Future-Proofing Financial Services: Barclays Accelerator Program and Open Innovation

“By accelerating the development of groundbreaking products and services, we know that we can help to keep Barclays at the cutting edge of financial services, all while helping to revolutionize the industry” – Michael Harte, Chief Operation and Technology Officer.

The rise of financial-technology (Fintech) is a response to both rising consumer demands for convenience and value as well as the untapped opportunity of large unbanked and underbanked populations. Traditional firms have historically struggled as innovation requires ever-broadening inputs including geographically or organisationally distant knowledge not necessarily within existing firm scope or capabilities[1]. Networks and partnerships have thus become critical in knowledge intensive industries and networks like financial services when relationships are used to acquire information[2].

Barclays Accelerator Program is an example of a partnership between large traditional institutions and technology entrepreneurs. Through a 13-week accelerator program held in several cities worldwide in partnership with Techstars, Barclays crowdsources 11 new ideas in the financial technology sector and incorporates 11 selected new start-ups into its network every year[3]. While Barclays externally advertises the program to be beneficial to the participating startups, Barclays is the main beneficiary by future-proofing itself from disruption and obsolescence via open innovation. The open innovation literature suggests that partnerships enable the exploitation of external knowledge and ideas to accelerate innovation and implementation[4].

Anticipating Industry Disruption. Open innovation is first being used broadly for Barclays to acquire knowledge about new technology and the best potential applications to financial services. Incubator and accelerators also identify potential threats or industry disruptions faster than it would take a competitor to go to market[5]. According to Michael Harte, Barclays’ Chief Operations and Technology Officer, “By accelerating the development of groundbreaking products and services, we know that we can help to keep Barclays at the cutting edge of financial services, all while helping to revolutionize the industry”[6].

New Markets/Products: Small and Medium Businesses. Growth is increasingly coming from open innovation[7]. New players and partnerships drive growth by tapping new markets or creating new product categories[8]. One of Barclays’ strategic objectives is to be the “bank of choice” for small and medium sized businesses. Corporate accelerators strategically indirectly enable new markets[9]. By opening up its human and technology resources to these startups, Barclays can determine which parts of their product and systems are compatible or incompatible with small busineses and adjust these accordingly to cater to the SMB sector.

New Markets/Products: Emerging Markets. In order to be the “the go-to bank across the globe”, Barclays has developed emerging market access via its accelerator. DoPay, a Barclays Accelerator and now subsidiary firm, aims to provide digital payroll software services to companies in developing markets starting with Egypt[10]. Through the innovation and subsequent mentoring and support process, Barclays learned how to leverage its current credit card infrastructure in emerging markets. It also allows Barclays an entry point into Egypt’s underbanked population via a payroll product which is now an adjacent capability.

Towards the Future: Artificial Intelligence. The 2018-2019 application call reflects Barclay’s strategic exploration towards leveraging artificial intelligence in financial services. According to John Stecher, Chief Innovation Officer, “We are integrating AI and decision support technologies across our company in order to create better experiences for our customers and clients. I look forward to seeing how these ten startups evolve their business propositions and how they leverage AI in doing so.”[11]

Reverse Mentoring and Developing an Innovative Culture. As Barclays continues its journey towards innovative transformation, I would recommend it leverage its network of founders and entrepreneurs to influence the firm’s internal teams to be more agile in identifying ideas and implementing them. Just as how the Accelerator Program provides entrepreneurs with Barclays mentors for scaling up their fintech ideas, these entrepreneurs are a strong source of reverse mentorship. Knowledge transfer and organizational learning literature mention that it is tacit knowledge, that is not explicit or codified, that builds capability and can drive innovation[12]. Tacit knowledge is difficult to transfer because it is “context specific” and must be “experienced” to be fully understood[13]. As such, reverse mentoring programs should be able to more visibly disruption and innovation into the bank’s strategy while deepening the partnership between startup participants and Barclays.

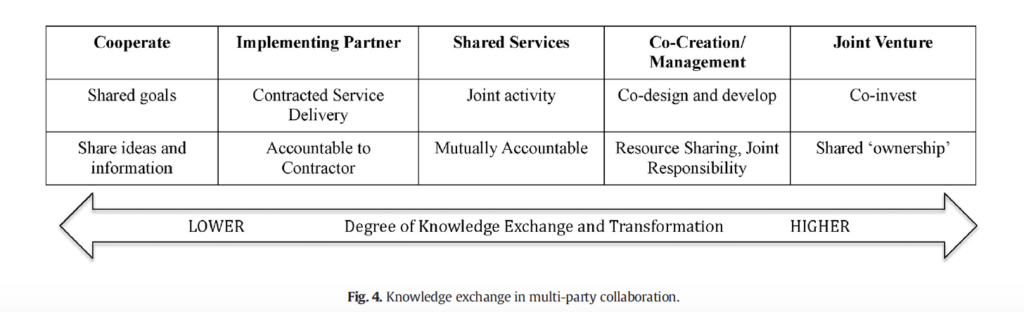

Collaborating for Innovation? The literature on networks and organizational learning mention that knowledge and learning varies across different partnership types. See Exhibit 1. More knowledge and strategies are transferred when ties between parties are stronger, more enduring, and more formal. Crowdsourcing via accelerators remains a relatively weaker and more flexible form of partnerships. Additionally, Heinemann mentions that accelerators are unlikely to generate immediate short-term financial impact and is largely long term or strategic in nature. Thus, I would posit the following question for further manager consideration: When would it be better to use Barclay’s Acceleration Program to incubate new startups versus integrating startups directly into Barclay’s value chain? Versus a full startup acquisition?

Figure 1: Knowledge Exchange in Multiparty Collaboration[14]

(Word Count: 774)

[1] Contractor, Farok J., Vikas Kumar, Sumit K. Kundu, and Torben Pedersen. “Reconceptualizing the firm in a world of outsourcing and offshoring: The organizational and geographical relocation of high‐value company functions.” Journal of Management Studies 47, no. 8 (2010): 1417-1433.

[2] Cross, Rob, Nitin Nohria, and Andrew Parker. “Six myths about informal networks-and how to overcome them.” MIT Sloan Management Review 43, no. 3 (2002): 67.

[3] Barclays, “Barclays Accelerator”, http://www.barclaysaccelerator.com/#/about/, accessed November 2018.

[4] Chesbrough, Henry William. Open innovation: The new imperative for creating and profiting from technology. Harvard Business Press, 2006.

[5] Kohler, Thomas. “Corporate accelerators: Building bridges between corporations and startups.” Business Horizons 59, no. 3 (2016): 347-357.

[6] Mirvis, Philip, Maria Elena Baltazar Herrera, Bradley Googins, and Laura Albareda. “Corporate social innovation: How firms learn to innovate for the greater good.” Journal of Business Research 69, no. 11 (2016): 5014-5021.

[7] Enkel, Ellen, Oliver Gassmann, and Henry Chesbrough. “Open R&D and open innovation: exploring the phenomenon.” R&d Management 39, no. 4 (2009): 311-316.

[8] Bower, Joseph L., and Clayton M. Christensen. “Disruptive technologies: catching the wave.” (1995): 43-53.

[9] Heinemann, Florian. “Corporate accelerators: A study on prevalence, sponsorship, and strategy.” PhD diss., Massachusetts Institute of Technology, 2015.

[10] Lomas, Natasha. “DoPay Banks $2M to launch a cloud payroll service for the unbanked.”Techcrunch.com, April 30, 2014. https://techcrunch.com/2015/04/30/dopay-seed/ Accessed November 2018.

[11] Zanoff, John. “Announcing the 2018 Class of the Barclays Accelerator Powered by Techstars in New York”. Techstars.com, September 10, 2018. https://www.techstars.com/content/accelerators/announcing-2018-class-barclays-accelerator-powered-techstars-new-york/ Accessed November 2018.

[12] Seidler-de Alwis, Ragna, and Evi Hartmann. “The use of tacit knowledge within innovative companies: knowledge management in innovative enterprises.” Journal of knowledge Management 12, no. 1 (2008): 133-147.

[13] Van Wijk, Raymond, Justin JP Jansen, and Marjorie A. Lyles. “Inter‐and intra‐organizational knowledge transfer: a meta‐analytic review and assessment of its antecedents and consequences.” Journal of management studies 45, no. 4 (2008): 830-853.

[14] Mirvis, Philip, Maria Elena Baltazar Herrera, Bradley Googins, and Laura Albareda. “Corporate social innovation: How firms learn to innovate for the greater good.” Journal of Business Research 69, no. 11 (2016): 5014-5021.

Great piece! I can share from experience that corporate accelerators often warrant heavy criticisms from internal stakeholders because of their long-term view (as you mentioned). We found, from our experience, that unless the accelerator participants were tightly aligned with a singular strategic objective (ex. medication adherence in healthcare), we could not drive any tactical short-term value from the interaction. So, in response to your question, I would pose that corporate accelerators can become a great short-term learning / innovation mechanism when a specific strategic objective has been identified, and all the participant companies play in that space.

Interesting read on the use of open innovation at a blue chip company.

I would argue that if Barclay’s incubator program is not accelerating the statups’ path to revenue through its own value chain, then it doesn’t offer a lot of value for the startup. Especially so because FinTech startups either want to bring down the current value chain (meaning they will not join the incubator) or want to partner with incumbents (meaning they are looking for co-innovation with Barclays).

Look forward to discussing further!

Super interesting post! I’ve seen first-hand how slow moving many traditional UK banks are, so I’m glad Barclays are attempting to innovate in this way.

To your question; I believe full-scale acquisitions are a way of supplementing the product development funnel. Fundamentally, by acquiring a business Barclays are signalling that they failed to develop that product via the Barclays Accelerator Program (or other internal innovation methods). As a result, the acquisition is a way of ‘plugging’ an innovation gap. For example, Societe Generale acquired Treezor, a payments platform, earlier this year as a way of reducing the time to market of payment products for clients [1]. This capability gap had not been addressed by their own open innovation process, so they were forced to acquire.

However, given a choice, I believe a business should choose to use its open innovation process to develop capabilities in an organic way. This allows you to achieve the ‘reverse mentorship’ you mentioned above, alongside influencing the direction of technological development and developing lasting partnerships with top talent. Indeed, 75% of FinTech start-ups noted they want to collaborate with banks – so the demand is there [2]. Conversely, by acquiring, you expose yourself to the classic risks of integration; that processes won’t integrate effectively and talent will leave.

—

[1] Societe Generale, “Societe Generale announces the acquisition of Treezor and accelerates its open innovation strategy,” September 2018, accessed November 2018.

[2] Capgemini, “World Fintech Report,” 2018, https://www.capgemini.com/wp-content/uploads/2018/02/world-fintech-report-wftr-2018.pdf, accessed 2018.

While startup accelerators are interesting ways of fostering external sources of innovation which can eventually be acquired, I feel like Barclays as a larger organization could benefit even more from fostering a global internal culture of innovation further. Internal hackathons, dedicated and encouraged 20% time, and intrapreneurship with budgets and resources are all things I have seen work well within Google, Microsoft and other companies, and I feel like Barclays would do well to experiment with.