GameStop in the Age of Digital Distribution

GameStop, the last pure video game retailer in the United States, has seen its stock price fall 34.1% over the last four quarters due to mixed sales results on its website and 6,627 physical stores. Can GameStop figure out how to keep their stores relevant, or will they go the way of other physical media retailers such as Blockbusters, Boarders or Tower Records?

GameStop History

In 2002, when GameStop was spun off from Barnes and Noble, the video game industry looked very different than it does today. High speed internet was still in its infancy, the Steam distribution platform, which today accounts for about 75% of PC game downloads, was still a year from creation.[i] Traditional console and PC games were sold primarily through retail stores.

GameStop had a few major competitors at the time: EB Games, Best Buy, and Walmart. In 2005, GameStop bought EB games, the only other major pure video game retailer which allowed it to take 25% of the video game industry retail sales during that year.[ii] By 2015, GameStop would become the largest physical game seller in the US, taking 45% of the market.[iii] However, a major trend in video game distribution was looming, threatening to upend GameStop’s dominance.

Video Game Distribution – Disrupted

Two separate technological innovations have disrupted the traditional business model of video game sales – the rise of digital downloading due to build outs of high speed internet throughout in the USA and mobile smart phones, with the iphone in particular. Both involve closed source – “walled garden” – approaches to video game sales, eliminating the need for physical retailers such as GameStop.

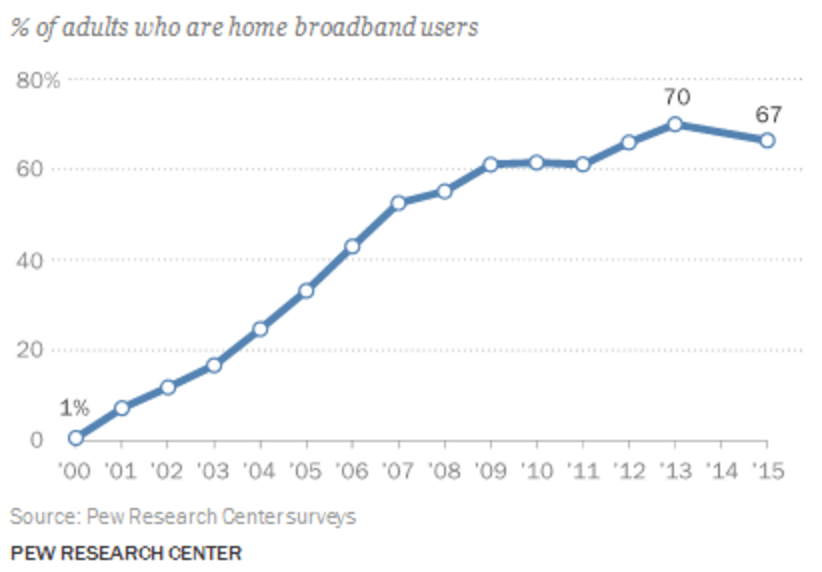

In 2003, Valve, a video game developer at the time, created the Steam digital download platform for PC games, just as high speed internet became mainstream in the USA (See figure below for USA broadband penetration by year). Steam allowed developers to skip traditional retail channels for PC games, save costs on distribution and COGs while allowing customers to purchase and play games without ever leaving their house. While GameStop has attempted to respond to open source PC market through acquisitions of digital distribution platforms[iv], they are unable to do that for “walled garden” consoles. Today, console game digital download penetration only continues to rise as hard drives and online stores have become standard in consoles. This year, Ubisoft, a large publisher, showed download penetration of their console game sales up to 26% from 19% last year.[v]

In 2008, Apple launched the app store and with it, digital downloads of mobile games, skipping traditional distribution channels and using hardware (iphones) which GameStop did not sell or service. In 2016, mobile game sales are projected to surpass traditional console games sales for the first time.[vii] As opportunities for video game sales growth for developers go mobile, investment in new games and marketing for traditional games has begun to slow down. The chart below shows the declining physical video game market from its peak in 2008 to today.

Can GameStop Defend Their Model?

Long gone are they days GameStop could simply sell games. Even without digital disruption, game companies have kept the purchase price of the stand-alone games and consoles basically the same over the past decade, leading to declines in price based on inflation.[viii] Games now come with DLC (downloadable content), season passes and many other types of post-purchase add-ons, increasing the lifetime price of a video game. In 2014, GameStop made $724M selling those add-ons and needs to increase this going forward.[ix] GameStop needs to defend their business model through exclusive content, as they have done with Call of Duty.[x] They also need to take a piece of mobile revenues, which can be done by converting cash from teenagers, who typically lack credit cards, into mobile currency. GameStop can partner with major developers such as King and EA to create bonus conversion deals in store to foster this transaction.

GameStop also needs to do more to entice customers into their store. In the past, selling used games, guides and add-ons was enough, but they also need to create better experiences, especially around new trends in gaming, such as eSports, which will be worth over $1B next year with double digit growth rates[xi]. They can be on the forefront of merchandising team gear, and engage with eSports fans through GameStop sponsored tournaments. GameStop needs to be a place customers want to go for experiences, similar to that of an Apple store, and thus should look at new hardware, such as VR, to help drive new customers looking for the latest trends.

Finally, GameStop should monetize the move towards retro gaming among millennials. Nintendo released a $50 NES system (originally released in 1985 in the US) this holiday season which sold out almost instantly[xii]. Retro gaming also takes place with buying and selling old cartages, discs and systems. While GameStop currently is a major player in the used video game market for modern systems, they should focus on monetizing the increasingly lucrative retro market.

Overall, the challenges facing GameStop will force them to innovate and change, however only time will tell if they can successfully survive this tumultuous decade of disruption.

Word Count: 796

[i] Bloomberg.com. 2016. Valve Lines Up Console Partners in Challenge to Microsoft, Sony – Bloomberg. [ONLINE] Available at: https://www.bloomberg.com/news/articles/2013-11-04/valve-lines-up-console-partners-in-challenge-to-microsoft-sony. [Accessed 17 November 2016].

[ii] GameSpot. 2016. GameStop buying EB Games – GameSpot. [ONLINE] Available at: http://www.gamespot.com/articles/gamestop-buying-eb-games/1100-6122418/. [Accessed 17 November 2016].

[iii] Demitrios Kalogeropoulos. 2016. GameStop Corp. Earnings Surge on Market Share Gains — The Motley Fool . [ONLINE] Available at: http://www.fool.com/investing/general/2015/05/29/gamestop-corp-earnings-surge-on-market-share-gains.aspx. [Accessed 17 November 2016].

[iv] VentureBeat. 2016. Retailer GameStop buys its way into digital distribution of games | GamesBeat | Games | by Dean Takahashi. [ONLINE] Available at: http://venturebeat.com/2011/03/31/retailer-gamestop-buys-its-way-into-digital-distribution-of-games/. [Accessed 17 November 2016].

[v] VentureBeat. 2016. Ubisoft: ‘Digital distribution was the main driver’ of our fiscal 2015 growth | GamesBeat | Games | by Jeff Grubb. [ONLINE] Available at: http://venturebeat.com/2015/05/12/ubisoft-digital-distribution-was-the-main-driver-of-our-fiscal-2015-growth/. [Accessed 17 November 2016].

[vi] Pew Research Center: Internet, Science & Tech. 2016. Home Broadband 2015 | Pew Research Center. [ONLINE] Available at: http://www.pewinternet.org/2015/12/21/home-broadband-2015/. [Accessed 17 November 2016].

[vii] Newzoo. 2016. The Global Games Market 2016 | Per Region & Segment | Newzoo. [ONLINE] Available at: https://newzoo.com/insights/articles/global-games-market-reaches-99-6-billion-2016-mobile-generating-37/. [Accessed 17 November 2016].

[viii] IGN. 2016. The Real Cost of Gaming: Inflation, Time, and Purchasing Power – IGN. [ONLINE] Available at: http://www.ign.com/articles/2013/10/15/the-real-cost-of-gaming-inflation-time-and-purchasing-power. [Accessed 17 November 2016].

[ix] Engadget. 2016. GameStop explains how it made $724 million selling digital games and add-ons. [ONLINE] Available at: https://www.engadget.com/2014/07/15/how-gamestop-makes-money-selling-digital-goods/. [Accessed 17 November 2016].

[x] GameStop Product Page for Call of Duty Infinate Warfare Legacy http://www.gamestop.com/ps4/games/call-of-duty-infinite-warfare-legacy-pro-edition-only-at-gamestop/130471

[xi] GamesIndustry.biz. 2016. eSports growth slowing but market to pass $1bn in 2017 – SuperData | GamesIndustry.biz. [ONLINE] Available at: http://www.gamesindustry.biz/articles/2016-07-20-esports-growth-slowing-but-market-to-pass-usd1bn-in-2017-superdata. [Accessed 17 November 2016].

[xii] MERRY JANE. 2016. Retro Games Making a Comeback: The Mini Console Wars Have Begun. [ONLINE] Available at: https://www.merryjane.com/culture/retro-games-making-a-comeback-the-mini-console-wars-have-begun. [Accessed 17 November 2016].

Great post; of all the retailers facing digital disruption, video game retailers don’t seem to get as much attention as others. Interesting point about the double-whammy that they’re facing. Not only is their core customer drifting onto digital platforms, but video game sales are in decline – so there’s less content going through their stores.

I agreed with your point around securing exclusive content, but I question whether GameStop could reasonably generate more sales from add-ons. If customers are already drifting towards digital platforms to buy the core game, would they head into store to buy DLC and season passes? They seem to be even more of a low-commitment purchase (smaller file size, quicker download time, lower dollar cost, potentially more of an “impulse” buy).

Completely agree with your final point about e-Sports, I couldn’t think of a better way for them to try and drive a “community” vibe in their stores than capitalising on this trend.

Finally, it seems to me that their days are numbered for console games too. I was surprised that the PS4 and Xbox One didn’t shift more towards digital platforms for content delivery. I imagine the next generation will improve storage space on the consoles & really drive digital downloads as the main channel for game purchases.

Great article and suggestions for what they should do moving forward, particularly the exclusive content and eSports idea. I think content and experience creation have the most potential. Right now they’re purely a distribution platform, and with all the trends – downloading onto consoles, mobile, faster ecommerce delivery times, etc. – it really does not seem like a sustainable place to be. Along your eSports community idea, I wonder if they could try to turn the stores into local competition / tournament centers and take the eSports local. If they could sponsor a local base of competitive gamers and viewers, maybe then they could try to get into people’s homes by allowing viewership of ‘televised’ content on home consoles, and build out that distribution model that directly reaches gamers at home.

JS – Fascinating post, given the challenges you outlined it is hard not to think the future for Gamestop is looking pretty grim. In addition to your points on Gamestop’s potential to shift its business to new segments like digital, merchandise, and retro, I believe its greatest point of potential is simply time. Despite same store sales declines of as much as 7% year-over-year, the Company is still generating significant operating cash flow ($240m over last-twelve months). The underlying driver behind this is that Gamestop’s trade-in policy is keeping physical games relevant, albeit at a declining rate. This is because the Company’s customer base values its ability to trade-in used games for credit towards a new purchase. This allows them to receive some value for their obsolete past-purchases, avoid slow download times, and preserve space on their hard drives. Because of this dynamic, Gamestop will be able to remain relevant and undergo a “slow-burn” before ultimately becoming replaced by its digital competitors. I see this “slow burn” effect as a point of potential for the Company, because it will be able to use its consistent Cash Flow generation to invest in the growth areas you suggested, while also exploring new opportunities to preserve its business. With time ticking away, it should be interesting if it can leverage its declining revenue base for growth in new arenas.

http://www.investopedia.com/news/bull-case-gamestop-gme/

Thank you JS for the text. It is always interesting to see when digitization profoundly changes an industry and puts long lasting industry leaders in a very uncomfortable position. Being from Brazil, every time I was in the US, my first stop was always Gamestop to buy the latest games since import taxes prevented me to do it domestically. However, since the advent of Steam, Xbox Marketplace and PS Store, prices have gone down and digital distribution became the norm. IT not only affected domestic customers, but digitization also completely changed the way gaming companies build relationship with customers overseas.