Exploring the Future of Beauty Through Open Innovation and Co-Creation at L’Oréal

Can L'Oreal use open innovation programs to co-create its way to the future of beauty consumer retail?

The global beauty sector, led by mature companies like L’Oréal, Estee Lauder, Shiseido and LVMH, is not usually top of mind when it comes to innovation. However, changing industry dynamics have placed traditional beauty companies at the forefront of new approaches to product development and the retail consumer experience.

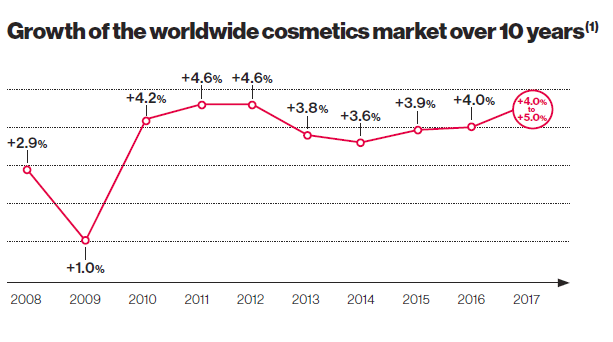

The beauty sector grew 4-5% in 2017 and is forecasted to continue at a similar pace over the coming 3-5 years [1].

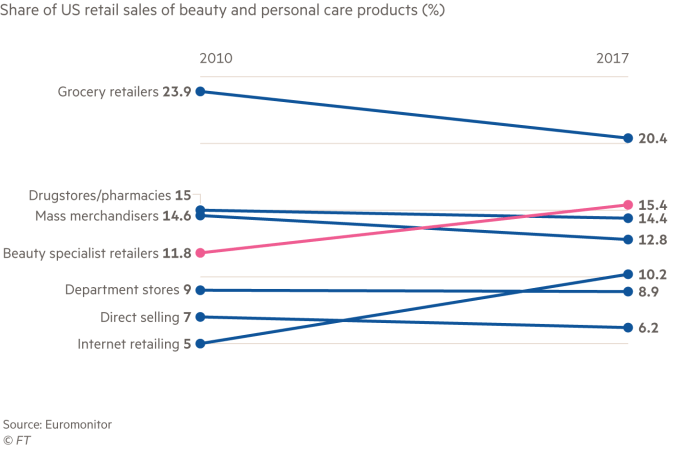

Unlike other categories of retail where growth in online sales has come at the expense of brick & mortar (B&M) sales, the beauty sector has grown in both online and offline channels [2].

Underlying overall industry growth is increasing demand for natural, organic and “clean” beauty products, increasing demand for personalized products and the rapid growth of niche, indie, and social-media savvy brands. Against this backdrop, major beauty companies are innovating to stay at the forefront of new product development and the beauty consumer experience. For L’Oréal, the largest beauty company in the world, with 35+ brands across makeup, skincare, haircare and fragrance, this has required embracing the principle of open innovation to become an accelerator for indie beauty brands, beauty tech and digital marketing startups.

Unlike traditional open innovation methods like public challenges and public voting on community generated ideas, L’Oréal’s approach to open innovation is to (1) identify early stage companies creating innovative beauty products and improving the beauty customer experience via partnerships with start-up incubators Station F and Founders Factory and VC firm Partech Ventures, and (2) work with those companies for 6 to 12 months to co-create beauty sector innovation. L’Oréal offers companies mentorship and access to L’Oréal’s R&D resources and distribution channels, with the goal of building proof of concepts, testing and scaling their ideas within L’Oréal brands [3, 4]. L’Oréal, in turn, gains insight into innovative approaches to the most pressing challenges in beauty and a pipeline of potential acquisition candidates and partners. With the company’s focus on the intersection of beauty and tech, many of companies that have gone through L’Oréal’s accelerator so far fall quite far outside the company’s traditional makeup and skincare product innovation domain. They include Sampler, a marketing tech solution for targeted direct to consumer product sampling, Tailify, an influencer management platform, Riviter, a visual search solution, and Preemadonna, a custom nail art printer. As such, L’Oréal’s open innovation program is more attuned to discovering the future of beauty than iterating the present.

While L’Oréal is currently using open innovation to identify transformative solutions within a broad list of pre-determined categories like data, ecommerce, retail transformation, influencer tools, personalization and AI / AR / VR, it can and should also leverage open innovation to tackle more granular day-to-day problems by issuing specific public challenges. Consumer goods peers Unilever and Johnson & Johnson frequently issue detailed public challenges and invite technical solution proposals from suppliers, start-ups, academics, designers, and individual inventors via pitching competitions [5, 6]. The challenges describe a specific problem faced by the company (for example, a need for novel freezing and cooling technologies), main requirements for a solution and the desired outcomes. L’Oréal could similarly leverage open innovation to solve similar granular business problems more creatively and efficiently by opening those problems up to the public.

L’Oréal should also try to engage its consumers in open innovation efforts, instead of just other companies. Management experts have argued users are more likely to generate novel product ideas because they experience novel needs when using the products, while manufacturers are likely to generate incremental innovations because they are focused on the challenges of mass production [7]. Pulling consumers into the idea generation and idea selection portions of the innovation funnel could yield significant benefits to L’Oréal and an edge over competitors more focused on internal R&D and B2B open innovation.

As L’Oréal and other beauty companies continue to incorporate open innovation into product development and their vision for the future of beauty, many open questions loom:

Do beauty companies risk losing their competitive edge by opening R&D, the highly guarded crown jewel of many beauty companies, to the public domain?

What areas of a company’s operations, if any, are not amenable to open innovation? Are certain processes better suited to traditional internal innovation processes?

How will open innovation change the beauty business model? What is a beauty consumer goods company’s core strength when idea generation and potentially even idea selection are crowdsourced? Could innovation management, manufacturing, distribution, sales or marketing usurp technological innovation via internal R&D as a beauty company’s core strength? (756 words)

[1] L’oreal 2017 Annual Report, “Cosmetics Market”, https://www.loreal-finance.com/en/annual-report-2017/cosmetics-market, accessed November 2018.

[2] Nicolaou, Anna and Keane, Aimee. “Retail: Is the beauty industry ‘Amazon-proof’?” Financial Times, May 7, 2018, https://www.ft.com/content/acfe1924-4de9-11e8-8a8e-22951a2d8493, accessed November 2018.

[3] L’Oréal’s Partnership with Station F, https://www.loreal.com/group/startups/stationf, accessed November 2018.

[4] L’Oréal’s Partnership with Founders Factory, https://www.loreal.com/group/startups/founders-factory, accessed November 2018.

[5] Unilever, “Open Innovation,” https://www.unilever.com/about/innovation/open-innovation/, accessed November 2018.

[6] Johnson & Johnson Innovation, “Challenges,” https://www.jnjinnovation.com/challenges, accessed November 2018

[7] K. Lakhani and J. Panetta. The principles of distributed innovation. Innovations: Technology, Governance, Globalization 2, no. 3 (Summer 2007): 97–112.

Very insightful and well-structured overview of L’Oréal’s approach to open innovation. I love the idea to include consumers more in this process, given how close they are to the products. I can see how this not only brings in new, innovative product ideas but also strengthens the identification with the brand, therefore creating positive “spill-over effects” to Marketing & Sales efforts.

One challenge I see here is how many of the ideas would be actually feasible, and how “widening” the funnel would increase costs for L’Oréal to evaluate and identify promising ideas. The current process in place seems to be very focused: By predominantly focusing on early stage companies that are active in the innovative beauty products space, L’Oréal already filters out a lot of potential sources for open innovation ideas (vs. companies that may let “everyone” participate in their open innovation process). The question here would be how to quantify the advantages of bringing in more ideas and having a larger pool of innovation available to choose from, in contrast to having to invest more resources in evaluating all these ideas, being aware of the risk that the quality of ideas might also decrease the more we open up our process.

Really interesting questions you raise in this paper. Here you lay out a really interesting tension of leveraging data and customer feedback to be more innovative vs. preserving brand authority by being more discrete and “knowing”/developing the best product. It feels like as L’Oreal has ventured into some of these more innovative spaces such as adtech/martech they are risking their stronghold of being a collection of strong legacy beauty brands. Ultimately big data and machine learning capabilities still feel comoditized today – people have more or less similar data, at least no one has found a dominant data set within beauty – and the value of a brand still rests on it’s reputation and the augmented value they provide to the consumer. It certainly feels like L’Oreal may risk the credibility of their brand if they start blindly following tech trends and open their R&D up to the public rather than leverage their new data assets in a more private way that will allow them to maintain their brand authority.

How interesting! I did not know that the beauty sector has grown in both online and offline channels while B&M sales in other retail sectors have declined (with the growth of online sales). From this article, I learned that L’Oréal’s main approach has been to connect with entrepreneurs at the cutting edge of their industry. Rather than source ideas from the public, L’Oréal is partnering with thought leaders who are similarly experimenting at the intersection of beauty and technology. I was struck by your comment “L’Oréal’s open innovation program is more attuned to discovering the future of beauty than iterating the present.”

While you question their resistance to engage in open innovation efforts with consumers, I believe it is precisely because they do not want to make their R&D efforts “public domain,” just as you said. By working closely with small companies, they have positioned themselves to gain significant insights from industry innovators and not waste time qualifying valuable consumer ideas.

I really enjoyed reading this post. I think your first question is critical, do beauty companies risk losing their competitive edge by opening R&D, the highly guarded crown jewel of many beauty companies, to the public domain? Another question I have is, how does the cost structure of open innovation programs compare to traditional R&D? Crowd sourcing seems like a very inexpensive way to conduct research, but on the other hand, joint ventures and partnerships might actually be more costly than traditional research conducted in-house.

Thank you for this post. As someone who knows very little about the beauty industry, it was interesting to hear your perspective on the opportunities for open innovation at L’Oreal. I was struck by your recommendation about how L’Oreal should offer specific “challenges” to the public in addition to their current program of incubators and accelerators. This is very similar to what NASA is doing to crowdsource innovations in space travel (see our classmate’s submission on NASA) In that case, I believe what makes their model successful is that NASA allows the public to use their IP in order to innovate. This may be a no-go for L’Oreal, but if they are willing to take the risk they may be able to generate more meaningful innovations!

Thanks for sharing the interesting info and great thoughts on L’Oréal!

In such a highly competitive beauty industry and with the numerous emerging DTC brands, it’s fascinating to see L’Oréal’s full-on approach to stay ahead. I agree with your suggestion on the customer focus to drive deep insights. I think the key here is on designing a program with strong financial incentives and psychological drivers for power users to engage. In addition, in conjunction with all the existing and suggested outward facing efforts to identify great ideas, L’Oréal also needs to focus on creating a risk-taking and entrepreneurial culture internally to most effectively adopt and adapt into the latest innovations.

You asked some amazing questions at the end, which I believe represent the trend of crowdsourcing ideas as the underlying fundamental shift of innovation processes across industries. This decentralization will eventually drive the sharing of reaped benefits from large corporates to individual contributors through a revolutionary way in the long long term.

Very interesting topic on the open innovation in L’Oreal as I also wrote about it. But I raised a question on the tension of both internal and external innovation due to the misalignment of interest, since the internal parties in the company might be hesitated to fully adapt the external innovation result given their existing collaboration resources and networks.