Disrupting GM’s Supply Chain One Tweet At A Time

General Motors faces President Trump’s ire for its globalized supply chain. Yet Trump’s “America FirsT” NAFTA renegotiations will only worsen the situation for American jobs.

President Trump was elected into office on a platform of fierce “America First” nationalism, and has repeatedly called NAFTA the worst trade deal ever signed. He argues that the deal disproportionately hurts the U.S., citing the ~$63B trade deficit with Mexico as evidence[1]. As a result, NAFTA renegotiations are currently underway. One of the industries most nervous is automobile manufacturing. The auto industry is responsible for ~$74B of the aforementioned trade deficit, and Trump has signaled out major players like General Motors (GM) for killing American jobs by moving production to Mexico[2], so it is clear that any NAFTA changes will involve the industry.

Figure 1. President Trump’s late night tweet decries GM’s decision to produce in Mexico.

GM and its peers have ample reason to be concerned, as they are deeply reliant on globalization. Auto manufacturers rely on off-shoring production to “best cost” countries, which ultimately translates into lower costs for consumers[3]. Under NAFTA, GM is able to source a variety of intermediate parts tariff-free from both Canada and Mexico. In 2016, Mexico and Canada accounted for 49% of U.S. vehicle and auto parts imports[4]. The supply chain is divided up so minutely that parts and sub-assemblies may cross NAFTA borders more than six times before converting to finished goods[5]. And production spreads much farther than just North America; GM’s supply chain spans 17 plants in 31 countries. Beyond significant cost savings, globalization has allowed GM to reduce supply chain risk via diversification.

A few of Trump’s proposed NAFTA changes are especially alarming. NAFTA’s “rules of origin” specify that 62.5% of regional value content (RVC) for vehicles and parts must be produced in North America[6]. Trump wants to increase the RVC to 85% and institute a U.S. specific content requirement at 50%[7]. Further, he seeks to both expand the scope of the requirements and tighten the rules for what can qualify. Trump has even threatened to institute a 35% tariff on imports from Mexico. These changes could be financially devastating for GM, as much of their labor-intensive production has moved to Mexico, and they benefit from content exemptions and loose qualification rules[8]. And supply chains have become so complex that implementing new tracing mechanisms would be onerous.

In the short term, GM’s management’s focus has been to influence NAFTA negotiations. The American Automotive Policy Council (AAPC), which represents GM, Ford, and FCA, has been vocal in expressing the severe negative effects the proposed changes could have on the American economy. AAPC and other major alliances representing the auto industry have also formed “Driving American Jobs”, a coalition leading the charge to influence lawmakers to prevent Trump’s changes[9]. Beyond lobbying, GM has largely continued business as usual, a smart move given the uncertainty around the negotiations’ outcome. For example, they have moved forward with an $800M investment to retool one of their Mexican facilities, but have not publicized it via press releases or released much information, presumably to avoid Trump’s wrath[10]. GM is also already digitizing their supply chain, which may help them in the event of new tracing requirements.

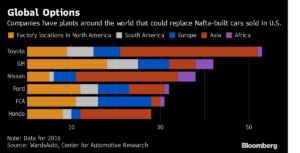

Beyond their actions to date, GM could take a few additional steps. They should clearly highlight their American investments; publicizing their recent $1B expansion of a Texan factory and establishment of a supplier facility can be powerful in swaying public opinion. Management can also prepare for the potential financial implications of NAFTA by continuing to invest in technological improvements that would increase efficiency and automation, thereby reducing costs. If any of Trump’s more radical proposals come to fruition, GM’s management will need to make difficult decisions on how to reshape their supply chain. Based on their financial calculations, GM could react by shifting production back to the U.S. as Trump hopes, or just the opposite. Increased U.S. production may only be economically feasible with high-tech production via robots (not American workers)[11], requiring significant technological investments. If management determines it is too costly to comply with increased content requirements, it may shift even more production to low-cost Asian countries, choosing to pay the 2.5% on imports[12]. This would entail additional investments abroad to increase capacity, and may involve shutting down North American facilities. Either way, it’s likely the increased costs GM would face under NAFTA changes will reduce, rather than create, American jobs.

Figure 2. GM has dozens of plants worldwide that could accommodate production.

Source: https://www.bloomberg.com/news/articles/2017-10-11/auto-industry-warns-trump-proposing-lose-lose-changes-to-nafta

For GM, a key question remains: given both the cyclical nature of automotive demand and the fact that only 3-7 years remain of a Trump presidency, how should GM walk the fine line of preparing itself for big changes while not incurring huge financial costs that may soon be unnecessary?

(Word Count: 788)

[1] “Auto Industry Warns Trump Is Proposing ‘Lose-Lose’ Changes to Nafta,” Bloomberg.com, October 11, 2017, https://www.bloomberg.com/news/articles/2017-10-11/auto-industry-warns-trump-proposing-lose-lose-changes-to-nafta.

[2] “Trump on Collision Course With Auto Industry as NAFTA Talks Begin,” Fortune, accessed November 16, 2017, http://fortune.com/2017/08/14/trumps-nafta-autos-talks-mexico/.

[3] “NAFTA Briefing: Trade benefits to the automotive industry and potential consequences of withdrawal from the agreement,” Center for Automotive Research, accessed November 16, 2017, http://www.cargroup.org/wp-content/uploads/2017/01/nafta_briefing_january_2017_public_version-final.pdf.

[4] “The North American Free Trade Agreement (NAFTA),” Congressional Research Service, May 24, 2017, https://fas.org/sgp/crs/row/R42965.pdf

[5] “A Renegotiated NAFTA: Implications For The Auto Industry,” Thomson Reuters Tax & Accounting, February 17, 2017, https://tax.thomsonreuters.com/blog/onesource/a-renegotiated-nafta-implications-for-the-auto-industry/.

[6] “NAFTA Negotiation Update: Auto & Parts Sector Implications,” Center for Automotive Research (blog), October 13, 2017, http://www.cargroup.org/nafta-negotiation-update-auto-parts-sector-implications/.

[7] “NAFTA Negotiation Update: Auto & Parts Sector Implications,” Center for Automotive Research (blog), October 13, 2017, http://www.cargroup.org/nafta-negotiation-update-auto-parts-sector-implications/.

[8] “Automakers Urged to Prepare for NAFTA Changes,” accessed November 16, 2017, http://www.autonews.com/article/20170605/OEM11/170609913/automakers-urged-to-prepare-for-nafta-changes.

[9] “Driving American Jobs,” accessed November 16, 2017, https://www.drivingamericanjobs.com/.

[10] Andrea Navarro Welch Nacha Cattan and David, “GM Invests Millions in Mexico as Ford Absorbs Blows from Trump,” chicagotribune.com, accessed November 16, 2017, http://www.chicagotribune.com/business/ct-gm-mexico-investment-20161014-story.html.

[11] “NAFTA Redo Could Lead to Tariffs on U.S.-Built Cars,” Detroit News, accessed November 16, 2017, http://www.detroitnews.com/story/business/autos/2017/08/14/nafta-renegotiation-tariffs-american-automakers/104608430/.

[12] The New York Times, “Revisiting Nafta: The Stakes for Key Industries,” The New York Times, April 27, 2017, sec. Economy, https://www.nytimes.com/2017/04/27/business/economy/nafta-impact-industries-cars-agriculture-apparel-pharmaceuticals.html.

I agree that increasing North American RVC content requirements could prove a crippling blow to U.S. automotive OEMs such as GM, who have historically had difficulty managing their cost structures through economic cycles. Despite the financial consequences of repatriating manufacturing operations, however, several players across the automotive value chain have responded to the populist pressures beyond merely increasing lobbying efforts.

In January 2017, for instance, G.M. announced a $1 billion investment to insource the production of pickup axles from Michigan to Mexico, reportedly creating 5,000 U.S. jobs.[1] This investment comes in addition to the Texan factory expansion, referenced above. Similarly, since January of 2017, Ford has announced billions of dollars of investment in U.S. manufacturing facilities and has cancelled previously announced plans for billions of dollars of investment in new facilities in Mexico.[2]

While it’s unclear how the NAFTA policy adjustments will ultimately manifest, it appears that recent operating decisions by U.S. auto companies have been influenced by anti-globalization sentiment. Whether these decisions represent marginal choices meant to assuage public outcry or signify a broader shift in strategy intended to preempt potentially punitive policy changes remains to be seen.

[1] General Motors says to invest additional $1 billion in U.S. David Shepardson – https://www.reuters.com/article/us-gm-jobs-trump/general-motors-says-to-invest-additional-1-billion-in-u-s-idUSKBN15107B

[2] Ford Adding Electrified F-150, Mustang, Transit by 2020 in Major EV Push; Expanded U.S. Plant to Add 700 Jobs to Make EVs, Autonomous Cars. http://shareholder.ford.com/~/media/Files/F/Ford-IR-V2/news-and-publications/2017/ford-adding-electrified-f-150-mustang-transit-by-2020.pdf

Very interesting perspective Anisha! A clear example of reactions automotive manufacturers have had to take because of the risks posed by potential NAFTA negotiations and measures the US government could take to encourage (or force?) production in the US is the fact that Ford cancelled its plans to invest US$1.6bn in a new manufacturing plant in Mexico in January of this year. I imagine this was a big hit to Ford, which had already made a decision that could not be done overnight.

A question I ask myself if whether taking away a significant number of job opportunities from countries like Mexico will only encourage Mexican illegal immigrants to go seek these types of opportunities in the US. Does the current administration prefer to have more jobs in America, even if they may be done by illegal immigrants?

Excellent summary of the key issues, and very helpful in framing up the implications. It is interesting that GM and Ford appear to be taking slightly different tacks in trying to handle this issue, with GM investing heavily in lobbying efforts while Ford has decided to eat some of the cost to take the “desired action” in an effort to win the PR game. I think one of the key questions underlying all of this is whether this is a short flare up of nationalism or a larger trend likely to extend beyond the duration of a Trump presidency. Given events around the world, it is likely also prudent to consider the potential impact beyond North America when evaluation alternate strategies. Both of those components need to be considered, especially when thinking about how to leverage GM’s lobbying efforts. Should they focus on putting pressure on representatives and candidates (e.g. media or inducements) which could be better to stave off a short-term issue? Or do they need to invest heavily in educating the public in an effort to persuade voters?

Really interesting (and a bit scary) read. I can’t help but wonder how the vicious cycle is not obvious to the Trump administration: forcing manufacturing operations / sourcing into the US will increase the company’s cost structure (albeit maybe mitigated by some of your suggestions) which will inevitably have to be passed on to consumers, which will drive volume away from the american players. These companies will gradually lose share and be forced to divest assets and therefore jobs in the United States – exactly the opposite of the stated campaign goals. While that might oversimplify and there are clearly mitigating strategies to take along the way, I worry that the underlying fundamentals make this a bleak picture regardless of the steps taken.

As you correctly pointed out, a key factor that GM and other US-based OEMs need to consider while deciding changes in their global supply chains around current NAFTA re-negotiations, is the length of the manufacturing cycle of automobiles. The development of a new model starts two to five years prior to marketing it to the public, therefore, in case current POTUS does not get re-elected, current mandated projects to GM’s plants in Mexico or to third-party autopart manufacturers are better off keeping current operations while NAFTA re-negotiatons end. The only solution that the OEMs should be implementing while re-negotiation results are uncertain, is to slow the awarding of new projects to manufacturers in Mexico and Canada.

Thank you for such an interesting read! GM should continue to lobby government officials and NAFTA however I would be worry of GM investing too much into trying to mediate Trump’s legislation. As mentioned in the other comments I think that Trump’s administration may not last long and the legislation may not take effect. Instead, I would look at options which is best for the company’s business as a whole. First, I would look at how much of GM’s revenue is made up of sales in the US market so evaluate whether it would be profitable. Secondly, from Figure 2 we see that compared to other motor companies, GM has the greatest proportion of manufacturing plants in North America. As competition increases I would expect increase in competition of prices. In order to remain competitive GM should maybe consider Asia where the cost of production is mentioned in the article to be cheaper. GM should only implement measures which will improve the company’s financials as a whole and grow the business rather than just implementing measures to mediate the threat of the legislation.