FedEx – the next big Challenge

“You can't ride along with your shipment, so let us do the work for you” [1]. Speed and reliability have been at the core of FedEx customer promise since its inception. However, both standards for speed and reliability are constantly increasing, challenging the shipping industry and keeping technological innovation as a top priority.

The Company

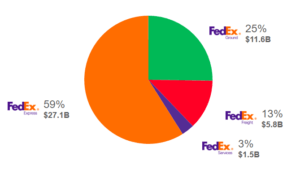

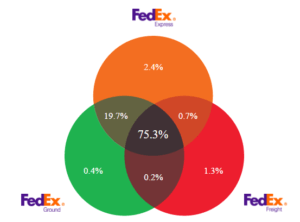

Since it started operations in 1973, FedEx has grown to one of the most important and admired shipment companies in the world [2]. It comprises of three main divisions: FedEx Express, focused on time-sensitive deliveries across the globe and present in more than 220 countries, FedEx Ground, small-packaging leader provider in the US and Canada, and FedEx Freight, offering less-than-truckload (LTL) services in North America (see Figure 1). The operation of each business unit is independent to increase focus and quality, but the customer takes advantage of the close relationship of units and the unified management – 96% of U.S. revenues represents customers that uses more than one type of service (see Figure 2) [3].

Figure 1 – Revenues breakdown per service

Souce: Investors Relation website

Figure 2 – Portfolio Bundle of Services

Souce: Investors Relation website

The Market Dynamics

Technological advancements can be seen as both opportunities and threats to leader companies, as they can either consolidate a privileged position or completely disrupt the market, capable of reshaping competition and strategy [4].

Based on the interconnectedness of hardware, the Internet of Things (IoT) can be ultimately considered a service, as the consumer has no visibility on the hard work of technology behind the scenes [5]. As Sonos Inc. CEO John MacFarlane said, “most people could care less about the underlying technology unless it doesn’t work.” [6].

For FedEx, IoT creates competitive advantage in two ways: it improves the quality of services, increasing the perceived value, and it also improves the efficiency of the operations, a great cost saving opportunity and differentiator. Currently, FedEx faces fierce competition from (i) less capital-intensive local transportation companies and startups, from which it differentiates itself by being global and offering reliable service and (ii) high volume package shippers, such as Amazon, that are integrating its logistics chain and can become a low-cost competitor [7].

SenseAwareSM: the innovation beyond the shipping industry boarders

SenseAwareSM is a breakthrough product that enhances productivity and supply chain management of customers. Conceived in 2006 and widely released in 2011, SenseAwareSM is a multi-sensor device that tracks and monitors shipment and is coupled with a powerful web-based application system that enables sharing of information across different stakeholders in the value chain [8].

Unlike the traditional track-and-trace technology in which only on designated points along the route the product is scanned and location is informed, FedEx application uses state-of-the-art sensors, GPS capabilities and advanced data analytics, providing near-real-time information about location, temperature, light exposure, humidity, pressure and travel performance (see Figure 3). Using cellular technology through a secure server, the information can be viewed in a personalized interface, allowing the customer to include triggers and alerts [9].

The information access enables the customer to proactively manage its supply chain. It fastens the response to adversities and improves the logistics. The gathering of historical information allows analytical inferences that can lead to optimized routes and strategies, thereby reducing costs, waste and time [9]. It is particularly valuable for sectors with sensitive shipments, such as the healthcare and electronic industry, where temperature and humidity variability can most easily damage the product.

Figure 3 – SenseAwareSM

Souce: “Inventing the Future – How Technology Is Reshaping the Energy and Environmental Landscape”, Business Roundtable. Apr, 2015.

Commitment to Innovation and the Future

Facing the challenges of moving time-sensitive shipments such as medicines and electronic parts and the lack of solution in the 1960s, FedEx was conceptualize to tackle this express-delivery niche and in 1975 was already the premier carrier for high-priority items [2]. As a pioneer in the industry, FedEx has kept itself ahead of the competition through continuous investment, creating a culture of innovation.

For each of the last three years the company invested $348-$403 million dollars in Information and technology (IT). Last year, the company hired the former Deputy Director of the National Security Agency, John C. Inglis, to tackle the industry next big challenge: cybersecurity [7].

Even with high investments, companies still fail to efficiently protect their data and the benefits so far outweigh the risks for users [10]. However, the dramatically increase of data transmitted online made cybersecurity a public concern. Recently, the European Union and the U.S. heightened regulatory standards on data protection that companies now have to comply with. Fail to do so may lead to litigation, fines and sanctions that can adversely impact operations and harm reputation. Since FedEx deal with critical confidential information, a data breach can significantly impact their operations and therefore data protection is a high priority [7].

(760 words)

Endnotes:

- FedEx Secure Transportation Solution Webpage, Nov. 2016. http://customcritical.fedex.com/us/services/secure/monitoring.shtml?utm_source=temp_nav&utm_medium=sag&utm_campaign=shipmentwatch

- FedEx History Webpage, Nov. 2016. http://about.van.fedex.com/our-story/history-timeline/history/

- FedEx Investors Relation Overview website, Nov. 2016. http://investors.fedex.com/company-overview/overview-of-company/default.aspx

- “How Smart, Connected Products Are Transforming Competition”, Harvard Business Review. Nov, 2014. https://hbr.org/2014/11/how-smart-connected-products-are-transforming-competition

- “What Google Really Gets Out of Buying Nest for $3.2 Billion”, Wired, Jan. 2014. https://www.wired.com/2014/01/googles-3-billion-nest-buy-finally-make-internet-things-real-us/

- “The Internet of Things Isn’t About Things — It’s About Services”, Wall Street Journal. Aug. 2016. http://search.proquest.com.ezp-prod1.hul.harvard.edu/docview/1812831632?accountid=11311

- “Fedex 2016 Annual Report”, FedEx. 2016. http://s1.q4cdn.com/714383399/files/doc_financials/annual/FedEx_2016_Annual_Report.pdf

- “FedEx Custom Critical Launches ShipmentWatchSM”, Business Wire. Apr. 2013.

- “Inventing the Future – How Technology Is Reshaping the Energy and Environmental Landscape”, Business Roundtable. 2015. http://businessroundtable.org/inventing-the-future/fedex

- “An empirical examination of consumer adoption of Internet of Things services: Network externalities and concern for information privacy perspectives”, Chin-Lung Hsu a, Judy Chuan-Chuan Lin. Nov. 2015.

- “The Internet of Things”, McKinsey. Mar, 2010. http://www.mckinsey.com/industries/high-tech/our-insights/the-internet-of-things

- “New Monitoring Service Uses SenseAware(R) to Enhance Secure Services Portfolio”, Business Wire. Apr, 2013.

- “FedEx Joins the Internet of Things With SenseAware”, Dec. 2009. http://readwrite.com/2009/12/04/fedex_joins_the_internet_of_things_with_senseaware/

- “The Internet of Things (IoT): Applications, investments, and challenges for enterprises”, Business Horizons. Aug, 2015. http://dx.doi.org.ezp-prod1.hul.harvard.edu/10.1016/j.bushor.2015.03.008

- “3 Innovation Trends Reshaping Global Business: FedEx Conference Explores Innovation”, Jun. 2014. http://about.van.fedex.com/blog/3-innovation-trends-reshaping-global-business-fedex-conference-explores-innovation/

Data is definitely a key component in improving operations, but FedEx needs to think beyond shipment information to compete in today’s technologically advanced world. As tech companies experiment with new shipment methods such as drones and driverless cars, FedEx needs to find new ways to leverage technology and stay ahead of the curve. One issue I’ve seen with FedEx is their weariness and dismissal of disruption to the actual shipment method which seems naive given the large amount of experimentation taking place. To retain their status as a top shipment company, they need to change the culture of their firm and challenge themselves to try new types of delivery.

Very interesting post! I agree with Sairah that FedEx needs to think bigger picture outside of their traditional shipping model to sustain its business in the long-term. I definitely think FedEx’s investment in its SenseAware technology can be a competitive advantage in the near term, but one question I have is how does SenseAware help customers during times of severe weather? Packages often get delayed for reasons related to weather, and having more visibility to exactly where packages are stuck might prove to be more frustrating to customers than the current model of track and trace technology.

I would be curious to see whether Fedex can use some of the new features in SenseAware to justify increasing price of its delivery services. While it is positive the technology will result in cost savings for the company and easier management of the entire value chain, Fedex could be able to market this value-add feature as a differentiating factor and charge premium to further expand its margin. The easy accessibility to delivery status and parcel information can justify higher price to a certain extent.

At the same time, I wonder how easy it might be for competitors to introduce similar features in their own application systems. With the pace of competition accelerating in this digital space, Fedex should also think about ways to fend off other potential disruptors in the market.

Very interesting post about the new applications that can be leveraged to give the customers more information, more reliability on the service and better timing for decision making.

However I’m concerned about the scalability and sustainability of SensorWare, today , businesses pay a single monthly fee of $120 – for that they get the devices and the browser-based web service. (1) It may not seem like a huge amount for big corporations, but for small companies that are trying to enter the space of B2C via e-commerce service, all extra charges can become a restraint.

Also, it would be interesting to see how this service is leveraged in other industries that doesn’t require so much handling care and still argue that the price is worth it.

1. “FedEx Joins the Internet of Things With SenseAware”, Dec. 2009. http://readwrite.com/2009/12/04/fedex_joins_the_internet_of_things_with_senseaware/

Thank you for sharing such an interesting post. SenseAware seems to present a big advantage where time and product quality is of the essence, aligning with FedEx’s customer promise. I am curious to see the opportunity size here. I.e. they are investing $400M per year, but what’s the value added? Do they expect SenseAware plus IT security to pay off immediately through higher pricing, or is this an investment that can only be paid back over time through added brand value? Or only in combination with other innovation that will make the impact noticeable?

Another thought is the extent to which they intend to share the detailed analytics with customers, versus using it only to improve company operations. To Ryan’s point, I can imagine that some customers would be willing to pay extra for such transparency. As a future service, if a customer’s package has a detailed ETA of say, 27 hours, that customer could pay extra to reduce the time in real-time. FedEx might then ship their package from the nearest mailing center by sending a drone at midnight, instead of waiting for the morning mail truck.

Curious to hear what you think!

Thanks for this post – very interesting! As several of the comments above have mentioned, my main area of concern for Fedex would be around its long term sustainability, particularly as highly-integrated competitors like Amazon begin implementing sensor-based logistical technologies using drones or driverless cars. Given that Amazon is currently a large client of Fedex (Fedex and UPS together deliver a large majority of Amazon’s packages), I worry that Fedex will be losing much of its business and competitive advantage as Amazon continues to experiment with new ways of delivering its own packages. Amazon has great incentive to fully integrate shipping into the rest of its supply chain, as it allows the firm to have more control over a consumer’s overall shopping experience, as well as helps to reduce shipping expenses for the long term (http://www.fool.com/investing/general/2014/07/21/despite-optimism-fedex-corporation-faces-challenge.aspx). Aside from looking into more disruptive, technological advances beyond SenseAware, I wonder if Fedex should look into establishing some type of partnership with Amazon in the short/medium term.

Thank you for posting, Gabriela! I think drone deliver is something FedEx should consider seriously. In a system where, I imagine, the bottleneck is the drivers and trucks, drones would drastically improve delivery speed and cost. In terms of providing real-time data to customers, I think something they still need to figure out is how to deliver to customers at the optimal time of day, especially when signatures are required. With Amazon starting to handle their own deliveries (and via drones), to compete, FedEx must increase its flexibility of delivery times.

Great article Gabriela! Really cool to see how FedEx is using SenseAware to give customers more granular and real time data on their shipments. While that data must be very useful to the customers, I also wonder about how FedEx can use this real time data about parcels in its system for logitical/operational improvements as well as for its pricing models.

While I am sure FedEx has very robust and complicated models, I am curious whether this additional data can be used to make FedEx’s resource utilization more efficient, and to map out last-mile delivery routes that decrease the total throughput of a package. More interestingly, I wonder whether this data might be used for last-minute dynamic pricing deliveries, where FedEx can determine routes with lower than expected capacity and offer discounted rates for people trying to send packages on those routes at the last minute or with more sensitive time constraints.

Interesting article, would love to understand the size of the SenseAware application now in FedEx (% of total shipments, revenue). Given that it was rolled out more than 5 years ago I would expect it to be a large part of FedEx’s delivery system. However, historically acceptance or applicability and scalability of such products has been a challenge. From the surface, this seems to be the case for this product as well. It is seems to be a small part of FedEx Freight Segment (not reported in 10-Ks) and the segment itself seems to have been flat overall in 2016. Would love to understand how successful this product was for them.

I wonder what other innovations FEDEX is pursuing with its annual R&D investments of $348-$403 million? The SenseAware technology is definitely a point of differentiation as you highlighted, but as Ryan An asked: can FEDEX charge higher prices with this technology? As you also pointed out, SenseAware adds packages to the IoTs and creates a great source of data for FEDEX, but what is the overall problem they are trying to address? Sorry for all of the questions, but this is a very interesting topic! Thanks for sharing.