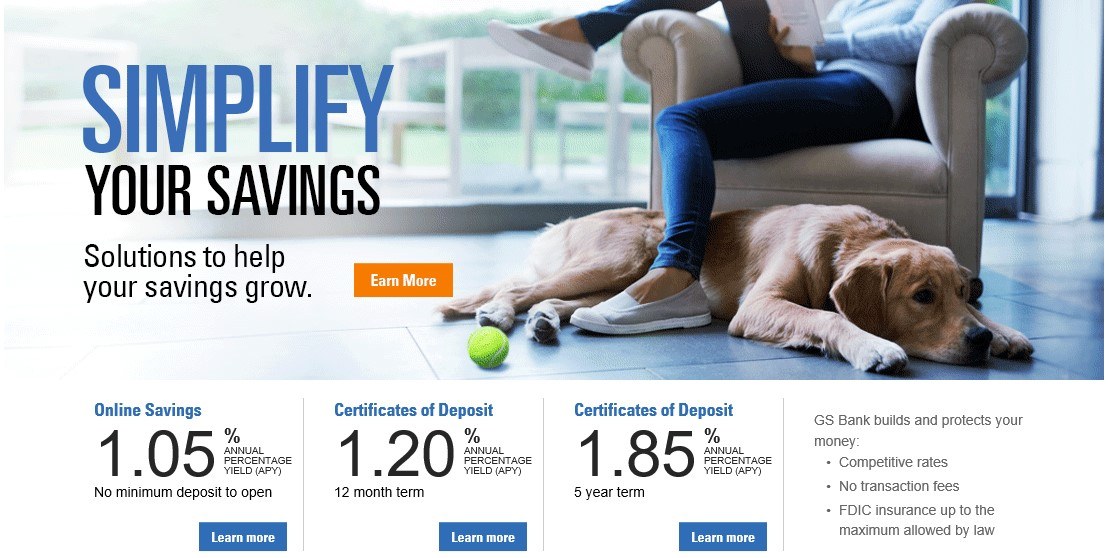

The value proposition of GS Bank for customers is very clear. There is no minimum deposit required to open an account, no transaction fees, a 1.05% APY (“annual percentage yield”), and FDIC insurance up to $250,000, the maximum amount allow by law. If the customer prefers to save the money through certificate of deposit, APY would range from 1.20% (12-month) to 1.85% (5-year) depending on the deposit duration.

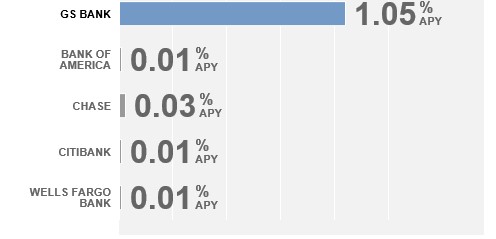

Other traditional retail banks such as Bank of America and Chase all have significantly lower APY (0.01%-0.03%) with minimum balance required of $2,000 to $2,500. The chart below compares the APY of GS Bank vs. largest US Banks.

However, although GS Bank offers the best-in-class interest rates, there are considerable downsides to its business offering related to the lack of offline retail branches. GS Bank does not offer checking account, no debit card and no ATM access at the moment, hence it could not replace the traditional banks when it comes to everyday spending. Also, customer services are provided entirely through phone or online service centers, and would require some level of tech-savviness for its customers.

GS Bank’s Operating Model

GS Bank’s ability to offer much higher savings rate to its customers is mostly due to its “online-only” operating model. Traditional retail banks require operating a network of bank branches and ATMs, and having many bank tellers and service employees to attract and service customers. Bank of America, the largest bank in the US, has 4,700 bank branches, 16,000 ATMs and over 200,000 employees globally. This requires significantly amount of capital investments and operating expenses. A quick calculation shows how much money can be saved by transforming from traditional offline to online banking model.

Take Bank of America as an example:

Assuming the company’s 2015 salary expense (~$30bn) can be saved by 50% through leaner operation and centralized functioning, and rental expense (~$4bn) can be saved entirely through its online-only strategy. The company would have saved $19bn (or 50% * $30bn + $4bn) in total. The company had $1.1trn in total deposits, and the savings would represent 1.7% of annual interest on the total deposit. And this is how GS Bank manages to offer a higher interest rate.

Where Next?

Since the rollout of GS Bank in April 2016, the company’s retail business has gained huge traction and on October 13, 2016, GS introduced another retail banking service “Marcus”, named after its founder Marcus Goldman, an online-only consumer lending platform that promises no sign-up fee, no late fee, and no prepayment fees ever, with comparatively low interest rate. Meanwhile, the company has been investing heavily on using big-data analytics to better understand the creditworthiness and spending behaviors of its customer base.

As Mark Schwartz, ex-CEO of Goldman Sachs Asia said during the company’s town hall meeting in 2014, “Goldman Sachs has transformed itself into a technology company”. The company is indeed investing significantly into technological innovation, to help the company stay ahead of the competition in the global financial industry.

Word Count: 800 words

Reference:

[1] www.gsbank.com, data retrieved on November 18, 2016

[2] www.capitaliq.com, data retrieved on November 18, 2016

Good job in making it exactly 800 words! Very interesting post, wasn’t aware GS has retail bank before reading this. As you mentioned, the value proposition is very clear – making a higher return on savings comparing to other traditional retail banks without any minimum balance requirement. But I find it difficult to picture a target customer group that would be attracted by this offering, especially in the US. Bank account penetration is already very high in the US and it’s hard to imagine people opening account with a new bank with only savings account provided. After all, the saving rate in the US is very low and this 1% increase in interest rate would probably only transfer into a few hundreds dollars a year for the account holder. Africa on the other hand would be a good choice for online banking as people are under-served by traditional banking due to the high cost to return ratio for opening physical branches and mobile penetration in Africa is high enough to provide an attractive potential market for mobile banking.

I had never heard of GS Bank up until now – it seems like great in concept to expand their product offering and start moving into the consumer space. At least for me, in order to adapt the service and move away from a Bank of America or a Fidelity would be the ATM access. The higher interest rate does not negate the lack of access to the money in the account. I wonder if they would consider partnering with an established ATM network and issuing a debit card that could be used on it?

I too was unaware about Goldman opening up a retail bank. I am struggling to see the value proposition here. Without an attached checking account and the ability to actually do banking activities I wonder if they will struggle to attract customers. Essentially this seem just like a place to park excess money and gain a higher return compared to other savings accounts. But the type of customer that has enough savings where the returns from the increased APR make a difference might be inclined to invest their money in other types of assets.

What concerns me a bit about self driving cars is the potential negative impact on the economy for a couple of reasons:

1. Putting the millions of drivers out of work could lead to a serious economic downturn and some serious civil unrest.

2. If cars are fully utilized instead of the current 5 percent utilization then obviously a lot less cars would need to be produced. This of course would have some serious negative implications for the auto industry. A lot of factory workers would lose their jobs.

With the potential devastating effect to the economy I wonder if politicians will be pressured to regulate away the driverless car.

My bad. Posted this comment to wrong blog.

GS’s move into retail reminds me quite a bit of USAA’s operating model. USAA has almost no physical branches, no ATM network, but unlike GS provides a full suite of online banking services to customers. While a bank like USAA has proven it can succeed without offline support, I think GS will certainly need to provide more robust services to attract away customers from their current bank.

Interesting article, Yao! I also struggle to see how GS Bank can stay competitive with no features of a traditional bank (ATM cards, retail branches, etc.). Have you seen any information on their customer base so far? I wonder how fast customers have been to adopt this new online bank. I believe the 1.05% APR is a tool to attract a wide customer base and that once they reach their minimum target level then they may be likely to reduce the rates to levels more in line with peers.

Nice post. I wonder if GS will break out the actual profitability / operating results of GSBank in its 10-Q or 10-K. Also, the move into the Marcus lending platform is a great strategic move for the company, given that peer-to-peer lenders like Lending Club and Prosper have recently been struggling due to higher borrowing costs, defaults, and legal issues. Marcus could be a nice alternative in the peer-lending space.

In terms of digitization, I am slightly confused as to why GSBank has not offered an ATM card or any standard banking products? It seems like if they want to make a real market share gain in retail banking that they need to provide more robust offerings. Online banking competitors like Schwab and Fidelity give you the online banking aspect of an ATM and reimburse you for all ATM fees from 3rd-party banks such as Chase, Citi, etc.

It makes me happy to know that Goldman Sachs is positioning itself to survive in the digital age. I don’t know what society would do without this fabulous institution!

On a less serious note, I believe Goldman Sachs is very smart in making use of the online banking channel to acquire less risky equity capital. They’ve accessed this form of retail financing online rather than in bank branches, which is the traditional means of accessing it – but very expensive. Turning itself into a technology company is also smart – as they’re using internal funding to finance potentially lucrative start-up ideas. Well done Goldman!

I see a whole lot of upside for Goldman, but minimal upside for consumers. If I want to park my money to obtain risk free interest, I’d just buy bonds or T-bills. What exactly is Goldman’s retail bank trying to achieve? Is there any way Goldman can partner with existing ATM networks? For those who might be interested, Fidelity Investments, for example, offers a cash management account with debit card that allows you to withdraw anywhere in the world for free (for currencies that are not of USD denomination, the rate is excellent.).

Thanks! It’s interesting! There are several successful direct banks (ING Direct, Tinkoff, Ally Bank) that also don’t have physical branches. Usually they start with a single product (e.g. credit card) and then increase the product portfolio with 1-3 banking products every year. They also make partnerships with ATMs,so that you can easily use their products all over the world. What’s the case of GS Bank? Are they going to expand further becoming a classic direct bank? Or is it a completely new model?