Digitize or Die – How the Nation’s Largest Magazine Publisher is Coping with Digital Transformation

As consumers are no longer engaged by print magazines, the nation’s largest publisher is being forced to innovate, and innovate quickly.

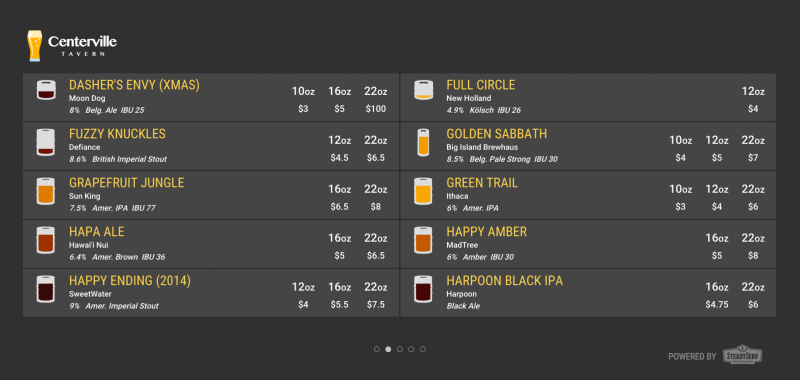

Framing the Scene: Print Advertising in Secular Decline

The U.S. magazine publishing industry is in steep secular decline given the proliferation of mobile devices and rising consumption of digital media.

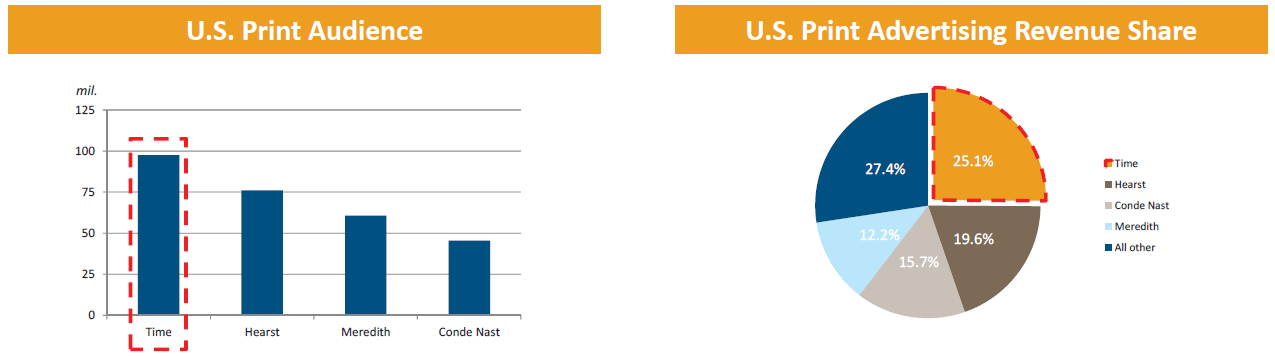

For Time Inc. (TIME), which was spun off from Time Warner in 2014, this trend is particularly disconcerting given for most of its history, TIME has been focused on publishing a robust portfolio of traditional print-based magazines, and has amassed the largest such portfolio of popular brands in the U.S. (e.g., People, Sports Illustrated, InStyle, TIME, Entertainment Weekly, Essence, and Fortune, among others). In 2015, its U.S. print audience approached nearly 100 million viewers and its print advertising revenue share surpassed 25%[1]. Though we have always been told that being the industry behemoth provides benefits of scale, a quick look at deteriorating newspaper businesses is quite sobering.

Source: Stephens Inc. Research, 6.23.2016, Page 8

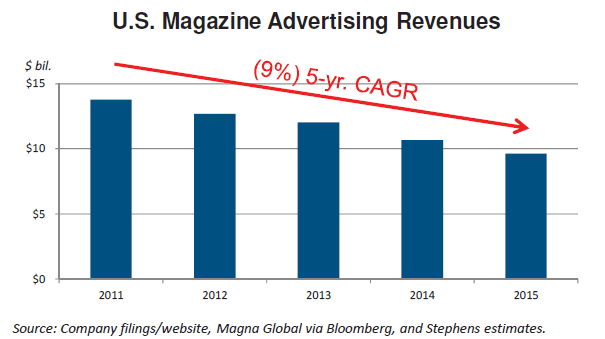

Despite enjoying double digit growth in digital advertising, TIME has yet to be able offset heavy losses on the print side[2]. In 2015, TIME’s print advertising revenue declined $153 million, only to be offset by $33 million growth in digital advertising revenue. TIME has for some time mentioned it expects to reach an inflection point in 2016, with growth in digital advertising expected to offset declines in print[3], although disappointing Q3 results present risk to turning the corner[4].

Source: Stephens Inc. Research, 6.23.2016, Page 12

Source: Stephens Inc. Research, 6.23.2016, Page 12

TIME Must Adapt and Transform Its Business Model and Organizational Strategy

When Joe Ripp took the reins of TIME as CEO post the spin-off in 2014 (since replaced by Rich Battista), he made it clear that TIME would no longer be associated as a magazine company, but as a full-fledged media company[5]. TIME deployed a robust digital transformation strategy, including redesigning the organizational structure and enhancing its business model in a number of key ways.

From an organizational perspective, TIME has attempted to redesign positions to suit an increasingly digital world[6], including:

- Forming new digital roles – President of Digital[7] and Chief Content Officer[8]

- Reorganizing Product, Editorial and Advertising Sales teams – Teams to work across all brands with a focus on digital and away from print vs. dedicated teams within brands[9]

TIME has also implemented key enhancements to its business model including:

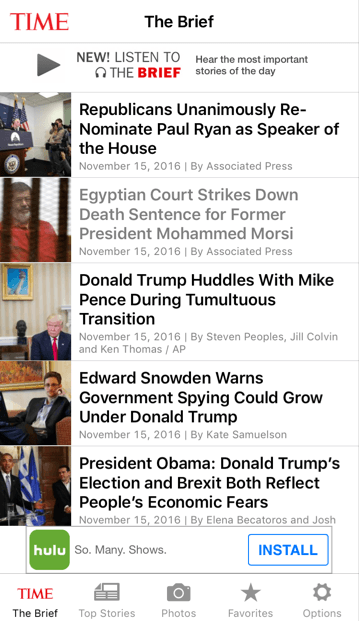

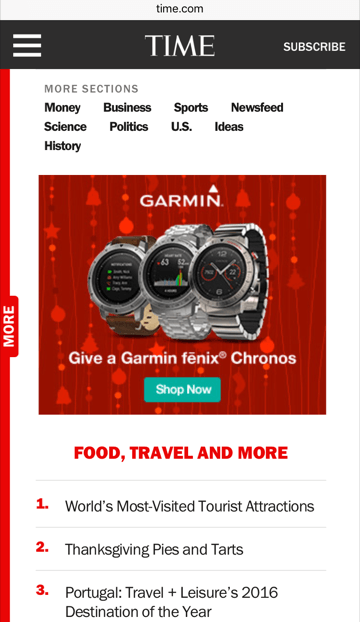

- Providing greater value to advertisers – Recently acquired people-based adtech company Viant[10] for $87mm to better understand its users and hopefully leverage Viant’s owned MySpace assets (failed social network millennials were addicted to in high school)[11]. Goal is to improve targeting and customization on digital formats, including via native solutions (as shown below)

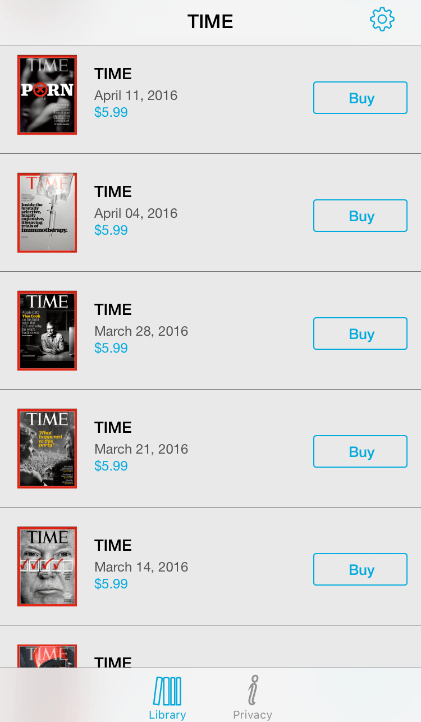

Source: TIME Mobile app. Time.com.

- Increasing diversity of pay offerings – Offering digital-only subscriptions and single-copy digital issues of magazines via digital stores (e.g., the App Store), as well as bundling print subscriptions with cross-device digital subscriptions

- Increasing social media presence – Creating branded pages, investing in content and forging key partnerships (e.g., Facebook)[11] to further engage viewers, particularly on mobile devices, with a goal of fostering loyal followers to convert into sales

- Diversifying revenue streams – Pursuing Time Inc. video programming and distribution, live events and conferences, as well as building out adjacencies including Sports Illustrated Play, a digital registration platform for youth and amateur sports[12]

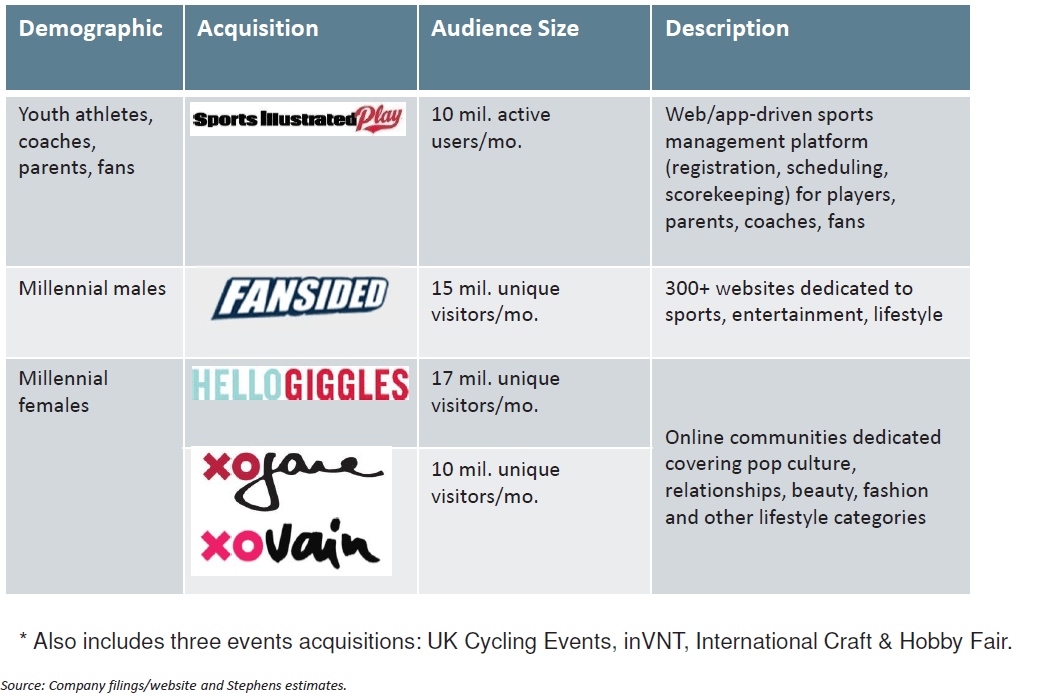

- Acquiring digital companies – If you can’t build it, BUY IT! In addition to Viant, TIME has recently been aggressively acquiring companies targeting millennial audiences

What More Can Be Done?

In a world in which consumers are constantly on their mobile devices sharing stories, photos, blogs, and Tweets, TIME should be further capitalizing on a user generated content (UGC) strategy. Research from Crowdtap and Ipsos states that millennials trust UGC 50% more than other media as UGC comes across more authentic.[13] An effective UGC strategy could serve to enhance brand awareness and loyalty, as well as increase lead generation data and sales.[14]

As a first step, TIME needs to more thoroughly understand and track how millennials are interacting with its brands and content. The next step would be to develop more effective mechanisms to convince consumers to engage and share on social platforms, including leveraging what’s popular in the media, spurring viral activity (e.g., ALS Challenge), providing incentives for engagement (e.g., having consumers rate each other’s posts to be featured), among many other strategies.[15]

Who Cares?

TIME shareholders, employees and consumers certainly should! As the largest publisher with over 100 brands and 7,200 employees, TIME must innovate and drive digital adoption or risk being a legacy brand from the past.

(742 words)

[1] Stephens Inc. Research, 6.23.2016, Page 8

[2] http://www.mediapost.com/publications/article/279073/print-ad-declines-newspaper-magazine-revs-fall-a.html

[3] Morgan Stanley Research, 11.4.2016, page 7

[4] http://www.wsj.com/articles/time-inc-revenue-falls-digital-cant-offset-print-declines-1478173930

[5] http://www.wsj.com/articles/SB10001424127887323829104578621762381384482

[6] https://www.epublishing.com/blogs/1/post/475-time-inc-lessons-in-digital-transformation

[7] http://www.wsj.com/articles/time-inc-appoints-new-digital-chief-1450195949

[8] http://www.nytimes.com/2016/07/14/business/media/time-inc-names-alan-murray-as-chief-content-officer.html?_r=0

[9] https://www.timeinc.com/about/news/press-release/time-inc-announces-key-steps-to-drive-transformation-for-long-term-growth/

[10] http://viantinc.com/about-us/

[11] http://fortune.com/2016/09/13/time-inc-new-ceo/

[12] Stephens Inc. Research, 6.23.2016, Page 12

[13] http://mashable.com/2014/04/09/millennials-user-generated-media/#d.nnzQhb8kqd

[14] https://www.epublishing.com/blogs/1-the-epublishing-blog/post/450-the-what-and-why-of-user-generated-content-ugc

[15] https://www.epublishing.com/blogs/1/post/455-thinking-digital-what-the-ny-times-innovation-report-tells-us-part-ii

While it’s great that Time isn’t standing still, I can’t help but wonder if this will be enough. It seems like the fundamental operating model hasn’t changed, despite the strong decline in revenue and the general devaluation of information across society. Will improving brand awareness and gaining new customers be enough, or will Time and other publishers need to dramatically change what it means to be a magazine?

I’m pretty frightened by the statistic that millennials “trust” user-generated content 50% more than other media sources, given that UGC is not fact-checked (I’m at least assuming it’s not!). Would you recommend a greater reliance on UGC across TIME’s 100 brands, or do you think this strategy is more appropriate for its millennial-oriented brands (e.g., Hello Giggles) only? In taking a quick look at TIME’s brand portfolio, many of the publications seem to target a different demographic. I’m curious to hear your thoughts on other strategies TIME should pursue outside of catering to our generation.

If I were them I would also focus on pruning its portfolio (i.e., monetizing its non-core assets / brands) in order to more effectively allocate resources towards its most profitable brands.

It’s interesting that Time is growing its digital footprint so aggressively, I just wonder if the lackluster Q3 results are an indication of tough times ahead. Integrating the magazine brands that are behind Time into a profitable digital space will take more than uploading them into an app, something I’m sure Time is realizing. Building trust behind each physical magazine’s brand took time. Now, with an influx of information and companies playing in the digital space, differentiating Time’s brands from the masses will most likely prove very difficult. It might be too little too late.

While I certainly believe that TIME is commited to succesfull transitioning in the digital age, I concur with DK that there seems to me a more fundamental shift in the industry due to the disruptive nature of digital innovations in this space. I wonder whether this industry, similar to the music industry, has experience such a tectonic change that will require companies like TIME to not only transform, but to completely reinvent themselves. “How?” is the more challenging question, as I can’t think of concrete ways that they should consider to change their business model.

Interestingly enough, I myself was thinking very hard about writing a post about the demise of print media. I certainly think that as population ages, the prevalence of this particular type of media will rapidly diminish. The question to me is one of relevance as you point out yourself. Increasingly we are living in an “echo-chamber” world where news and media are tailored to our preferences, which we in turn reinforce through conscious self-affirming behavior. Where can a once reputable magazine like TIME fall in this dynamic landscape? Big question, and I am glad I am not the one answering that on Time’s behalf. Great post overall and I am hoping this one is picked for discussion during TOM.