GE’s additive capability; Is it a future of GE or just another potential business for divesture?

GE is always seen as a leader for its manufacturing capabilities and spent significant amount of money to build up its additive manufacturing business. Though additive manufacturing has huge potential, it can be realized only if leveraged appropriately. What should GE do in the current situation they are facing?

Additive manufacturing is the technology that could disrupt traditional manufacturing process and product development. It uses the 3D software to create objects layer by layer and often referred as 3D printing, too. It’s application depends on the company and the industry. For this article, I will focus on GE’s additive technology application, its impact as well as challenges and recommendations to the company.

GE’s path to create additive capability:

In 2016, GE acquired majority stakes in Concept Laser at $599 million and Arcam AB at $1.4 billion, part of a push to expand the Boston-based company’s additive manufacturing capabilities.1 GE has also invested approximately $1.5 billion in manufacturing and additive technologies at GE’s Global Research Center (GRC) in Niskayuna, New York, in addition to building a global additive network of centers focused on advancing the science.2 So why the additive is important to GE? There are two main reasons.

1) To grow GE’s internal businesses through additive

GE has diversified portfolio of businesses such as Healthcare, Power, Aviation. Since the company is focused on industrial manufacturing businesses, GE wants to enhance the business by levaraging additive so that they can create parts/products more efficiently and effectively.

2) To capitalize on the growing external market

GE sees a $76 billion opportunity for additive manufacturing.3 Given the size of the potential market, GE is trying to capitalize the opportunity to grow the business. GE Additive business is currently selling the products to Healthcare, Aerospace, and Automotive industries outside of GE. The company has an ambitious goal that GE plans to sell 10,000 3D printing machines over 10 years and expand additive into a $10 billion business for itself.4

Benefits of additive to GE:

So how GE could utilize additive to internal customers and external customers? GE’s management is hoping that the additive capabilities could take the manufacturing process and product development to the next level. The followings are the main areas where additive could be beneficial for GE.

- Resource Efficiency: 3D printing produces less waste during manufacturing compared with conventional machines.5

- Complexity Reduction: 3D printing is a powerful tool to reduce complexity in the supply chain, from the consolidation of components into a single product.6

- Product Design and Prototyping: Because 3D printing technology is so versatile, it can produce a vast range of fundamentally different outputs cheaply, easily, and quickly.7

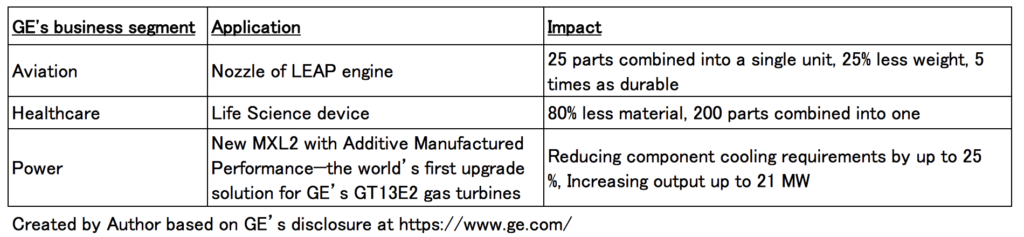

As you can see in Exhibit1, GE’s major business units have clear benefits from each of the above three areas. For example, LEAP engine has combined 25 parts into one to make it simple with 25% less weight. Additionally, GE Additive business is fast growing. According to the 4Q’17 press release, the Additive business booked $226 million of orders this year, increasing backlog by 44%8

So what should the GE’s management do?

I believe the additive capability is beneficial to GE as the above fact shows. Having said, I need to say that this technology is not a game changer for the company for the following reasons:

1) Customization is not a key for GE’s products

3D printing simply works best in areas where customization is key.9 This is because of the fact that traditional manufacturing can be economical for large volume of standard products. Where there is need for customization, additive can be powerful to minimize costs associated with the specific change though GE’s product is mostly standardized (Exhibit2).

2) Overspent with minimal return

Another point to consider is that GE spent $3 billion, but GE Additive’s order for 2017 is just $226MM. GE is currently in a crisis mode. Stock price is down by two thirds vs 2 years ago, dividend was cut from 12 cents to 1 cent, and $22B of impairment10 is recorded due to cashflow concern of the Power business. Clearly, the investment they made and the return so far cannot be reconciled.

Given the above three considerations, my recommendation to GE’s management is to

a) Sell majority of the GE’s Additive business. Use the cash to focus on additive capability for the remaining GE’s businesses as well as other product development.

b) Shrink the scope of the Additive capability to internal customers to focus on areas where additive is most effective such as “customized products/parts”

Questions that still remain are 1) how do you think about GE’s Additive strategy in light of the costs spent and economics realized thus far, 2) how can company like GE realize the potential of additive technology in the area where customization is not much required?

[741 words]

Exhibit1: Application of 3D printing for GE’s business segment

Exhibit2: Nozzle of engine created by 3D printing

Exhibit3: GE’s stock price

Endnotes:

1Bill Koening, GE Executive Sees 3D Printing Market Surging – Advanced Manufacturing, https://advancedmanufacturing.org/ge-executive-sees-3d-printing-market-surging/, Accessed 13 Nov. 2018.

2GE Additive, GE Agrees to Purchase Controlling Shares of Arcam AB, https://www.ge.com/additive/press-releases/ge-agrees-purchase-controlling-shares-arcam-ab, Accessed 13 Nov. 2018.

3Bill Koening, GE Executive Sees 3D Printing Market Surging – Advanced Manufacturing, https://advancedmanufacturing.org/ge-executive-sees-3d-printing-market-surging/ , Accessed 13 Nov. 2018.

4Ibid.

5Sebastian Mohr and Omera Khan, “3D Printing and Its Disruptive Impacts on Supply Chains of the Future”, Technology Innovation Management Review; OttawaVol. 5, Iss. 11, (Nov 2015): 20-25. Accessed via ProQuest on 13 Nov. 2018.

6Ibid.

7Ibid.

8GE, https://www.ge.com/investor-relations/sites/default/files/ge_webcast_pressrelease_01242018.pdf, Accessed 13 Nov. 2018.

9Sebastian Mohr and Omera Khan, “3D Printing and Its Disruptive Impacts on Supply Chains of the Future”, Technology Innovation Management Review; OttawaVol. 5, Iss. 11, (Nov 2015): 20-25. Accessed via ProQuest on 13 Nov. 2018.

10GE, https://www.ge.com/investor-relations/sites/default/files/ge_webcast_presentation_10302018.pdf, Accessed 13 Nov. 2018.

Super interesting article, Daichi! Really well laid out with a number of important facts and figures. I agree with how you have balanced optimism about 3D printing along with skepticism about whether or not GE stands to benefit relative to other companies that need more customization and may be scrappier about implementation.

Great article Daichi. I really like the clarity regarding the future of GE’s Additive Manufacturing efforts. I personally feel that GE will probably divest from that business given that there are several startups whose only focus is to push the envelop on 3d printing (Formlabs, MakerBot, etc.) in contrast with GE whose ongoing crisis will probably mean less focus on R&D – which this area really needs!

Great article! Absolutely agree that GE needs to divest this business due to their current situation. But I wonder whether they would want to keep this unit if they were not under such severe financial distress.