Ford’s Global Supply Chain Hits a Bumpy Road

Isolationist trade policies threaten to disrupt the supply chain of U.S. auto manufacturers such as Ford.

Ford’s Global Supply Chain Hits a Bumpy Road

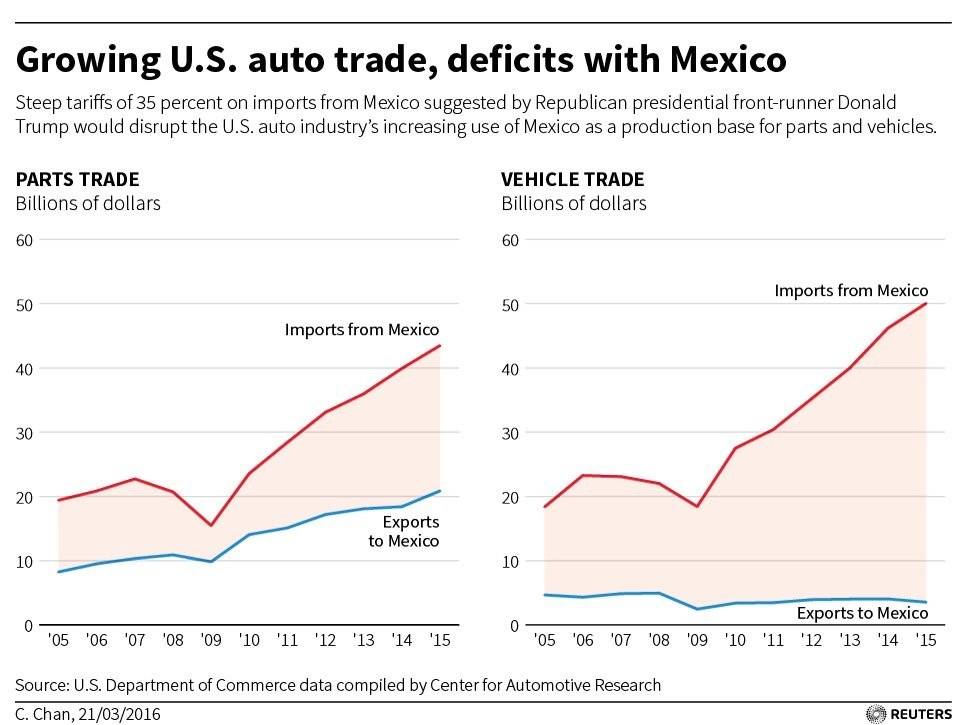

The current U.S. administration is contemplating a dramatic isolationist trade policy in the form of a significant “border tax” which would impose steep tariffs on Chinese and Mexican imports – potentially as high as 45% on goods from China and 35% on goods from Mexico.[1][2] Successful implementation of these policies would have a profound impact on the U.S. auto industry, as more than half of U.S. auto sales are supplied by production from Asia and Mexico.[3]

Government officials are also in the midst of renegotiating NAFTA. Continued U.S. isolationism during these negotiations carries the threat of rebuke from long-standing trade partners. Of particular concern to U.S. auto makers, such as Ford and General Motors, is the potential end of an exemption from a 25% duty the U.S. imposes on all pickup trucks produced outside the country.[4] This has significant implications, as “Last year through November, the U.S. imported $18.5 billion worth of vehicles from Mexico that would be subject to the tax.”[4] As a result, the U.S. auto industry faces potential tariffs on both cars that are manufactured abroad and imported domestically and on imported parts used for manufacturing within the U.S. Ford and other auto manufacturers are particularly vulnerable to strains on the supply chain because cars require up to 15,000 individual parts and failure to deliver even one can halt a production line. Furthermore, studies indicate that companies “that experienced even minor [supply chain] disruptions faced significant declines in sales growth, stock returns, and shareholder wealth, and that these effects tended to linger for at least 2 years after the disruption.” [5]

https://d3.harvard.edu/platform-rctom/wp-content/uploads/sites/4/2017/11/US-mexico-auto-trade.jpg

https://d3.harvard.edu/platform-rctom/wp-content/uploads/sites/4/2017/11/US-mexico-auto-trade.jpg

In the short term, Ford’s management has responded to these threats by curbing imminent plans to build manufacturing plants in Mexico. Earlier this year, the company cancelled a $1.6Bn car plant in Mexico and chose to increase production in Michigan instead.[6] To complement its existing geographically diverse manufacturing base, Ford is, in the medium term, continuing a healthy rate of investment in U.S. plants: the company’s investment strategy calls for $9Bn for U.S. plants over the next four years.[7] By investing heavily in domestic plants, Ford partially insulates itself from the potential tax that it would have had to pay on cars produced abroad for the U.S. market. One specific element of its supply chain that Ford would likely look to either manufacture themselves domestically or source from a domestic supplier is diesel engines. The company’s F-Series and other medium-duty pickup trucks represent some of its most profitable vehicle lines, but they are currently built using Mexican-made diesel engines; a 35% tariff would materially affect the company’s cost of production. [8]

Ford’s response to this relatively recent megatrend has been appropriately cautious, likely lessening the negative effects on the company if these tariffs end up becoming legislation. I would recommend not overreacting quite yet, as the U.S. President championing these tariffs has proved relatively ineffective at turning ideas into law. Others question the President’s conviction on such matters: “it is also possible that Mr. Trump will not follow through such policies to their conclusion. His strategy may simply be to bounce individual businesses into making eye-catching investment decisions that will win the White House a news cycle.”[9] In the scenario in which these tariffs are implemented, there is risk of stoking a protectionist backlash against America [10], meaning potential tariffs when automobiles are imported into foreign countries from the U.S. For this reason, I would also recommend continuing to invest in manufacturing abroad so that Ford cars imported into foreign countries would not be subject to such a tax. This way, Ford’s domestic business would be harmed the most, but it would still be on a level playing field with other U.S. auto manufacturers, and the increased cost of production might be passed onto consumers. Eliminating risk of import tax on the foreign part of Ford’s business is strategically beneficial given “95 percent of consumers, 80 percent of purchasing power and the fastest-growing markets for our products are outside the United States.” [11]

Looking to the future, the biggest open question related to this isolationist trend in America is whether or not it will continue beyond the current administration. How strongly should companies react to recent trends which may eventually be reversed?

Word count – 715

- Reuters, “Here’s How Donald Trump’s Trade Policy Could Backfire,” com, March 24, 2016.

- Patrick Gillespie, “40% of a Mexican import is American,” CNNMoney, January 26, 2017.

- Dow Jones Institutional News, “S&P Global Ratings Says De-Globalization May Threaten US Supply Chains,” Dow Jones Institutional News, 30 May 2017.

- Today’s Top Supply Chain and Logistics News From WSJ Dow Jones Institutional News; New York 16 Feb 2017.

- Snyder L, Atan Z, Peng P, Rong Y, Schmitt A, Sinsoysal B. OR/MS models for supply chain disruptions: a review. IIE Transactions [serial online]. February 2016;48(2):89-109. Available from: Academic Search Premier, Ipswich, MA. Accessed November 14, 2017

- FT, “The Protectionist Trade Fallacy of America First,” com, January 4, 2017.

- Reuters, “Here’s How Donald Trump’s Trade Policy Could Backfire,” com, March 24, 2016.

- Ibid

- FT, “The Protectionist Trade Fallacy of America First,” com, January 4, 2017.

- Ibid

- Shawn Donnan, “Trump strategy threatens US competitiveness,” com, January 10, 2017

CranberryCo, I appreciate you highlighting a really important issue – not just for American automakers, but also for American consumers. It sounds like you take issue with Ford’s short-term response to ramp up investment in domestic manufacturing capabilities, based largely on your belief that the Trump Administration may not be able to codify significant changes to NAFTA with legislation. The article linked below seems to indicate that Trump could likely withdraw from NAFTA altogether, but then would need Congress to pass legislation repealing, among other things, favorable tariff treatment for goods such as imported automotive parts.

Given the difficulties of passing such legislation in the current U.S. political environment, I’m wondering if companies like Ford are investing in domestic manufacturing in part for reasons external to the Trump Administration. For example, they could be concerned that trade isolationism is likely to endure this administration given the lack of good-paying blue-collar jobs in America. Or perhaps they think that manufacturing next-generation electronic vehicles near their end consumers makes good economic sense?

https://www.theglobeandmail.com/news/world/us-politics/could-trump-really-pull-the-us-out-of-nafta/article36111184/

Great article, CranberryCo. I absolutely agree with you that Ford and others should continue developing plants abroad as the proposed isolationist trade policies may have a number of unintended consequences, namely retaliation from other countries leading to an increase in the tax rate for vehicles imported from the US. While companies like Ford can hope that “Mr. Trump will not follow through such policies to their conclusion,” I would strongly recommend that companies begin investing in lobbying against these isolationist trade policies; there are several strong arguments against implementing these policies and lobbying may be a worthwhile investment in ensuring the policies don’t pass.

CranberryCo, the Ford example really highlights the issue well. You bring-up good points about Ford’s investment in building capacity in the US and investment overseas to hedge retaliatory isolationist policies. Unfortunately, the current situation may have more unintended consequences. The demand for new units in the US car industry is slowing down and manufacturers are seeing declining profits [link 1 below]. Therefore, forcing big car companies to invest in capacity in the US, may also force their hand on investing in manufacturing automation. The competitive market is forcing car makers to continuously improve their products while keeping prices low, causing them to replace employees with automation in manufacturing [link 2]. GM has announced plans to lay-off 4,000 workers, while Ford is planning to cut 1,400 jobs [link 1].

[1] https://www.economist.com/blogs/graphicdetail/2017/05/daily-chart-15

[2] https://www.economist.com/blogs/buttonwood/2017/01/economics-and-finance

I am going to take the alternative view to Mike and HBSRules. My suggestion to Ford is to manufacture closer to whichever customer base you are trying to reach. However, this isn’t just because of the risks of rising isolationism. My suggestion is also predicated on potential cost-savings that can be realized throughout the supply chain, including transportation costs, inventory level costs, and the risk of missing a delivery due to unanticipated events (e.g. a ship is not on time due to a hurricane). However, cost-savings do need to be realized for reasons cited by Japees. Strategy& recently released a report with two suggestions I will highlight [1]. The first is to use smart-sizing, where OEMs enter agreements to share car platforms (a fairly standard part of most cars) to build economies of scale, thus reducing costs. The airline industry participates in this practice to realize the very valuable cost-savings. The second recommendation is to decrease the retail side (car dealerships) and use data on customer preferences to accurately target each market. Ford could go as far as Tesla has in the U.S., where company-owned showrooms and online platforms are replacing traditional car dealerships.

[1] Strategy&, “2017 Automotive Trends”, https://www.strategyand.pwc.com/trend/2017-automotive-industry-trends, accessed December 2017.

Cranberry: Thank you for the extremely informative and relevant article!

Everyday I check the news to follow the latest updates on NAFTA and the impacts it will have on the United States. While I don’t think Ford (and the rest of the country) will see the extreme impact of the threat, President Trump’s administration has already influenced companies such as Ford to respond to the threats. As you pointed out, this included the cancellation of production plants in Mexico and shifting the workload domestically, among many other reactions. As you alluded to, I truly believe that this was the intent of the administration: A scare tactic to influence companies to make moves….

No matter what happens, history tells us that the policies under this current administration will almost certainly be reversed in the future. I think about the influence that the Reagan, Bush, and Clinton administrations had on progressing the U.S.-Canada Trade Agreement, and then eventually NAFTA. Their influence mirrors the intensity of Trump’s, yet they were supporting the other side of the coin. History will repeat itself….

We will see what happens! Thanks again for the read!

Thanks for this interesting article, CranberryCo. The auto industry is probably the most globally-linked industry in that parts of a car are always manufactured in a number of countries and shipped to one country for assembly into finished goods. No matter what the US government’s ultimate decision is on the isolationist trade policy, risks associated with import restrictions and increase in tariff will always remain a concern to Ford and other auto companies in the world. I agree to your arguments that Ford should not implement profound changes to its supply chain management just yet given the uncertainties of the policies at this point. However, I do think that import restriction is only one of the many factors Ford should consider when making decisions on where to locate its plants. Even if the isolationist policy ends up being implemented, it could still make sense for the company to continue sourcing parts overseas because the overall cost would still be lower than if it manufactures and sources parts domestically given the generally higher labor and machine costs in the U.S.

Thanks @CranberryCo for a really interesting and well-written post!

I’d like to respond to a different part of your argument than the other commenters, namely the Trump administration’s reliance on short-term domestic manufacturing investments to create a win for the White House in the media. Since the election, the administration has used specific and limited investments in domestic manufacturing to project an overall image of “worker friendliness” that is actually undercut by policy in other arenas (e.g. the choice to award lucrative government contracts to companies with lower cost bases due to offshoring). One great example of this was the news cycle created by Trump’s decision to “save” a Carrier plant in Indiana that was facing layoffs due to offshoring by brokering a deal with the company. However, one year after the deal, layoffs are still occurring and many of Trump’s words have been proven hypocritical (https://www.washingtonpost.com/news/posteverything/wp/2017/11/29/a-year-ago-trump-promised-carrier-workers-help-were-still-waiting/?utm_term=.094ec76d26d7). Carrier’s decision to continue with the layoffs comes down to the fact that the company does not feel its business is sustainable with its current operating environment in Indiana.

This example makes me wonder how sustainable and impactful Ford’s investments in domestic manufacturing will really be — or whether they are simply meant to create positive press coverage for Trump in the same way the Carrier deal did a year ago. If companies indeed believe that these investments are unsustainable and merely for show, they should refuse to participate in the sham. This would deny the media their story and deny Trump the power and sway that are so dangerous to these companies in the first place.

A great article on a conundrum facing many CEOs today! Isolationist policies are particularly difficult to react to when they happen so suddenly. I agree with Ford’s strategy of maintaining production plants in countries throughout the world. Disparate supply chains can be more complex to manage efficiently. Yet they also offer the benefit of diversification – Ford won’t be crippled if the Trump administration does set off a trade war. A rule of thumb I would use in gauging how much to react is to make sure you’re no worse than your competitors. If every other major car company is in as poor of a position to respond to the potential tariff, then it may not be worth making additional adjustments to your company strategy. If, however, Ford’s supply chain (e.g. reliance on Mexican factories) leaves it particularly exposed compared to competitors, then Ford should protect itself against the regulatory change.