Digitalization for survival – Halliburton’s attempt at transforming the oil and gas industry

A world of fully automated robotic rigs may be around the corner. Read how Halliburton plans on going about doing it.

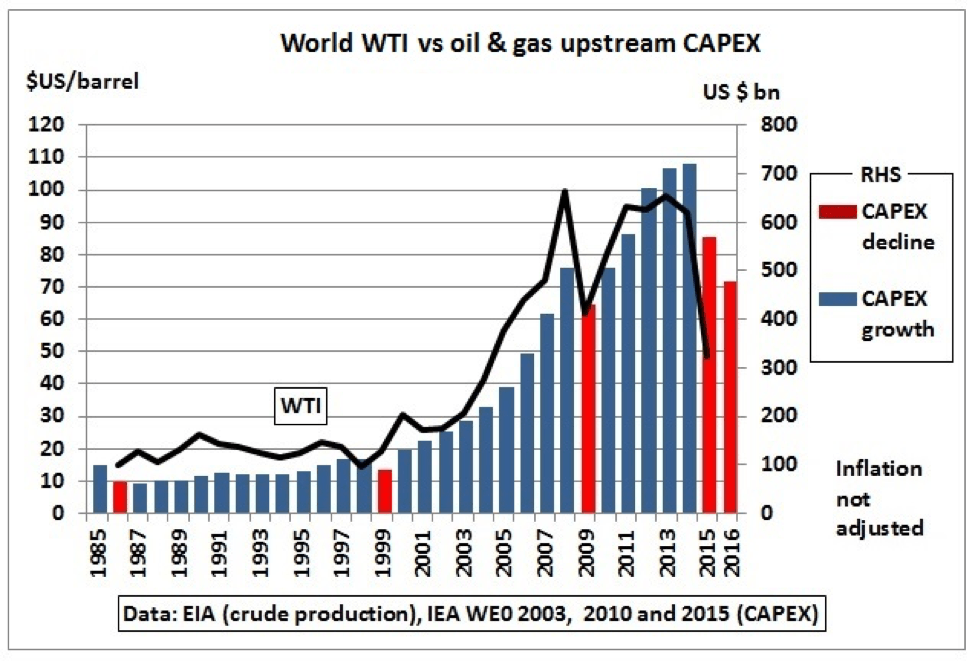

As oil prices continue falling like a knife because of sentiment shift owing to the structural changes in supply caused by shale revolution, operators are laser focused in reducing costs. This has translated to a sharp cutback in supply chain spending [1].

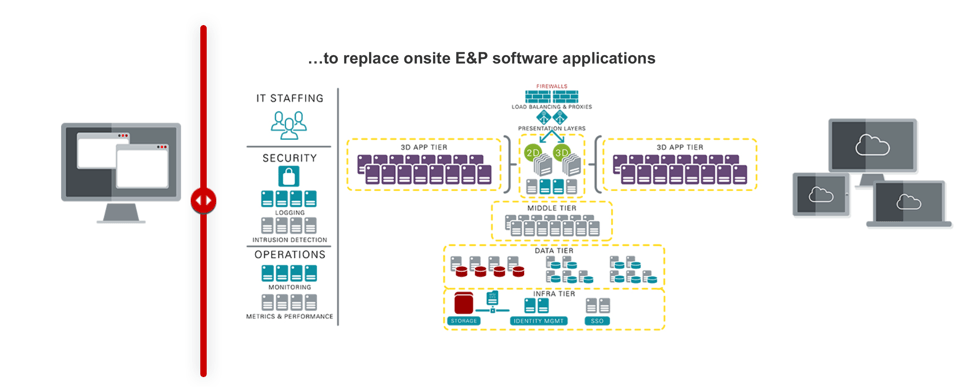

GE spent 32 billion dollars to take over Baker Hughes largely because it saw an untapped opportunity of bringing digitalization to the oil patch [2]. Because of GE’s domain expertise on digitalization of industrial goods, the entry of GE has ringed alarm bells in the oilfield services sector. Traditionally, Halliburton has relied on its size to weather oil industry downturns. Given the acquisition of Baker Hughes by GE, Halliburton stands as a distant 3rd in terms of revenue. To remain competitive in this post acquisition environment, Halliburton has to move towards innovation. Innovation that can lead to reduction in cost per barrel for its many clients. In the short term, Halliburton’s Landmark has introduced the DecisionSpace Platform that enables large-scale collaboration on large quantities (terabytes) of legacy data and real-time information in upstream operations [4]. In the next two years, Halliburton looks to transform this platform to the cloud under the name of DecisionSpace365.

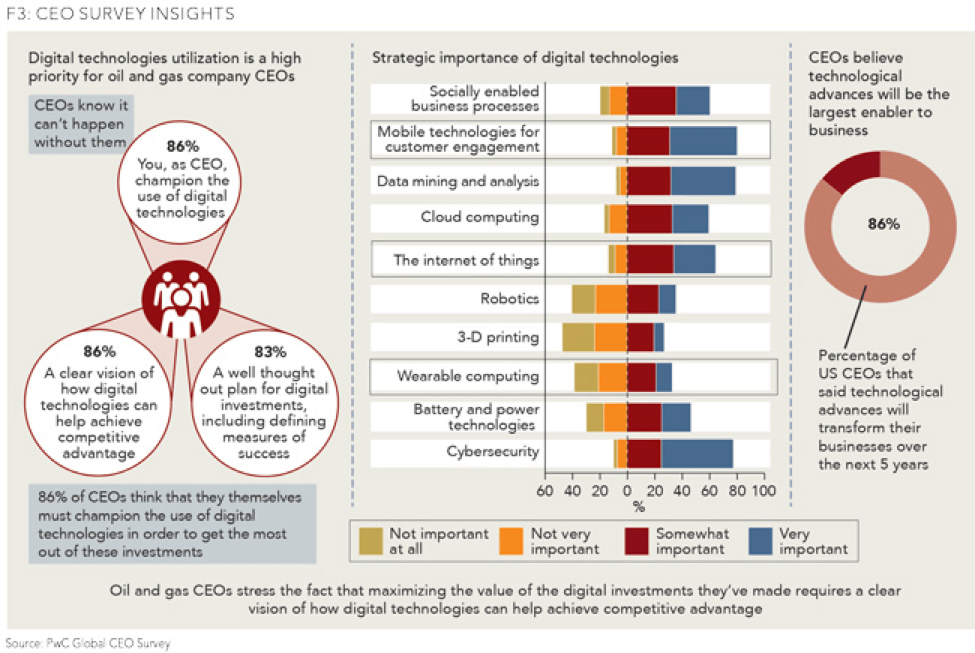

The roll out of digital technologies has been hampered by a scattershot approach, with discrete systems deployed to solve narrow problems [2]. With a scattershot approach companies, particularly large service companies such as Halliburton, risk not realizing the full potential of digitalization. I would recommend for the organization’s management to develop a strategic road-map that helps them asses the digital standing of every operation and identify deficiencies. The goal should be to integrate the various database systems deployed by the different product service lines across a common digital platform. This would allow the company to fully leverage the massive data collected by the different product service lines.

I would also encourage the management to consider rapid prototyping (“fail early, fail fast, learn faster”) of new technologies. The oil industry has traditionally been a slow-moving industry. Rapid deployment of technology would allow Halliburton to capitalize on this urgency and establish a competitive advantage that would not only allow it to survive but also thrive in this new low price, high supply environment.

The need and advantages of digitalization in the oilfield is clear, but the question remains as to whether the change will come from the traditional, large service companies or will a new incumbent, such as GE, bring about the change? Unlike capital intensive physical tools market in which the market allows for more than one player, software as a service (SAAS) is a winner takes all market. Will an industry giant like Halliburton be able to uproot and replace its legacy systems with inter-connected cross disciplinary systems, which allow for it to fully leverage the vast amounts of data it collects on every well or will it find the task too daunting? In this new climate the cost, for Halliburton, of missing the boat on digitalization can very quickly turn into a question of survival.

[Word Count 798]

- https://www.mckinsey.com/industries/oil-and-gas/our-insights/five-strategies-to-transform-the-oil-and-gas-supply-chain

- US/INT: Digitisation will cut energy sector costs. (2017, Aug 03). OxResearch Daily Brief ServiceRetrieved from http://search.proquest.com.ezp-prod1.hul.harvard.edu/docview/1925453621?accountid=11311

- http://www.digitalistmag.com/digital-supply-networks/2017/08/07/artificial-intelligence-future-of-oil-gas-05259467

- Priyadarshy, S. (2017). Digital transformation essential for E&P industry to thrive in new economy.World Oil, , 66-67. Retrieved from http://search.proquest.com.ezp-prod1.hul.harvard.edu/docview/1886578675?accountid=11311

- https://dailyenergyinsider.com/news/7410-microsoft-halliburton-partner-digital-modernization-oil-gas-industry/

- http://www.resilience.org/stories/2016-02-10/iea-in-davos-2016-warns-of-higher-oil-prices-in-a-few-years-time/

- http://www.ogfj.com/articles/print/volume-13/issue-5/features/unrealized-potential-of-digital.html

- https://www.landmark.solutions/DecisionSpace-365

While I agree that if Halliburton does not implement digitization as a service it will miss the its chance, and most importantly, will lose on the first movers advantage and market share. as mention above, operators in the oil industry are slow moving, but given the low margins that they are witnessing today, having additional information before going into a well can save a lot of money, and inform the operator and service company on the best way to drill and extract oil rather than incurring cost experimenting. If Halliburton was successful in its transformation it will also reduce the inherited risk of operations given the deep analysis on previous blowouts due to certain formations.

I agree that the oil patch is ripe for a revolution through digitalization. When it comes to well completion, for instance, petroleum engineers have made great strides to improve designs by coupling the traditional trial and error approach with advanced numerical modeling. However, the industry is not taking advantage of all of the rich data available, and in my opinion could better leverage predictive analytics and multivariate analysis to further improve completion practices.

In response to the question of whether traditional oil companies or new entrants will bring about digitilization, my money is on traditional companies. Although the oil patch is historically slow moving, we have seen that the industry can be remarkably innovative when left with no other options. For example, horizontal drilling and hydraulic fracturing were invented so that U.S. companies could reenter the oil market, and U.S. companies found innovative ways to reduce cost and increase productivity during the recent oil downturn. I believe traditional oil and gas companies will continue to innovate to remain competitive in today’s low price environment.